The surge in deal activity reported in Q1 2021, the result of an opening up of business after the COVID-19 lockdown, did not flow through to the current year’s Q1 numbers, as the quarter returned to its traditionally quiet period. The value of M&A transactions, including those companies with a secondary listing on a local exchange was R59,3 billion off 78 deals. Of the top 10 deals by value, six involved real estate transactions valued at c.R22 billion, and real estate was by far the largest component of sector analysis at 30% of transactions.

Equity raising during the quarter saw an aggregate of R19,9 billion raised, while R36 billion was paid back to shareholders by way of share repurchase programmes; most notably, Prosus, British American Tobacco and Quilter, all of which hold inward secondary listings on the JSE. The largest general corporate finance transaction by value was the unbundling to shareholders by Rand Merchant Investment of its stakes in Momentum Metropolitan and Discovery valued at R35,96 billion, followed by PSG of its stakes in subsidiaries PSG Konsult, Curro, Kaap Agri, CA&S and Stadio valued at R19,56 billion.

The delisting haemorrhage continues from Africa’s largest bourse with the most recent announcement being that of PSG, citing onerous listing and compliance requirements, but also what many other investment holding companies face – that of their shares trading at a significant discount to their net asset values. The JSE has been proactive in stemming the tide, releasing in early May an announcement that the Financial Sector Conduct Authority had approved amendments to the JSE listings requirements, which, it hopes, will reduce red tape and create an enabling environment for companies listed on the JSE. In addition, it has introduced the JSE Private Placements platform, establishing a broader revenue stream by providing a digital marketplace that pairs private debt and equity issuers with investors, not just in South Africa but on the rest of the continent.

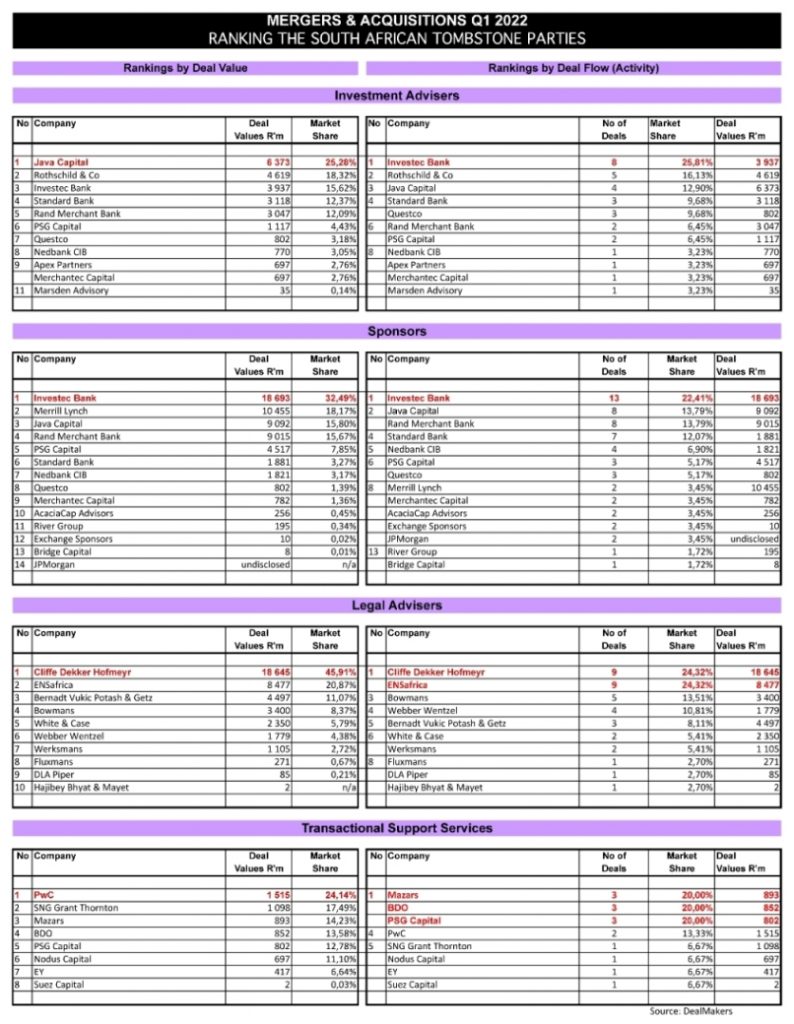

Analysis and rankings (below) by DealMakers of M&A activity by the top South African advisory firms (in relation to exchange-listed companies) for Q1 2022.

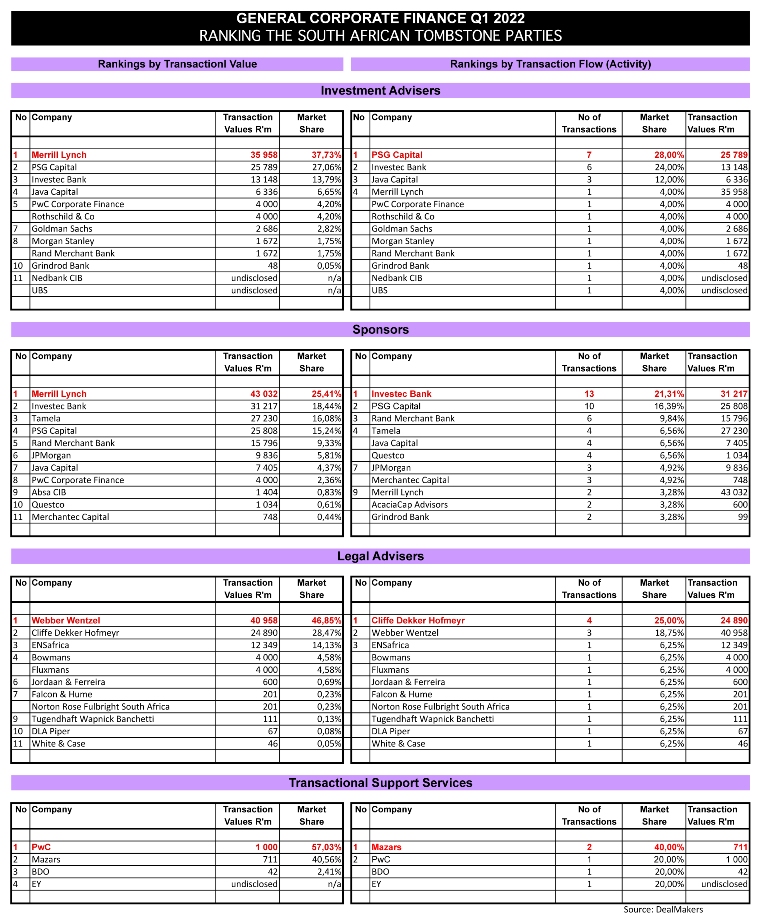

Advisory firms ranking in activities of general corporate finance for Q1 2022 are as follows:

The latest magazine can be accessed as a free-to-read publication at www.dealmakersdigital.co.za

DealMakers is SA’s M&A publication

www.dealmakerssouthafrica.com

Hi, the M&A and Corporate tables are the same. Is this correct or is there an error? Thanks

Hi Annemieke – thanks for your feedback – you should see two different tables now.