Some good news at Alphamin (JSE: APH)

The Bisie tin mine in the DRC has resumed operations

Market sentiment is disastrous enough right now without taking into account additional risks like regional conflicts. This is why it was very important for Alphamin to get the Bisie tin mine operations in the DRC back up and running as soon as possible, although the conflict situation is obviously outside of their control.

The share price was in proper trouble before the news of the resumption of operations, having dropped around 40% year-to-date. Thanks to a sharp rally of 24% based on the latest news, that year-to-date picture has improved to a drop of 26%. It’s ugly, but less ugly at least.

Importantly, although the mine was evacuated in mid-March, tin concentrate export logistics continued without interruption. They have limited concentrate stock on hand, so they definitely can’t afford any more problems like this.

The insurgents are 130kms east of the mine. That’s not exactly the biggest margin of safety, so investors will still be wary here.

In a shock to no one, Assura has rejected the Primary Health Properties proposal (JSE: AHR | JSE: PHP)

I really didn’t understand the deal strategy here

UK-based healthcare property group Assura is the talk of the town. They’ve been looking at a potential offer from KKR and Stonepeak Partners that has now turned into a firm offer. It’s an all-cash deal, which is always appealing to shareholders who enjoy clean transactions with low implementation risk. The board has decided to recommend this offer to shareholders.

This means that the approach by Primary Health Properties has been rejected once and for all. I’m not surprised in the slightest. As I wrote at the time when the indicative terms first came to light, a part-share part-cash offer that is essentially a merger would need to be at a price that is a premium to the competing all-cash offer. You’re asking shareholders to walk a road of believing in synergies and taking on deal risk. How can you ask them to do that for less money than the alternative?

Weak corporate finance strategies aside, we can now just focus on the KKR / Stonepeak offer. It comes in at 49.4 pence per share, comprising 48.56 pence in cash to be paid by the offeror and the rest in the form of the quarterly dividend that existing shareholders will be permitted to receive. This works out to 33.9% premium to the 30-day VWAP up until 13 February, which is when the offer period commenced.

Alas, no sooner had Assura arrived on the JSE than it seems to be leaving. At least we will still have Primary Health Properties. I just hope they get better advisors, or more executives with corporate finance experience if they plan to be doing transactions like this. I’m all for throwing your hat into the ring, but at least give it a chance.

Jubilee has found an unnamed partner for its surplus PGM feed material in South Africa (JSE: JBL)

This is necessary because chrome production is much higher

Jubilee’s chrome concentrate production reached record numbers in the six months to December 2024. This has created a lot of PGM-bearing material on the surface as a by-product. Instead of investing in capacity to process this material themselves, Jubilee has opted to partner with a local company to do it – they just won’t tell us who it is.

Earnings from the project will be shared equally and there’s an initial term of 12 months. This sounds like a pretty smart plan that will do wonders for FY25 production levels and especially return on capital, as no additional capex is required.

The flywheel is spinning at Purple Group (JSE: PPE)

Assets are growing faster than clients – and that’s what you want to see

This is easily the best set of numbers that we’ve seen from Purple Group. That seems obvious when a metric like HEPS jumped by 204.1%, but that’s not even the best part. The key is to look at the sources of that growth, particularly in the core EasyEquities business.

The flywheel that needs to spin is client growth. Active clients grew by 8%, so that gets a tick in the box. The next all-important wheel is average inflow per retail client. Ideally, you want clients to put more and more money into the platform each year as their investment capability and level of financial acumen grows. Sure enough, the numbers per cohort are encouraging (longer standing clients are more valuable) and the average inflow per retail client is up 49% to R5,201. That’s still such a small number compared to how traditional brokers think about their clients, which shows you why this business is important.

Then, you want to see that costs aren’t growing as quickly as revenue. The HEPS growth kinda gives that away already, so you know there’s good news coming. There’s a comment in the CEO report that for every R100 increase in revenue, R70 is flowing through to the bottom line. That’s a strong incremental margin of 70%. For reference, the group profit before tax margin is currently 25%. This shows that top-line growth has every possibility of turbocharging the profit before tax growth.

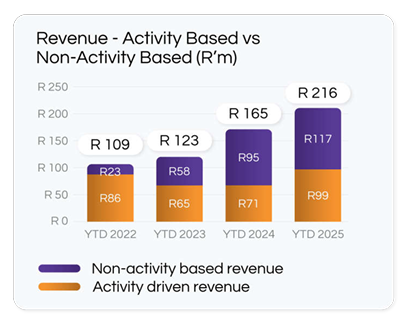

For me, the best story in the group is the reduced reliance on activity-based revenue. Just take a look at this chart from the earnings report and consider how different this story would be if the purple bars weren’t there:

Aside from my worries about the valuation, my biggest gripe was that the immense multiple was being applied to revenue that isn’t recurring in nature. I wasn’t wrong, as you can see by the dips in the orange bars and the general lack of growth in that type of revenue, particularly when compared to the purple bars. These days, the multiple is far more reasonable and the underlying revenue is more recurring in nature.

With initiatives like EasyCredit, they certainly need to be careful about the risk that they introduce into the business model. The key is to go steadily rather than quickly. We’ve also seen very little progress thus far in the Philippines, with a current monthly cost of R1.5 million per month. Thankfully, the core business looks solid enough to support some initiatives that bring upside optionality to the story.

I’m finally ready to be long Purple Group, after a good few years of having to explain to people what the difference is between a great company and a great investment. If a share price is at reasonable levels, it’s possible for something to be both.

Nibbles:

- Director dealings:

- Des de Beer bought shares in Lighthouse Properties (JSE: LTE) worth R523k. This adds to his significant recent tally.

- The COO of Spur (JSE: SUR) sold shares worth R421k.

- The independent chair of KAP (JSE: KAP) bought shares worth R232k.

- There are a couple of significant senior management changes at African Rainbow Minerals (JSE: ARI), with the current CEO of ARM Platinum moving across to run ARM Technical Services, a division that is being reintroduced at the group to focus on enhancing the efficiency and effectiveness of the group.