Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Calgro M3’s executives are going out on a high (JSE: CGR)

With major changes at the top, Calgro’s business is on a strong footing

Calgro M3 has released a trading statement for the six months to August 2024. This will be the last set of results presented by the outgoing CEO Wikus Lategan and his right-hand man Waldi Joubert. Although the market already knows about these changes, it’s worth reminding you of the good news that Sayuri Naicker remains as the CFO, so there’s some continuity in the C-Suite. Ben Pierre Malherbe will be returning to the group as its CEO.

Malherbe will be walking into a group that is on a solid footing, with HEPS for the period up by between 23.54% and 33.54%. No further details are given but you won’t have to wait long, as results are due on 14th October.

Datatec has flagged really strong earnings growth (JSE: DTC)

All divisions have a good story to tell

Datatec has released a trading statement for the six months to August 2024. They can feel proud of these numbers, with HEPS up by between 58.7% and 74.6%. If you are willing to use underlying earnings per share (with various adjustments that Datatec believes are in line with peers), then the growth rate is 50.7% to 64.4%.

The great news is that whichever way you cut it, that’s a fantastic growth rate.

The trading statement also tells us that all divisions were up for this period, with Logicalis International “strongly” increasing profitability.

Detailed results are due for release on 24 October.

Jubilee Metals pulls the trigger on Project G (JSE: JBL)

The due diligence has been concluded and they are acquiring a 65% stake

Jubilee Metals is a diversified metals producer focused on Zambia and South Africa. The Zambia story is all about copper, with various initiatives underway. One of the possibilities on the radar has been Project G, an open pit copper mining operation in Zambia. Jubilee Metals has been busy with a due diligence on the opportunity and has made the decision to go for it, making this the second open-pit mining operation acquired by Jubilee.

In fact, they’ve decided to take a 65% stake rather than the 51% stake that was initially intended. They must have really liked what they saw in the due diligence. To fund the deal, they will pay $2 million in cash with a commitment to invest a further $500k into upgrading the operations. The idea is that Project G will supply pre-concentrated run-of-mine to the Sable Refinery, so you can see the Jubilee strategy coming together.

Jubilee initially planned to pay for the acquisition in shares rather than cash. The change of heart is interesting and no further details are given in the announcement as to why this happened.

In additional news in the same update, Jubilee has secured more power under the private power purchase agreement to ensure that all Zambian operations are supplied under that agreement. This means the entire Zambian strategy is being powered by renewable energy.

Despite all this good stuff, the cycle hasn’t been kind to the Jubilee Metals share price:

Richemont finds a home for the mess that is YOOX NET-A-PORTER (JSE: CFR)

But are they just throwing good money after bad?

Online luxury remains an oddity for me. To be fair, the entire luxury sector doesn’t make a huge amount of sense to me. Call me a simpleton, but I am never going to buy a pair of shoes that costs the same as a flight overseas. I’m therefore no expert in how such consumers are willing to shop for this stuff, but even with that disclaimer out the way, I suspect that those in the luxury market enjoy the experience of going to a boutique and feeling fancy. There’s absolutely nothing fancy about logging onto a boring-looking website and buying luxury products.

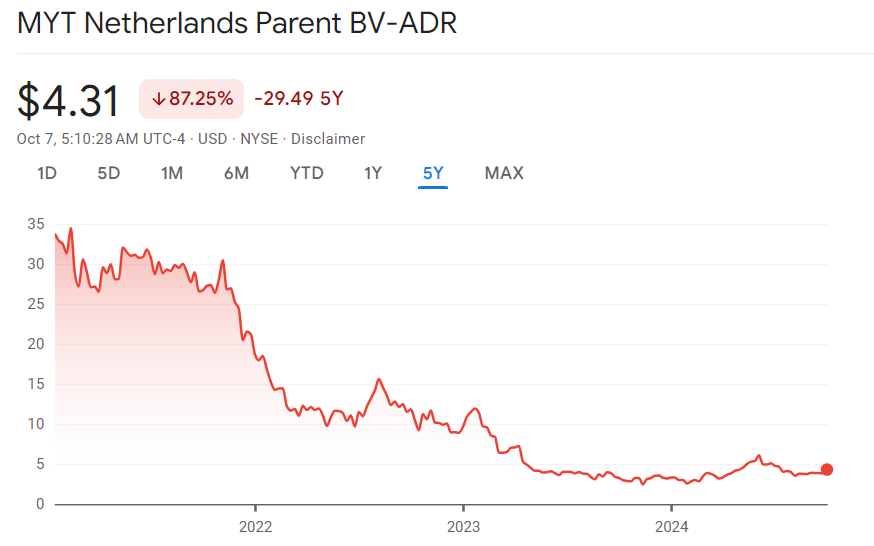

YOOX NET-A-PORTER hasn’t worked out well for Richemont. I’m sure there are many reasons why, but the share price of Mytheresa (the group buying YOOX from Richemont) tells me that my thesis about online-only luxury stores isn’t far off the mark:

Of course, with a well-timed IPO in the frothy times of 2021, it was unlikely that things would go well for the share price from there. Still, a drop of 87% since then is quite extraordinary.

If you’re a Richemont shareholder, you might be feeling relieved at the prospect of being out of YOOX. I’m afraid that it’s not that simple. Mytheresa is buying YOOX for EUR 555 million, but is paying for the acquisition by issuing shares to Richemont. This will leave Richemont with a 33% stake in Mytheresa.

So, there’s no cash unlock here. In fact, it’s quite the opposite, as Richemont is providing a EUR 100 million revolving credit facility to YNAP. Putting money into a company to help it go away seems to be the theme of the JSE recently, with flavours of the recent news at Spar and Transaction Capital to this deal.

Of course, Richemont puts a much more positive spin on it. They talk about creating a multi-brand digital group of scale and global reach. With Richemont expecting a write-down of EUR 1.3 billion for YOOX as part of this deal, it’s hard to find much of a silver lining here. In reality, this deal just gives Richemont some optionality into online luxury and the hope that a larger platform may be the way to get it right in this space.

Sirius expects property valuations to start increasing (JSE: SRE)

This is exactly why I’ve been long the property sector for months now

When interest rates start dropping, there is an overall decrease in yields in the market. This means that investors don’t have any many options elsewhere to earn strong yields, so they are willing to pay a bit more for the dividends coming out of property funds. This effect cascades down into the portfolios, where property values also increase as yields come down and investors are willing to pay more for each property. All of this contributes to higher share prices in the sector.

After a rough period in European markets due to a high interest rate environment, things have turned the corner. Rates have started decreasing and that is lovely news for property funds, as they enjoy the double benefit of cheaper debt and better property valuations. I’ve been writing about this for months and it is finally happening, with Sirius Real Estate noting an expectation that property valuations in the UK and German should increase in the six months to September 2024.

Of course, growth can’t just be driven by a change in rates. The underlying properties also need to perform. Sirius managed a 5.5% like-for-like increase in the rent roll for the period, which means they are growing ahead of inflation. For a property fund, that’s the primary goal as this is what investors are looking for. A 14.9% increase in the overall rent roll is a less helpful metric, as this simply reflects how acquisitive Sirius has been.

Germany has marginally outperformed the UK, which is slightly surprising for me given the challenges being faced by the German economy at the moment. It all comes down to the specific underlying properties, of course.

The acquisitions are set to continue, as Sirius raised €180 million in July 2024 for the purposes of further acquisitions in Germany and the UK. The balance sheet is strong and there are no significant debt maturities until June 2026.

Detailed results are due on 18th November.

Nibbles:

- Director dealings:

- Des de Beer is at it again, buying shares in Lighthouse Properties (JSE: LTE) worth R27.7 million.

- A director and prescribed officer of Standard Bank (JSE: SBK) sold shares worth a collective R3.9 million.

- The COO of Italtile (JSE: ITE) has sold shares worth R3 million. Although improved local sentiment and decreasing interest rates will help that business, the share price has run hard and they are facing strong competition in the market, so that’s a useful signal I think.

- The share awards at Aspen (JSE: APN) were a mixed bag, with some directors and prescribed officers retaining all the awards, others selling to cover the tax and some selling in full. I appreciate the level of disclosure by the company in this regard.

- Back in August, Hulamin (JSE: HLM) alerted the market to a fire that caused damage on Coil Coating Line 2. Two months later, plant repairs have been completed and the plant has been recommissioned for production.

- Stefanutti Stocks (JSE: SSK) announced that the parties to the transaction for the disposal of SS-Construções in Mozambique have agreed to extend the fulfilment date for conditions precedent to 30 November 2024.

- There’s trouble at Acsion (JSE: ACS), with BDO resigning as the auditor with immediate effect and not for happy reasons. BDO notes that Acsion “lacks sufficiently adequate resources to be able to release the financial statements” and that their invoices for cost overruns were not being met with a response from the company. Sounds messy.

- AVI (JSE: AVI) will pay its special dividend on 21 October, so keep an eye out for it if you’re a shareholder there.