The losses at Accelerate have accelerated (JSE: APF)

At least interest costs have come down thanks to capital raising efforts

Accelerate Property Fund is in a bad space. They’ve had to dispose of assets and raise R200 million through a rights issue to give some support to the balance sheet, yet the loan-to-value ratio has improved by just 100 basis points to 46.7%.

For the six months to September 2024, the headline loss per share worsened substantially from 2 cents to 6.32 cents. This is despite a reduction in finance costs based on the capital raising activities and resultant decrease in debt.

At the moment, lenders are still refinancing the debt – mainly because they believe that they can keep squeezing juicy amounts of interest out of this thing. At least the banks are getting something, as equity holders can’t expect much when you see underlying metrics like a huge vacancy rate of 17.9% at Fourways Mall. Accelerate is working with Flanagan and Gerard as well as the Moolman Group to try and improve things there, but there have been difficulties in getting a contract implemented.

Notably, the BMW Fourways building suffered a negative reversion of 25% after the renewal of a ten-year lease, showing exactly what has happened in the Joburg property market (and the automotive sector) in the past decade. This contributed to the total negative reversion of 7% for the fund.

As should be obvious by now, there is no dividend for shareholders. The share price is down 29% year-to-date.

Dezemba weirdness at AECI (JSE: AFE)

The CFO is on her way out, practically immediately

‘Tis the season for weird SENS announcements and AECI hasn’t disappointed, with news that CFO Rochelle Gabriels is stepping down on “mutually agreed terms” with effect from 31 December 2024.

Ian Kramer has been appointed as acting CFO. He is currently Senior Finance Advisor to the group – a rather odd title that makes it sound like he only has one foot in the door there.

No further details are available at this point. This is the kind of stuff that sets off alarm bells for investors.

Bell’s earnings are falling through the floor (JSE: BEL)

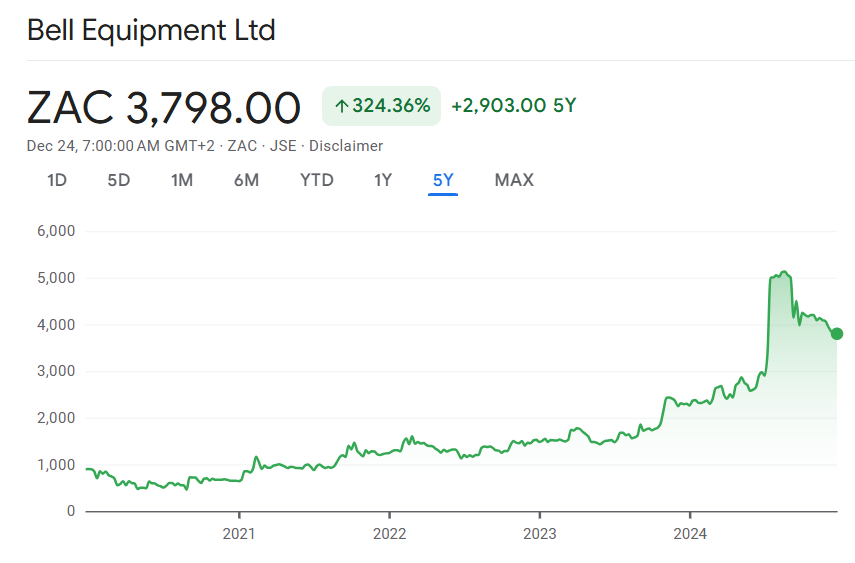

That rejected offer of R53 per share must be a cause of regret by now

When the Bell offer was made and a few activist investors fought hard for it to be higher, I feared at the time that people might live to regret not taking the R53 offer. The share price is currently at around R38 and an updated trading statement for the year ended December doesn’t give us much reason to believe that it will be heading higher from here.

The initial trading statement suggested that HEPS would be at least 25% lower for the year. Now, the company has guided that HEPS will be at least 40% down on last year. This implies HEPS of a maximum of 478 cents and possibly lower.

The take-private offer would’ve ended up being a forward multiple of at least 11.1x for a cyclical group with heavy exposure to the mining industry. Hindsight may be perfect, but there’s also that old story about how the pigs get slaughtered.

This isn’t a chart that I would like to own:

Cilo Cybin: one of the highest valuation multiples you’ll ever see (JSE: CCC)

You might want to be sitting down for this one

Cilo Cybin is a special purpose acquisition company (SPAC) that was set up to facilitate the acquisition of Cilo Cybin Pharmaceutical, a private company that was started in 2018 to focus on the medical cannabis industry. Despite a lot of very impressive paragraphs about their facilities, the net asset value was -R18.7 million as at March 2024 and the loss after tax was R5.9 million.

No matter, because in cannabis startup land, this doesn’t stop the business from being sold to the SPAC for R845 million. And no, there isn’t a missing decimal there. You’ll need to give me something a lot stronger than medical cannabis before I feel comfortable about that valuation.

For the six months to September 2024, things improved to a profit after tax of R13.6 million and a net asset value of R1.3 million. Clearly, the trajectory is strong and the valuation is based on immense growth and a hope that the multiple unwinds quickly. Many startups tend to forget the impact of competition and a slower growth curve as a business matures.

We will have to wait and see what happens here. Forgive me, but paying a 650x price/book multiple is somewhat outside of my comfort zone.

Gemfields takes drastic steps to navigate a difficult market (JSE: GML)

Mining is risky and the mining of pretty things is even riskier

As I wrote some months ago, the back-end of 2024 was absolutely critical for Gemfields. They have been on quite the capex spree, with more planned for 2025. At the same time, prices for emeralds and rubies haven’t really been playing ball, especially in the case of the green stones.

Things have now come to a head, with ongoing problems of oversupply in the emerald market leading to Gemfields taking the decision to suspend production for up to 6 months at Kagem Mining. They will focus on processing ore stockpiles at Kagem while the emerald market hopefully comes right. The problem is that if the Zambian competitor can somehow keep selling emeralds at a discount, then this could get very painful indeed.

The rubies aren’t free of issues either, with fewer premium rubies coming out of the ground in Mozambique recently and worries around civil unrest. Still, construction of the second ruby processing plant is a critical project and it remains on time and on budget, with planned completion by the end of H1 2025. The civil unrest is taking its toll though, with all non-essential capex in northern Mozambique suspended.

That’s not all, folks. They are “assessing strategic options” in respect of Fabergé, a luxury jewelery business that they frankly should’ve sold ages ago. They are also very keen to sell the gold project Nairoto Resources Limitada, going so far as to put contact details in the SENS in case anyone is interested!

Perhaps they should try Facebook Marketplace as well?

Somehow, despite this, the share price closed 10% up for the day. It’s down 44% year-to-date.

Prosus and Naspers deepens exposure to Latin America with the acquisition of Despegar (JSE: PRX | JSE: NPN)

The new CEO knows how the region works and I think it creates a great opportunity

We don’t see enough deals in Latin America by JSE-listed companies. Historically, local executives liked to create emigration opportunities by making acquisitions in places like the UK and Australia. These days, we at least see more of a tilt towards higher-growth markets in the developed world. Yet, for some reason, our execs are scared of other emerging markets despite navigating all the challenges that South Africa throws at them.

Aside from rare examples like Pepkor acquiring Avenida in Brazil a while ago, South Africans tend to limit their exposure to Latin America to watching football games.

Fabricio Bloisi is the man in charge these days at Prosus / Naspers and he knows the region intimately, having been born in Brazil and having built iFood there. So, when the group announces a deal in Latin America, you can be sure that there’s proper on-the-ground experience being applied.

Prosus is acquiring Despegar, Latin America’s leading online travel agency, for $1.7 billion. Now, this may sound like a business model from last century, but they understand platform businesses over in that part of the world, as evidenced by how developed a competitor like Mercado Libre has become. Prosus can find ways to cross-pollinate the various platforms in the group with different service offerings, with access to over 100 million customers in the region.

Despegar generated revenue of $706 million and EBITDA of $116 million in 2023. The deal has therefore been priced at a revenue multiple of just over 2.4x, representing a 34% premium to Despegar’s 90-day VWAP. In my view, that’s really not a bad price for a quality platform business.

Thungela invests further in Australia (JSE: TGA)

They will now have an effective 77.475% in Ensham

Thungela acquired an effective 62.475% in Ensham back in September 2023 in an effort to diversify exposure away from South Africa (and mainly Transnet, if we are honest). I can understand the appeal of a country with working infrastructure.

Although there were critics at the time, mainly because everyone just wanted Thungela to be a cash cow, the board was more interested in creating a group with reasonable risk exposures. Ensham has been a solid performer and is now contributing 35% of the group’s EBIT.

Thungela is now increasing its stake to an effective 77.475%, so that profit contribution can be expected to increase if the good times continue at Ensham and if things don’t materially improve in South Africa.

The structure is that Thungela holds 73.5% in Australian subsidiary Sungela Holdings, which in turn originally acquired 85% in Enham. The other 15% holder in Ensham will now sell to a different subsidiary (Thungela Resources Australia) which is 100% held by Thungela. In other words, the minority holder in Sungela Holdings isn’t getting any exposure to this additional 15%.

One of the benefits of this deal is that Thungela will look to deepen synergies with Ensham, particularly with the external direct shareholder in Ensham out of the way. This includes a desire to open up markets in Japan and Malaysia.

The deal is too small to be categorisable under JSE rules, so there are no further disclosures at the moment.

Nibbles:

- Director dealings:

- A non-executive director of Supermarket Income REIT (JSE: SRI) bought shares worth £33k.

- A director of Visual International (JSE: VIS) bought shares worth R160k.

- The CEO of Argent Industrial (JSE: ART) sold shares worth R97k.

- The PBT Group (JSE: PBG) scrip dividend received a reasonable amount of support in the end, allowing the group to retain more than half of the dividend in cash. The end result was a cash dividend payout of R13.1 million and an issuance of shares to the value of R14.9 million. I’ve included this note in this section as a number of directors elected the scrip dividend alternative and received shares instead of cash.

- MAS plc (JSE: MSP) has renewed the cautionary announcement regarding negotiations with Prime Kapital to acquire the 60% interest in PKM Development Limited. The company reckons that contracts should be concluded by the time that results for the six months to December 2024 are released.

- Labat Africa (JSE: LAB) is still catching up on its financials, rather hilariously releasing a trading statement for the six months to November 2023 (not a typo) and then the results for that period on the same day. At least they made an operating profit in that period, although the numbers are so old that I’m not sure they are very useful.

- Here’s another one catching up on financials: Kibo Energy (JSE: KBO) has released results for the year ended December 2023. Again, not a typo. The company is currently a cash shell, so these results are literally pointless as they relate to assets that aren’t even owned anymore!

- Tongaat Hulett (JSE: TON) continues to make progress with the business rescue plan, with the latest update being the sale of the Zimbabwe business to the Vision consortium.