African Rainbow Capital gives a portfolio update – and Tyme still looks exciting (JSE: AIL)

As for problem child Kropz, they are still putting in more money

African Rainbow Capital has released an update on the performance of the portfolio and the capital allocation activities in the three months to September. This was obviously a far more bullish period than before, with GNU-inspired improvements to sentiment and interest rates starting to come down.

The announcement is generally big on narrative and low on numbers. For example, rain is described as having continued growth and momentum, along with growth in mobile customers. Bluespec is meeting the demanding budgets set for the business, with Weelee noted as a highlight. At Upstream Group, which operates in the debt recovery industry, EBITDA is up 13% overall but there are major differences in performance across the various units of that business, giving them an opportunity to invest in the stuff that is working. The agri portfolio is in line with projections, although they note challenges there based on costs and logistics.

The one I haven’t mentioned yet in the diversified investments portfolio is Kropz Plc, where production at Elandsfontein was slowed to reduce costs and modify the process. They hope for production efficiencies going forwards as a result. This business has been a headache, with ARC putting in R140 million during the quarter and another R270 million since September. Good money after bad? Hopefully not.

Moving on to the financial services portfolio and dealing with Tyme Group as the most important and exciting part, they now have 14.4 million customers! 10 million are in South Africa and 4.4 million are in GoTymeBank. TymeBank in South Africa achieved sustainable profitability in September and GoTymeBank is on track. They have acquired Savii, a Philippine payroll lender, with integration underway. There’s a new CEO in the local business to keep supporting growth and Tyme Group is now pursuing a Series D capital raise. A listing of Tyme cannot be far away. I just hope it will be on the JSE!

Ooba is enjoying a jump in home loan applications thanks to lower interest rates, with “bond production” in October up 18.7% year-on-year! Crossfin is showing solid growth, with the major milestone this quarter having been the sale of Adumo to Lesaka Technologies for R1.6 billion. This gave ARC a shareholding in Lesaka.

And finally, Capital Legacy has been boosted by the deal with Sanlam that saw Sanlam Trust become part of the Capital Legacy group in exchange for a 26% stake for Sanlam.

Overall, things are firmly on the up and African Rainbow Capital’s share price has enjoyed a return this year of 57%!

The Boxer listing has truly been a success (JSE: BOX | JSE: PIK)

The price didn’t need to be stabilised in the end and another R500 million has been raised

The Boxer share price has traded consistently above the IPO price since listing, so the bank that was appointed as stabilisation manager thankfully didn’t need to undertake any stabilisation activities to settle the market. They are confident that this situation won’t change, so they’ve agreed that no stabilisation activities will be possible going forward.

The stabilisation manage has exercised the overallotment option, which means Boxer has issued another R500 million worth of shares for the stabilisation manager to close out its short position. This takes the final size of the offer to R8.5 billion and it means that Pick n Pay holds 65.6% in Boxer. It’s going to be really interesting to track the performance of both companies going forwards!

Labat Africa has lost a ton of money (JSE: LAB)

It might be a going concern, but it’s also an ongoing concern

Labat Africa finally released results for the year to May 2023. That isn’t a typo – they have been terribly behind on their financial reporting. Despite revenue having more than doubled to nearly R50 million, they still managed a headline loss per share of 7.14 cents – similar to the previous year. I must note that the comparative period was only nine months rather than twelve, so this would’ve affected the revenue growth.

The net asset value per share fell all the way down from 15.4 cents to 1.58 cents. To add to this, they had operational cash flow challenges based on disputes with SARS. We will need to wait for the 2024 financials to see what the current position looks like.

Single-digit growth at Nedbank (JSE: NED)

The share price has certainly done far more than that this year

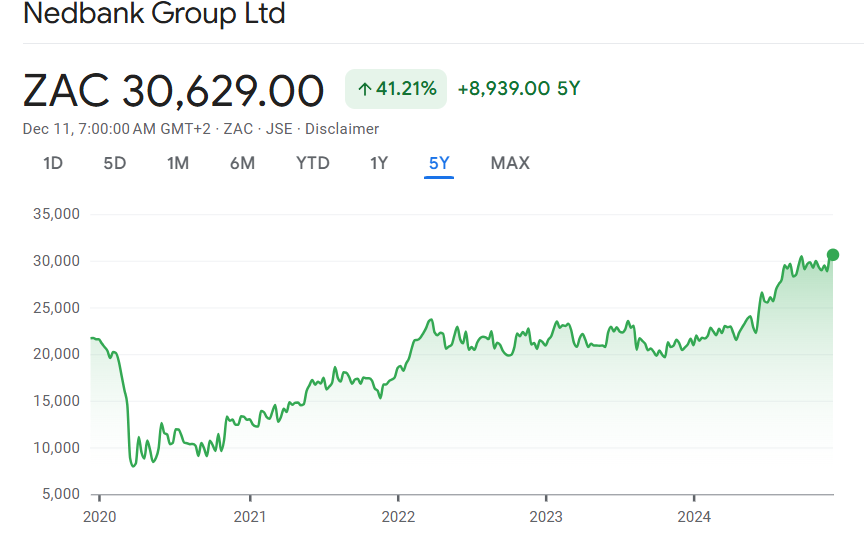

Despite the decreasing interest rates and what this will likely mean for banking margins going forwards, the market has been celebrating renewed confidence in South Africa with an excellent rally in Nedbank. The share price is up 42% this year, finally breaking out of the channel it was stuck in for a long time:

A pre-close update now gives us an updated view of the underlying business performance for the ten months to October.

Household credit growth was just 3.2%, which Nedbank reckons is the bottom of the cycle as interest rates have now started to ease and demand for credit should pick up. Corporate credit growth was up 5.6%, with hopes for this to increase in 2025 as business confidence improves.

Headline earnings growth is above mid-single digits, driven by lower impairments and strong growth in non-interest revenue (NIR), with the net interest income (NII) growth as a drag. Although they expect an improvement in NII in 2025, they will need decent growth in the book to offset the lower margins that are the inevitable outcome of decreasing interest rates.

The credit loss ratio is down year-on-year and is now within the top half of the approved through-the-cycle range of 60 to 100 basis points.

The cost-to-income ratio has unfortunately increased, so operating margins went the wrong way. This is why HEPS growth will only be mid-to-upper single digits. Still, that means growth ahead of inflation and that’s a decent outcome! An improvement in return on equity vs. last year is also good news for the share price.

Renergen released a short story on SENS, not just an announcement (JSE: REN)

And it all deals with the “implied threat to mineral rights”

If you’ve been following Renergen, you’ll know that they are currently having a large fight with a solar company that is busy developing a project on land where Renergen has a petroleum production right. There are a bunch of technical arguments here, with the solar company even appealing Renergen’s right to helium! Renergen’s argument is that helium cannot be separated from petroleum underground prior to extraction, so that is a moot argument as they have the petroleum right.

The timing of this is extremely inconvenient for Renergen, which I’m sure is no accident in terms of the solar company’s strategy. Renergen is looking to raise capital in the US and any question marks around the fundamental legal rights of the business make that very difficult.

Renergen has released a very long SENS announcement setting out the alleged behaviour of the solar group and the lack of meaningful engagement, along with the impact for the broader mining industry if construction is condoned by the DMRE without consent from existing mineral and petroleum right holders. Renergen is looking for an ability to co-exist with the solar group, provided their access to the known gas-bearing fault lines is protected.

It certainly doesn’t sound like an outrageous expectation from Renergen. With the share price down 48% this year, they really can’t afford any nonsense around their legal rights.

Sabvest takes broader exposure in moulded plastic products (JSE: SBP)

This is an example of how broad the portfolio is

Sabvest Capital is one of the more interesting investment holding companies on the JSE, with a broad portfolio of unlisted assets that investors cannot otherwise gain access to. This is how investment holding companies should work, as there’s really no point in a listed company having large stakes in other listed companies.

The latest news in the portfolio is that Sabvest is swapping its 47.5% holding in a company called Flexo line Products for a 23.75% stake in Amicus Investments. Flexo is the largest manufacturer of high quality injection moulded plastic products for the food industry. Amicus is a holding company for business operating in this space, so they are piecing together complementary businesses here in the hope of creating value.

It’s far too small a deal in the Sabvest context to require detailed disclosure, so we have no sense of numbers here.

South32 is being impacted by civil unrest in Mozambique (JSE: S32)

Production guidance for Mozal Aluminium has been withdrawn

South32 has released an announcement based on escalating civil unrest in Mozambique. The issue is road blockages, which are making it difficult to transport raw materials to Mozal Aluminium.

Given the uncertainty around the issue, the group has withdrawn guidance for Mozal Aluminium. There have thankfully been no security incidents at the facility thus far, so this is purely a logistics problem at the moment.

A far more bullish narrative at Thungela around production (JSE: TGA)

They even have nice things to say about Transnet!

If this Thungela update is anything to go by, then finding a lump of coal under the Christmas tree might not be so bad this year – especially if it takes the form of a share in Thungela! In a pre-close update, they note that full-year export saleable production is expected to exceed guidance in both South Africa and Australia. That’s a big deal!

To add to the cheer, they expect the FOB cost per export tonne to be below the guided range, thanks to higher production and cost efficiencies.

Perhaps the best news of all in this update is that things are getting better at Transnet Freight Rail, admittedly thanks to a lot of support from the coal industry that depends on this infrastructure. On an annualised industry basis, performance has improved from 47Mt in the first half of the year to around 56Mt at the moment.

The production side of the update is clearly positive. As for pricing, although there are factors supporting the coal price, the direction of travel in the past year has been downwards. For example, the Richards Bay Benchmark is down from $121 per tonne to $105.21 per tonne. The Newcastle Benchmark has dropped from $172.79 per tonne to $135.59 per tonne.

The benchmark price isn’t the same as the price that Thungela gets. The big swing there is on the Newcastle Benchmark, where they got 92% of the benchmark price this year vs. an 11% premium last year thanks to fixed price contracts that were part of the acquisition. The current discount is being driven by disappointing demand in Asian markets, so Chinese stimulus would help here.

Another important metric is capital expenditure. Total capital expenditure in South Africa for the year is expected to be R2.7 billion, of which R1 billion is maintenance capex and R1.7 billion in expansionary capex. Both numbers are within range. In the Australian business, maintenance capex of R550 million came in slightly below guidance.

With expected net cash of between R8 billion and R8.5 billion by the end of December and this positive outlook, things are on track for the dividend policy of distributing at least 30% of adjusted operating free cash flow to shareholders.

Nibbles:

- Director dealings:

- Ready to feel poor? After exercising options in the stock, a director of Naspers (JSE: NPN) sold shares worth R187 million!

- The Chief Customer Officer of Powerfleet (JSE: PWR) sold shares worth a meaty $1.84 million. This works out to over 80% of the executive’s total position in the stock, so this is a major sale.

- The CEO of Lewis (JSE: LEW) sold shares worth around R6.4 million. Given the focus on buybacks over the years, seeing the top executive selling into the market is an important signal.

- Two directors of DRA Global (JSE: DRA) have bought shares worth roughly A$180k in total. This an Australian company, hence the reference to Australian dollars.

- The outgoing CFO of AfroCentric (JSE: ACT) has sold shares worth R660k.

- A director of MTN (JSE: MTN) has sold shares worth R632k.

- Astoria Investments (JSE: ARA) has renewed the cautionary announcement regarding the potential sale of the 49% stake in ISA Carstens. An indicative non-binding offer has been received and negotiations are ongoing.

- The scheme of arrangement for the deal that will see Capital & Regional (JSE: CRP) merge with NewRiver REIT has become effective. Capital & Regional will now delist and local investors in Growthpoint (JSE: GRT) will have indirect exposure to the merged portfolio.

- Marshall Monteagle (JSE: MMP) has very little liquidity, so it only gets a mention down here. A trading statement for the six months to September reflects a jump in HEPS from 2.2 US cents to 6.2 US cents. They attribute this mainly to higher profits in the trading and property operations. They also note disposals of investments, although this would normally not fall into HEPS.

- Super Group (JSE: SPG) announced that S&P Global Ratings has affirmed the company’s credit ratings. Given some of the recent changes at the company, ranging from disappointing performance in Europe through to the positive news of the deal in Australia, this is useful.

- It never rains but pours in the platinum industry, with Wesizwe Platinum (JSE: WEZ) announcing a potential cybersecurity breach. Systems have been shut down and experts have been brought in to investigate the breach and recovery solutions. At this stage, there’s no indication of how severe the breach has been or whether there could be financial impacts (beyond the costs of expensive experts).

- Sable Exploration and Mining (JSE: SXM) announced that the board has received a demand from holders of 10.74% of the company’s issued share capital to call a shareholders meeting. They are considering the demand and will update the market accordingly.