Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Bidcorp goes from strength to strength (JSE: BID)

Double-digit growth is always good news

Bidcorp is one of the best businesses on the local market. Through a combination of organic and inorganic growth, they’ve built an exceptional global food service empire. As offshore exposure goes, this is one of the best choices on the JSE in my opinion.

The share price has been erratic though. This is a function of the rand, the COVID disruptions to the restaurant and hospitality industries, as well as Bidcorp’s demanding valuation that recognises the quality of the business:

The management team is in control of the earnings, not the share price. They are doing a great job with those earnings, with the latest numbers from Bidcorp reflecting revenue growth of 15.1% for the year ended June. That translates beautifully to cash and profits, with EBITDA up by 14.4% and a cash conversion ratio of 102% of EBITDA. That’s hard to fault.

HEPS is up by 15.5%, so there are no weird once-offs driving that EBITDA performance. Thanks to the cash quality of earnings, the dividend is up 16%.

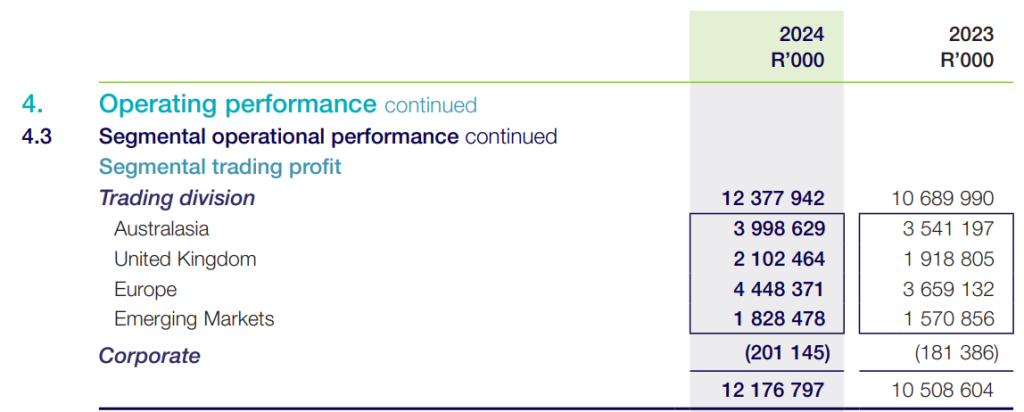

The segmental view gives a great idea of not just the diversification, but also the level of performance in Europe in particular in the latest period:

If ever you wanted to do a deep dive into the power of bolt-on acquisition strategies, Bidcorp would be a great place to do it.

Finbond makes two acquisitions in South Africa (JSE: FGL)

Buying short-term consumer lenders based in the Eastern Cape seems rather brave

Finbond is taking the rather interesting step of making acquisitions in two short-term consumer loan businesses that operate through a total of five branches in the Eastern Cape. The region is not exactly a hotbed of activity and has really struggled during the tough times in South Africa, so this is a big bet on the success of the GNU.

These businesses made a net profit before tax of R3.93 million for the year ended February 2024. This includes expenses of R4.85 million which apparently won’t be applicable after the acquisition, which isn’t uncommon for small businesses. The net asset value of the businesses is R6.75 million, so they generate a lot of profit off a small net asset base – typical of a short-term lender with constant churn in loans.

Finbond is paying R25.75 million for the deal, which seems like quite a lot even after that adjustment for expenses. Finbond’s market cap is worth R336 million, so it’s not an insignificant transaction.

Murray & Roberts is fighting hard, but there are still losses (JSE: MUR)

This has been an extremely rewarding speculative punt for those who were brave enough

The Murray & Roberts share price is up by a rather ridiculous 114% year-to-date, reflecting renewed enthusiasm around South African investment prospects and how much of this should hopefully flow into the construction industry.

For now, the share price is a much better story than the earnings. As a trading statement tells us, Murray & Roberts has certainly made improvements but is still loss-making.

Many of those improvements have come from cost-cutting exercises, with annualised savings of R100 million just in corporate costs. The full effect of those cost savings will be felt in the 2025 financial year.

The other good news is on the balance sheet, where South African debt has been reduced from R2 billion in April 2023 to R409 million as at the end of June 2024. Negotiations are underway to refinance the remaining debt. Importantly, at group level, they are now in a net cash position rather than a net debt position.

There’s still a lot of noise in the numbers, particularly due to deconsolidation of the Australian businesses. The best approach is to look at continuing operations, where the headline loss per share improved from -71 cents to a loss of between -19 cents and -29 cents.

Looking ahead, FY25 will be the first year where Murray & Roberts can really show us what the new and improved version of the group looks like. The recovery still has some way to go though, with a recovery to pre-pandemic levels of earnings only expected from 2027.

MC Mining has found itself a major investor (JSE: MCZ)

Kinetic Development Group will take a 51% stake in MC Mining

Here’s a big piece of news for MC Mining: the company has agreed that Hong Kong-listed Kinetic Development Group will subscribe for enough shares to take it to a 51% post-money stake. This will happen in two tranches.

Kinetic is a coal mining and trading group, so MC Mining’s Makhado steelmaking, hard coking coal project is of interest here and the capital will take that asset into production. There’s also enough capital on the table to help MC Mining develop other assets.

The first tranche is for a subscription of 13.04% in MC Mining for $12.97 million. It works out to around R3.72 per share, which is more than double the current share price. The second tranche for $77 million will come in after the various conditions precedent are met, which will include shareholder and regulator approvals. That is going to take a while. The parties have allowed for up to 270 days to achieve this. If it goes beyond that, Kinetic has the right to require the first tranche shares to be repurchased.

Let’s call this what this is: a great example of foreign direct investment flowing into our country. The winds of change are blowing for South Africa!

A special dividend at PPC (JSE: PPC)

PPC is paying out most of the proceeds from the sale of CIMERWA

Special dividends are interesting things. They are often rooted in disposals of major businesses, with the company’s management team showing the maturity to return the capital to shareholders rather than invest it in marginal products.

This is what is happening at PPC, with the group electing to pay a special dividend of 33.5 cents per share. Although the wording of the SENS is a bit confusing at first, this represents 66% of the cash that was obtained from the sale of CIMERWA in Rwanda.

Transpaco’s earnings and margins have dipped (JSE: TPC)

Both the plastic and paper divisions saw a drop in operating profit

Transpaco has released results for the 12 months to June and there aren’t really any highlights. There was plenty of load shedding for most of that period and very little of the GNU-inspired good stuff. For those reasons, a 4% drop in revenue and an unpleasant 15.7% decrease in operating profit isn’t the biggest shock around.

The group’s two major divisions, plastic products and paper and board products, are similarly sized – or at least, they are now. Operating profit in plastic products fell sharply from R134 million to R99 million, while paper and board products fell from R99 million to R87 million.

Group operating margin fell from 9.7% to 8.6%. A 110 basis points deterioration on what is already a fairly tight margin is significant.

By the time we reach HEPS level, the impact is slightly less severe. HEPS fell by 8.3% and the total dividend was down 7.7% as the payout ratio moved up slightly. The group is in a net cash positive position rather than a net debt position, which does wonders when earnings move lower. Share buybacks also helped improve the HEPS result relative to operating profit.

The group doesn’t exactly give the market much to hang onto in the results, with little or no commentary on the outlook. Transpaco is an illiquid counter with a wide bid-offer spread. Some additional management commentary might help address that over time, as investors would be armed with more information to help them make decisions.

Little Bites:

- Director dealings:

- There’s more selling of Investec (JSE: INL | JSE: INP) shares by Stephen Koseff, this time to the value of £1.2 million.

- An associate of a director of Brait (JSE: BAT) – not Christo Wiese – bought shares worth R2.3 million. This is a follow up to another recent purchase by that director.

- A director of Afrimat (JSE: AFT) has sold shares worth R535k.

- There’s yet more selling by a director of a major subsidiary of RFG Foods (JSE: RFG), this time to the value of R453k.

- A director of Insimbi Industrial Holdings (JSE: ISB) bought shares worth R78k.

- For those interested in Powerfleet (JSE: PWR), the full 10Q report is now available to supplement the press release that recently came out. You can dig in here if you want all the details on the company. The US reporting style is very different and is worth checking out.

- I have no idea why they are bothering, since the company is suspended from trading, but Chrometco (JSE: CMO) is going through the process of changing its name to Sail Mining Group.