AngloGold reminded us why the saying “it’s a gold mine” can be appropriate (JSE: ANG)

How does an almost 9x increase in free cash flow sound to you?

AngloGold Ashanti delivered a set of numbers in 2024 that are quite magnificent really. With cash costs up just 4% for the year, the company was in the perfect position to generate immense profits from the much higher gold price (up 24% on average for the year).

Free cash flow increased from $109 million in 2023 to $942 million in 2024. That’s truly insane. The swing in HEPS is equally breathtaking, from a loss of 11 US cents per share in 2023 to a profit of 221 US cents per share in 2024. It’s also worth noting that headline earnings came in at $954 million, so free cash flow conversion was excellent.

There’s a new dividend policy in place at the company. The base dividend is $0.50 per annum, payable in quarterly payments. The total dividend will be 50% of free cash flow, provided that adjusted net debt to adjusted EBITDA remains below 1x. Considering that they are currently at 0.21x on that metric, the lowest level since 2011, I think the payout ratio is pretty safe.

The total dividend for 2024 was 91 US cents per share.

In terms of outlook, guidance for 2025 is production of between 2,900Moz and 3,225Moz. That’s way up from 2,661Moz in 2024, with the acquisition of Sukari helping to boost the outlook. AISC is expected to be between $1,580/oz and $1,705/oz. That’s a perfectly acceptable range vs. $1,611/oz in 2024. Provided that the gold price behaves itself, AngloGold is setting itself up for another massive year.

Despite this, the share price fell 6%. The gold price wasn’t the issue on the day, so it seems that the market was expecting more here. I guess in the context of a 62% return in the share price over the past 12 months (net of this sell-off), there’s always risk of profit-taking.

Some good news at Aveng (JSE: AEG)

Yet the share price still hasn’t found any support

Aveng fell another 8.3% on Wednesday, taking the year-to-date drop to a hideous 37%. Currently at R8.15 per share, I must point out that the 52-week low is R5.48. This thing can drop a lot further if the narrative doesn’t improve.

There aren’t many highlights in McConnell Dowell right now, the business segment focused on Australasia and Southeast Asia. As you may recall, Aveng recently flagged ugly losses there. Much closer to home, Moolmans (the segment focused on mining industry opportunities) put in a solid recent performance and has now locked in a large new contract.

The contract in question is worth R10.6 billion and is with Black Mountain Mining’s Gamsberg mine, a zinc mine in the Northern Cape. This is jointly owned by Vedanta and Exxaro Resources. The parties know each other well, as Moolmans delivered on an existing mining contract over the past 7 years.

The project requires capex of R1.3 billion over the life of the contract. As Aveng is busy losing money elsewhere in the world, they’ve had to get creative with how to fund this. One of the strategies is to rely on equipment OEMs for payment terms, while also designing the contract in such a way that the fleet renewal program is over the life of the contract rather than upfront.

The contract creates 342 new jobs in the Northern Cape, which is a pretty big deal.

City Lodge’s recovery story has stalled (JSE: CLH)

The dividend is flat

City Lodge Hotels has released results for the six months to December 2024. I’m afraid that they aren’t great, with revenue up just 2%. Although the average room rate increased by 10%, this had an impact on volumes with average group occupancy down 400 basis points to 57%.

Although HEPS climbed 15% without adjustments, it actually fell 2% on an adjusted basis. If you’re not quite sure what to make of this difference between the metrics, then always have a look at the dividend. Cash tells the real story and with the dividend staying flat at 6 cents per share, that story isn’t one of growth.

Interestingly, the company narrative suggests that the demand pressure on rooms was there anyway, so they pushed up rates in response to try and make up for it. Forgive me for relying on everything we know in this world about supply and demand, but that sounds odd. I’m not suggesting that they didn’t maximise things as best they could. It just seems strange to suggest that they responded to a weak demand environment by becoming more expensive!

Despite the lower occupancies, food and beverage revenue grew 6% and is now 20% of revenue. Gross margin improved from 59% to 61%. Management has done a great job in that space and this segment is the post-pandemic success story at City Lodge.

Another area where management deserves credit is cost management, particularly thanks to investment in areas like solar power.

This has been a period of extensive refurbishment projects to several key hotels in the group, so they will need to show growth in 2025 off the back of that investment. Occupancies are encouraging in January and February, up 200 basis points and 380 basis points respectively.

The share price is down 13% over 12 months and has taken a nasty knock of 17% year-to-date as the market has dumped many consumer-facing local stocks.

The strong momentum continues at Discovery (JSE: DSY)

They can get more than a free smoothie as the reward for these numbers

Discovery has released a trading statement dealing with the six months to 31 December. They expect normalised headline earnings to jump by between 30% and 35%. Before you worry too much about the “normalised” part of that, headline earnings without adjustments grew by a similar amount.

This was driven by a lovely performance in normalised profit from operations of an increase of between 25% and 30%. Discovery notes that Discovery South Africa and Vitality achieved similar growth rates.

Full details will be available on 4th March. In the meantime, the market celebrated with a 7.6% rally, taking the 12-month move to a juicy 54%.

Gemfields can breathe again: the stupidity of a Zambian export duty on gemstones is over (JSE: GML)

Well, for now at least

At a time when Gemfields is looking increasingly vulnerable, the very last thing they needed was the Zambian government trying to put a 15% export duty on precious gemstones and metals. As our very own government just showed us in the budget-speech-that-didn’t-happen, emerging and especially frontier market governments are always keen to shake the tree in search of more tax.

Thankfully, some degree of sanity has prevailed in Zambia and the export duty has been suspended. Make no mistake, this isn’t a forever solution. The word “suspended” is important here, as government might lift the suspension in future.

Gemfields finally caught a bid off the back of this news, closing 11.6% higher. Alas, it’s still down 45% over 6 months.

Glencore focused on cash generation in 2024 (JSE: GLN)

Lower energy coal prices were mainly to blame here

Glencore has released preliminary results for the year ended December 2024. Although revenue increased by 6%, they unfortunately saw adjusted EBITDA drop by 16%. That’s nothing compared to the net loss of $1.6 billion, which was driven by huge impairments.

Funds from operations is the metric that Glencore would far prefer you to focus on, not least of all because it increased by 11% despite bright red movements elsewhere on the income statement. Impairments are a non-cash expenses and Glencore also achieved net working capital inflows, hence the positive move in cash.

This is why Glencore has the confidence to announce top-up share buybacks in addition to the base dividend. This is despite net debt to adjusted EBITDA increasing from 0.29x to 0.78x off the back of the $7 billion EBR acquisition during the year.

Some relief to the net debt ratio will come from the disposal of Viterra, with $1 billion expected in cash proceeds (along with 15% in equity in the purchaser, Bunge).

The share price closed 5.7% lower on the day and is down 17% over 12 months.

Another Metrofile earnings release, another day of head scratching for the few remaining bulls (JSE: MFL)

Petition to change the ticker from MFL to FML

I will never understand the appeal of Metrofile. While writing the above headline, I initially mistyped the ticker as FML instead of MFL. Honestly, it feels more apt, particularly when you see a share price chart with a drop of 38% in the past year.

Buying low or no growth companies for the sake of a dividend yield is a fool’s errand in my opinion. Equities are for growth. If what you want is fixed income, then go buy bonds. When a share price falls by these sorts of numbers, the dividend won’t make up for it.

With HEPS down by between 23% and 46%, and normalised HEPS down by between 15% and 31% for the six months to December, it’s pretty woeful out there for Metrofile. Although there are pockets of growth in the group, they expect the “current challenges” to persist into the second half of the year.

Mpact’s margins are under pressure (JSE: MPT)

Operating margins have contracted off a high base

Mpact has released a trading statement dealing with the year ended December 2024. I’m afraid that this isn’t the kind of trading statement that you want to see, as the direction of travel for earnings is down. HEPS from continuing operations will fall by between 23.3% and 30%. Discontinued operations are much worse, with HEPS down by between 72.6% and 81.2%. Versapak was thankfully sold in November, so its challenges won’t be in the numbers again.

The share price is flat over 12 months, but this announcement came out at close of play on Wednesday. The market will only have time to trade on it on Thursday morning, so it could be a wild ride.

The issue wasn’t revenue growth, as revenue from continuing operations increased by 4%. Paper was up 3% and Plastics 8%. Despite this, EBITDA fell by 14% and operating profit by 24%. Clearly, the revenue growth wasn’t nearly enough to offset cost pressures.

Net debt at the end of the year was around R2.37 billion, well down from R2.7 billion at the end of 2023. The proceeds from the sale of Versapak helped here. Despite the lower overall debt, net finance costs came in at R300 million vs. R284 million the year before, which suggests that average balances over the year were higher.

Look out for the release of results on 10 March.

Sibanye-Stillwater expects a slight uptick in HEPS (JSE: SSW)

And you need to read this if you’re a Merafe (JSE: MRF) shareholder

Sibanye-Stillwater released a trading statement for the year ended December 2024. It may come as a surprise to you that HEPS is expected to increase by between 0% and 7%, despite all the negativity around the company in the past year. Even in HEPS though, there were a number of once-offs to help offset underlying pressure in PGM basket prices.

As for earnings per share (EPS), which includes the effect of impairments, there was another loss per share. It’s admittedly a lot better than the prior year loss of 1,334 ZAR cents, as the 2024 loss is expected to be between 245 and 271 ZAR cents.

It seems as though the second half of the year was the highlight, with the group also managing to achieve production within 2024 guidance for all but the US PGM operations. They also benefitted from the acquisition of Reldan (effective in March 2024), as Reldan’s focus is primarily on recycling industrial waste and achieving an output of gold as the primary commodity. It was a good year to be turning rubbish into gold!

The Sibanye share price remains a sad and sorry situation, down a whopping 73% over three years.

Separately, Sibanye announced an “enhancement” to the deal with the Glencore – Merafe venture. The change will lead to an accelerated completion of delivery of the required chrome volumes, which then leads into a new chrome management agreement that gives Sibanye more exposure to chrome prices than under the legacy agreement.

In a separate announcement, Merafe echoed Sibanye’s view that this is beneficial for all parties involved. Although there might be a change in exposure to chrome prices, there’s also an expectation of an increased feed and improved recoveries.

And in another separate announcement, Sibanye released its mineral resources and mineral reserves declaration as at December 2024. As they mine resources like PGMs and gold, these reduce over time. It isn’t so great to see things like geological changes and lower basket price assumptions. The only highlight really is the 36.6% increase in the attributable lithium mineral reserves, as well as a massive 116% increase to copper.

Revenue and margins down at Transpaco (JSE: TPC)

Here’s another SA Inc stock that is struggling

Transpaco’s share price fell 5% in response to the release of results for the six months to December 2024. With revenue down 3.1% and HEPS falling 9.8%, that dip isn’t a surprise.

When revenue decreases like that, it’s very hard to maintain margins. Inflationary pressures on costs are a reality, which is why operating profit fell by 13.7% and operating margin contracted by 100 basis points to 8.2%.

The HEPS impact was somewhat mitigated by share buybacks, shielding investors against some of the pain. The dividend displayed the most modest drop of all, down by 6.3% to 75 cents per share.

With pressure on profits seen across both major operating divisions, Transpaco needs a strong second half to the year. There isn’t much in the outlook section to suggest that anything is going to change in the near-term. The share price is up 22% over 12 months and trades on pretty thin volumes, so you could see some major percentage changes here.

Vodacom has laid out its five-year bull case (JSE: VOD)

The investor day presentation is well worth a read

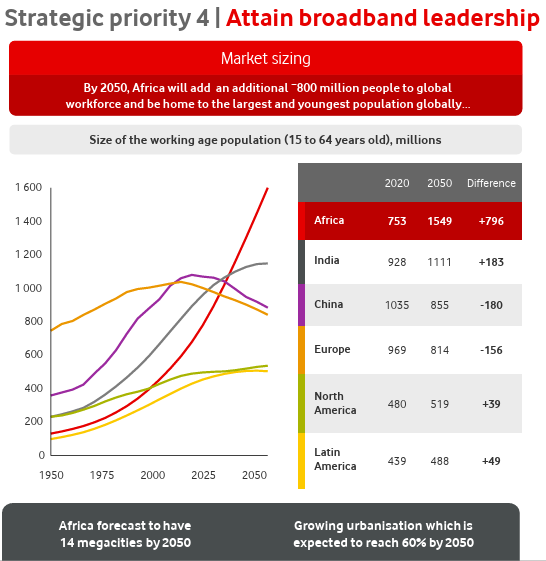

Vodacom hosted an investor day themed around the concept of Vision 2030. The title is pretty self-explanatory, I think. It includes some absolute gems like this chart:

The story is firmly one of African growth, with Vodacom expecting South Africa to become a smaller part of its business over time. Although South Africa will still contribute the bulk of operating profit in 2030 (an expectation of 59%), that’s way down from 71% in FY20.

Key drivers of the growth story include population growth, smartphone penetration (with associated fintech benefits) and urbanisation. You can immediately see that these trends are stronger in the rest of Africa rather than South Africa, as they talk to frontier market rather than emerging market metrics.

Frontier markets unfortunately come with macro risks, particularly around their currencies. One of the ways to mitigate the risk is through localised costs, for example in Egypt where over 90% of operating expenses are denominated in local currency.

Of course, this doesn’t solve the issue of translating earnings into rands and ending up with large forex losses. These are the risks of chasing growth in frontier markets.

Still, it’s an enjoyable presentation to flick through. You’ll find it here.

Vunani is selling 30% of Fairheads to Old Mutual (JSE: VUN | JSE: OMU)

Now we know why they were trading under cautionary

The cautionary at Vunani has been lifted and we now know exactly what they were up to. Vunani has decided to sell 30% in Fairheads to Old Mutual for R70 million. For context, the Vunani market cap is R290 million. This is about as close as you can get to a Category 1 deal (and shareholder approval) without actually triggering one.

Fairheads is an important business for many reasons, not least of all because it does the financial administration for over 100,000 children who are dependents of deceased members of retirement funds. You can see why there is synergy with Old Mutual here.

If this deal manages to genuinely unlock synergies, then it could be pretty lucrative for Vunani thanks to the 70% stake being retained. Fairheads generated profit of R21 million in the interim period. If we double that to R42 million as a quick and dirty, then 30% of that is R12.6 million and Old Mutual has paid an annualised P/E of 5.6x for the stake.

WBHO has flagged a decent increase in earnings (JSE: WBO)

The share price is looking vulnerable though after a strong rally

Construction group WBHO is up roughly 50% in the past year. That’s a really strong performance, although this chart shows you that the share price has been battling to retain those gains for the past 6 months or so:

Is it forming a new base here, or will it crash through support and experience a nasty correction? While acknowledging that it was a wild afternoon in South Africa with the cancellation of the budget speech, it’s also worth noting that WBHO closed 2% lower after releasing a trading statement at 3:15pm that flagged a solid uptick in earnings. That’s a further worry for the share price, as momentum has waned.

Was the market perhaps hoping for more? Or was everyone just distracted? We will find out in days to come, as the market properly digests an expected jump in HEPS of between 15% and 25% for the six months to December 2024.

Focusing on HEPS from continuing operations, this means interim HEPS of between R10.42 and R11.32. Even if you double these numbers to annualise them, an incredibly risky approach to take in the construction industry, WBHO is on a forward P/E of 9x. Given the challenges that can easily take place in this industry (just look at the latest numbers from Aveng), that’s not a bargain in my books.

Nibbles:

- Director dealings:

- A non-executive director of BHP (JSE: BHG) bought shares worth roughly R12 million.

- Things are finally happening at Labat Africa (JSE: LAB). Under new management and with a totally new strategy, they announced that the acquisition of Classic International will impact earnings at Labat by positive 7 cents per share. For context, the current share price at Labat is also 7 cents per share! The company has also made another non-executive director appointment with a focus on experience in the IT industry. It’s all about IT going forwards, which means a change of name is surely due at some point.

- Northam Platinum (JSE: NPH) has finalised a power purchase agreement with an independent power producer in respect of a 140MW wind farm to provide energy to the group’s operations. The wind farm is close to Sutherland and will deliver power over the Eskom grid to Northam Platinum’s three operations. I always love the thought of the existing Eskom infrastructure being used like this. Deals like these have a number of benefits, ranging from energy security through to cost savings over time.

- Super Group (JSE: SPG) announced that one of the conditions for the disposal of SG Fleet Group in Australia has been met. Noteholders gave a resounding approval to the deal, with the next critical milestone being Super Group shareholder approval that will be sought at the meeting on 25th February.

- Salungano Group (JSE: SLG) announced that CFO Kabela Moroga has resigned from the company. Jannie Muller has been appointed as interim CFO. The process to appoint a suitable replacement CFO has commenced.

- BHP (JSE: BHG) has indicated to the market that they are looking to add more debt to the balance sheet, so it’s not a surprise to see them pricing $3 billion worth of bonds in the US market. Here’s what the curve looks like: 5-year bonds at 5.000%, 7-year bonds at 5.125% and 10-year bonds at 5.300%. So, in case you didn’t already know this, the usual shape of a curve is that longer-term funding carries a higher cost. BHP will use the debt proceeds for general corporate purposes.

- Redefine (JSE: RDF) announced that Moody’s has affirmed its long-term issuer ratings with a stable outlook. These credit ratings are particularly important in the listed property space due to the extensive use of debt.

- Alexander Forbes (JSE: AFH) announced that is has repurchased all the shares held by the Isilulu Trust, an employee share scheme implemented in April 2015. The total guaranteed pay of affected employees will be adjusted to place them in the same position.

- Tongaat Hulett (JSE: TON) announced that the High Court dismissed an application seeking to interdict the implementation of the adopted business rescue plan. It’s not over yet, as the applicant (RGS Group) is also seeking to have the business rescue plan set aside. The urgent interdict was thrown out, but further affidavits can be delivered in the broader matter. Separately, the board and business rescue practitioners have made some key executive appointments to the board.

Stayed at a Town Lodge recently. With breakfast you had to ask at a counter for the bacon, mushrooms, potatoes etc that you wanted – no self service. Probably a control / cost-cutting measure but not necessarily a good look, especially given the cost (R220.00).