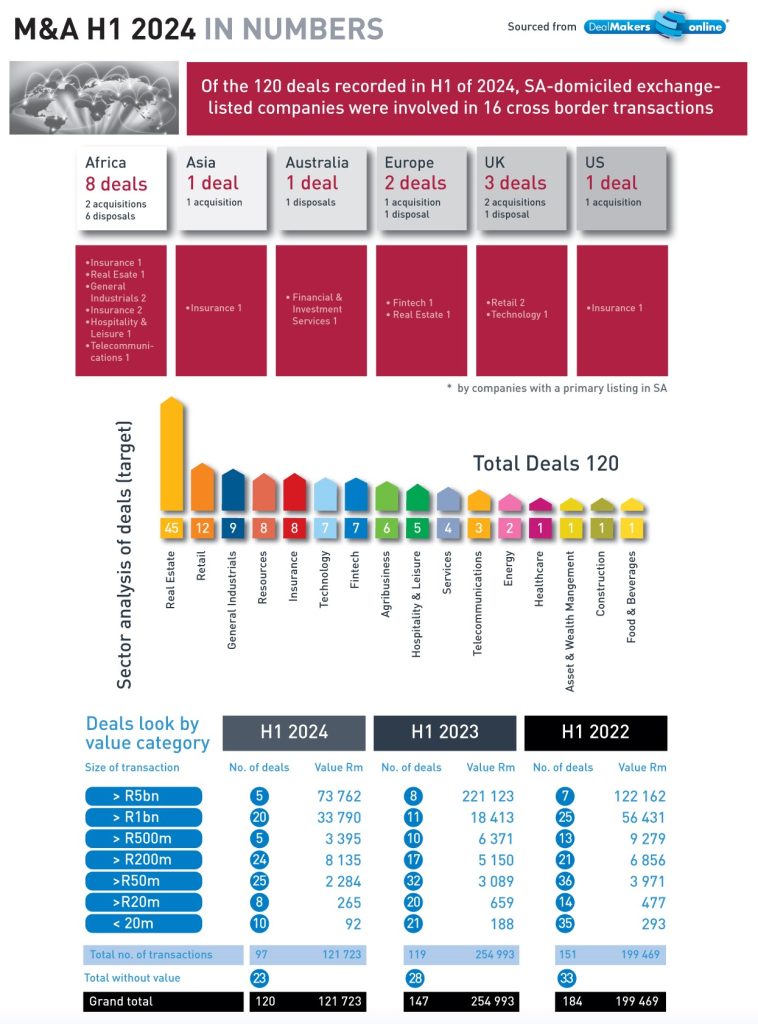

It’s easy to be despondent when looking at the historic M&A data in SA to ascertain a trend – its interpretation is not pretty. M&A activity has been on the decline since 2008, for a variety of reasons, most of which are of our own making. Initially triggered by the financial crisis, the further decline in investor confidence was driven by state capture and the revelations of the extent and reach of the malaise throughout the organs of government, the COVID pandemic, together with uncertainties created by the war in Ukraine, higher inflation and interest rates globally, a low domestic growth rate accompanied by a weakening exchange rate, ‘grey listing’, and foreign policy blunders, all of which have had investors running scared.

And while still with us are the problems of failing infrastructure, dysfunctional SOEs, looming water shedding and skills shortages, to name but a few, there are – for the first time in a while – reasons to take a positive view.

South Africa has a government of national unity, inflation data shows the Reserve Bank’s strict interest rate policy is working, the domestic exchange rate has recently found support, and the private sector is willing to partner with government. These positives offer an opportunity to address the challenges that could alter SA’s economic and financial market trajectories. Although not reflected in the H1 M&A numbers captured for the period, the dealmaking pipelines are (according to industry advisers) healthy, also witnessed in the past few weeks by the increased number of deals announced by SA exchange-listed companies. The local equity market presents an opportunity for investors – supported by attractive valuations and reasonably priced – and the country’s diversified economy offers opportunities to invest in strong sectors able to withstand global economic storms. The trick will be for SA Inc to stay the course on this new path, take advantage of opportunities presented, and make the necessary changes to regulations that impede investment flows. If ever there was a right time, this is it.

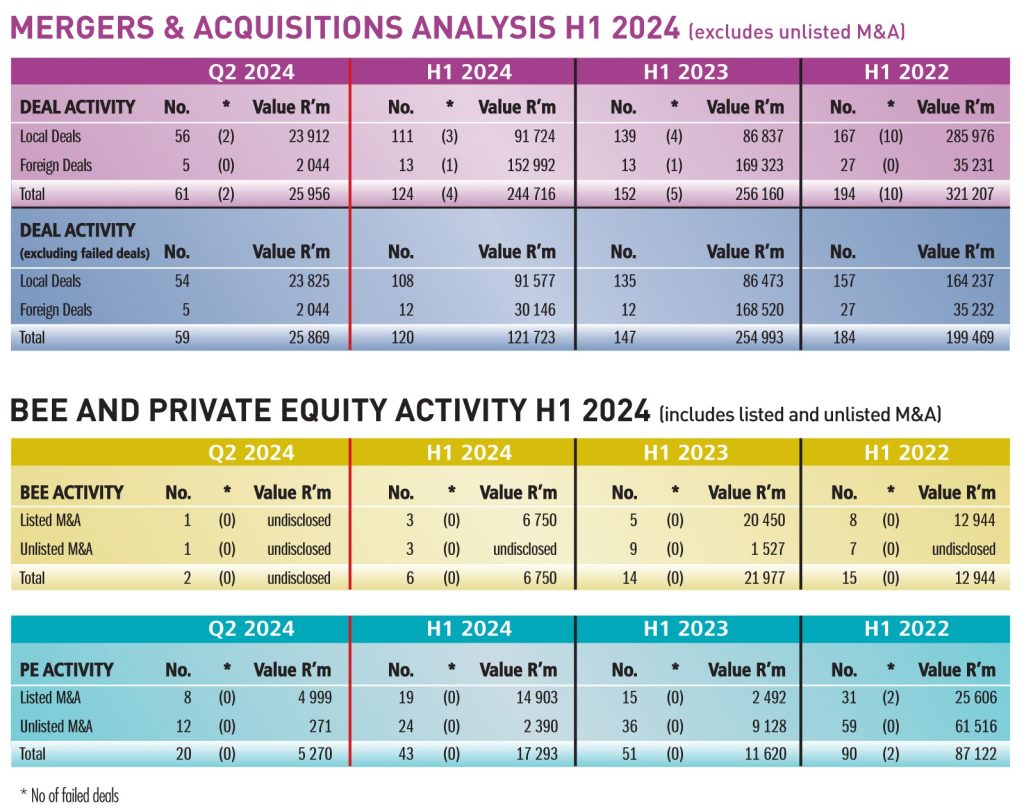

The most active sectors during H1 were Real Estate (38% of the quarter’s deals) followed by the Retail sector. Deal size fell typically in the R50m to R200m bracket reflecting 41% of deals recorded for the period. SA-domiciled companies were involved in 16 cross border transactions, notably within Africa (8) followed by the UK (3).

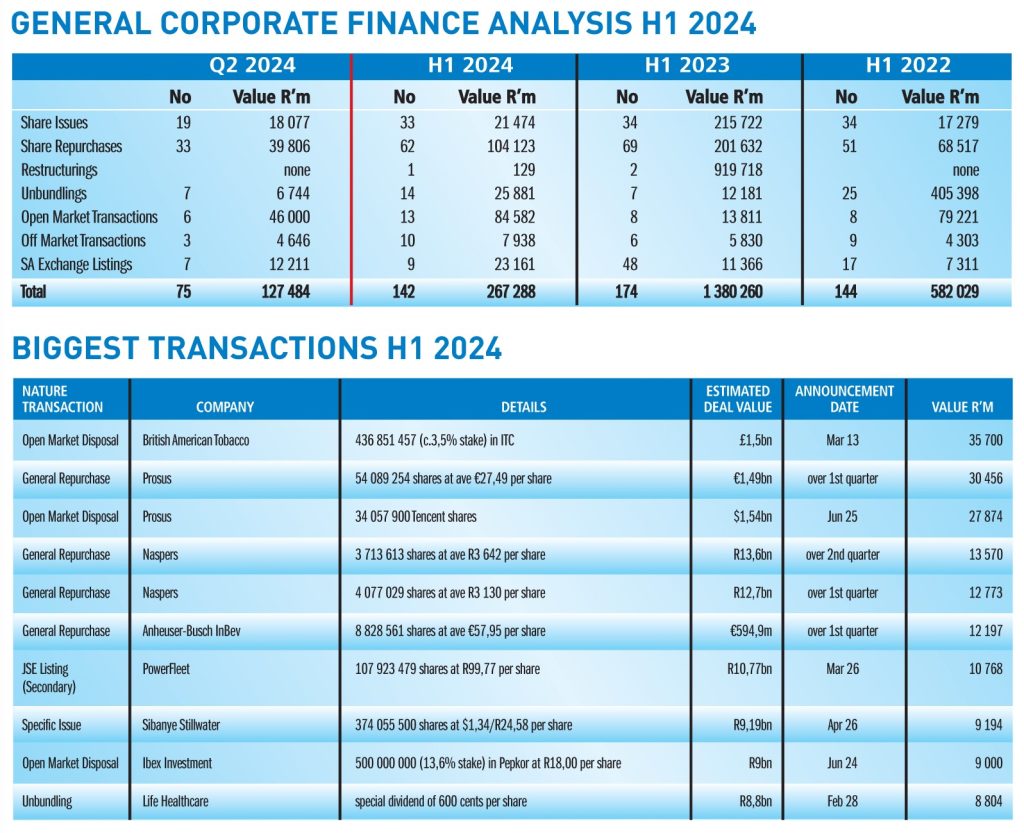

As is the norm, share issues and repurchases characterised general corporate finance activity for the first six months of 2024, with R21,5 billion raised from the issue of shares and R104 billion the value of shares repurchased. The repurchase programmes of Prosus, Naspers and British American Tobacco account for most of this value.

All data used in this H1 2024 analysis sourced from DealMakers Online

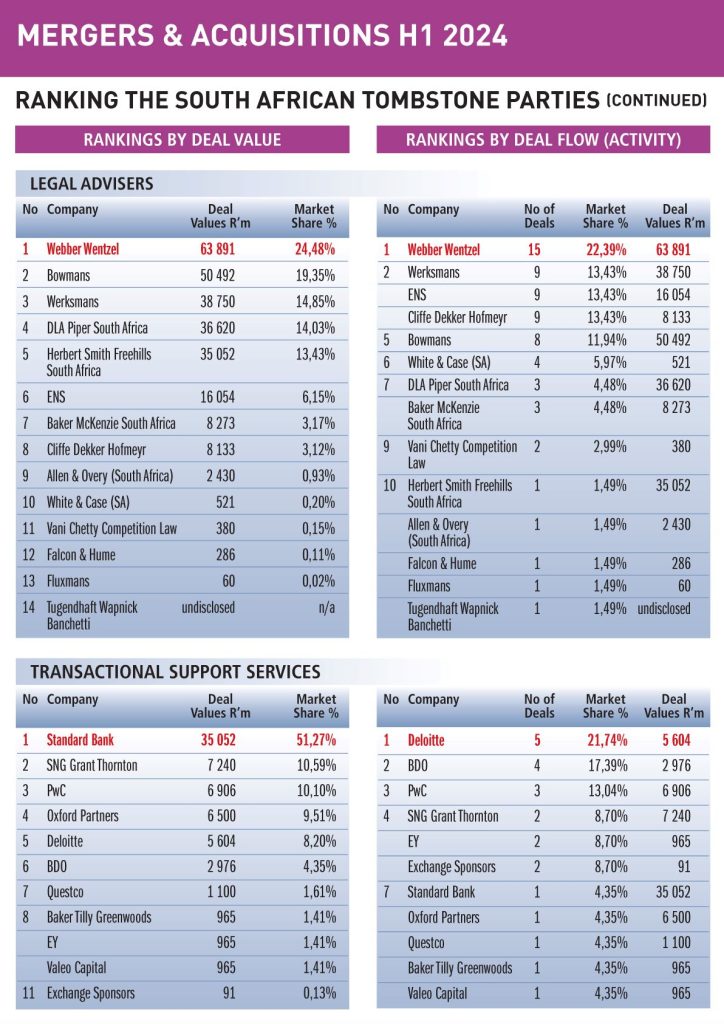

DealMakers H1 2024 League Table – M&A activity by the top South African advisory firms (in relation to exchange-listed companies).

DealMakers H1 2024 League Table – General Corporate Finance activity by the top South African advisory firms (in relation to exchange-listed companies).

The latest magazine can be accessed as a free-to-read publication at www.dealmakersdigital.co.za or on the DealMakers’ website.

DealMakers is SA’s M&A publication.

www.dealmakerssouthafrica.com