Grindrod’s Mozambican headache is over – for now (JSE: GND)

That was quick, wasn’t it?

Grindrod’s port and terminal operations in Mozambique have been an important part of the recent story. Due to post-election violence in the country, they announced on Thursday that operations had been suspended. A day later, the suspension had been lifted.

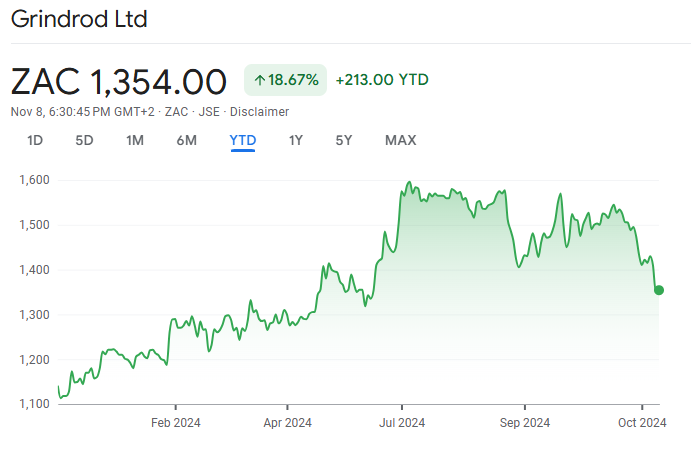

Despite the incredibly quick resolution, the market didn’t jump back into Grindrod. It’s down 4% in the past week. Perhaps there’s still some nervousness around potential further issues. Either way, for those who enjoy a speculative punt, this chart is interesting:

Huge Group’s net asset value is higher (JSE: HUG)

Nothing is as huge as the discount to NAV, though

Huge Group accounts for its group as an investment holding company. Given the vast discounts to net asset value (NAV) at which these structures trade on the JSE, that was a decision that I doubt they will look back on with much joy. Sure enough, the NAV has moved up to R9.84 and the share price is stuck at R2.00.

When you see this, the very first thing you should assume is that the market is right until proven otherwise. The directors are incentivised to value the assets as optimistically as possible. The market is incentivised to be more cautious. I use the latter as a safer point of departure.

I guess it also helps that I’ve looked at Huge before, so I know that they value R490 million worth of preference shares at an hilarious required rate of return of 10.75%. That’s a spread of just 138 basis points over where 10-year government bonds are trading right now. It’s little wonder that the market isn’t interested at that price, particularly when the total investment portfolio is valued at just under R1.6 billion. These prefs are therefore a material part of the story, with Huge trying to justify the valuation based on contractual cash flows in the prefs. Those cash flows are only as good as the underlying business paying them, which I somehow doubt is less risky than e.g. South Africa’s biggest banks, which have a significantly higher cost of equity than 10.75%.

As for the rest of the group, discount rates don’t look too unreasonable actually. The group’s track record just gets in the way, as the market doesn’t look very favourably upon Huge. Despite being a South African focused business, the share price has returned exactly nothing this year at a time when the rest of the market has rallied strongly.

Again, the market is telling you something here.

ISA Holdings reports better profits despite a dip in sales (JSE: ISA)

Margin mix is important here

ISA Holdings is an interesting technology company that has delivered a share price return of 60% this year. The improved sentiment around South African stocks has certainly helped here.

For the six months to August, the group managed to increase HEPS by 10% despite turnover taking an 8% knock. The turnover dip was caused by timing differences on larger contracts, which makes sense in a group of this size. Due to the focus on margin mix and of course the timing differences as well, gross margin jumped from 47% to 55%. This is why profits went the right way in the end.

Another highlight is the share of profits from equity-accounted investment DataProof, which jumped by 25%. Cybersecurity is a very important growth area at the moment.

Shareholders will keep an eye on cash, which fell 25%. Although there are good reasons for it, one of the factors is a negative move in working capital that management explains as being due to timing differences. That’s an entirely plausible explanation, but still worth confirming at year-end.

The word “resilient” isn’t what Richemont shareholders want to see (JSE: CFR)

With flat sales, the share price fell 5% on the day

The luxury sector has been having a tricky time recently. Richemont could only manage flat sales in constant currency for the first six months of the year. As reported, sales came in 1% lower. Of course, when you dig deeper into the segments, you find much more variance. Asia Pacific dragged the team down with an 18% decline, while the Americas grew double digits and Japan managed 42%! Asia Pacific is just so big that the decline in that region was enough to offset all the growth elsewhere.

Another way to slice and dice the numbers is by looking at operating segments. Jewellery Maisons grew 2% and Specialist Watchmakers fell by 17%, so there’s quite the divergence there. The margins are also very different, with Jewellery Maisons at a 32.9% operating margin and Specialist Watchmakers at 9.7%.

Sales may have been “resilient” but the same can’t be said for operating margin from continuing operations, down a nasty 17% as operating margin contracted by 410 basis points to 21.9%. Cash flow generated from operating activities also showed exactly what shareholders don’t want to see: a drop of 25%.

The discontinued operation is YNAP and the non-cash write-down in that business has had a significant impact on earnings at Richemont. Discontinued operations contributed a loss of €1.3 billion this year vs. a loss of €655 million in the prior year. Although they will sell that business to Mytheresa, the pain may not be over yet – it’s a share-for-share deal, so if things keep getting worse, Richemont will just end up recognising losses on the Mytheresa stake instead.

In summary, HEPS fell by 21% and the share price is now down 3.7% year-to-date. That doesn’t tell the full story though, with a pretty serious double top in the middle of the year that shows how severely it has come off the 52-week highs:

The construction industry remains subdued, so read Sephaku’s numbers carefully (JSE: SEP)

You can’t extrapolate this growth in profits

Sephaku has released results for the six months to September. The underlying theme is one of little to no excitement in the construction industry, evidenced by a slight decline in group revenue. The story looks completely different for profitability though, with HEPS up from 7.54 cents to 13.78 cents – a jump of 83%!

How can this be? The answer lies in the SepCem profit contribution, which swung from a loss last year of R14 million to profit of R1.5 million. This is because EBIT margin in that business normalised at 4.8% in this period vs. just 1.1% in the comparable period due to supply and maintenance issues.

At Metier, the subsidiary within Sephaku, EBIT margin dipped by 40 basis points to 8.0% and profit came in slightly slower than last year at R36.5 million.

So, the important thing is to avoid interpreting the HEPS jump as an improvement in the construction sector. The narrative is one of subdued activity, with the HEPS increase due to the base effect of a highly problematic period last year rather than anything else.

Sales are down across The Foschini Group (JSE: TFG)

Yet the dividend is 6.7% higher

The Foschini Group certainly knows how to give shareholders something to smile about. Even though group revenue for the six months ended September was down 1.4%, gross profit was up 2.5% – and they point out that the R12.8 billion in gross profit is a record number. As a retailer should essentially be growing every single year due to inflation, each year should theoretically be a record! Still, it’s all about the narrative.

There’s so sign of any records further down the income statement, with operating income before finance costs down 3.4% and HEPS down 5.6%. Despite this, the group then gives shareholders another nugget of happiness: an increase in the dividend of 6.7%.

The third bone thrown to shareholders comes in the form of recent improvements in sales. Group sales were down 3.5% for the first 21 weeks and ended 2% lower for the 26 weeks, so there’s been a significant improvement across the group since September. In the last 5 weeks of the period, sales in TFG Africa were up a meaty 8.3%. TFG London grew 0.3% in those 5 weeks and TFG Australia was 0.1% lower. Along with the dividend increase, I suspect that this is why the share price closed 5% higher.

It’s interesting to note that they are more fully stocked than this time last year, with inventory up 7.5% despite lower sales. This is due to port delays in the comparable period that impacted stock levels at TFG Africa, so things seem to have normalised.

Within TFG Africa, clothing sales fell 1% year-on-year. Although the Chinese competition in the market must be playing a role here, they also had a lot of clearance activity in the comparable period. This explains why gross margins increased this year but sales growth was negative, as clearance sales in the base period would boost sales and punish gross margin.

Special mention must go to Bash, the online platform that grew sales 47.9%. It now contributes 5.6% of TFG Africa’s sales.

Looking abroad, TFG London is in trouble. Sales fell 8.2% in GBP and gross profit was down 3.1%, with some of the pain at least offset by a focus on gross margin. In TFG Australia, they are also complaining about consumer pressures as sales fell 2.4% in AUD. Again, the focus is firmly on gross margin.

Despite the challenges overseas, TFG is moving ahead with the acquisition of a business called White Stuff in the UK. Shareholders would love to see some green stuff, particularly in the column showing the percentage change year-on-year for offshore sales!

Nibbles:

- Director dealings:

- The largest shareholder in Exemplar REITail (JSE: EXP) will be unbundling 10,000,000 Exemplar shares to its own shareholders. Whilst this doesn’t immediately change the ultimate beneficial ownership of the shares, it could logically lead to some further trading in shares as they will now be more widely held. At the current price of R11.50 per share, that’s R115 million worth of shares. The market cap is R3.8 billion.

- Eastern Platinum (JSE: EPS) released results for the third quarter. Revenue fell 49.5% and mine operating income swung from positive $8 million to a loss of $1 million. Attributable net loss was $3.4 million, with lower chrome sales in the quarter as the primary culprit. The focus remains on ramping up the Zandfontein underground section at the Crocodile River Mine.

- Oasis Crescent (JSE: OAS) shareholders, pay attention. The fund is using a reinvestment alternative for distributions, except here’s the trick: the default choice is to reinvestment the distribution, not receive the cash. Here’s the second trick: the reinvestment price is R27.57 per unit, whereas the current traded price is R19.20. That’s because the reinvestment price is set at the NAV per unit. Usually, companies set the price with reference to the market price and make the cash distribution the default, so Oasis Crescent is being cheeky here.

- Redefine (JSE: RDF) is taking the popular route of offering a dividend reinvestment alternative, which is basically like a miniature rights issue. For some reason, they are vague about the reinvestment price though. It will only be confirmed on 19 November. I tried to download the circular to see if they give more details in there, but alas the wrong PDF was uploaded to the Redefine website on that link. So, for now, I can’t tell you anything further. If you’re a shareholder, keep your eyes open for further announcements.

- As the Initial Reserve Milestone (as defined in the prospectus) has been achieved, Southern Palladium (JSE: SDL) has issued 1,200,000 shares upon conversion of performance rights. The thing about junior mining is that dilution over time for shareholders is guaranteed.