China is a land that is fraught with risk and brimming with opportunity. With enhanced upside as well as downside protection, International Opportunities Limited is a structured product that seeks to balance the risks and rewards available in Chinese equity markets.

International Opportunities Limited offers 1.3x geared exposure to the CSI 300 Index, capped at 60% growth for a maximum return of 78% in USD. In addition, there is 100% capital protection at maturity in USD.

Japie Lubbe of Investec Structured Products joined me on this podcast to discuss the investment characteristics of the Chinese market and the way in which this product has been built in that context.

Applications close on 7 March 2025, so you must move quickly if you are interested in investing. As always, it is recommended that you discuss any such investment with your financial advisor.

You can find all the information you need on the Investec website at this link.

Listen to the show using this podcast player:

Full transcript:

The Finance Ghost: Welcome to this episode of the Ghost Stories podcast. It’s a new year and that means lots of new opportunities. In fact, today’s opportunity is called International Opportunities Limited. So no messing around – there’s clearly something to pay attention to here. And of course there is, because it’s another podcast with the team from Investec Structured Products and they always bring us super interesting stuff to learn about and think about for your portfolio.

This time around, Japie Lubbe you are back on the show. Thank you for joining. You’ve been on it before and we’ve met quite a few people from the team actually. It’s always lovely to have you on here. A happy new year to you. It is starting to head towards late January at time of recording, so maybe it’s too late to even wish you a happy new year. I’d rather say that I hope your year has got off to a good start. Thank you for joining me. This is going to be a pretty interesting show, I think!

Japie Lubbe: Thank you.

The Finance Ghost: So, Japie, let’s get into the meat of this thing. What’s quite interesting is that this latest product that we are talking about comes hot on the heels of a product towards the end of last year that was focused on the Indian market, which was a very good excuse to go and just check out what was going on in that side of the world from an emerging market perspective. Now we’re back to the “other big emerging market” if I can call them that, which is China – certainly on that side of the world – and I mean, let’s face it, China has been a bit of a tough story recently. The news of stimulus at the end of last year first caused some excitement and some crazy share price moves in single stocks and then it sort of fizzled out a little bit, maybe due to lack of details, maybe due to some geopolitical uncertainty.

So, it’s a tricky, but it’s an exciting market. It definitely comes with some risk and that’s why the structured products can be so interesting, actually. What attracted you to doing a structured product on this Chinese market as we now head into a new year.

Japie Lubbe: Yeah. I think the first thing that we look at as investment people is: what are the alternatives that I can buy? And when I buy one of those alternatives, how does it add up to what I already have?

In investments, it’s important to identify potential assets that have a low correlation to what you already typically have as an investor. We recognize that mostly, our client base would have developed market exposure through the US and Europe and the UK and maybe some Japan and some MSCI World type exposures. They are invested, obviously because they live here, mostly into South African shares.

We start off by looking at the index correlation between the Chinese market and the other major markets of the world. In our presentation there’s, a matrix which shows how low the correlation is of the Chinese market to the S&P 500, to the EURO STOXX, even to commodities, to the JSE. This is a great addition to a portfolio for a South African because this market is, roughly – I’m going to take a stab here – roughly 30% correlated. Whereas for instance, the S&P 500 is 82% correlated to the FTSE and 90% to the EURO STOXX, so those go up and down together.

What you want is you want markets or assets to be added – they call it the cheapest free lunch, is diversification. So that’s a key thing for us in why we’re looking at China.

The second thing is, if you look as far back as five years ago, we’ve done an evaluation of the performance of the Chinese equity market on a total return basis compared to the S&P and the Nikkei and the EURO STOXX, MSCI World, India, which you mentioned, the JSE Top 40. It’s very interesting to note that the Chinese market was the best performing market for the first two years of that time. Then as we know, Covid hit and the Chinese market with all markets came down, but the others all recovered and this one didn’t. Why? Because the Chinese government, they applied a lot more tough love. They didn’t give a lot of money to their people, to corporates, to businesses, as the US did, and even South Africa and Europe and other countries.

These other countries that allocated a lot of government money to stimulate the economies ended up with, on the flip side of the balance sheet, a whole pile of debt. They’ve got a lot of debt, but the people got a lot of money from this stimulus. This chased up interest rates, chased up inflation in those countries and also resulted in quite good growth in asset pricing. Shares went up a lot, properties would have gone up a lot. We’ve seen what’s happened to gold, we’ve seen what’s happened to Bitcoin.

So these assets – a lot of them got this cash that came from government printing money or issuing money to the populace. China, exact opposite! What you have in Chinese equities, the last five years the total return is 9% including dividends. The US is 94%. The Nikkei, which is Japan, is 96%. The MSCI world is 71%. Huge numbers, whereas China stayed back a lot. So from a pure valuation perspective, that gives us a good entry level for people that want to consider it now.

When we look at the actual valuations of the market, which is on that same screen, when we look at the price/earnings ratio, the price to book, the return on equity, and we compare the Chinese market to all these other major markets, it stacks up very well. In other words, it’s cheap. The market is cheap because it hasn’t gone up a lot of late, but the GDP is still reasonably strong. China’s growing at over 4% and that compares favourably to most markets in the world. So we think that a good reason to target it is that the valuations are good as we speak.

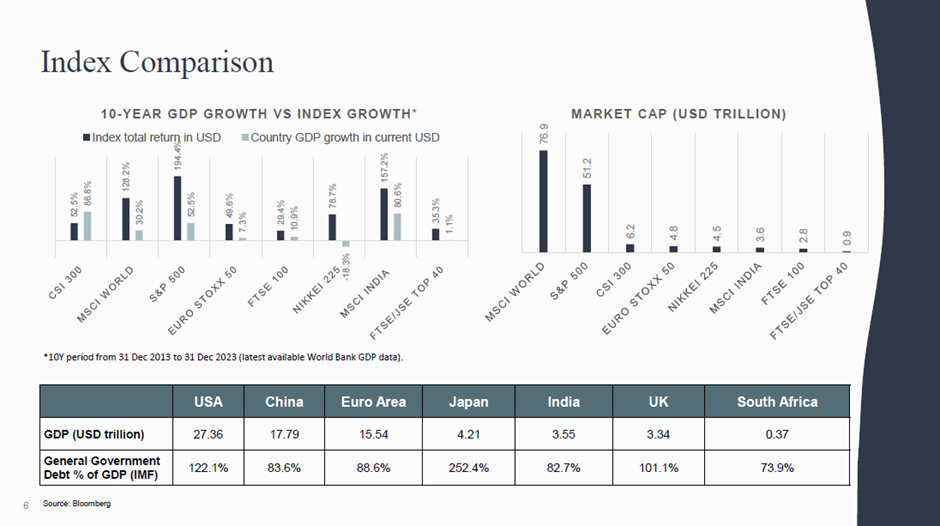

Then if you look at other important metrics for investment, we look at an index comparison where we have a look at: how much did the GDP of each of these major markets grow over the last 10 years and how did that compare to the total return of the equity market? This is at major index level for the 10 years. I’ll just quote you two. The Chinese market: equities total return went up 52%. That includes the 10 years of dividends, but the economy grew 86%. In the US, the shares went up 191% total return and the economy grew 52%. And you can look at the comparative countries there.

So what you have, where the stimulus was given to the economies, the GDP still did what the GDP would do, but the assets grew fast because there was free money, more money, investable money coming from the governments, stimulating the economies. And we notice a very big divergence between what’s happened in China and what’s happened in the rest of the world. So we think as an investor, if you’re going to be contrarian, you got to go where it’s different to the other places for the fact it will probably recover and probably normalise.

Then if we look at the size of the markets. In other words. I don’t think all the readers and listeners are often versed with how big China is. If you compare the market capitalisation of China versus most other countries, the biggest market out there is the US market at $51 trillion value. Second is China at $6.2 trillion, then followed by the EURO STOXX at $4.8 trillion, FTSE say $2.8 trillion, India $3.6 trillion. India is just over half the size of China based on market value of equities and South Africa is at $0.9 trillion. China is roughly seven times bigger than our market cap on the JSE. So just put these markets into perspective.

The next thing that’s important is looking at the ability of the countries to stimulate. You mentioned up front, they’ve started trying some stimulus and I’m sure they’re going to carry on until they find something that works. But their ability to stimulate is driven by two major factors. And one of them is the amount of debt you have to your GDP. China for instance, has 90% debt to GDP versus the US at 122% and Japan at 250%. The debt levels worldwide are actually very high.

The interest rate that you pay on the debt is the other big thing. In China, the interest rate’s 1.5% because inflation’s at 0.4%. In the US, you’re paying 4.5%. Say you’ve got debt as a country and you’ve got to service that debt and you’ve got 122% of your country’s GDP is the debt level. And now you’re paying 4.5% interest rate compared to another superpower who has only 90% of GDP versus your 122% and is only paying at 1.5% interest rate. Can you see? So the country that can stimulate and support the economy and the investors if trouble comes – because we don’t know, might be another COVID, there might be some other headwinds in life – is the country with the deepest pockets and the least overdraft in simple language.

China compares very favourably on debt to GDP and the interest rate on the debt.

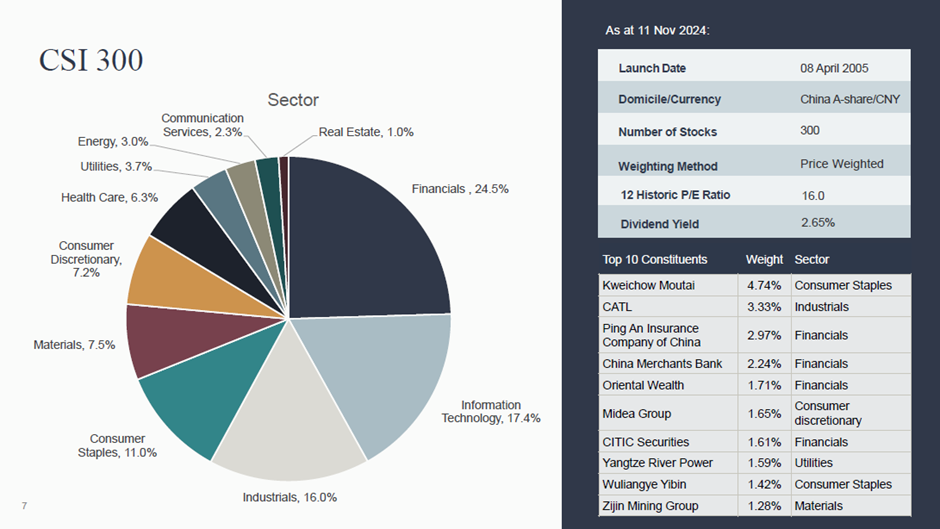

The next thing that we look at is if we invest in the CSI 300, which is the index we’re using in this offering, it’s very, very nicely diversified across mainland China companies. There’s a composition pie chart which shows the actual breakup of the market. The biggest sector is Financials with 24.5% followed by Technology with 17.4%, Industrial 16% and so on and so forth. But not massively dominated by any one share. Let’s say the biggest share in the market is Consumer Staples at 4%. You don’t have a massive dominance but you’ve got 300 shares very widely dispersed and a very nice underlying asset base to cover.

Then if you look at the next thing that we like about and why we’ve selected China, we look at the price/earnings ratio that the market’s trading at. It’s trading at roughly 16x and the average from inception has been like 18x. So you’re buying a market where the price/earnings ratio is a bit below the long-term average. Now you’ve probably seen that the US is trading massively above its long-term average and so are most of the developed markets of the world.

As an investor, you want to try and identify markets – this is at market level, at index level – where they’re trading at compelling multiples. Especially if you’re confident that they’ve got the ability in future to have good earnings because then they’ll re-rate to the average or better and you’ve got a tailwind for your equity valuation.

The other thing about the Chinese market is that the volatilities that we’re buying these indices at are quite low by historic norms. They’re trading at substantially below the long-term average volatility. Which is quite strange in the sense that the equity markets in China have been depressed and have gone down, but in reality they went down four years ago and for four years they’ve just been bubbling along. They picked up a bit last year because last year the first of the stimulus has started coming through. And it looks as if now with the most recent discussions with Mr. Trump and his Chinese counterparts that if they’re anywhere reasonably friendly, you could get that the Chinese market actually does quite well. We’re fond of buying where the assets are well priced.

Other things that we notice is that the dividend yields on those markets are at like 2.5% versus interest rates for five-year money is 1.4%. Now when you get that, it creates an opportunity because the forward price of the market is below spot, because the dividends are higher than the interest rates embedded. This makes call options very cheap. That’s why it gives us a lot of upside potential.

But let’s say you as an investor wanted to buy an ETF and protect it. It would cost you roughly 11.5% premium to protect $100 for five years. Now we’ll show you in our structure, we don’t have to lay out that money because we’re going to use bonds that give us $100 back. We don’t have to buy protection like you have to buy car insurance or household insurance or medical insurance, so that’s very favourable.

The other thing that’s very favourable about China, I see the latest numbers came out that they anticipate it’s just had a 5% GDP growth, but their inflation is 0.4%. Understand that when you’ve got that type of growth and your inflation is so low, you’re going to dominate exports to the world. Even if someone wants to introduce a tariff on you, you just say, no problem, I’ll add that tariff to my price because no one can produce that product at the price. You can see you’ve got lots of power in the fact that you’ve got the cheapest manufacturing, so that’s very good.

Then the other thing we really like is the fact that they’ve got growing foreign reserves. China has been a big buyer of gold, they’ve been a big buyer of US bonds. As a country, the foreign exchange reserves have been growing. In a world where people are really maxing out on their credit cards and the available cash to spend, the Chinese government is actually to a large degree sitting pretty because they don’t have those massive debt-to-GDPs and high funding costs. They’ve got reserves both in bullion and in foreign exchange reserves.

So those are the major reasons why in this offering, we’ve really wanted to go for China.

The Finance Ghost: Japie, there’s an investment masterclass in there. You’ve got tons of experience. I learn a lot from you when we do these. I’m sure everyone listening learns a lot. I think you’ve run through just so much good stuff there, ranging from the macroeconomics through to understanding the volatility. We’ll get into some of that just now that helps make options a bit more affordable, etc. But even more than that, just stuff like trading below long-term average P/E multiples. That’s something that I apply every single time I take single stock exposure. You can have academic debates all day long about whether something should trade at 10x or 12x or 15x or 20x, but the strongest sign is: is it trading below where it has historically been? And are there good reasons, yes or no? Because then you’re actually using tons and tons of market data. You’re not coming up with your own esoteric argument for should it be 10x or 12x or 14x. You’re saying, hey, this is where the market has been pricing it for the longest time, now it’s less, is there a good reason or are they missing a trick? Just lots and lots of cool stuff coming through there. I’d almost encourage someone go and listen to that again because there’s so much to learn in what was that, like 15 minutes basically?

Something I just want to reference so that people are certain which index we’re talking about here: it is the Shanghai Shenzhen CSI 300 index or CSI 300 for short. Not CSI Miami that you once watched on TV – CSI 300. Not a name that people are familiar with. Everyone knows the S&P and the NASDAQ and the Top 40.

The other thing that I just want to pick up there was you talked about the relative market cap. It’s quite incredible that if you add together the MSCI India and the FTSE 100, so that’s India plus the UK, you’re at roughly the same size – not exactly, but it’s very close – the same size as the Chinese market. That is quite extraordinary. You know, it really, really is. It’s obviously an exciting market. Yes, it’s had a tough few years, but investing is about understanding what’s going to happen in future, not just what has happened.

There’s some really cool stuff that you’ve raised there. However, there’s also a lot of risk, obviously, and that’s why structured products are very, very helpful. Because China, the US obviously with President Trump coming in, you’ve already referenced tariffs. There’s a lot going on there. There’s a lot of geopolitical uncertainty. We don’t know what will happen. There was this whole recent story with Tencent being added to that list of: are they a company that assists the government with military type stuff? A lot of this is just posturing and politics and there’s going to be more of it.

I think the only thing we can be certain of is uncertainty. There’s going to be more of this. You’ve got these two global powers who are having a bit of an argument. It’s the old joke of when the elephants are fighting, it’s the grass that gets trampled. And the idea is to not make your money the grass. You don’t want to be trampled by this stuff. I think if you have naked exposure to China, so in other words, unstructured exposure, you’re just holding an ETF, obviously it can just keep dropping, right? Cheap, can always get cheaper. That’s unfortunately a lesson that most of us have learned in the markets at some point or another. But you’ve done a lot of backtesting here. You’ve obviously structured this thing for downside protection. I think let’s deal with that before we get to the upside because I think the upside around China is relatively understood. It’s the downside that worries people and scares people away. So how have you addressed that in this product?

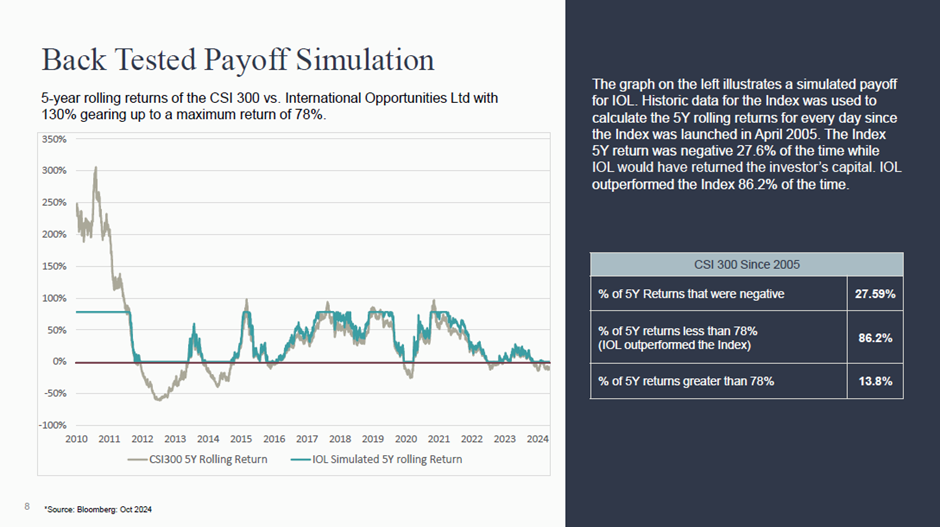

Japie Lubbe: So firstly, what we looked at is just to say from the inception of that index in 2005, if we did – the product that we’re doing is a five-year share and it has 100% capital protection in dollars over the five years and it gives 130% gearing to the first 60% of any positive performance in the index. So if the index is at 4000 points, it ends at another number, that percentage, we times that by 1.3 until that percentage got to 60%. So if it was 60%, it maxed out at 78%. And all the returns are in US dollars. The capital is protected in US dollars and the growth formula and the payout from the banks that we trade with is in US dollars. The entire discussion is in US dollars.

Now, if we look at the five-year rolling returns, there’s a back-test in the presentation, and we simulate that against what you would have had, had you had the product as opposed to having the index. In this case, this is the price of that index and the five-year rolling returns are shown. We’ve superimposed on that an historic view if we had the product. What this demonstrates to us is roughly 27% of the time, if you’d been an investor for five years, starting a new five year every day for the last 20 years, 27% of the time, you would have lost money. That’s the hurtful thing with China. That’s what puts people off, is that you have too much where you could have lost…

The Finance Ghost: I mean, that’s – sorry, Japie, that’s a big number, right? 27.6% of the time. I mean that’s, that’s more than you would typically see on a lot of other markets, am I right?

Japie Lubbe: Absolutely. Because the other markets are all high now, you see, so they’re all – because they’re very high in valuation, the back-testing would show that they haven’t done that. But that doesn’t tell you what’s going to happen tomorrow morning. That only says what happened historically.

What happened historically says to us at Investec, we’re not going to put our reputation at risk where people go into this Chinese market and then lose their money. So that’s why we say the best way to address it for our own money and for clients for their money is to have 100% capital protection in dollars. So that addresses the issue of why the protection. The protection is very important.

Now secondly, you can mitigate risk, as I said earlier in the discussion, by just going like you buy car insurance, like you buy household insurance or medical insurance. But it’s very expensive to buy that on the Chinese markets in dollars for five years. That’s why that’s not a plausible solution because let’s say you had a $100 and you had to pay 12% to protect it. You’re only getting 88% of the upside on the total return of the market.

Now our product here shows that historically this product would have beaten the direct market 86% of the time. Why? Because in the negative 27% at a time, this thing would have given you nought, not a loss. And in the majority of the return where it was giving a mediocre return, you’d get 30% more. So the only time you lose out is if the market does more than 78%, which happened to be about 14% of the time. We’re saying that this could happen because of all the metrics that we’ve identified. But for our type of clients, we don’t want them to face the risk of the downside. We’re happy to say if it did more than 78%, I made peace, I only got 78%. 78% is 12.2% in dollars IRR with no capital at risk.

The Finance Ghost: Thank you very much. You’ll take that all day, right?

Japie Lubbe: Exactly. You’ve got credit risk, but I’m talking about the market risk. We address it now…

The Finance Ghost: Japie, sorry to interrupt there, but in terms of fees, I mean are those returns – that back-testing you’ve done there, those returns are net of fees? So it’s beaten the index that many times net of fees?

Japie Lubbe: Yes, our product is net of fees. The market is just the actual market before fees. Because it’s just the index.

The Finance Ghost: Exactly. So that’s the point I wanted to raise. You can’t buy the market…

Japie Lubbe: Exactly.

The Finance Ghost: …you’re still going to, even if it’s an ETF, it’s going to have a small fee. But it adds up, whereas what you’re saying here is this is net of fees. If the return is zero, if it’s capital protection time and you’re just getting your money back, there aren’t fees that come off that. You’re literally putting in $100, getting back $100, in dollars admittedly, but still.

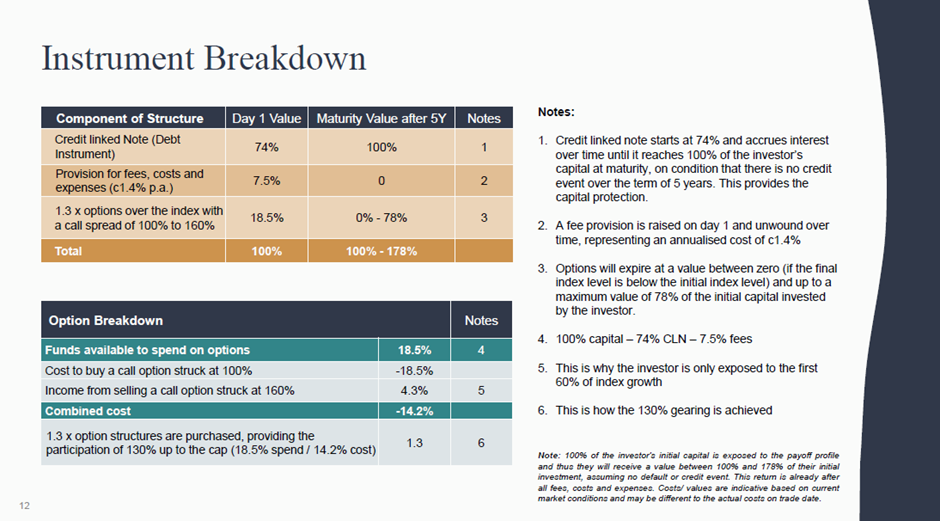

Japie Lubbe: Yeah. Your next question being, how do we do this? In our presentation we show the instrument breakdown. There’s this company that we incorporate in Guernsey. We list on the Bermuda Stock Exchange and the company buys the assets. There’s only three assets and they buy them on day one. We, Investec, are the investment advisor to the company, recommending to the board of directors which assets to buy. We don’t run an active process so we don’t have any changes to the assets during the five years. It’s a five-year fixed term.

The investors who buy the shares, there is liquidity provided for them should they want to sell the shares. But most people, 98% of people, keep it for the five years.

In our pack we show that we start with $100, so let’s take the listeners through how we spend $100.

The first thing that we do is we contract with one of the major banks of the world. We’ll talk about the credit separately but it’ll be one of the major four US banks. We buy a credit-linked note from them that references 1/3rd each the tier-two debt of five potential banks. But all the paper is investment grade paper i.e. better than SA government paper. We spend 74% of the primary capital day one to buy that bond and it’s bought inside this Guernsey company. The Guernsey company gets an annual tax exemption so it doesn’t pay income tax on that growth and it grows from 74 to 100. So that’s how we protect the capital. 74% growing at about 6% yield. It compounds to 75%, 76%, 77% – when the sun sets in five years’ time, there’s exactly $100 on that asset. And it’s that asset that enables us to say to you, you can have your capital protected.

Now the second thing that we do is we put roughly 7.5%, because this is a new company, 7.5% in a bank account which is for the distributor’s annual fees, our annual fees, the lawyers, the auditors, because these companies are highly regulated. Regulated in Bermuda, Guernsey and South Africa under the Companies Act, being signed off by the Companies Act for Distribution in South Africa. Why I think it’s such a good deal, just to come from a fees perspective – the total fees for five years, which are all built in, is 7.5%. If you pick up the phone at your desk and phone a bank and ask for protection for five years, they charge you 12%. Here the fees are built in and it’s only 7.5%. So you can’t do it cheaper. You’ve got no chance to do it cheaper.

The third thing…

The Finance Ghost: And Japie, sorry, the other way to think about that is the per annum fee, right? Which works out to, what is it, almost 1.5% a year?

Japie Lubbe: 1.5%, which is cheaper than active management….

The Finance Ghost: Well, that’s what I wanted to say…

Japie Lubbe: Yeah.

The Finance Ghost: There’s many a unit trust, there’s many an actively managed fund out there that doesn’t have the capital protection. Yes, they might be making more investment decisions, but they don’t give you the protection on the downside and you’ll end up paying more than that, typically, or at least that.

Japie Lubbe: The big thing is, just compare A to B: B is worth 11.5% more because you don’t have to buy protection, you’ve got protection. It’s like me saying to you, look, I’ve got two cars in the parking lot. One’s a green one and one’s a blue one. You can pick. I’m going to give them to you for free. Now, if you take the blue one, I’ve covered you at Santam for the next five years on your insurance. Which car is worth more? Because you know when you drive the blue one, if you drive into a Ferrari, you’re covered, the insurance paid. But you drive the blue one and you drive into a Ferrari, you’re selling a flat in Cape Town because you’ve got to pay.

The Finance Ghost: It sounds like personal hurt in that story. Japie, I hope you haven’t driven into any Ferraris uninsured?

Japie Lubbe: Yeah, just be careful. You don’t know what you drive into!

The next thing is – we spent 74% and 7.5%, so we’ve clearly got 18.5% left over on day one. What we do with the 18.5% is we go to a panel of banks. They have to have a rating of at least S&P A or better and have been cleared by us for credit. We say to them, we’re going to ask you a question. If we were to buy unlimited upside to the CSI 300 in dollars for five years as a call option, what would the call option cost? And it just coincidentally happens to be 18.5%.

But we don’t think at Investec Capital Markets where we work, in corporate institutional banking, that that market will easily do more than 60%. So we say okay, we’ll sell you a cap at a level of 60%. And they say no problem, then we rebate you 4.3%. This means the net is 14.2%, 18.5% less 4.3%. But because you physically got cash of 18.5%, if you divide it by 14.2%, that’s what gives you 1.3. That’s 130% gearing.

So the leverage in this, the gearing, doesn’t come from borrowing money, you’re not borrowing money like a hedge fund may do. You just have more premium available than what that call spread costs.

The principle is very simple. If you bought a new car and you went to Santam and you said I want to insure this car and they said it’ll cost you R5,000 a month. Say it was a R1,000,000 car just for the discussion, and you said I’m going to use this car just around the house, so I don’t think I’m going to have a claim of more than R600,000. And you said to them, I’m prepared to limit my claim to R600,000. They said well, we’ll give you a rebate – now it only costs R3,000 a month, because for them they’re only insuring a R600,000 car, not a R1,000,000 car. They look at what the claim potential is. It’s the same principle.

Let’s have a look what’s going to happen over five years. Either the stock exchange in China, the CSI 300 shares, go down. Let’s say they went down 40%. We can’t really easily foresee that because they’re really low. But they can for the reasons we said: there’s risk. Then the bond pays out the $100. The fees and costs always amortise to nought. The option is worth nothing because that’s when they refer to an option as underwater. It’s out of the money because it’s a call option. If the market goes down, it’s worth nought. But that doesn’t stress us because the $74 still grew to $100. And we say to you, there’s your $100 back. Now it’s your prerogative to buy the market the next morning available at $60. The investor who bought the ETF or the unit trust or the direct shares if that scenario played out has got a big problem because their valuation shows they worth roughly $60 plus or minus the alpha, plus or minus dividends received. But that’s the problem they’re stuck with, whereas this investor avoids that problem by virtue of the structure.

Thirdly, if the market is up anything up to 60%, so let’s take for this discussion it’s up 50%, then they take 50% times 1.3, entitled to 65%. What we’ll do at that stage is come to them and ask them whether they want to sell their shares or keep their shares. You can then if you keep the shares, lock in the profits you made commercially and then obviously you’re going to pay tax one day when you sell the shares, but that’s on the sale of the shares.

So that’s really, how we give that protection. So then as far as the question about – let’s talk about the credit. So what is your risk here? You’ve taken out the market risk because of the structure as we’ve discussed. You have the risk to the suppliers of the assets. The suppliers of the assets are the banks. Now, what we’re going to use here is one or two or more of the following banks: Citigroup, Goldman Sachs, Morgan Stanley and Bank of America. There’s a full description of the credit risk and the summary of the amount of money and assets these banks have.

Then, they’re going to reference, one of them is going to reference to 1/3rd each either Barclays, Soc Gen, NatWest, Deutsche Bank or Lloyds, 1/3rd each the tier-two debt. That’s a credit-linked note and that note – all the assets that you could potentially target there are all investment grade paper by international recognition. The document, you should have a good look at the document, the probability of default – these days you can just go on Bloomberg and get a two year probability of default of any issuer or any instrument and it’s very, very low. You can have a look and see. We’re confident that those are good banks to use.

We’ve done, in the time that I’ve been at Investec, in 23 years we’ve done 107 worldwide listings and of them 87 have matured of which we gave a profit 83 times – 96% – and we haven’t had one loss. The other three, we gave the people their money back. Our selection of the credit has been very, very successful historically. Obviously you’ve probably seen that US banks are coming out with their profits. Last week there were quite a few declaring their profits. With the interest rates where they are now and the economy, they’re fairly strong. These banks seem to be well capitalised and the regulation is very high. So, that’s the risk, is the risk that any of those banks get a problem.

The other risk is that the guy that sells us the call options gets a problem. We’ve never had that in 23 years and we only use the best banks.

Then obviously, as with any investment, you can have regulations change, you can have tax change, things outside of our control. Fortunately, we haven’t had that in the past. I’m just saying as far as risk is concerned, if anybody’s interested in the offering, the prospectus is available and the risks are spelled out very clearly. But I’m just saying high level for this discussion, those would be sort of risks you’d contemplate.

For us, we think that China has got very reasonable valuations as we speak. It’s a great asset to add to a portfolio. They have a lot of capability to assist the public and corporates with a lot of spare cash and reserves in China as a country with low interest rates and low inflation. I was staggered to find out that China only exports 15% of anything that they export to the USA. So 85% exports are non-USA! I think that one must be careful not to make too much of this whole tariff thing. I think it’s a great ploy for politics and a great way to get votes. I’m not so sure that when you think logically about it, that you’re going to impose so many tariffs because it’ll unfortunately just result, I think, in inflation in the US. You’re going to import this inflation because they’re just going to add it to their price simply because there’s no other supplier who can do it cheaper. I think that that’s the real thing.

For us though, in our way we structure products, we really want to be sure here that we give the clients the best chance to not lose any money and give them the best chance to make substantial money in the context of having capital protection. Clearly if you went live to that portfolio and the market did 90%, you’d get 90%, but that’s not the part of your money you necessarily want to deploy. You want to have diversification at a time where other markets are expensive into a market that’s better priced, but because it’s got some unknowns and uncertainties, we think if you get capital protection in dollars and the growth is on that market’s performance, but in dollars, that might be a nice addition to your portfolio.

The Finance Ghost: So Japie all of that is really, really good and makes a world of sense. And this is the point, right? This is to help investors diversify a portfolio in a way that is somewhat risk-mitigated, takes into account some of the challenges of being in China, but as I always write, you have to get comfortable with equity risk because without the risk you’re not going to get the returns. That’s literally how finance works. You can’t run away from risk, you just manage it and you try and manage it alongside the returns available to you. That’s exactly what a product like this tries to do, which is why I always find it so interesting.

Of course, the other risk which is very hard for you to mitigate but is something that investors must consider is their risk of making a mistake in terms of either how much money they put in or understanding their five year liquidity. Unfortunately, life happens, things do happen – divorce, death, let’s call a spade a spade, this stuff happens, it’s a reality. Other things can go wrong for people financially, etc. Obviously, you should always speak to a financial advisor. You should always be doing that. You should always be putting an amount in here that you’re comfortable with. But for when things happen, is there a way to potentially get some money out within that five-year lockup period? I know you do normally have some kind of liquidity mechanism, so I think let’s just talk about that briefly.

Japie Lubbe: Yeah, sure. So obviously we’ve done this for 23 years. We’ve probably got across our products, 21,000 investors’ deals on our books and we are definitely very mindful of liquidity.

There are three levels of liquidity. The first level of liquidity is John wants to sell and Peter wants to buy. They operate under the same distributor, under the same financial advisor. That just transfers from John to Peter. There are no costs involved. You want to sell an asset to me, I buy your asset. It’s a willing-buyer, willing-seller.

The second one, which mostly happens, is that John wants to sell, but there’s no direct buyer that says I’ll buy your shares. What Investec does is we then enter and we say that if you accept a 1.25% early redemption fee, early redemption of your shares, then Investec will buy it. So that’s what happens 99% of the time. We as a bank buy the shares and we then hold them in secondary stock. Then another person looks at the secondary stock schedule every month and they can ascertain if they want to buy it. They like the share. We show them a matrix which shows if the market goes up or down, how will that impact your secondary share? But John left, John sold his shares, Investec owns the shares and Investec on-sells the shares.

The third level of liquidity is if Investec doesn’t want to buy the shares, we’ve only had this four times in 23 years. Why would they not want to buy the shares? It’s only if the capacity to buy the shares is full up. In other words, you got a certain credit limit, you can’t buy more than so much. Then we unwind the shares. What does unwind the share mean? We just go to the market and sell that bond which has now accumulated from $74, it’s now priced at say $80 or $82, $89 – it’s got a price every day. We sell that product, that bond into the market. We also have contracted with the option provider that he gives us daily liquidity. This has already been taken into account on the screen price the client’s looking at. The fees and costs, they put in a bank account, 7.5% amortised once a year down to nought. Whatever’s left in the bank is then credit, so then the client gets paid out. That takes a little bit longer. That takes about, say three weeks, two-and-a-half, three weeks. But that’s only happened four times in history.

What is more normal is that they want to sell their shares, they tell their advisor and we obviously authenticate that they’ve requested the sale and the bank details and that it’s going to the owners account. That normally takes, I would say, 10 days at the max. So it’s not as liquid as when you own say BHP Billiton stock, you just press the button and in two days’ time you’ve got the money in your account. This takes slightly longer. So that’s how the liquidity works. And just to give you an idea, over the 23 years that we’ve done this, we only find 1% to 2% of people actually ever sell early. But they can. And we recognise that if they couldn’t sell, that would be a deterrent.

The Finance Ghost: Yeah, things do happen, so it’s good that the mechanism is there. I think, as we bring this podcast to a close and we encourage people to go and read the documentation and listen to the podcast again, what is the minimum investment amount? Just so people understand what sort of numbers we’re talking about. And then – look, they should always be speaking to a financial advisor, but for those who want to do their own stunts, can they reach out directly or do they have to come to you through an advisor? What are the different channels through which people can actually invest?

Japie Lubbe: Yes, so the majority of the business gets placed through financial advisors. We have roughly 310 companies worldwide that market and sell the products. It’s very, very extensive. Mostly if you speak to your own financial advisor, they should have a licence. But the licensing works on who’s allowed to sell shares. If you go through an advisor, then the minimum is $10,000. This is a foreign share and you can use your R1,000,000 allowance, money cleared through SARS, more than R1,000,000 or money you already have overseas. If you buy in a trust or in a company, you can use asset swap, you can swap your rand to dollars and then they buy it for you. Investec’s got capacity, most other banks have.

Then if you go through a platform, so some people, especially let’s say younger investors or people that are starting out in life, they go through EasyEquities or DMA. There are other online platforms that also make it available. So if you don’t need advice, in other words, if you just say I’m reading this document, which you can, they can link into your podcast and well you’ve answered all my questions, then I can just go online and buy.

If you need advice, so you want to see how this fits into a bigger portfolio. How much must I buy? What’s the approach to allocation? Etcetera, then you can reach out to us. We know many good advisors, we can put you onto them.

Our team, by the way, don’t act as advisors. We are manufacturers, we don’t register under FAIS. That keeps it very simple and independent. We assist all the advisors in the market. I think that the first protocol would be if anybody’s got any questions or any uncertainty or wants to clarify anything, you’re always welcome to check with us. We’ll give you factual information about how it works, what it does, all that good stuff. So that’s really the essence of it.

The Finance Ghost: Excellent. Japie, thank you. Certainly we always encourage people to speak to your financial advisor, do the research, all of these things. We can’t stress this stuff enough. The purpose of this podcast is to really give you the information on the product and also some understanding of some of the risks and opportunities in the Chinese market. Obviously you’ll need to form your own views on that. The starting point of being interested in this product is: hey, I want to own the Chinese market! If you only want to buy the Magnificent Seven in the US for the rest of your life, then this is not the one for you. But if you’re looking for diversification, you’re looking for emerging market exposure, you’re looking for something a bit interesting, then this is well worth considering.

Japie, thank you so much. I’ll make sure that the links to the documents are in the podcast notes. For those of you who are listening to this, maybe you don’t have the transcript in front of you, just go onto the Ghost Mail website, go and find the links to the relevant Investec documentation, go and check it all out.

Japie, last thing before we close off is just the closing date for this investment. When do people need to be ready to act by?

Japie Lubbe: We’re closing this one on the 7th of March.

The Finance Ghost: Perfect. Thank you. So there’s a bit of time, but not a lot of time. Japie, thank you so much for your time today. It really has been another great podcast. I love having you on the show. We’ve done this a few times now. I feel like this is the third time. I’m not 100% sure, but it’s lovely to have you back, so thank you. Good luck with this raise. I’m sure it’ll be just as successful as all the others. And to those who are interested in the opportunity, as I say, go and read the documentation. You can’t possibly read enough. If you want to learn more about structured products, even the stuff that’s closed previously, you can’t necessarily get into anymore, go back and listen to some of the other podcasts with the Investec team because you’re going to pick up a lot of themes that come through in how these things are structured and what they’re all about. I would recommend going and checking that out as well. Japie thank you for your time today and good luck with this one.

Japie Lubbe: Thank you.

This podcast is for informational purposes only and does not constitute advice. You must speak to your independent financial advisor before investing in any product, and especially this one. Investec Corporate and Institutional Banking is a division of Investec Bank Ltd. – an authorised financial services provider, a registered credit provider, an authorized over the counter derivatives provider and a member of the JSE.

Ts & Cs apply to this product and you should refer to the Investec website for full details.