Anglo American is getting many nickels for its nickel (JSE: AGL)

Here’s another major step in the simplification of the group

Anglo American is making solid progress with its plans to become a more focused group. Hot on the heels of the news that it will be stripping Anglo American Platinum of a fat dividend before cutting that controlling stake loose, we now also know that Anglo American will be selling its nickel business for up to $500 million.

These nickel operations are in Brazil, with two operating businesses and two greenfield growth projects. The buyer is MMG Singapore Resources and they already have a presence in Latin America.

The deal structure is a cash consideration of up to $500 million, with an up-front cash payment of $350 million as the deal is completed. There is then a price-linked earnout of up to $100 million (calculated over four years and with reference to the nickel price) and contingent consideration of $50 million subject to a final investment decision for the development projects.

Along with the steelmaking coal disposal announced in November 2024, Anglo American expects to generate up to $5.3 billion in gross cash proceeds. Although the words “up to” can work hard in these circumstances, it’s clear that Anglo is making a lot of progress on its stated strategy.

Local volumes are still light in Assura Plc, but the recent news got it some attention (JSE: AHR)

For now though, the board is rejecting the approaches from KKR and USS Investment Management

Assura Plc is a large UK-based property group focused on the healthcare space. Without much fanfare, the group added a JSE listing to its corporate structure in late 2024. Such listings can quickly diminish into obscurity, with little in the way of interest on the local market. That seemed to be the case for a while, although bidders circling the company could well have put it on the map.

Kohlberg Kravis Roberts & Co LP (or KKR for our collective sanity) put a proposal through to the board for a cash offer of 48 pence per share. That’s a 2.8% discount to the most recently disclosed tangible net asset value and a 30.1% premium to the 30-day VWAP. Talk about closing the gap to NAV! The board said thanks but no thanks, believing that this offer undervalues the company.

Separately, USS Investment Management Limited confirmed that it does not intend to make an offer for Assura, either as part of a KKR consortium or otherwise. So, that’s another potential bidder off the table.

The net result is that Assura is trading 13.9% higher on the day, still at light volumes though. Perhaps more investors will now pay attention to the company going forward? It certainly has no shortage of attention in the UK, considering the market cap is well north of R30 billion.

Earnings up, but dividends down at BHP (JSE: BHG)

Mining isn’t always a cash cow

BHP has released results for the six months to December 2024. At the halfway mark in the financial year, things are looking promising in key metrics like copper production (up 10% year-on-year). The group is on track to hit production guidance at all assets and they’ve made strong progress on unit costs as well.

From a revenue base of $25.2 billion, BHP generated attributable profit of $5.1 billion and will pay dividends of $2.5 billion. Or, put differently, the business generated $1 in dividends for every $10 in revenue.

HEPS has increased by 28.8% to 86.3 US cents. Despite this, the dividend per share has dropped by 31% from 72 US cents to 50 US cents. The market didn’t love this at all, with the share price down another 1.4% to take the drop in the past 12 months to 15.7%. When payout ratios are being decreased, it’s usually a sign that either management is worried or that the underlying business will need far more capital expenditure going forwards.

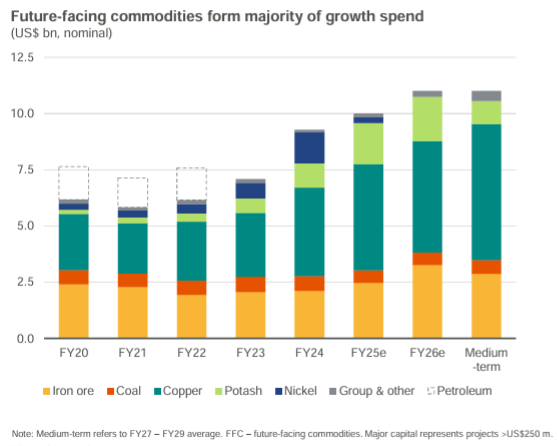

The balance sheet is fairly conservative by sector standards, with BHP expecting net debt to increase to the top end of the target range by the end of the financial year. Remember, debt isn’t inherently a bad thing. When correctly managed, it can boost equity returns. It’s also an important part of the capital structure in terms of funding capital spending, beautifully reflected in this chart from BHP that shows how copper has become such a big focus area:

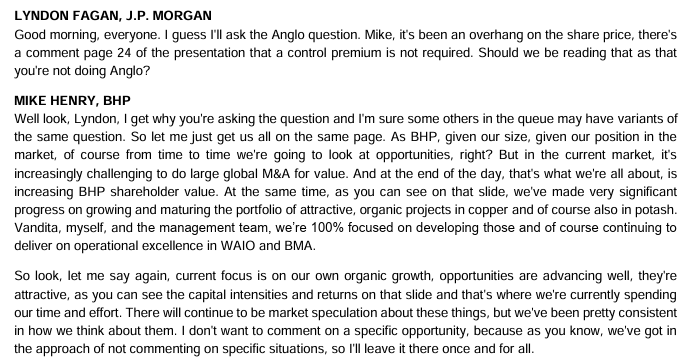

If you’re wondering about whether BHP is still eyeing out Anglo American for another takeover attempt, especially now that Anglo has already done much of the cleaning up of its group, you certainly aren’t alone. Here’s an excerpt from the earnings transcript and I wanted to include it here to show you how analysts ask questions and how executives respond to them:

It’s actually very rare to see locally listed companies making a full Q&A transcript available. I recommend you give it a read to see how institutions approach equity research. Here’s part 1 and here’s part 2.

DRDGOLD celebrates the gold price (JSE: DRD)

A delicious jump in earnings is the reward for gold punters

DRDGOLD has released earnings for the six months to December 2024. With the gold price making headlines for such great recent performance, you probably already know that these earnings are shining brightly. Sure enough, HEPS jumped by 65% and the interim dividend was good for a 50% increase.

The driver of this result is a 28% increase in revenue, paired with an inflationary increase in costs. Operating leverage (the presence of fixed costs that go up with inflation rather than revenue) is a beautiful thing when it works in your favour.

With only a 1% increase in gold sold, this period clearly wasn’t driven by production volumes. In fact, were it not for the great gold price performance, they would’ve struggled to maintain margins. Luckily, the average gold price received was up 26% in ZAR, so all was well in the end.

Of course, there’s no guarantee of the gold price continuing to go up, so underlying metrics like a sharp decrease in yield at Ergo Mining are worth thinking about. Although the company will obviously seek out as many cost efficiencies as possible, having to process more volume to get the same amount of gold can only put pressure on costs over the long term.

The highlight at Kumba Iron Ore is definitely free cash flow (JSE: KIO)

As for revenue and HEPS, the trajectory is firmly in the red

Kumba Iron Ore has released results for the year ended December 2024. Most of the metrics look pretty rough, like a 21% drop in revenue and a 45% decrease in HEPS. The final dividend was 18% lower, similar to the drop seen in the interim dividend. TL;DR: it’s not good.

Return on capital employed halved from 82% to 41%. I must point out that 41% is still a great return on capital. 82% as the comparable number was just a tad on the ridiculous side.

This drop comes despite only a 2% decrease in export sales. Thy also achieved a significant decrease in cash costs per tonne, with Sishen and Kolomela improving by 10% and 16% respectively on that metric.

With sales only slightly down and costs improving by such a great extent, it’s clear that the metric that explains the negative performance is the average realised export price. That price fell by 21%, so it would’ve been very hard for Kumba to achieve much against that backdrop. Frustratingly, their ability to produce iron ore is limited by Transnet’s ability to transport the stuff, so Kumba can’t offset weak prices by ramping production.

Speaking of production, they expect 2025 production of 35 – 37 Mt (guidance unchanged). In 2026, production is expected to fall to 31 – 33 Mt based on planned activity at the manufacturing plant. My understanding is that they expect to make up the shortfall in sales using finished stock at Sishen. In 2027, production is expected to once again be 35 – 37 Mt.

The focus is therefore on cost efficiencies, with the hope of course that iron ore prices will increase.

Nibbles:

- Director dealings:

- Acting through Titan Premier Investments, Christo Wiese has bought another R793k worth of shares in Brait (JSE: BAT).

- The CEO of Crookes Brothers (JSE: CKS) sold shares worth R191k.

- For Spear REIT (JSE: SEA) to have gotten its acquisition of the Western Cape portfolio from Emira Property Fund (JSE: EMI) across the line, the Competition Commission needed to give their approval. Of course, as we’ve come to expect, they used this as great opportunity for some regulatory overreach by forcing an increase in the Black Ownership percentage. Your guess is as good as mine in terms of how this addresses competition concerns. This means that an associate of a non-executive director of Spear has bought roughly R35 million worth of shares, funded to the extent of R30 million by a Nedbank loan that is guaranteed by Spear. In other words, all the shareholders of Spear (including existing Black shareholders who hold listed shares) are carrying more risk so that one specific shareholder can enjoy a great risk/return opportunity that wouldn’t be available without the corporate guarantee. This is a really old school approach to Black Ownership and it isn’t a net positive for the country vs. other ways of doing things, particularly when the situation is being forced by a competition regulator!

- Keep an eye on Alphamin (JSE:APH), as the risks of doing business in Africa seem to be creeping up to its door. Insurgents in the Democratic Republic of Congo (DRC) have seized the city of Bakavu, which is the second largest city in the east. This follows the seizure of Goma in late January. Alphamin operates in a remote area and for now at least, there are no disruptions. Clearly, operations risks are now running red hot and any further escalation in the conflict could lead to disruptions.

- Vunani (JSE: VUN) has renewed its cautionary announcement related to the disposal of a minority interest in a subsidiary. Negotiations are still underway and there’s no guarantee at this stage of a deal being announced.

- Dipula Income Fund (JSE: DIB) doesn’t have any listed debt and doesn’t intend to have any, so they’ve decided to cancel the GCR credit ratings.