Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Bytes is growing, but just watch those margins (JSE: BYI)

The market liked this update, with the price closing 9.5% higher

Bytes Technology has released an update for the six months ended August 2024. The highlights are that gross invoiced income and adjusted operating profit grew by 13.5%, with the market showing its appreciation for that number. The net cash position at the end of the period was £71.5 million. This is after paying £35.3 million in dividends.

They are generally more cash generative in the second half of the year than the first half, so keep that in mind when results come out on 15 October.

But perhaps the bigger thing to keep in mind is that gross margin has been a pressure point in recent periods and that seems to have continued over these six months, with gross profit only up by 9%. That’s well below the growth in gross invoiced income, which is precisely the challenge.

Clientèle’s numbers aren’t as bad as they thought (JSE: CLI)

Accounting changes are having a major impact here

Clientèle has released an updated trading statement dealing with the year ended June 2024. Their first trading statement noted an expected drop in HEPS of between 33% and 53%. The updated number is a drop of between 30% and 35%, so they’ve ended up right at the bottom of that initially guided range. That’s a good thing, I guess.

Much of this is because of the significant changes to accounting rules in this space thanks to the introduction of IFRS 17. Without that impact, earnings would not differ by more than 20% to the comparable period.

Detailed results are due for release on Friday 20th September, so we will shortly have full numbers.

Discovery delivered a much better set of numbers (JSE: DSY)

Discovery SA and Vitality were the stars

We already knew that these numbers would be good, as Discovery released quite a detailed update dealing with the year ended June 2024. Full results are now available for those who want to really dig in.

The numbers look a lot better than usual at Discovery, with normalised headline earnings up by 15% at group level. Without the normalisation, headline earnings is up by 7%. The really strong contributions came in from Discovery SA and Vitality Global, with normalised profit from operations up by 16% and 57% respectively. Sadly, Vitality UK was down by 14%.

Return on embedded value is an important metric for insurance businesses, a bit like return on equity for banks. Discovery managed a 13.2% return, which is a decent outcome. Discovery’s embedded value per share is R166.95 and the current share price is R159. This similarity is no coincidence, as the return on embedded value is pretty close to the cost of equity for a group like this. In other words, investors are happy to pay only a slight discount to embedded value per share for the returns that Discovery is currently generating. This is much like a bank trading at close to its net asset value per share.

Lighthouse Properties had an excellent day of capital raising (JSE: LTE)

We’ve reached that point in the cycle where property groups can raise a fortune in a matter of hours

I’ve written before in Ghost Bites that one of the best analytical tools for the property sector is to look at which companies are raising capital. When the best funds are able to raise in oversubscribed bookbuilds, things are getting better. When the really marginal funds are able to raise, you’re probably at or near the top of the cycle and it’s time to go.

Lighthouse is one of the former, so news of an oversubscribed capital raise is positive in my books. The first announcement in the morning suggested a raise of roughly R500 million in equity to support the growth ambitions of the group, with the recent focus being on Iberia. By late morning, they announced that the raise would be increased to R1 billion, such was the level of demand from institutional investors.

Finally, at lunchtime, they announced that R1 billion had been raised at R7.85 per share, a discount of 3.1% to the closing price on 18 September. They say that it was still oversubscribed at this level, but R1 billion was already double what they were planning to raise.

Times are good again in the property sector – especially for the advisors like Java Capital who make a fortune from property capital raises.

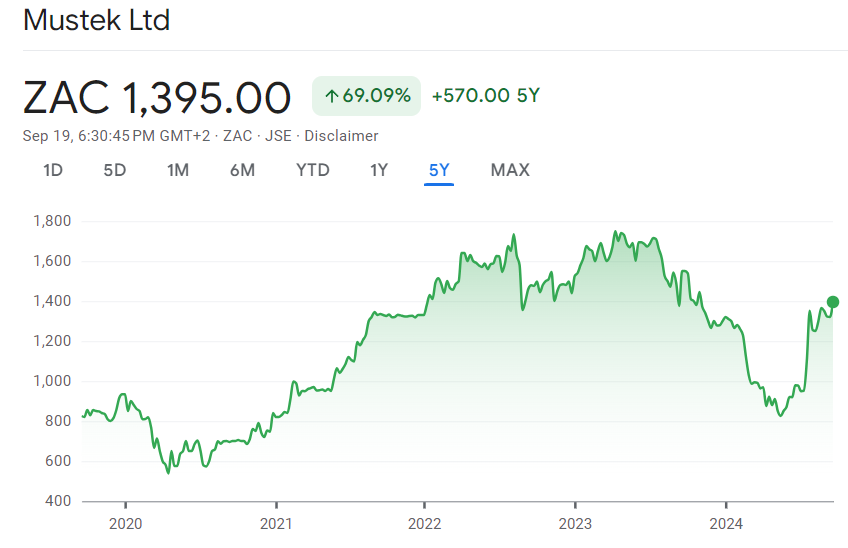

Mustek’s HEPS is even worse than initially guided (JSE: MST)

And the dividend for the year is down 90%

In what can only be described as an awkward situation, Mustek released an updated trading statement for the year ended June 2024 at 08:15 and then released full earnings at 09:40. The problem is that the initial trading statement that came out just over a week ago indicated a massive drop in HEPS of between 70% and 80%. The final drop was 82.1%. That’s so close to the guided range that I can’t believe that a last-minute trading statement added much value to the market – especially coming out just before full results anyway!

Either way, it was a very poor year for a number of reasons, some of which were way outside of Mustek’s control (like the sudden disappearance of load shedding). Revenue fell 16% and gross profit margin dipped from 13.9% to 12.2%, so net profit never really stood a chance. The dividend fell 90%, so even the dividend payout ratio decreased vs. the previous year.

Going ahead, they describe themselves as being “cautiously optimistic” – and when your earnings just collapsed, the market is looking for something stronger than cautious optimism.

Still, the share price has been on a wild ride in recent years and is a strong beneficiary of the impact of GNU optimism on local sentiment:

Powerfleet announces a major acquisition (JSE: PWR)

They are buying Fleet Complete for $200 million

Powerfleet is listed on the Nasdaq. One thing you need to know about US-based listings is that they don’t make disclosures very simple. The SENS announcement for this deal is closer to being the introduction to a legal agreement than a helpful disclosure to shareholders. Nonetheless, we persevere.

Long story short, Powerfleet is buying a Canadian business called Fleet Compete for $200 million. They are paying for it through issuing $15 million in stock and the rest in cash. Of the cash amount, $60 million is being funded by a private placement of shares and $125 million is coming from a senior term loan facility with FirstRand.

Another important point is that they are actually raising fresh equity to the value of $70 million, which means they will have $10 million left over for general corporate purposes and working capital.

If you want to learn anything about the company they are buying, you need to go through to the EDGAR filing rather than the SENS announcement. The presentation can be found here, showing that Fleet Complete is a $105 million revenue business that will add significantly to Powerfleet’s current revenue of $300 million. Fleet Complete runs at an adjusted EBITDA margin of 24% vs. 20% at Powerfleet, so it will also uplift the group margin.

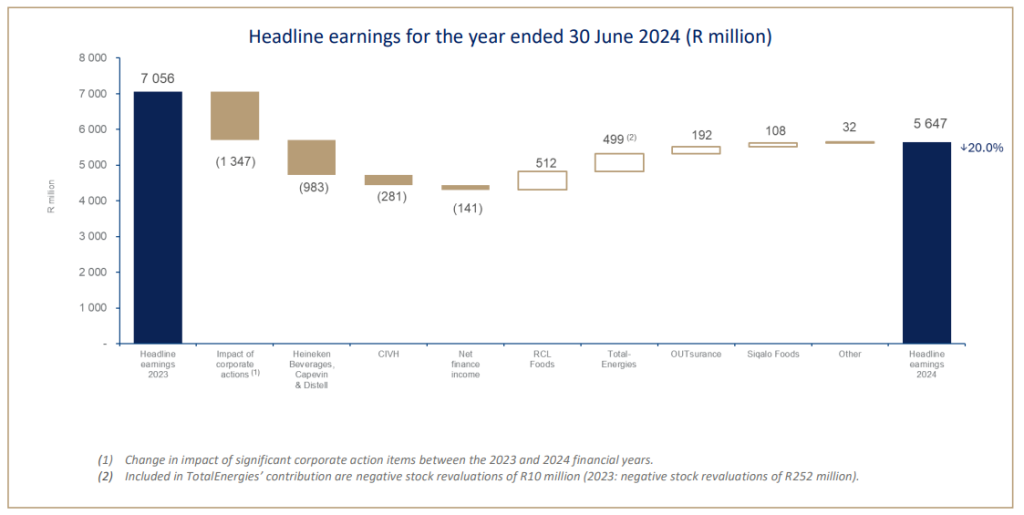

Heineken Beverages continues to hurt Remgro (JSE: REM)

What started as an exciting deal has turned into a real mess

I’m usually not one to focus on HEPS when looking at an investment holding company like Remgro, as the accounting rules inevitably lead to weird distortions. This is because some companies get consolidated, while others are accounted for as associates. Smaller stakes don’t even hit the income statement, other than their fair value movements.

Having said that, it’s hard not to notice the mismatch between HEPS falling by 18.8% and the intrinsic net asset value (INAV) per share increasing by 1%, with the dividend up 10%. To add to this fruit salad of numbers, earnings per share (EPS) fell by 86.9%, impacted by impairments.

The biggest impairment is in Heineken Beverages. Sadly, the aftermath of the Distell deal has turned into reason to have something stronger than just a beer. Before the deal, Distell contributed profits of R751 million to Remgro. After this deal, Heineken Beverages contributed a loss of R297 million, partially offset by Capevin’s positive R65 million. It’s little wonder that there’s a multi-billion rand impairment here.

Across the various corporate actions in the group, including the big stuff like the Mediclinic deal as well as smaller deals, there’s a negative impact on headline earnings of R766 million this year vs. a positive impact in the comparable year of R581 million. They give a useful waterfall chart showing the sources of major impacts on headline earnings:

I’ll still never understand what the excitement was around buying Mediclinic. In this period, Mediclinic’s revenue was up 5% and adjusted EBITDA was down 2%. Does that sound like a great use of capital to you?

Another unfortunate outcome this year was CIVH, with a loss of R75 million after a profit of R206 million last year. They blame higher finance costs and the levels of competition in the market. At least one of those things is only going to get worse from here.

The food businesses did well, like RCL Foods (which more than doubled its headline earnings contribution) and unlisted business Siqalo Foods with an increase of 31.4%. Another winner as you might have seen in the chart is OUTsurance group, with those excellent numbers having recently been featured in Ghost Bites. Honourable mentions must also go to Air Products (up 18.9%) and TotalEnergies, which saw the earnings contribution jump quite spectacularly from R54 million to R553 million. Much of that swing is due to stock revaluations. Still, without those revaluations, TotalEnergies was up 84% thanks to better refining results.

As you can see, the volatility at individual investment level is quite something to behold. It’s no different when it comes to INAV, despite such a small move at group level. The pain in Heineken Beverages was offset by the valuation increase in OUTsurance, just as one quick example. Still, the share price is down slightly over 12 months despite the improved sentiment around South Africa, so that really tells you something.

The INAV per share is R251.01 and the current share price is R145.83, so that’s a meaty discount of 42%. This is roughly in line with the usual discount at which Remgro trades.

Nuggets:

- Director dealings:

- The CEO of Sun International (JSE: SUI) has disposed of shares worth R10.8 million as part of a “rebalancing exercise” of his personal portfolio. The announcement notes that this concludes the rebalancing, with the sales representing 13.5% of his current holding in the group. The group company secretary sold shares worth nearly R1.5 million.

- A prescribed officer of WBHO (JSE: WBO) and his spouse sold shares in the group worth a total of R6.4 million.

- There’s another purchase of shares by the CFO of Metrofile (JSE: MFL), this time to the value of nearly R62k.

- Omnia Holdings (JSE: OMN) has presented at the RMB Morgan Stanley Off Piste Conference and has made the presentation available at this link. It’s a pretty useful overview of this interesting group that has operations in agriculture, mining, chemicals and manufacturing and supply chain. They are still trying hard to use global comparative companies to justify an uptick in the valuation though, an approach that I’ve never been comfortable with. Big offshore companies trade at higher multiples for a reason.

- Grindrod (JSE: GND) also participated in the RMB Morgan Stanley conference and their presentation (available here) has a lot of pretty pictures. Interestingly, it notes that the internal rate of return on the deal to acquire the remaining 35% in the Matola Terminal is expected to exceed their risk hurdle rate of 16% despite the valuation multiple being paid. It does help that there’s quite a big cash balance in the terminal, which obviously adds to the value.

- Hulamin (JSE: HLM) has also released its presentation from the same conference. It goes into quite a bit of detail, showing exactly which products will be expanded or discontinued going forward.

- There are some changes to the board at Jubilee Metals (JSE: JBL). Neal Reynolds is resigning as CFO and Riaan Smit has been named as internal replacement. On the non-executive side, Dr Reuel Khoza will be joining the board. He has immense experience across numerous institutions in South Africa, so that’s quite a win for the group.

- As part of the major corporate activity at Kibo Energy (JSE: KBO), which includes a reverse takeover, the group is required to sell its Kibo Mining (Cyprus) subsidiary. This is because the counterparty in the reverse takeover doesn’t want those assets. It’s therefore an important step that Kibo has signed a sale and purchase agreement with Aria Capital for that subsidiary. Shareholders will need to approve the disposal, along with the various other planned transactions at the group.

- For those who are closely following Ascendis Health (JSE: ASC), Alpvest Equities has sold its interest in the company and Kingston Kapitaal has acquired a stake of 6.1% in the group’s equity.