Having faced numerous challenges, including muted economic growth, geopolitical upheaval, high food prices, spiking interest rates and power supply interruptions, South Africa (SA) is fast improving its prospects for growth and becoming an attractive proposition for companies looking to raise equity capital. The formation of the Government of National Unity (GNU) has been positively received by the market and has lifted both international and domestic investor confidence.

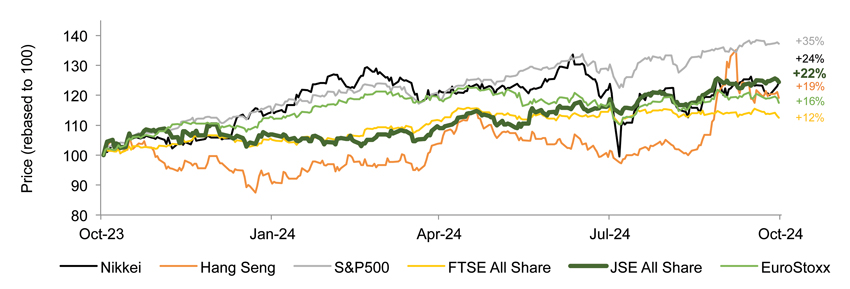

On the valuation front, SA trades at a price-to-earnings (PE) discount relative to both developed and emerging markets, presenting an opportunity for global investors to deploy capital into the South African listed environment. Currently, the JSE All Share trades at a forward PE multiple of 12.6x, which represents a 21.3% discount to the average forward PE multiple of 16.0x reported in developed markets. Relative to emerging markets with an average forward PE multiple of 14.5x, the JSE trades at a 13.5% discount. Over the past 12 months, the local bourse has outperformed its global counterparts, such as the FTSE All Share, EuroStoxx and Hang Seng, underperforming only the Nikkei and S&P 500, demonstrating higher market confidence in the South African equity environment, and an improved investor outlook.

Global equities performance (LTM) – Source: Bloomberg

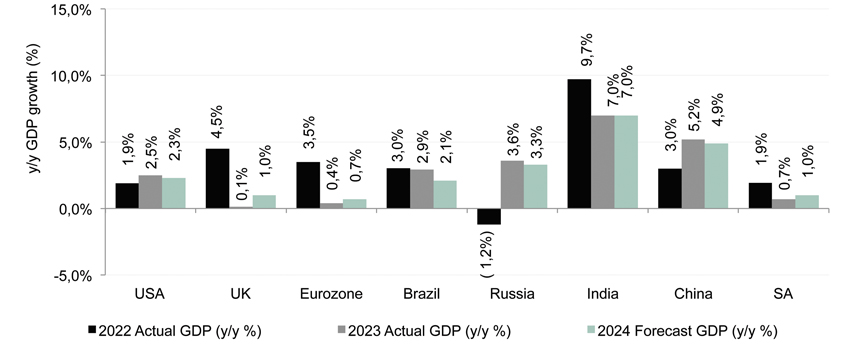

On the macroeconomic front, SA’s gross domestic product (GDP) is expected to climb moderately from the subdued 0.7% year-on-year growth in 2023 to 1% in 2024 and 1.7% in 2025. Relative to the United States and BRICS nations, forecasted SA output will remain subdued, albeit in line with the lacklustre GDP growth seen in the United Kingdom and eurozone. Rand strength, lower inflation and interest rate cuts will be key factors to propel equity capital market deal flow.

GDP performance (2022 – 2024) – Source: Bloomberg

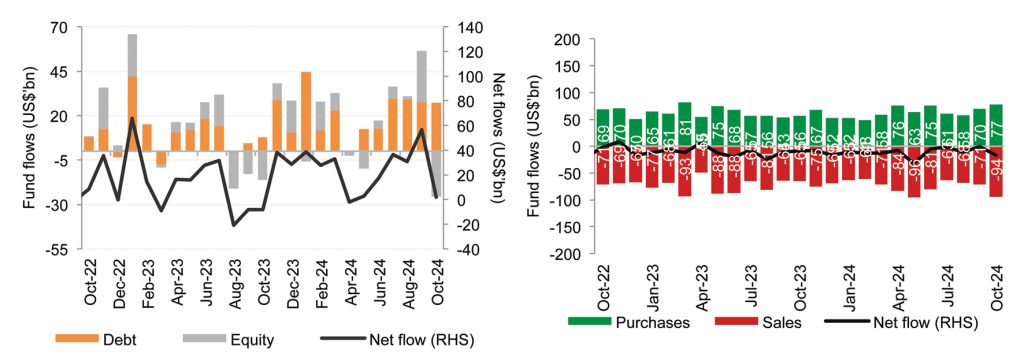

The recent amendment to Reg 28, increasing the institutional fund offshore investment weighting from 35% to 45% of portfolio allocations, has negatively impacted the South African equity market over the past two years, resulting in the net selling of South African counters as investors looked for investment in global equities instead of local stocks. However, with the JSE currently outperforming emerging markets, the capital outflow trend may be only short-term as local and global investors regain confidence in the local bourse. As institutions seek to meticulously allocate their capital to markets that will deliver higher equity returns, competitive dividend yields and attractive valuation metrics, emerging markets are expected to see an increased inflow of capital from local and foreign investors, with the JSE expected to benefit from this trend as investor sentiment and market conditions continue to improve.

Emerging markets and JSE capital flows – Source: Institute of International Finance (IIF), JSE

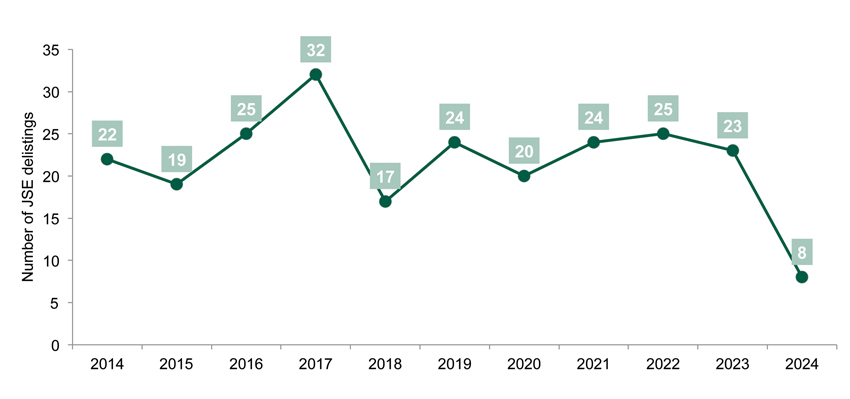

New primary markets issuance on the JSE is also showing signs of improvement. In the past 10 years, we have seen over 230 companies delist from the JSE due to various reasons, such as excessive listing costs, stringent regulatory requirements, lack of trading activity, management buyouts, and merger and acquisition opportunities that have enabled businesses to grow further after being acquired and taken private. Some notable delistings from the JSE over the past five years include Royal Bafokeng Platinum, Distell Group, Mediclinic International, and PSG Group. Notwithstanding this grim historical picture, the local bourse is now turning the tide from a wave of delistings as capital market activity increases and a significant pipeline of new initial public offerings (IPOs) has built. Recently, every company that has listed on the exchange did so due to unbundlings driven by debt-related pressures experienced by the holding company. Examples are Premier, WeBuyCars, Zeda and Boxer Superstores, which were unbundled from Brait, Transaction Capital, Barloworld and Pick n Pay respectively.

Delistings on the JSE (past 10 years) – Source: JSE

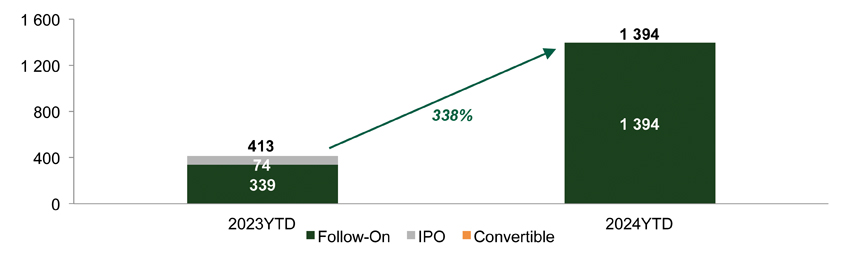

With a stabilising rate environment, easing inflation and higher growth outlook, South Africa is set for increased equity capital markets (ECM) deal flow across various equity offerings, including through IPOs, secondary inward listings, rights issues, accelerated bookbuilds and share buybacks. Notable ECM transactions concluded on the JSE in 2024 include the R8,5bn Boxer listing, R9,6bn Anglo American accelerated bookbuild, R4,0bn Pick n Pay rights offer and Pepkor R9,0bn accelerated bookbuild. The investment community is optimistic and anticipates more activity in the ECM environment, with over 10 deals already concluded in 2024 YTD. The pipeline of IPOs in SA includes African Bank, Fidelity, Coca-Cola, and other companies that envisioned coming to market in the pre-COVID-19 era.

SA ECM volumes (US$m) – Source: Dealogic

We have witnessed the JSE make efforts to simplify regulatory requirements to encourage more listings and equity issuances. Recently, we have seen secondary listings on the JSE become thematic. UK-listed companies such as Assura plc and Supermarket Income REIT have identified the opportunity to broaden their access to capital and diversify their shareholder base by pursuing listings on the JSE. As the global macro environment improves – inflation remains controlled, interest rates are cut further and the rand holds its ground – SA will see a significant increase in equity capital markets deal flow, which will further bolster local growth and attract investment.

Leago Papo is an Investment Banking Associate: Equity Capital Markets | Nedbank Corporate and Investment Banking.

This article first appeared in DealMakers, SA’s quarterly M&A publication.

DealMakers is SA’s M&A publication.

www.dealmakerssouthafrica.com