Structure Overview

South Africa is often referred to as the business gateway to the African continent due to its strategic location, advanced infrastructure, diverse economy, regulatory environment and skilled workforce. Parties looking to set up an investment structure in South Africa to tap into this market generally have a choice between: (i) incorporating a limited liability private company; or (ii) setting up a partnership, with the latter rising in prominence over the past decade.

The two main categories of partnerships are general (en nom collectif) and extraordinary partnerships. Extraordinary partnerships can further be divided into anonymous and en commandite partnerships (ECPs), with both sub-categories possessing unique characteristics, and catering to different business needs and strategic goals. This article will focus on the role ECPs can play in unlocking capital in South Africa for deployment into Africa.

En Commandite Partnerships

ECPs are carried on by two or more partners, comprising (i) a general or managing partner (GP) which is the named partner, responsible for the management of the partnership; and (ii) one or more limited partners (also known as commanditarian or en commandite partners), whose name(s) is/are not disclosed (LPs). LPs are, generally, silent partners who contribute a fixed sum of money to the partnership, on condition that they receive a share of the profit (to the extent that there is a profit); but in the event of loss, they are liable to their co-partners only to the extent of the fixed amount of their agreed capital contribution.

ECPs are widely used in South Africa, due to their unique ability to combine the expertise and management skill of GPs with the capital and limited liability of LPs. Entrepreneurs can utilise ECPs to attract passive investors looking to generate returns without being actively involved in the management of the business, and who wish to remain anonymous. In return for their investment, the passive investors can leverage off the expertise of the general or managing partner to help generate economic

returns.

Considerations before creating an ECP

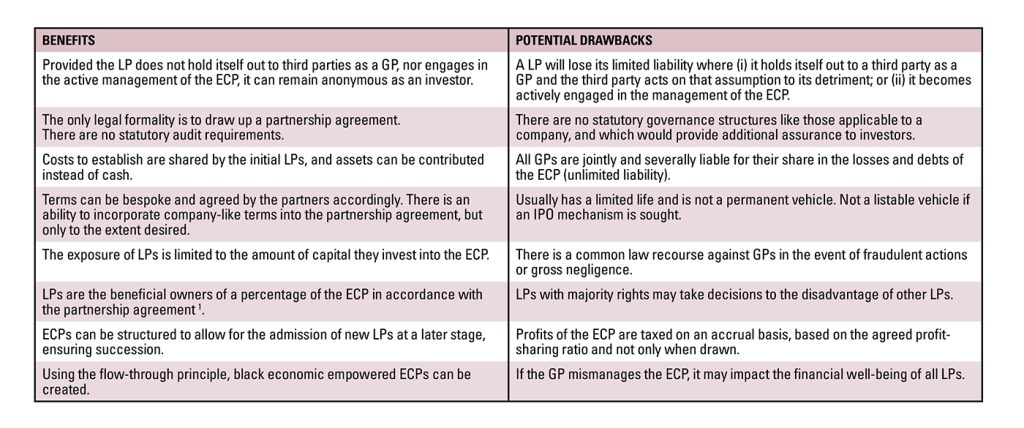

While offering numerous benefits, ECPs also pose some potential drawbacks. Understanding these differentiators is crucial for investors when deciding on the appropriate structure to pursue. The table below highlights some of the benefits and potential drawbacks associated with ECPs.

Typical example of an ECP structure used for an investment fund

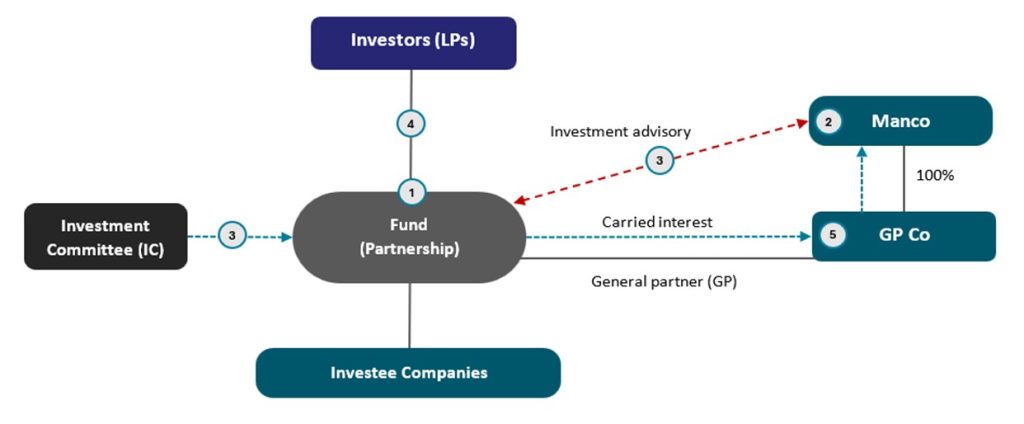

Each of the individual parties outlined in the diagram below play an integral part in the successful implementation of an ECP structure for a fund:

1.Fund set up as a limited liability partnership (ECP), but can also be set up as a trust.

2.GP Co sets up the fund (with GP Co having potential empowerment credentials if required to benefit using flow-through principle).

3.Manco appointed by the GP Co as the investment adviser to the Fund. LP appoints an investment committee (IC) to approve investment decisions.

4.Investors are LPs to the Fund. Investors contribute capital or assets to the Fund.

5.GP Co is the GP, and the vehicle earns the carried interest (which is essentially the profit share for the GP’s performance). The carried interest is then distributed to Manco, to the extent that Manco is a shareholder in GP Co.

ECPs play a key role in corporate finance by providing a flexible structure for capital raising, profit-sharing and risk management, with a reduced administrative burden.

In practice, it has been seen that some investors have recently favoured the conversion of partnerships into permanent capital vehicles (PCVs), allowing an unlimited time horizon for investment and realisation without pressure to realise assets within a certain period.

In the current landscape, LPs continue to benefit from tax efficiency, risk mitigation, and access to specialised expertise. This makes ECPs a valuable tool for businesses

seeking capital for strategic initiatives and growth.

By leveraging the advantages of ECPs effectively, businesses can navigate the complexities and demands of the modern business environment while generating value for various stakeholders.

A trusted advisor with relevant practical experience is a crucial link in helping entrepreneurs and investors navigate the permutations of an ECP structure to ultimately maximise utility for all parties involved.

1 Comprehensive Guide To Dividends Tax (Issue 4), p 50, SARS.

James Moody and Mikayla Barker are Corporate Financiers | PSG Capital

This article first appeared in DealMakers AFRICA, the continent’s quarterly M&A publication.

DealMakers AFRICA is a quarterly M&A publication

www.dealmakersafrica.com