AfroCentric suffered a sharp drop in HEPS (JSE: ACT)

And no, the market didn’t like it

AfroCentric Investment Corporation released a trading statement dealing with the six months to December 2024. The period is particularly important, as the financial year has changed and hence the comparison is being made to the year ended June 2024.

Unfortunately, comparing six months to twelve months isn’t the reason for the decrease in earnings. With HEPS down by between 85.6% and 95.6%, there’s clearly a lot more at play here.

The company notes a number of factors, ranging from investment in growth through to trading conditions in the retail cluster, leading to margin erosion and impairments of goodwill as well. Of course, impairments don’t affect HEPS, but they do explain why earnings per share (EPS) has slipped into a loss position.

All the worries about life-after-REIT for Fortress feel so long ago (JSE: FFB)

The fund is flying

Fortress Real Estate posted excellent numbers for the six months to December 2024. The fund has a portfolio of logistics properties in South Africa as well as Central and Eastern Europe (CEE), as well as retail properties in South Africa. For further exposure to CEE, they have a huge stake in NEPI Rockcastle, one of the best funds on the local market – although NEPI’s growth in earnings on a per share basis are under pressure lately based on recent capital raising activities.

Still, with distributable earnings per share up 29.8% at Fortress, things are going well. This is being supported by metrics such as like-for-like net operating income growth of 9.2% in the retail portfolio and 4.7% in the logistics portfolio. They sold R259.2 million in office properties in the period and they are looking to sell the industrial portfolio. The remaining office portfolio of R897 million is only 1.6% of total assets, so it’s a pretty clean overall picture right now.

Remember that Fortress isn’t a REIT, so distributions are taxed as normal dividends rather than at marginal income tax rates. When you compare its distribution yield to other funds, keep in mind that you’re most likely paying more tax on distributions from REITs, so the pre-tax numbers aren’t directly comparable.

Also, Fortress is continuing with its plan of offering shareholders an option to receive NEPI Rockcastle shares in lieu of cash dividends.

Looking ahead, guidance for FY25 was revised to distributable earnings of R1.925 billion. That’s significantly up from previous guidance of R1.78 billion and shows further expected growth on the FY24 number of R1.79 billion. They basically ran a full year ahead of expectations!

In a notable change to the board, Robin Lockhart-Ross will retire as independent non-executive chairman. Herman Bosman, currently the lead independent director, will be taking on the role.

As you might expect, earnings at Harmony Gold are up (JSE: HAR)

Cost pressures did blunt some of the benefit of higher prices, though

Harmony Gold released a trading statement for the six months to December 2024. Thanks to the average gold price increasing by 23% in rand terms, HEPS (also in rands) increased by between 24% and 42%.

If you’ve been following some of the other names in the sector, you might have expected to see a more impressive jump in earnings based on the price increase. Harmony’s year would’ve been better if not for above-inflation increases in labour and electricity costs (which they refer to as “planned” increases) as well as higher taxes.

I’m not sure what to make of the tax comment. It’s obvious that taxes are higher if revenue is higher, so I’ll wait to see what the effective tax rate (i.e. the percentage) looks like when detailed results are released on 4th March.

Impala Platinum will be hoping for better PGM prices going forwards (JSE: IMP)

Profits suffered a nasty drop in the interim period

Impala Platinum released results for the six months to December 2024. Refined and saleable 6E production increased by 2% and 6E sales volumes were up 5%. 6E unit costs were up 3%. They therefore put in a decent performance on the metrics that are within their control. Alas, rand revenue per 6E ounce fell by 8%, so the income statement is still a sad and sorry tale.

With EBITDA down 23.4%, there wasn’t much chance of survival for HEPS. Indeed, it dropped by a nasty 43.6%.

At least free cash flow was a highlight, improving drastically from an outflow of R4.8 billion to an inflow of R639 million. A large decrease in capital was a helpful contributor here. Of course, celebrating a 59% reduction in expansion capital is a fairly self-defeating approach, as the reason for less expansion is because PGM markets are so depressed.

Full-year guidance has been maintained for production and unit cost guidance. They expect to come in below guidance on capital expenditure, so that should be a further boost to free cash flow.

The ramp-up of the new PG Bison line hurt KAP (JSE: KAP)

They need a strong second half here

KAP released results for the six months to December 2024 and they don’t represent a strong start to the year. Revenue increased by just 2% at group level and EBITDA fell by 4%. By the time you reach HEPS, it’s a drop of 21%. Cash generated from operations wasn’t any better, down 18%.

As always, you need to look into the segments at KAP to see what is really going on. At PG Bison, the largest profit contributor, revenue was up 5% and operating profit fell by 28% due to the inefficiencies and costs associated with the ramp-up of the new MDF line. They’ve spent R2 billion on the thing and they need to find markets to absorb the new capacity. They think it will take four years to reach the point where they are selling its full capacity! One really has to wonder about the capital allocation model here and whether they aren’t taking on too much risk.

Over at Safripol, revenue increased 10% and operating profit jumped by 58%, so there’s a highlight for you. They had a decent production period with fewer disruptions and the results are clear to see in the numbers. They expect the global polymer industry to be depressed until at least 2027.

Thanks to a period in which profit grew by 22% while revenue shrank by 2%, Unitrans is now the second largest profit contributor in the group. Initiatives like the discontinuation of loss-making contracts made a material difference here.

Alas, there’s no good news at Feltex. Local vehicle OEM assembly volumes fell by 19% and hence Feltex’s revenue dropped 16%. Operating profit nosedived 69%. They expect better local production in the second half of the year.

Sleep Group (previously Restonic) increased revenue by 4% and operating profit by 12%. Strategies like changes to the product range have helped to bring the margins up.

This doesn’t exactly sound like the kind of group that should be incubating a start-up, now does it? Despite this, Optix is sitting there with R294 million in revenue and an operating loss of R18 million. In the comparable period, they managed to break even on R285 million in revenue. If this is the kind of business that needs years of investment with little to show for it in profits (and clearly it is), then KAP isn’t the right owner for it.

The focus in the second half of the year is on debt reduction, particularly now that the major capital projects have been completed. It’s a pity that it’s going to take so long to make the most of those projects, as the market isn’t famous for being patient with JSE-listed mid-caps. The share price is up 16% over 12 months, but down 44% over 3 years.

Life Healthcare released the circular for the LMI disposal (JSE: LHC)

This is a Category 1 transaction, so shareholders need to pay attention

The back-story here is pretty interesting. Back in 2018, Life Healthcare invested in Alliance Medical Group (AMG) and acquired what became Life Molecular Imaging (LMI) as part of it. Over time, Life invested $66 million in LMI to commercialise the NeuraCeq product. In early 2024, Life disposed of AMG and returned R8.8 billion to shareholders as a special dividend.

They decided to hang onto LMI at the time. A sub-licence agreement was entered into with Lantheus, leading to an up-front payment of $36 million that was very helpful to Life’s earnings. But here’s the interesting part: while conducting a due diligence, Lantheus decided that they wanted to acquire all of LMI.

Given the capital requirements of LMI going forward and how different the business is to the rest of what Life does, they are not really natural owners of this asset. The board therefore decided to say yes to Lantheus, leading to the release of this Category 1 circular.

Aside from a vast amount of information on Life’s remaining business, the circular notes that the selling price for LMI is based on a cash-free, debt-free enterprise value of $350 million, with further adjustments for working capital. This excludes earn-out payments from 2027 to 2029 based on net sales of Neuraceq in the United States, with Life entitled to 23% of such sales capped at $225 million in total over three years. There’s also a potential milestone payment of $125 million in NeuraCeq global net sales exceed $1.25 billion in any calendar year until 2034. Finally, there’s another milestone payment of $50 million if the sales of three of LMI’s pipeline products exceeds $500 million in any single calendar year until 2034.

As you can see, this is a complicated deal that gives Life a juicy up-front amount and exposure to the long-term success of the product.

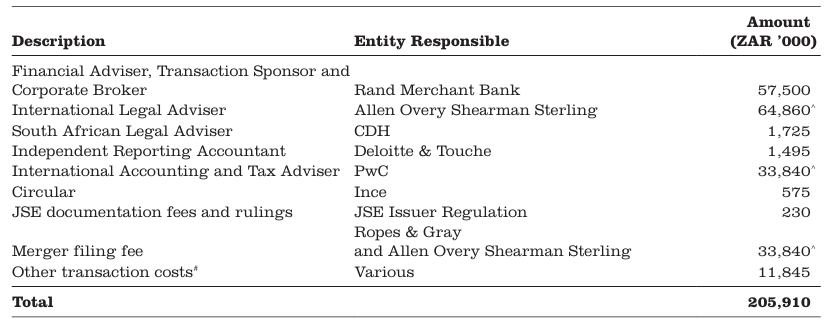

Complex deals come with massive bills from advisors. Just take a look at this:

That’s the market cap of a JSE small-cap, eaten up entirely by fees! International dealmaking is where the advisors make the serious cash.

The shareholder meeting is scheduled for 2nd April. You’ll find the circular here.

The markets seems to have been caught off guard by Motus (JSE: MTH)

The share price closed 14% lower in response to results

The car industry is going through a tough time. Manufacturers are suffering and market share is changing rapidly. The downstream impact on this is severe, particularly for businesses that nailed their colours to the mast in the form of having dealership networks representing particular brands. This is exactly why WeBuyCars is my preferred company in the sector, as they are brand agonostic. They literally couldn’t care less whether you buy a Haval or a Ford from them.

As for Motus, they are sitting squarely in the cross-hairs of the disruptive forces in this sector. Under the circumstances, I think they actually did pretty well to grow HEPS by 3% in a period where revenue fell by 2%. Despite resilient interim results, the market had a little panic and the share price closed 14% lower. Truly, I have no idea why anyone was expecting growth here.

With roughly 20% market share in South African new passenger vehicle sales, Motus is largely beholden to the broader consumer spending story. They note that the second quarter (i.e. the end of calendar 2024) was far better than the first quarter, which suggests that some of the consumer spending we saw at the likes of Lewis in furniture also filtered through into Motus. Discretionary spending had a strong finish to the year in South Africa.

This gave Motus an opportunity to reduce inventory and net debt, which would’ve done wonders for the HEPS performance.

It’s important to remember how diversified Motus is. They generated 55% of revenue and 65% of EBITDA from South Africa, with the rest coming from the UK, Australia and Asia. The UK is problematic, with weak demand and regulations requiring OEMs to show an increasing percentage of new vehicle sales as “new energy” vehicles. They are trying hard over there to force consumers into electric cars. The Australia market at least showed some growth to growth levels of volumes in new cars.

With all said and done, the interim dividend increased by 2% to 240 cents per share. The share price has given up basically its entire gain over the past 12 months:

MTN’s earnings have plummeted (JSE: MTN)

Forex remains a factor, but it doesn’t explain the year-on-year move

MTN released a trading statement for the year ended December 2024. Unsurprisingly, forex losses continue to plague the group. What surprises me though is that the impact this year is actually significantly lower than the comparable year, yet HEPS collapsed anyway.

They expect HEPS to be between 59% and 79% lower. In reality, this means a drop by between 186 cents and 249 cents. Now, in the comparable year, they had an impact of 888 cents on HEPS from “non-operational” items like forex, hyperinflation and other charges. When you’re choosing to operate in countries like Nigeria, I’m afraid those inverted commas are necessary. Without even going down that rabbit hole, the impact on the current period of the same items was 718 cents.

This means that year-on-year, HEPS is 170 cents better off from these items. This shows you that there’s a sizable drop in earnings due to other factors, much of which came through in the first half of the year. Although MTN has noted improved performance in the second half of the year, they are clearly still facing issues.

Notably, the tariff adjustments by regulators in Nigeria have started to be implemented by MTN Nigeria. This should help with the unit economics of the business in that country.

Detailed results are due for release on 17 March.

OUTsurance shareholders are definitely going to get something out (JSE: OUT)

Even the short-term book posted strong earnings growth

OUTsurance Group released a trading statement dealing with the six months to December 2024 and it didn’t disappoint. Group HEPS is expected to jump by between 42% and 48%, a particularly strong performance even by current sector standards.

The short-term operations in South Africa are the largest contributor to group earnings and they grew by between 24% and 30%. Next up in terms of size of contribution is Youi Group in Australia, one of the very few examples of a South African corporate finding success in that market, with earnings more than doubling! In both cases, much lower natural perils claims did wonders for underwriting profits.

OUTsurance Life also posted earnings that grew by more than 100%, so this wasn’t just a short-term insurance celebration.

The start-up losses at OUTsurance Ireland are in line with expectations. The group has a track record of entering markets and doing things the “hard” way by building up from zero. In reality, it’s proven to be a better way to do things than the standard approach by SA corporates of overpaying for offshore deals.

When one of the drags on performance is the performance of the employee share scheme in response to the extent of share price growth, you know things are going well.

Detailed results are due for release on 14 March.

Sanlam had a lovely time in 2024 (JSE: SLM)

Earnings growth is excellent

As we saw at sector peer Momentum earlier in the week, times are good in the life insurance space. Sanlam has added strongly to that narrative, with a trading statement for the year ended December 2024 reflecting a juicy increase in HEPS of between 30% and 40%.

This puts the company on an expected range of 913 to 983 cents. At the current share price of R88 and using the middle of that guidance, the P/E is thus 9.3x. You can buy some excellent companies on the JSE at modest multiples.

There was a once-off in these numbers in the form of a reinsurance recapture fee after the conclusion of the funeral insurance joint venture with Capitec. Net operational earnings per share excluding that fee grew by between 20% and 30%, so there was still plenty of good stuff in the core business to support these earnings.

One of the factors was an improvement in investment returns, with the markets giving life insurers a boost in the past year as they invested their reserves.

Sanlam’s share price is up roughly 24% in the past year.

Shaftesbury is having a grand old time in London’s West End (JSE: SHC)

Life after the Capital & Counties merger is going well, it seems

Shaftesbury is a perfect example of how you can give your money a passport via the JSE. The fund is entirely focused on the UK property market and specifically London’s West End. If you’ve ever had the pleasure of walking around that part of London (note: preferably in their summertime), it’s quite a thing.

Despite some pressure on valuation yields, there was enough growth in rentals to support a 4.5% increase in the portfolio valuation. There was also sufficient cash flow for the total dividend for the year to be up 11%.

Other metrics are also encouraging, like positive reversions in rentals and decent growth in underlying tenant sales. To make sure that metrics keep going the right way, they’ve been busy recycling capital. Since the merger, they’ve completed £246.6 million in disposals and reinvested £86 million in acquisitions. The loan-to-value ratio is down from 31% to a very comfortable 27%.

Despite the increase in net tangible assets per share, the share price on the JSE is down 8.4% in the past year. The strengthening of the rand is largely to blame for that.

Spar’s Swiss headache is getting worse (JSE: SPP)

And Southern Africa isn’t exactly shooting the lights out

In a trading update for the 18 weeks to 31 January, Spar reported a decline in total sales of 1.6%. A 9% drop in Switzerland is a major worry and a 6.7% decrease in BWG Group (Ireland and South West England) isn’t far behind. With growth of just 1.6% in Southern Africa, this is a disappointing set of numbers.

Even more concerningly, grocery was up just 0.6% and TOPS grew 1.9%. The core grocery business is putting in an dismal performance. It looks like Pick n Pay’s troubles are being mopped up entirely by Shoprite. This is further evidenced by Spar’s comments that their middle- and higher-end stores had subdued growth. Checkers and Woolworths remain the market winners.

Oddly, aside from 13.3% growth in SPAR Health off a small base, Build it was the highlight with 7.3% growth. That’s certainly a lot more than we’ve seen at the likes of Cashbuild recently, so they are doing something right there.

The top-line performance is uninspiring, but Spar has noted that margins are going the right way based on lower promotional activity and other initiatives. We will have to wait and see.

As for the offshore stuff, any hopes that the disposal of the business in Poland would make the end of the troubles have been dispelled. BWG Group’s sales are down 1.6% in EUR terms, with the blame put on consumer spending. SPAR Switzerland suffered a 5.2% decrease in turnover in CHF terms. Of course, a stronger rand has made these numbers look worse in reporting currency.

Interim results for the six months ending March will be released on 4th June. In the meantime, the market dished out a 7% hiding. Still, the share price is up 35% over 12 months.

Truworths’ interim dividend dipped thanks to weak performance (JSE: TRU)

Margins are under real pressure here

Truworths has released its interim results for the 26 weeks ended 29 December 2024. As we already knew from previous updates, they weren’t very good. In fact, they were poor.

Sales of merchandise increased by just 2.5%. You would therefore hope that they locked in stronger margins, with higher prices leading to depressed sales. Alas, gross margin fell from 53.6% to 51.8%. Not only were sales disappointing, but so too were the margins at which they were achieved.

Naturally, things don’t improve from there. Operating margin fell by 200 basis points to 22.5%. HEPS decreased by 4.6% and the interim dividend followed suit, down 4.5%. Don’t be fooled by a magical uplift in cash generated from operations, as the end of the reporting period was before month-end payments went off.

Office UK managed sales growth of 11.3% in local currency in this period and Truworths Africa was down 1.1%, so it’s pretty clear where the improvements need to be made. Cute stats like 38% growth in online sales in SA don’t make up for the overall number, particularly when higher promotional activity didn’t translate into sales.

Nibbles:

- Director dealings:

- An associate of a director of Afrimat (JSE: AFT) sold shares worth just over R2 million.

- A director of a major subsidiary of Altron (JSE: AEL) sold shares worth a total of R1.2 million. The announcement doesn’t explicitly say that this is the taxable portion of the share awards, so I assume that it isn’t.

- The CEO of RH Bophelo Limited (JSE: RHB) bought shares worth R27k.

- Here’s an unusual type of director dealings for you, with Afine Investments (JSE: ANI) noting that a trust associated with a non-executive director sold its shares in a company which in turn holds 77.78% in Afine. The sale was one level above the company and so no Afine shares changed hands. The announcement doesn’t clarify the stake that the trust held in the company further up the chain, nor does it give a value of the sale.

- Kore Potash (JSE: KP2) has released the highlights of its optimised Definitive Feasibility Study (DFS). They assume a construction start date of 1 January 2026, with a 43-month construction period. The initial life-of-mine is 23 years and they believe that further exploratory work could extend this. They expect an average EBITDA margin of 74% and a post-tax real IRR of 18% on an ungeared basis, measured in dollars. This shows you the kind of returns that can be achieved in frontier markets. Of course, the timing of this study is important as the company is looking to finalise the funding required for the project.

- Conduit Capital (JSE: CND) renewed its cautionary announcement based on ongoing engagement with the liquidator of CICL. The company remains a couple of years behind on publishing audited annual results due to the impact on CICL as its main subsidiary.

- London Finance and Investment Group (JSE: LNF) has decided to go ahead with a return of capital and a delisting of the company. They expect shareholders to receive 71 pence in cash per share. If all goes to plan, they intend to wrap it up by early May.