EBITDA more than doubled at Alphamin (JSE: APH)

This is what happens when mining groups deliver on promises

Alphamin has been an interesting growth story. The tin mining house had to deal with some of the usual infrastructure challenges in Africa, but has come through them strongly. The impact of rainfall in Q4 is particularly relevant, creating a backlog that generally gets cleared in Q1 of the following year.

Weather aside, they’ve been expanding capacity and delivering on what they need to do. The result of all this? EBITDA more than doubled from FY23 to FY24 with an increase of 102%.

Production was up 38% and sales were up 57% for the year. This increase in production and sales was accompanied by a 17% increase in the average tin price and only an 8% increase in all-in sustaining costs per tonne sold. With numbers like that, the EBITDA jump makes sense now.

Production guidance for FY25 is 20,000 tonnes of tin, an increase of 15.4%. The rate of growth has slowed as Mpama South’s numbers were a contributor to FY24 as well, so they are now growing off a more challenging base number. This doesn’t mean that long-term production jumps are not an option. One of the important parts of the investment thesis is that Alphamin has a busy exploration strategy for Mpama South and Mpama North, as well as other opportunities.

The share price is up a spectacular 472% over five years. The return in the past year is 18%, as the market was aware of the expected production increase based on the work to increase capacity and had already priced much of this in.

When it comes to mining in the rest of Africa, you have to pick your fighter very carefully:

Flat production for the year at Merafe (JSE: MRF)

And a dip in the final quarter

Each quarter, Merafe releases a production report for ferrochrome from the Glencore Merafe Chrome Venture.

In the quarter ended December, they saw a dip in production of 6.7%. This resulted in an increase of just 0.3% for full-year production from 300kt to 301kt. No information was given on why the final quarter of the year was disappointing.

In case you’re wondering why the image for this edition of Ghost Bites included a stainless steel kitchen, it’s because ferrochrome is the most important raw material for the production of stainless steel.

Ninety One’s AUM has moved higher (JSE: N91)

This is a key driver of earnings

Asset management groups live and die based on assets under management (AUM). The clue is kinda in the name, isn’t it? Fees are earned based on AUM, so higher AUM means higher fees.

There are only two ways to grow AUM. The first is based on the whims of the market: simply, this is the change in value of the underlying portfolios. If markets go up, AUM goes up and so do fees. It’s therefore important for asset management firms to have appealing underlying funds that go up in value, not just because this wins more clients, but also because it makes more money.

The second is based on net inflows, which means attracting new investment in the fund that exceeds any withdrawals. This is hard for pure asset management players that don’t necessarily have an army of salespeople out there. The likes of PSG and Quilter have taken the route of focusing on inflows by building out a distribution side to the business.

The worst position to be in is to be focused on South African funds (as they have heavily underperformed offshore) and to be doing it without strong distribution. Coronation, I’m afraid I’m looking at you.

As for Ninety One, they are strongly focused on offshore funds and they do have some benefit from the association with Investec, along with strong relationships elsewhere in the market. For example, Nedbank just replaced Abax with Ninety One as the managers of the R6.3 billion Nedgroup Investments Rainmaker fund. Talk about making kings and paupers with the swish of a pen!

Still, Ninety One is so huge that even R6.3 billion won’t make a huge difference to them. The company has confirmed that it had £130.2 billion in AUM as at the end of December 2024. Yes, you read that currency correctly. That’s up from £127.4 million as at the end of September 2024 and £124.2 billion as at the end of December 2023.

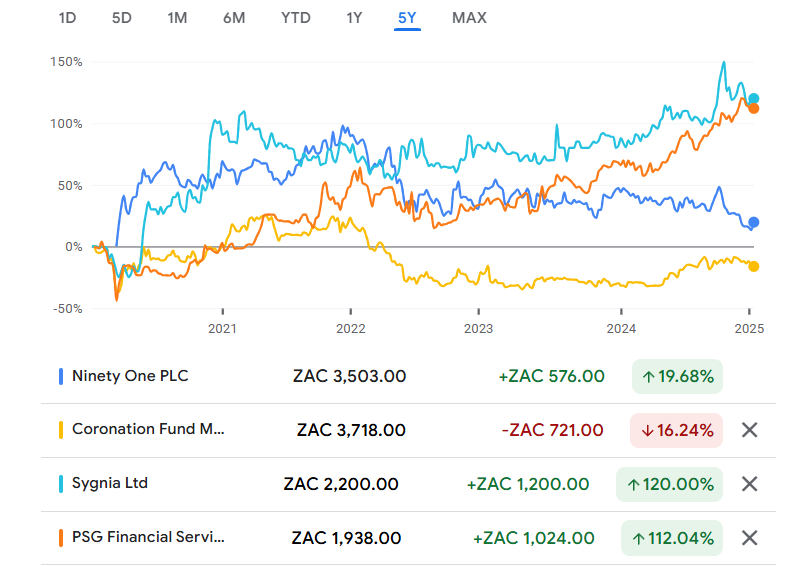

Here’s a chart showing you the five-year performance of Ninety One and some of its competitors. See what I mean about Coronation? They are in strategic no man’s land in this sector:

Nibbles:

- Director dealings:

- It looks like the CEO of HCI (JSE: HCI) happily picked up some shares from a fellow director and also from someone else. A director sold shares in an off-market trade for R9.3 million and an entity associated with Johnny Copelyn bought shares worth R12 million.

- Entities related to the CEO of Deutsche Konsum (JSE: DKR) increased their stake in the group from 25.26% to 29.78%

- 4Sight (JSE: 4SI) will follow in the footsteps of a number of other small- and mid-caps that have moved their listing to the General Segment of the JSE Main Board. The nuance here is that they are moving from the AltX, as opposed to an existing Main Board listing.

- Numeral Limited (JSE: XII) really is an example of a corporate that is calling all pockets in the hope that something will go in. They have expressed interest in financial services, being an official Google Partner for marketing and looking for biotechnology assets. Yes, I know – what a strange combo! In the meantime, revenue for the 9 months to November was $449k and operating profit was $411k. They’ve obviously found ways to put revenue streams through the business that come with little in the way of costs, while they look to get the biotech stuff off the ground.

- Sebata Holdings (JSE: SEB) announced a further delay to the release of results for the six months to September 2024. They are now scheduled for release on Friday 24 January.