Anglo’s deal with Peabody is under fire – literally (JSE: AGL)

Will we see a material adverse change clause being triggered here?

Nothing ever seems to be simple at Anglo American. Although they’ve undoubtedly created a number of problems for themselves along the way, they’ve also had some bad luck. The latest such example is an “ignition event” (i.e. a fire) at the Moranbah North mine that is part of the steelmaking coal business that Peabody Energy is buying.

Well, that they are in theory buying. Peabody has come out with a statement that they are “reviewing all options” in relation to the deal. In other words, the lawyers are pointing out the material adverse change clauses in the deal and the corporate financiers are working with the accountants to figure out if the fire exceeds any thresholds that are in the agreement.

This isn’t an uncommon thing. Imagine if you were buying a car, but you would only take ownership in 6 months and the current owner will continue to use the car for that period. Wouldn’t you want some kind of protection regarding the condition of the vehicle by the time you take ownership? This is what material adverse change clauses do.

Anglo American is downplaying it of course, referring to a “minor ignition” and the camera footage showing no evidence of damage. Again, nothing unusual here – the lawyers are making sure that Peabody puts out grave-sounding announcements in case they want to pull out of the deal, while Anglo is making it sound like it would be ridiculous for Peabody to do so.

And so the corporate dance continues…

Choppies is selling its business in Zimbabwe (JSE: CHP)

This isn’t exactly the biggest deal that you’ll see on the market

Choppies is selling Choppies Zimbabwe to Pintail Trading, a competing retailer in the southern region of Zimbabwe. The buyer isn’t a related party to Choppies.

It’s a tiny deal, with a price of just $260k. This is really just a case of getting rid of a headache, allowing Choppies to focus on regions where it believes it can be profitable. Instead of throwing more capital at Zimbabwe, they are simply getting out with a clean exit and a small cash inflow.

The Choppies market cap is R1.9 billion, so this disposal is truly a rounding error in the bigger picture.

You have to read the Life Healthcare update carefully (JSE: LHC)

There are some important earnings adjustments

Life Healthcare is in the process of selling the LMI business in a deal that shareholders almost unanimously voted in favour of. Against this backdrop, they’ve also released an earnings update dealing with the six months to March 2025.

Although there are some timing differences related to Easter, the southern African business experienced a 2% uptick in Paid Patient Days (PPD) and a 6.1% increase in revenue per PPD. This has driven revenue growth of between 8% and 9%, which is pretty good for a hospital group.

Now, you would expect to see that kind of number driving a significant jump in HEPS. Instead, once you work through the adjustments to arrive at pro-forma HEPS from continuing operations, you find a move of between -5% and +7.1%. In other words, barely positive at the midpoint. If you use pro-forma normalised earnings per share from continuing operations (no kidding), then the increase is between 0.2% and 12.3%.

Here’s the thing that a lot of shareholders probably didn’t realise: there’s a large contingent consideration payable to Piramal Enterprises, the previous owners of LMI. This is a good example of being on the wrong side of an Agterskot! The fair value adjustment is a huge R2.9 billion, or 203 cents per share. They exclude this from normalised earnings per share and from pro-forma HEPS. It will be included in HEPS from continuing operations though due to technical definitions, which means that Life will actually report a substantial headline loss this period.

There are other adjustments in the numbers as well, mainly related to payments to LMI management. These deals are complicated.

Results are due for release on 22 May. I suspect that most investors will focus on operating profit and whether the increase in revenue actually led to better margins. It’s pretty hard to tell from this trading statement whether that was the case or not.

The show is over for Murray & Roberts shareholders (JSE: MUR)

As I suspected from the business rescue plan, it is indeed a doughnut

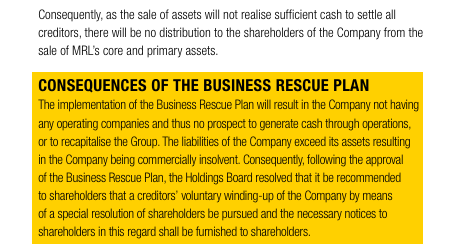

Zero. Niks. Nada. F*kol. That’s what Murray & Roberts shareholders will be receiving from the business rescue process. Although that did come through pretty strongly for me in the business rescue plan, it wasn’t explicit. The release of interim results by the company has now confirmed the position.

Here it is, in black and white (and yellow):

For employees and other stakeholders, the mining business will continue operating. This is because the business is being rescued, even if it comes at the expense of shareholders. This is obviously a vastly preferred outcome to the whole thing shutting down, but it’s a timely reminder that shareholders very rarely get anything out of a business rescue process.

Remaining announcements from the company will sadly be administrative in nature as the various processes are followed to wind-up the company.

Finally, some good news for Renergen (JSE: REN)

But what about the court proceedings?

Those who have been following the recent news at Renergen will know that the company has been locked in battle with Springbok Solar regarding a development that has been at odds with Tetra4’s production right. Tetra4 is Renergen’s subsidiary that houses the helium assets.

The big news for Renergen is that the defective Section 53 MPRDA approval for Springbok Solar has been revoked, based on Renergen’s appeal to the Director-General of the MPRDA. It was specifically found that Springbok Solar failed to consult Tetra4 as required by regulations.

The share price closed 14% higher as the market celebrated this outcome. I’m certainly no expert in this space, but it doesn’t look as though the court judgement has been handed down yet. This means there is still the risk of something going wrong. The devil is always in the details in these processes and making assumptions is very dangerous.

Tharisa’s production has been impacted by the weather (JSE: THA)

At least Q2 was ahead of Q1, though

Tharisa has released a production report for the quarter ended March 2025. If you compare the numbers to the immediately preceding three months, then both PGM and chrome production came in higher. Prices for PGMs were also up, although chrome prices were well down.

The group’s net cash position decreased from $89 million at the end of December to $79.3 million at the end of March, mainly due to an increase in debt.

If you look at the six months on a year-on-year basis rather than sequentially, then PGM production fell by 12.2% and chrome concentrate production was down nearly 13%. PGM prices in USD increased by 4%, but chrome prices were down just over 12%.

You can therefore see why the price is down 20% over 12 months, as the PGM price move isn’t enough to offset the dip in PGM production, while both key chrome metrics went the wrong way.

Trematon should be repurchasing shares instead of focusing on dividends (JSE: TMT)

At least include some buybacks in the strategy to return capital to shareholders

Trematon is an investment holding company, which means they trade at a discount to intrinsic NAV. If you are wondering why, just refer to the recent African Rainbow Capital transaction and then consider the bad name that it gives to the entire sector, as they’ve basically turned the discount to INAV from a market estimate into an observable fact.

Where does this leave Trematon? Well, they plan to sell off assets and distribute proceeds to shareholders. Over time, this reduces the INAV. But what it doesn’t do is reduce the INAV per share, as they are paying dividends rather than doing share buybacks. All this does is reduce the share price over time, which means anyone looking at the company needs to constantly remember that there were prior dividends. I must acknowledge that I forgot this when writing about the trading statement that preceded this announcement, in which I pointed out the downward trend in INAV, so my apologies for that.

The point here is that buybacks, which would protect INAV per share (and perhaps even enhance it), while returning capital to shareholders, would be preferred to dividends. Liquidity is the obvious challenge here, but the average daily traded volumes aren’t too bad.

If we dig into the underlying assets, we find 1% revenue growth at Generation Education. Student numbers and operating profit fell year-on-year and the schools are sub-scale. They need to try attract more students without deviating from what makes these schools different. The group has raised external funding in the schools business and has seen its shareholding decrease from 82.7% to 68.2%. You have to wonder if diluting ownership at this point in the Generation journey is really the optimal approach, particularly when they’ve unlocked capital through other disposals (e.g. Aria) that could’ve been allocated into the schools. If they have their doubts about the business, then they also can’t expect the market to form an orderly queue to buy Trematon shares.

Club Mykonos in Langebaan also saw a drop in profits, contributing just R2.6 million to group profits in this period. It’s a decent cash generator, but those are marginal numbers at the end of the day. The development of the last piece of land at the resort is imminent.

There are a couple of other property assets as well, with an overall flavour of asset disposals rather than acquisitions being clearly visible.

The TL;DR here is that Generation is now the biggest asset. Trematon isn’t exactly showing growth in that asset and is happily diluting its stake in the business, while paying dividends instead of doing share buybacks. I must tell you that none of this fills me with confidence.

The INAV per share is 344 cents and the share price is R2.00, so that’s a 42% discount to INAV. As investment holding companies go, that’s actually a pretty standard discount.

Nibbles:

- Director dealings:

- Des de Beer bought shares in Lighthouse Properties (JSE: LTE) worth R11.25 million.

- A non-executive director of BHP (JSE: BHG) bought shares worth a meaty R833k.

- A director of a major subsidiary of Shoprite Holdings (JSE: SHP) bought shares worth R261k.

- The CEO of Momentum Group (JSE: MTM) bought shares worth R234k.

- The CEO’s spouse bought shares in Purple Group (JSE: PPE) worth R195k.

- A non-executive director of STADIO (JSE: SDO) bought shares for his minor child worth R5.5k. Start ’em young!

- Nu-World (JSE: NWL) has a market cap of just R545 million. This is a typical small cap with limited liquidity in its stock. The results for the six months to February 2025 reflect revenue growth of 28.8%, which obviously sounds fantastic. Although blunted somewhat by the time we get to HEPS growth, there’s certainly nothing wrong with HEPS being up 19.2%. Margins are under pressure in the business due to levels of competition in the market. Another interesting nugget is that the company saw an increase in sales from the two-pot savings withdrawals, so this revenue growth should be treated with caution in terms of how sustainable it is (or isn’t). As a final comment, the company saw solid growth in revenue in Australia, so here’s a rare example of a South African company seeing some success in that frightening land of spiders, snakes and broken retail dreams.

- Wesizwe Platinum (JSE: WEZ) is still trying to recover from a cyberattack in December 2024. This has led to ongoing delays in the publication of financials for the year ended December 2024. And perhaps most importantly, they are still working on the approval for the letter of support beyond the current funding cap of $1.52 billion. This requires approval from the China National Development and Reform Committee (NDRC). Given the South Africa – China relations, you would think that this is an easy thing to get right, but it does seem to be taking its time. This is all part of Wesizwe’s broader plans to obtain funding for the Bakubung Project.

- Mpact (JSE: MPT) announced a couple of new independent non-executive director appointments, including Sbu Luthuli as lead independent director.

- Purple Group (JSE: PPE) announced that chairperson Happy Ntshingila is stepping down on a temporary basis due to requirements under the Legal Practice Act (nothing untoward here – Ntshingile is completing a pupillage). Craig Carter will act as interim chairperson.

Tharisa cash is down because of an increase in debt? makes no sense

Hi Zach, it’s the net cash that is down, which total cash minus debt. So if debt is up, then net cash can be down. Hope that explains it?