Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

African Rainbow Minerals has released full details on a difficult year (JSE: ARI)

The cycle hasn’t been kind here

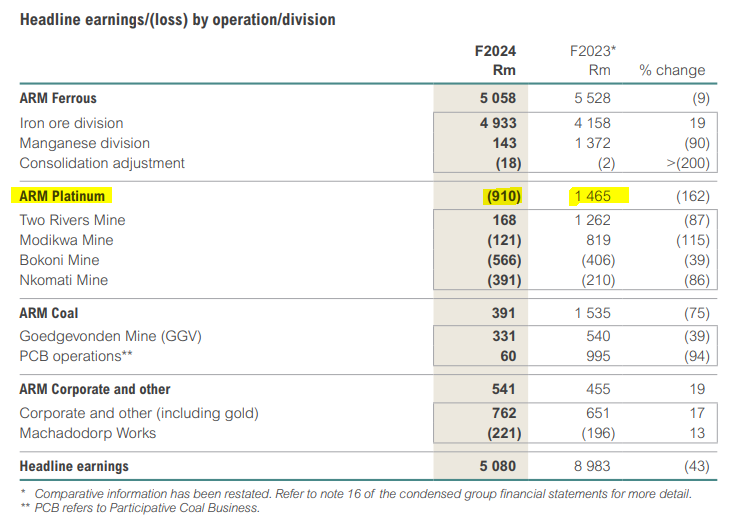

When assessing the performance of a mining group, the most important thing is to understand the underlying commodity exposures. This table does a great job of showing not just the different segmental contributions at African Rainbow Minerals, but also the impact of a terrible year for the PGM industry:

With that level of exposure to PGMs, it’s little wonder that HEPS fell by 43% to R25.91 per share. The dividend is also down 43%, but at least there is still a dividend despite the challenges. This is thanks to the health of the balance sheet, with a net cash position of R7.2 billion, admittedly a fair bit down from R9.8 billion 12 months ago.

The PGM sector troubles continue, with the group taking steps like putting the Two Rivers Merensky project into care and maintenance from July 2024. Unsurprisingly, this comes with a substantial impairment of over R1 billion that is excluded from HEPS. Bokoni Mine is a cautious ramp-up strategy, with the board having now approved the construction of a chrome recovery plant.

There’s a lot of corporate activity around copper at the moment, with African Rainbow Minerals also getting in on the action. They took a 15% stake in Surge Copper Corp on 31 May. This is a Canadian group with resources of copper, molybdenum, gold and silver. 15% doesn’t exactly give them much influence there, but it’s a start.

Sudden management changes at Calgro (JSE: CGR)

The share price was surprisingly unresponsive to this

Calgro released a shock announcement that Wikus Lategan and Waldi Joubert will be leaving the group to pursue other interests. Wikus was the CEO and Waldi was very much his right-hand man and ex-CFO, running the Memorial Parks business. Thankfully, current CFO Sayuri Naicker isn’t going anywhere.

The change is with effect from 31 December 2024, so there isn’t a lot of time here for a handover. Ex-CEO Ben Malherbe will return to the CEO role. As one of the co-founders of Calgro, he certainly knows the business. The other change to the board is that Allistair Langson, Calgro M3 Developments Limited Managing Director, will be appointed to the group board as an executive director.

Caxton is on a treadmill at the moment (JSE: CAT)

Publishing and printing isn’t exactly a land of milk and honey at the moment

Caxton and CTP Publishers and Printers, or just Caxton for short, released results for the year ended June. Revenue fell 47% and operating profit after depreciation was down 11.4%, with the company buckling under the pressure of reduced printing throughputs and a decline in media advertising revenue from national retailers.

I still find it amazing that such a big piece of Caxton’s business is based on retailers being willing to print their specials for inclusion in community newspapers. That doesn’t sound sustainable to me. This division saw operating profit after depreciation fall by over 18%. It contributed 37% of group operating profit, down from 40% the year before.

In the packaging business, revenue at least managed to grow. Operating profit can’t say the same thing, dropping roughly 15% year-on-year. I’m not sure what’s worse: the revenue trajectory in the printing business or the margin trajectory in packaging!

Although Caxton did its best in containing costs like salaries, the reality is that this isn’t known as a bloated operation and they can’t just keep shrinking costs forever to try and address the revenue problem. These are band-aid strategies that don’t fix the underlying wound.

The drop in operating profits was largely offset by insurance proceeds received in this period as well as a sharp jump in net finance income thanks to the size of the group’s cash balance (R2.5 billion vs. R1.9 billion at the end of the comparable period).

These offsetting factors helped HEPS increase by 4% despite the rough operating performance. The dividend was flat at 60 cents per share. The lack of growth in the dividend tells us quite a bit about the underlying concerns in the business.

And yet, the market seems to think that something big is about to happen at Caxton, with a massive rally being driven by speculation that a major corporate action could be on the table. The source of that speculation? A SENS announcement on 3rd September that Peregrine Capital now holds 9.6% in the company. For the market, that’s enough to believe that a buyout offer could be coming, with the share price now looking like this:

City Lodge had a tougher second half (JSE: CLH)

The market didn’t like it, with a 5.5% drop on the day

The City Lodge share price is a volatile thing, with sharp moves that can make paupers and kings out of traders:

As you’ll see on the far right there, the correction after the release of annual earnings was significant. For the year ended June, City Lodge managed revenue growth of 13% and HEPS growth of 10% as reported or 37% on an adjusted basis. Those don’t exactly sound like bad numbers, do they?

Average group occupancy moved 200 basis points higher to 58%, so that’s also encouraging news. We can’t even say that the cash quality of earnings was poor, as the dividend increased by 15%.

Other important data points include the lack of debt on the balance sheet (and that’s a big deal), as well as the growth in food and beverage revenue of 22%. That revenue line now contributes 19% of total revenue, which is an impressive part of the investment case. It’s also great to see that gross margin in the food and beverage business moved 200 basis points higher to 60%.

Excluding foreign currency moves, adjusted EBITDAR margin improved from 30.1% to 30.4%. City Lodge increased room rates by 8%, helping to offset some major inflationary pressures in the cost base.

So, what didn’t the market like? The likeliest culprit seems to be the second half performance, which took the shine off a really good first half where occupancy was up around 800 basis points. Between November and June 2024, occupancy fell by 100 basis points, with the lack of consumer and business confidence in the run-up to elections no doubt playing a role.

The 2025 financial year hasn’t gotten off to a good start, with occupancy down by a most unfortunate 500 basis points year-on-year in July. The August drop was 600 basis points. Although the first week of September was thankfully in the green, that’s not really a long enough period to make a call.

Logically, in an environment with improved business confidence and activity, City Lodge should be a beneficiary. The company has been through so much and is now on the strongest footing I’ve seen, with a clean balance sheet and plenty of evidence that the food and beverage strategy is working. The valuation is a challenge though, with the Price/Earnings multiple at around 14.6x based on adjusted HEPS.

I’ve seen arguments in the market that the group should be valued based on the replacement cost of the hotels. I don’t agree with that approach. If the hotels can’t generate sufficient economic returns, they wouldn’t be built as hotels in the first place and won’t change hands at replacement cost. This is why I believe that it should always come back to earnings, with City Lodge’s current valuation looking a bit demanding for now.

IFRS17 contributes to a notable decline in earnings at Clientele (JSE: CLI)

Shareholders will have to be patient for all the details

Clientele has released a trading statement for the year ended June. It’s not good, with HEPS expected to drop by between 33% and 53%. Although they note that the application of IFRS 17 has a substantial impact, they go on to say that earnings on a like-for-like IFRS 17 restated basis will differ by at least 20% – but they don’t specify up or down vs. the comparative period! As HEPS was down by 35% for the interim period, I suspect that earnings are down regardless of how you apply the IFRS 17 lens.

Oddly, because of the way that IFRS 17 works, the group’s net asset value has actually moved higher to between R1.8 billion and R2.4 billion!

Full details will only become available when results are released on 18 September. The share price has had pretty serious volatility, with a 52-week low of R9.50 and a 52-week high of R12.98. At the current level of R11.77, the share price is practically flat over 12 months despite the volatility.

Momentum also has a great financial services story to tell (JSE: MTM)

As we’ve seen elsewhere in the sector, earnings growth looks strong

Momentum Group has released a trading statement for the year ended June. HEPS is up by between 41% and 46%, so there’s nothing wrong with that. Normalised HEPS is up by between 33% and 38%, which is still great. The normalisation adjustments mainly relate to the iSabelo Trust B-BBEE scheme.

Looking at the underlying drivers of this performance, there’s a positive story almost across the board. In both the long-term and short-term insurance operations, things have gone in the right direction. The higher interest rate environment was also good for investment income.

The downer was in the venture capital portfolio, where fair value losses were experienced. I’m really not sure that dabbling in that asset class is the right move for a group like Momentum.

Little Bites:

- Director dealings:

- A2 Investment Partners, which has board representation at Nampak (JSE: NPK) in the form of Andre van der Veen, bought another R39.3 million worth of shares. That’s a pretty big show of faith in the progress of that turnaround story.

- The CEO of RCL Foods (JSE: RCL) bought shares in the company worth R3.34 million. There’s no stronger signal out there than an on-market purchase!

- Speaking of on-market purchases, Des de Beer bought another R2 million worth of shares in Lighthouse Properties (JSE: LTE).

- A director of a subsidiary of Capital Appreciation Limited (JSE: CTA) sold vested shares worth R1.11 million. It doesn’t specifically say that this was only the taxable portion, so I assume that it wasn’t.

- Similarly, directors of Sasol (JSE: SOL) sold share awards worth R1.3 million. The announcement isn’t explicit on whether this is only the taxable portion.

- A non-executive director of South32 (JSE: S32) bought shares worth roughly R870k.

- A director of a major subsidiary of RFG Foods (JSE: RFG) sold shares worth R535k. Separately, associates of a different director of the subsidiary sold shares worth around R1.87 million.

- A director of a major subsidiary of Sappi (JSE: SAP) bought shares worth R91k.

- There’s yet more activity on the Quantum Foods (JSE: QFH) shareholder register. This time, Capitalworks Private Equity and Crown Chickens have taken an interest of 11.44% in Quantum. For a R1.5 billion group based in the little town of Wellington, there really is a lot going on.

- Lesaka Technologies (JSE: LSK) has announced leadership changes, with current CFO Naeem Kola moving into the COO role, with particular focus on driving synergies across the fintech businesses. Dan Smith moves from investment director at Value Capital Partners (the largest shareholder in Lesaka) into the CFO role. He has loads of M&A experience. This makes a world of sense for an acquisition-focused strategy in fintech.