South African M&A activity in 2024 showed an improvement when compared with the previous year, with a favourable re-rating of equity prices due to a combination of economic and political stabilisation and sectoral growth, which in turn increased investor confidence.

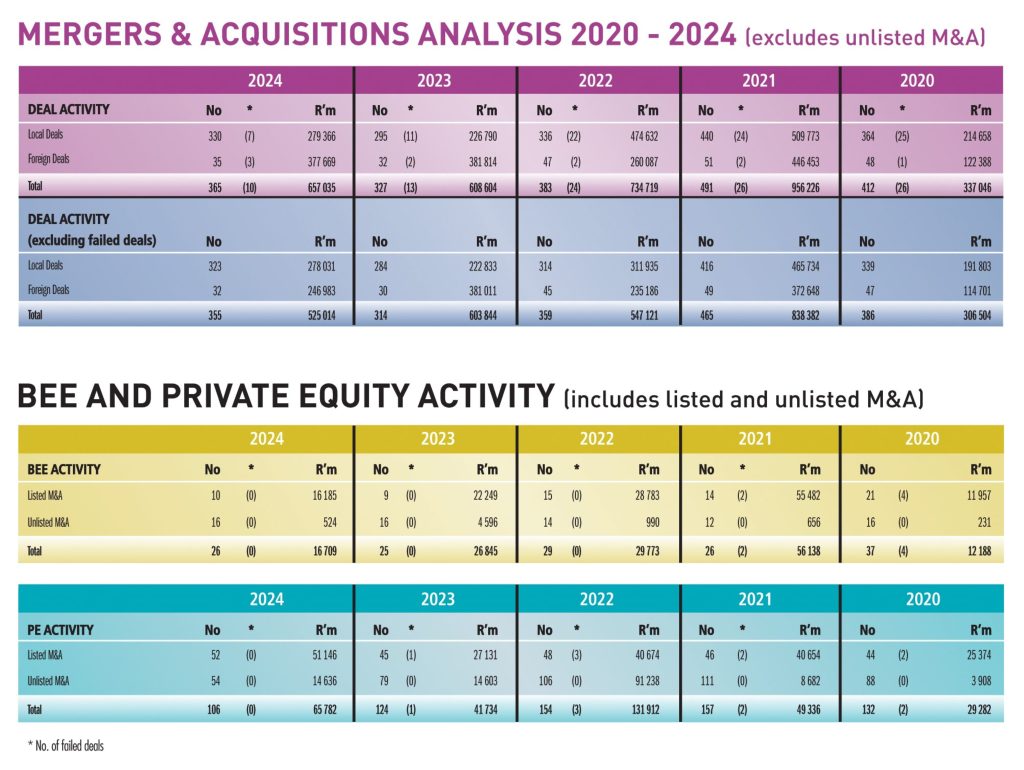

Deals announced during the year increased 12% to 365 deals valued at R657 billion (2023: 327 deals valued at R608,6 billion). R377,7 billion of this total value represented deals by foreign companies with secondary listings on the JSE. 10 deals failed – the largest by value being Mondi’s proposed acquisition of DS Smith valued at c. R123 billion. The real estate sector remained buoyant, accounting for 34% of M&A activity in South Africa during 2024. This trend underscores ongoing investor confidence in the country’s property market, with significant transactions contributing to the sector’s dynamism.

High profile deals during the year included Groupe Canal+’s acquisition of MultiChoice – which won the award for Deal of the Year – Barloworld’s take private, and the sale by Telkom of Swiftnet, its telecom tower portfolio. The JSE welcomed WeBuyCars and Boxer Retail to the bourse, in addition to three inward secondary listings by Powerfleet Inc, Assura plc and Supermarket Income REIT plc, with a combined market capitalisation of c. R100 billion.

Behind the scenes, in what DealMakers categorises as general corporate finance activity, 275 transactions were recorded, amounting to R532 billion. Share repurchases of R217 billion accounted for the lion’s share of the total value, with the repurchase programmes of Prosus and Naspers dominating. The local listing of Boxer Retail in November was a significant event in the capital markets, with a market capitalisation at the time of listing of R29,05 billion. There were 15 listings on South Africa’s exchanges during 2024 – eight on the JSE (including three inward listings), six on A2x (with two inward listings), and one on the Cape Town Stock Exchange.

M&A activity in 2025 presents potential challenges, including global economic uncertainties and possible shifts in U.S. trade and investment policies under a new Trump administration. However, if South Africa continues to implement pro-investment reforms and stabilise key industries, the pipeline of deals could become a reality, and M&A momentum sustained.

The winners of the gold medal subjective awards are as follows:

Ince Individual DealMaker of the Year – Sally Hutton

Brunswick Deal of the Year – Groupe Canal+ acquisition of MultiChoice

Exxaro BEE Deal of the Year – Coronation Fund Managers

Catalyst Private Equity Deal of the Year – Harith InfraCo’s acquisition of assets from the Pan African Infrastructure Devlopment Fund

Business Rescue Transaction of the Year – West Pack Lifestyle

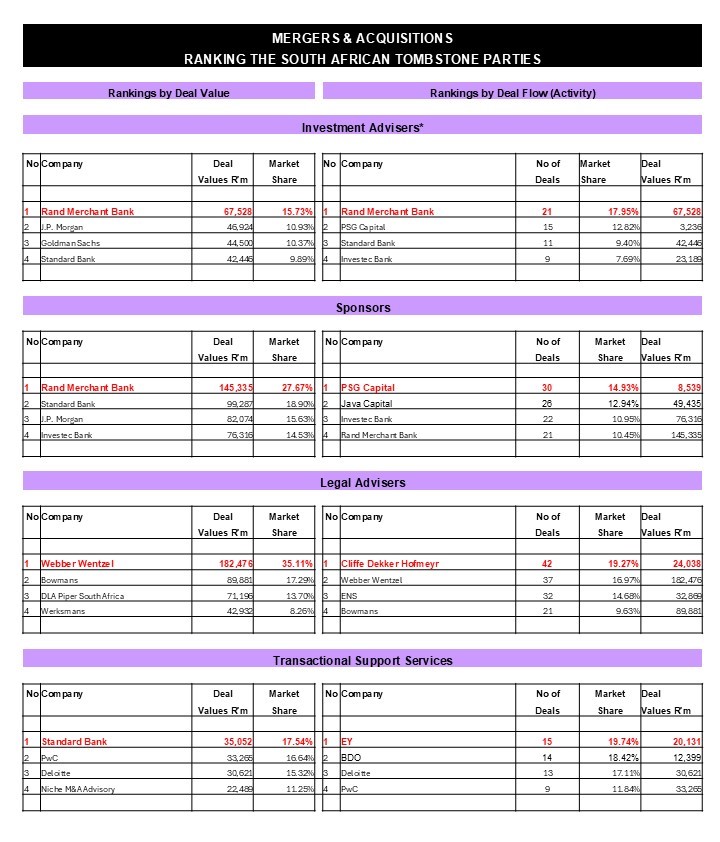

2024 M&A award winners (listed companies)

INVESTMENT ADVISERS

SPONSORS

LEGAL ADVISERS

TRANSACTIONAL SUPPORT SERVICES

Winners of other awards presented on the night were:

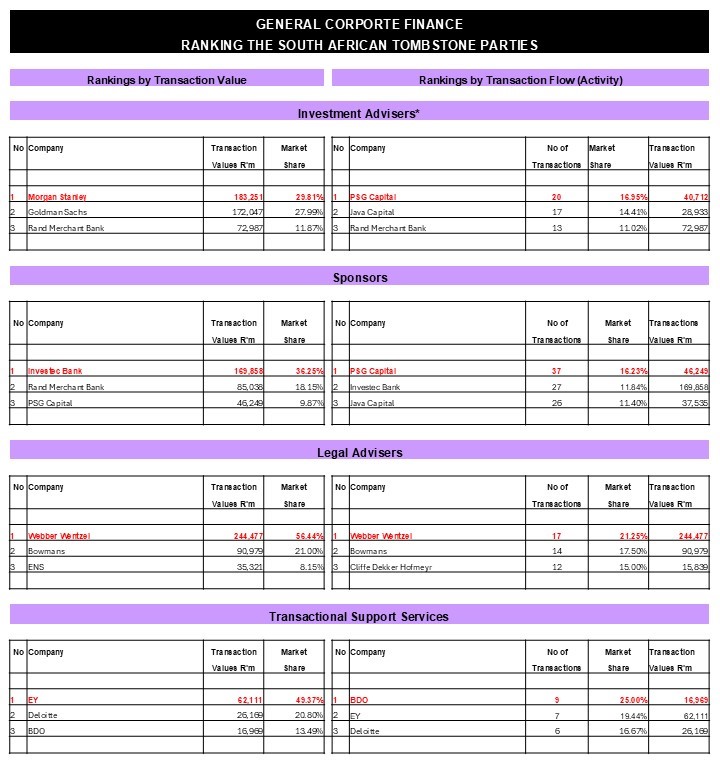

In the category of General Corporate Finance:

Investment Adviser (by transaction value): Morgan Stanley

Investment Adviser (by transaction flow): PSG Capital

Sponsor (by transaction value): Investec Bank

Sponsor (by transaction flow): PSG Capital

Legal Adviser (by transaction value): Webber Wentzel

Legal Adviser (by transaction flow): Webber Wentzel

Transactional Support Services (by transaction value): EY

Transactional Support Services (by transaction flow): BDO

Top BEE advisers were:

Investment Adviser (by deal value): Rand Merchant Bank

Investment Adviser (by deal flow): Pallidus Capital

Legal Adviser (by deal value): Webber Wentzel

Legal Adviser (by deal flow): ENS

Top advisers (unlisted deals) were:

Investment Adviser (by deal value): PSG Capital

Investment Adviser (by deal flow): Benchmark International

Legal Adviser (by deal value): Bowmans

Legal Adviser (by deal flow): Bowmans

2024 M&A League Tables: SA advisory firms (in relation to exchange-listed companies)

2024 General Corporate Finance League Tables: SA advisory firms (in relation to exchange-listed companies)

DealMakers is SA’s M&A publication

www.dealmakerssouthafrica.com