Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

AfroCentric didn’t escape the red day on the JSE despite growing earnings (JSE: ACT)

Earnings may be up, but revenue growth is modest

AfroCentric has released its earnings for the year ended June 2024. Revenue only increased by 0.4%, with this mainly due to the discontinuation of the surgical business. Still, headline earnings increased by 54.1%, so there’s an unusually shaped income statement for you. On a HEPS basis, the increase of just 11%, as the number of shares in issue has increased substantially after the deal with Sanlam.

The synergies from the Sanlam deal will be felt mainly in the Corporate Solutions Cluster, where AfroCentric has made progress in selling into Sanlam channels. Lovely as that is, it’s still small in the group context. The biggest operation is the Services Cluster, where you’ll find the medical scheme administration businesses and a revenue growth rate of 6% in the past year. The Pharmaceutical Cluster is also important and is facing challenges in profitability, with operating profit growth of 7.3% but some major underperformers within the cluster that are stopping this from being better.

Hopefully, the synergies with Sanlam will start to pick up steam.

Ascendis is finally profitable – well, mostly (JSE: ASC)

With the delisting off the table for now, it’s unclear what the future will hold

Ascendis has been the topic of quite the regulatory tussle this year, with the Takeover Regulation Panel at the centre of the debate. The potential delisting seems to be dead for now, so there’s no offer left to fight over. Instead, investors have to focus on the underlying business and whether they want to own it.

Despite a decrease in revenue, Ascendis managed to swing from losses to an operating profit of R46.4 million. Although HEPS from total operations came in at 1.1 cents, HEPS from continuing operations was a loss of 1.4 cents (admittedly a much better situation than a loss of 41.5 cents in the comparable period).

The company is now switching to an investment holding company structure, with ACN Capital (the Carl Neethling entity) appointed as the investment manager. The tangible net asset value per share of 91 cents is likely to be the important metric going forward, with the share price currently at 71 cents.

Apart from some strong words aimed at the regulators and activist shareholders, the announcement also raises a concern around group cash flow. Although they have no external debt, the cash position of the group deteriorated during the year.

The market hated the Aspen numbers (JSE: APN)

Watching a >R100bn market cap company take a 13% bath is quite something

The year-to-date Aspen share price now looks like the elevation profile of someone jumping off the side of a mountain:

As they say, the bulls take the stairs up and the bears take the elevator down. That’s a huge one-day move of 13%, with this large cap being thrown around like a rag doll on the market.

The market didn’t care much about Aspen’s news of its highest-ever normalised EBITDA for H2 in the second half of the year. The market also didn’t focus on the cash conversion ratio of over 100%, or the news of manufacturing contracts exceeding guidance.

No, the market was only interested in normalised HEPS being flat for the year, with HEPS down 3% without those adjustments. Even the dividend increasing by 5% couldn’t save the story, as investors panicked about lack of growth in earnings.

Pressure on gross profit margin didn’t help, with revenue up by 10% and gross profit up by just 4%, impacted by sales mix with more focus on manufacturing revenue. This was enough to help Aspen tread water based on growth in expenses and a flat move in net financing costs, but the market wanted more than that.

Investors do seem to have glossed over the impact on margin of the Heparin inventory being cleared. They unlocked a lot of operating cash flow through this process (up 13%) and managed to do so without causing a negative year-on-year move in earnings. The manufacturing segment saw gross margin decrease from 11.4% to 9.2% and this will clearly be a focal point for the market going forward.

On normalised HEPS of 1,492.1 cents, the share price of R206 is a Price/Earnings multiple of 13.8x. It feels like this drop might have been overdone, so keep an eye on this for short-term long opportunities to play the closing of the gap.

Motus is a tale of thin margins and expensive debt costs (JSE: MTH)

The combination isn’t going well at the moment

Motus has released its financials for the year ended June 2024. With revenue up 7%, you would hope that the rest of the income statement looks decent. Alas, operating profit fell 4% and HEPS was down by a rather ugly 28%, leading to the dividend for the year dropping from 710 cents in 2023 to 520 cents in 2024.

The Retail and Rental division is over 80% of group revenue before eliminations and that business saw operating margin decline from 3.0% to 2.8%. A 20 basis points move on such tiny margins is material. Import and Distribution is the next largest division in terms of revenue and margins there fell from 5.8% to 4.0%. The 20 basis points improvement in Aftermarket Parts from 8.4% to 8.6% wasn’t enough to offset this.

Sadly, operating profit is only one part of the story in a business that runs with structurally high levels of debt. Finance costs jumped significantly from R1.4 billion to R2.3 billion, which is a very large number when operating profit was R5.5 billion. More importantly, operating profit dipped from R5.7 billion to R5.5 billion, so finance costs increased substantially at a time when operating profit fell.

The impact was most severe in Import and Distribution, which saw profit before tax plummet spectacularly from R1.14 billion to just R95 million.

Automotive groups are pretty desperate for interest rates to drop. Not only does it improve customer affordability and thus put less pressure on gross margins, but it helps reduce the costs of their own debt.

I genuinely don’t know how the share price has managed to behave like this despite the negative move in the cycle:

Pepkor: less building materials, more furniture (JSE: PPH)

The group clearly sees value in Shoprite’s furniture business

Pepkor has taken a couple of major steps in changing the shape of its group.

One of them we’ve known about for a while, which is the disposal of The Building Company to Capitalworks and the company’s management in a deal worth R1.2 billion. This is a classic management buyout structure in which a private equity player puts in the balance sheet for the deal.

The other is hot off the press, with further details below.

Before we get to the new deal, the news on the disposal of The Building Company is that the Competition Tribunal has approved the transaction, so the closing date is 30 September and Pepkor can get its hands on the money.

That’s just as well, because Pepkor is buying the furniture business out of Shoprite. As I cover further down in the Shoprite section, the business isn’t exactly a fast growing operation. With sales growth of 2.3%, Pepkor will need to really sweat this furniture asset to get real benefits for shareholders. The good news is that they are buying it for its net asset value, so Shoprite is happy to pass the baton to Pepkor without asking for any goodwill on top.

The deal will be settled in cash and represents around 4% of Pepkor’s market cap, so they aren’t exactly betting the farm. That’s just as well, because I don’t think this is the most lucrative deal around. Pepkor reckons that they can integrate the business with other Pepkor businesses focused on complementary categories.

With a 2.6% drop in the Pepkor share price, the market didn’t exactly pop the champagne at this news.

A strong top-line result at Shoprite didn’t quite convert this time (JSE: SHP)

And on a red day for the broad market, Shoprite’s share price was punished

A 5.9% decline in Shoprite’s share price is a big move, especially in one day. Although the JSE was down 1.6% for the day (and this is important context), it still tells us that the market didn’t love the results from Shoprite.

The problem wasn’t in sales growth, with group sales up by 12%. Supermarkets RSA grew 12.3%, Supermarkets non-RSA managed 6.1% and other operating segments grew by a significant 21.1%. Furniture could only achieve 2.3%, with more on that later.

We need to look deeper into Supermarkets RSA, with Checkers and Checkers Hyper up by 12.3%, Shoprite by 10.3% and Usave by 13.2%. Once again, the group has done a lovely job of resonating with customers of all income levels. This is yet another warning to those who are bullish on the Pick n Pay turnaround: it’s going to be really tough when you’re in the same market as Shoprite’s businesses.

And in case you’re curious, which you probably are, the turquoise scooter army delivered sales growth of 58.1% in Sixty60.

Despite the great sales growth, Shoprite’s full-year dividend only increased by 7.4%. This is in line with the increase in diluted HEPS from continuing operations, which excludes losses in various underlying African businesses that were recognised as discontinued operations in this period. On such a demanding Price/Earnings multiple, this wasn’t enough for the market and the share price took a knock as growth expectations were moderated.

There’s a much more important discontinued operation coming, with Shoprite finally making the decision to sell the furniture business. I think this is absolutely the right decision, as this is a slow-growth business in an industry that is all about credit sales rather than pushing high volumes, so it’s a poor strategic fit with the rest of the Shoprite group. OK Furniture and House & Home will be sold to Pepkor at a price equal to net asset value. I’ve covered this in more detail in the Pepkor section in this edition of Ghost Bites.

Back to the broader Shoprite group, the store footprint increased by 343 stores to 3,639 stores. This intensive expansion programme is another reason why the furniture business had to go, as they need the capital elsewhere to earn better returns. As mentioned earlier, the furniture division grew sales by just 2.3% in this period, so Shoprite shareholders won’t be sad to see it go.

Due to the mix effect of underlying divisional growth, gross margin decreased by 10 basis points to 24.0%. Importantly, Supermarkets RSA achieved a small increase in gross margin.

Trading profit increased by 12.4% and trading profit margin moved slightly higher from 5.5% to 5.6%. At this point, you’re probably wondering where the catch was that saw such subdued growth in the dividend vs. trading profits.

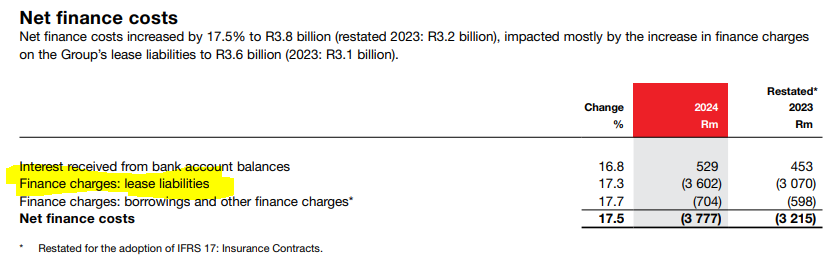

The problem is that in their infinite wisdom, IFRS accounting standard setters decided that lease costs should be in net finance costs rather than operating costs. With an increase of 17.3% in this metric (and 17.7% in finance charges on borrowings), this is what went wrong between trading profit and HEPS:

What this really shows is the inflationary pressure in the cost base, as well as how expensive money is at the moment. A drop in interest rates will help here, as will an even slicker group that allocates capital into the best opportunities.

HEPS for the period was 1,250.2 cents, so the share price after the sell-off reflects a Price/Earnings multiple of 23.6x. Shoprite is a terrific business, but at some point this multiple is simply too high for the realities of growth in South Africa.

Little Bites:

- Director dealings:

- An associate of a director of Afrimat (JSE: AFT) sold shares worth R6.7 million.

- Two directors of different associates of Blue Label Telecoms (JSE: BLU) sold shares in the company worth a total of R330k.

- An associate of the CEO of Sirius Real Estate (JSE: SRE) bought shares in the company worth £7.9k.

- It feels like it’s been a while, but Des de Beer is buying more shares in Lighthouse Properties (JSE: LTE) – this time it’s a small purchase though (by his standards), coming in at R74k.

- There’s a buzz in the market around potential corporate activity at Caxton (JSE: CAT), with Peregrine announcing that it has acquired shares and now has a 9.61% stake in the company.

- Orion Minerals (JSE: ORN) has completed the confirming drilling programme at Okiep Copper Project, confirming the quality of the drilling database that was inherited from Newmont and Gold Fields. The next step is to update the Mineral Resource estimate.

- Coronation (JSE: CML) has received SARB approval for the special dividend, with a payment date of Monday 16th September to shareholders who are on the register as at Friday 13th September. It’s quite funny that Friday the 13th effectively brings the entire SARS fight to a close, with the missed dividend being paid.

- Shareholders in NEPI Rockcastle (JSE: NRP) should note that the circular for the scrip distribution alternative has been made available at this link.

- Omnia (JSE: OMN) announced that Global Credit Rating Company has affirmed the long-term issuer rating of A+(ZA) and short-term issuer rating at A1(ZA). Importantly, there is a stable outlook as well.

- Insimbi Industrial Holdings (JSE: ISB) announced that the clever reverse asset-for-sale transaction has now been completed. Basically, they sold off businesses and executed share buybacks to help the buyers pay for them.

- Oando PLC (JSE: OAO) released some very angry SENS announcements presumably aimed at the Nigerian press and speculation around various allegations related to the company. I don’t think I’ve ever seen such a strongly worded statement, so there’s either a genuine smear campaign out there against the company or there really is something to worry about. Given the wording of the announcement, I lean towards the former.