Harmony is on track to exceed full year production guidance (JSE: HAR)

This is what the market likes to see

Harmony Gold has updated the market on its performance for the six months to December 2024. They achieved gold production of between 790,000 and 805,000 ounces. This is well down on the comparable period in 2023, in which they managed 832,329 ounces.

All-in-sustaining costs (AISC) will be between R960,000/kg and R985,000/kg. That’s a big jump from R843,043/kg in the comparable period.

If you look at the guidance for the full year, it gives us clues about the reasons for this. The comparable period saw higher production from the South African underground portfolio and Hidden Valley. Aside from planned production increases and decreases, there are also grade differences that have an impact on the amount of gold that actually comes out of the ground.

Despite this, the share price is up 82% in the past 12 months! There’s only one possible explanation of course: the gold price. Sure enough, gold has gone mad in the past year, up roughly 40% in USD.

Harmony reckons it can exceed full-year production guidance, which would then imply more than 1,500,000 ounces for the year. The total last year was 1,561,815 ounces, so it still looks unlikely that production will grow year-on-year.

Despite hoping to beat guidance on production, they don’t expect to do the same on AISC. Guidance of between R1,020,000/kg and R1,100,000/kg is still where they expect to end up. Anything inside that range is much higher than R901,550/kg in the previous financial year.

Thank goodness for the gold price, then.

A very unpleasant day for Merafe shareholders (JSE: MRF)

There’s nothing quite like a 20% drop to kick off a week

In and amongst all the market chaos thanks to the US, Merafe released some concerning news of its own. Doing this on a risk-off day was basically a guaranteed way to obliterate the share price. Sure enough, the share price closed an ugly 20% lower for the day.

The reason? The state of play in the global ferrochrome market and what it means for the ferrochrome smelting business that is operated as a joint venture with Glencore. They expect the prolonged downturn to continue in the near to medium term, so unless they can figure out a solution, they expect to see a reduction in ferrochrome production from May 2025 due to a potential suspension of certain furnaces.

This is obviously very bad news and a reminder why Merafe trades at such a low price/earnings multiple.

Pepkor’s credit and fintech strategy is a powerful growth flywheel (JSE: PPH)

And the back-to-school January story is very promising

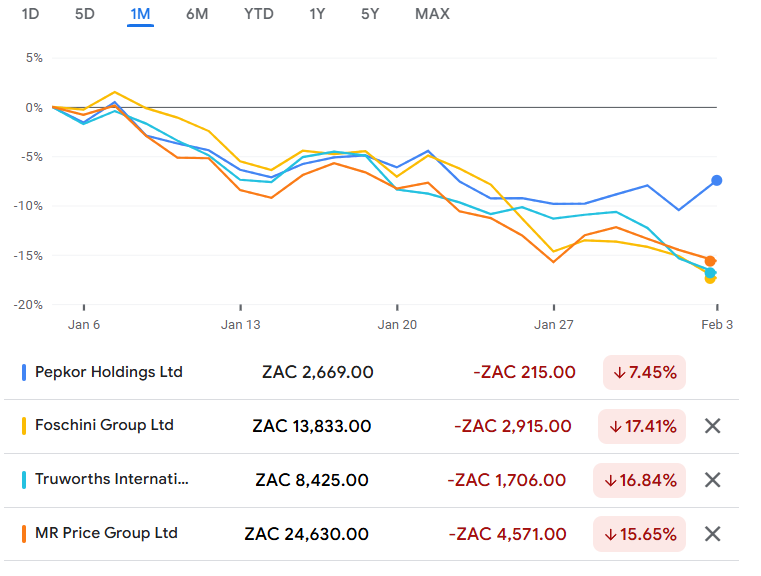

Pepkor released a trading update for the three months to December 2024 and the market liked it, with the share price closing 3.4% higher. Context to this move is important, as Pepkor has now dislocated from the suffering of its peers in the past month:

It’s still red of course, but reading Pepkor’s update against what we saw from the likes of Truworths is quite something. It’s clear that one group has a coherent strategy and the other has a lucky UK business.

So, what is that strategy at Pepkor? Simply, they are focused on the fintech segment as a major source of not just revenue growth, but also margin improvement. Fintech is now bigger than the furniture, appliances and equipment (FAE) segment in terms of total revenue! This is what happens when fintech posted juicy growth of 35% vs. 8.4% in FAE and 9.2% in clothing and general merchandise (CGM). Mind you, there’s nothing wrong with those growth rates in either FAE or CGM!

The disappointment was actually in Avenida, which came as a surprise to me. Like-for-like sales fell by 2.7%. Although total sales there increased 11.3% in constant currency, they were down 9.7% in reported currency. I’m really hoping they get that story back on track. Things seem to have improved in early trade in 2025, at least.

Other interesting nuggets of information include the ongoing strength of PEP and Ackermans, up 12.1% and 9.7% on a like-for-like basis respectively. I must also highlight the Home division in Pepkor Lifestyle, which achieved 15.1% sales growth.

But now we get to the really big story: growth in credit sales of a whopping 30.9%, taking the contribution of credit sales from 13% to 16%. This is a direct result of the “credit interoperability strategy” in the South African business. The Fintech operations are driving this, along with other important business units like Flash and its revenue growth of 19.3%.

The strength continued into January, where group sales jumped by 17.8% for the first three weeks. Aside from an improvement to Avenida as mentioned earlier, they have had a great back-to-school season in PEP and Ackermans as the core businesses. Now they need to keep the momentum going!

Schroder European Real Estate’s gearing is coming down through disposals (JSE: SCD)

The European economic trajectory is murky to say the least

When property funds focus on reducing debt, it’s either because they currently have too much debt or they are worried about what the future holds. With a loan-to-value ratio of 25%, it seems to be the latter at Schroder European Real Estate, as that isn’t an over-geared balance sheet.

With the disposal of the 50% interest in the Metromar Joint Venture (holder of a shopping centre in Spain), they’ve managed to get rid of some debt. There was no equity value in that mall, so the debt (and the asset) was simply transferred to the purchaser. This reduced the loan-to-value from 25% to 21%.

The next reduction will come from the previously announced sale of a grocery asset in Frankfurt, with the deal expected to close in March 2025. The loan-to-value should drop by another 2%.

Super Group has released the circular for the SG Fleet disposal (JSE: SPG)

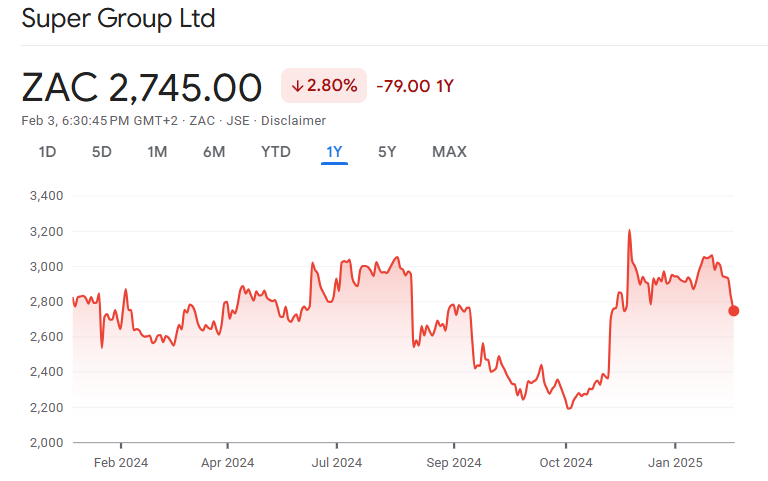

This transaction has been the only thing propping up the share price

Super Group is having a tough time at the moment. The underlying exposures are enough to give anyone a bad headache, with European car manufacturers and the operational metrics of Transnet as two of the biggest “success” factors in the group. The are more like failure factors at the moment, sadly.

There hasn’t been much for investors to hang their hats on in the past year, aside from the disposal of the SG Fleet business in Australia. You can see the impact on this chart of the deal news breaking at the end of November and full details coming out in early December:

Selling the perceived crown jewel in the business obviously doesn’t do anything to fix the other problems. It simply puts on a band-aid while they figure out what to do elsewhere.

In return for selling its 53.584% interest in SG Fleet, Super Group’s wholly-owned subsidiary is set to receive A$641.4 million, or roughly R7.5 billion. For context, Super Group’s market cap is R9.5 billion! This is exactly why Super Group believes that the rest of its business is being undervalued by the market.

After settling debt and other costs, Super Group intends to declare a special distribution of R16.30 per share before the end of June 2025. The share price is R27.45, so a decent chunk of capital will be coming back to shareholders.

If there is some kind of improvement on either the logistics or automotive side, then they may well be right about the rest of the group being undervalued by the market. Special situation and value investors will be taking a close look here, especially as the anticipated net debt to EBITDA ratio in the group is expected to drop sharply from 2.96x to just 0.77x after the deal.

On a pro-forma basis, the net asset value (NAV) per share is expected to be R38.29 and HEPS from continuing operations would be 229.5 cents. Although Super Group is trading way below its NAV per share, looking at HEPS relative to the NAV explains why that is the case. They simply aren’t generating sufficient profits from the asset base.

If that improves, then you could see serious share price action here after the deal. Personally, I’m too bearish on the traditional automotive manufacturers to see sufficient room for improvement here. It’s certainly a stock that is worth keeping an eye on though!

For some reason, the market really liked the Vodacom update (JSE: VOD)

I wish I could tell you why

Vodacom closed 5.6% higher on a day when equity markets really struggled as investors digested the tariff news. That’s a major shift in momentum, although it’s well worth remembering that this is what the long-term chart looks like:

What has changed here that could’ve gotten the market excited?

Starting with South Africa, total revenue growth for the quarter ended December was 4.7% and service revenue growth was 3.2%. Although lack of load shedding would’ve probably done wonders for margins, that’s still below-inflation growth in revenue. Unless the Competition Tribunal changes its tune about the fibre deal with Maziv (part of Remgro), it’s unclear where a material acceleration in overall revenue will come from. Although there are obviously some faster-growing pockets of the business, my cellphone bill seems to go down each time I renew my contract, not up!

The next largest segment is International, where growth was just 1.9% as reported. On a normalised basis, it was 7.5%. I will remind you once more that normalising for forex movements and just pretending that they will one day stop being an issue is very dangerous. Just ask the likes of MTN and MultiChoice.

This brings me neatly to Egypt, where the forex issue is at its most obvious. Revenue fell by 7.5% on a reported basis, yet was up 54.9% on a normalised basis. That’s obviously a great growth rate on a constant currency basis, but my view on forex risk remains the same: reported numbers are what count.

The combination of deep capital expenditure and exposure to African currencies lead to me sitting this one out. Perhaps one day it will improve. For now, I struggle to build an appealing bull case here.

Nibbles:

- Director dealings:

- After putting a large hedge in place last week, Datatec (JSE: DTC) founder and CEO Jens Montanana features in this section once more. This time, he’s bought shares worth R79.6 million!

- Acting through Titan Fincap Solutions, Christo Wiese has bought exchangeable bonds in Brait (JSE: BIHLEB) worth R1.9 million.

- Two directors of a major subsidiary of Stefanutti Stocks (JSE: SSK) bought shares worth R475k.

- Acting through an associate, a director of Huge Group (JSE: HUG) bought shares worth R42k.

- ArcelorMittal’s (JSE: ACL) losses are slightly worse than they feared in the initial trading statement. Instead of an expected range of R4.06 to R4.41 for the headline loss for the year ended December 2024, they now expect a headline loss of R4.50 to R4.66 per share. Either way, it’s a terrible deterioration from the headline loss of R1.60 per share in the comparable period. You may recall that it was ArcelorMittal that kicked off the January jitters for South Africa with the news of substantial job losses related to the longs business.

- If you would like to flick through an up-to-date presentation on the Southern Palladium (JSE: SDL) opportunity, you’ll find it here.

- Having spent what I’m sure was a lot of money fighting the JSE in court, Trustco (JSE: TTO) has now run out of courts to complain to. Trustco’s application for leave to appeal the Supreme Court of Appeal’s judgement to the Constitutional Court was refused by the most important court in the land based on a lack of any reasonable prospects of success. This issue has therefore been brought to a close and all the egg has settled on Trustco’s face. It’s rather ironic to see Trustco renew its cautionary announcement on the same day regarding potential delistings from all markets that it is currently listed on. They have now engaged an independent expert in this regard. They are also still trying to get their financials for the year ended August 2024 finalised.

- Conduit Capital (JSE: CND) has finalised the disposal of its shares and claims in estate agency group Century 21 for R7.2 million. It’s a rare example of good news for this battered and broken group.

Can somebody break down the Datatec’s CEO’s hedge for a noob please? Just interested how it works.

Hi Peter. Thanks for your question and apologies for the delay in getting back to you. Essentially, the founder has protected himself against downside by giving away some upside at a point in future. The put strike price tells you the level below which he is protected (in this case R49.99). But this costs money, so to fund that benefit, a call option is put in place further up at a strike price of R73.50. If the share price gets above that level before the expiry date, then the CEO loses out on that excess. With an expiry in August 2027, this tells you a lot about what the CEO’s view is of a reasonable range of returns going forwards. The share price at time of this message is around R51, so there’s effectively protection below this level (the put strike is very close to the spot price) and any growth above 47% (R73.50/R50) over the next 2.5 years is given up in return. Smart trade, don’t you think?