Castleview ups its stake in SA Corporate Real Estate (JSE: CVW | JSE: SAC)

Western Europe really isn’t offering much excitement at the moment

Castleview Property Fund, which owns a controlling stake in Emira Property Fund (JSE: EMI), also clearly likes the look of SA Corporate Real Estate. In February this year, they announced that they had bought derivatives referencing the underlying shares, as well as a direct stake of shares to the value of R139 million.

The latest news is that they have sold derivatives and bought more direct shares to the value of R756 million. This is buying the dip at scale, with the latest purchase being at R2.76 per share vs. the initial purchase at R2.85 per share.

The two purchases combined represent 323 million shares. Based on the number of issued shares at SA Corporate Real Estate, this puts them on roughly a 12.5% stake in the fund (ignoring the derivatives, which I’ve gotta tell you are pretty light on details in the announcement).

The thing that I don’t understand is why we haven’t seen a SENS announcement from SA Corporate Real Estate as of yet. Whenever a shareholder moves through a 5% ownership threshold, there should be an announcement…

Remgro is on a charm offensive (JSE: REM)

It’s just a pity that they are obsessed with dividends

Remgro hosted a capital markets day and made the presentations available online. If you want to dig into them in detail, you’ll find them here.

The best slide for me is this one:

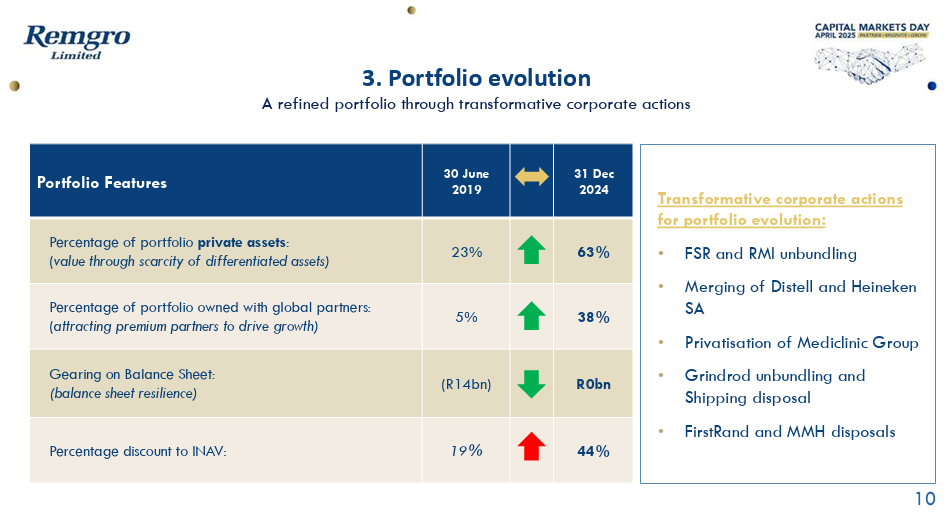

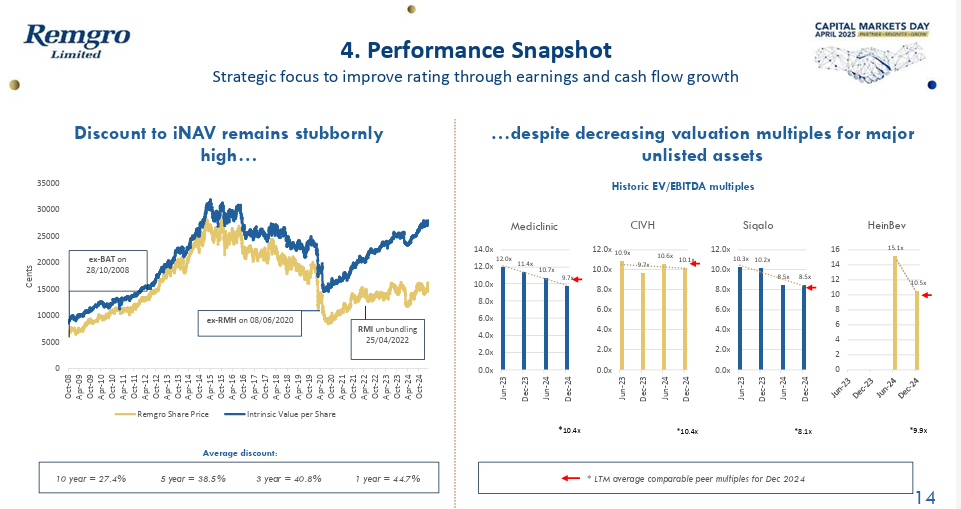

Essentially, Remgro is pointing out that they are in much better shape than they were before the pandemic, yet the discount to the INAV is much higher than it was before. Sentiment towards investment holding companies is really poor on the JSE, not helped by the likes of African Rainbow Capital and their plan to delist at a significant discount to INAV, supported by a valuation from an independent expert. As an investor, it’s hard to look at something like this and conclude that these discounts will close.

Something that would help a lot would be for Remgro to scrap the dividend and focus entirely on buybacks at this discount to INAV. That would be the textbook route to take from a capital allocation perspective. I suspect that there are major shareholders who have gotten so used to the Remgro dividend that this simply isn’t an option. Still, even if there’s some short-term volatility in the share price as dividend-focused investors try to exit, I’m quite sure that there would be enough buyers who would be encouraged by this superior capital allocation strategy.

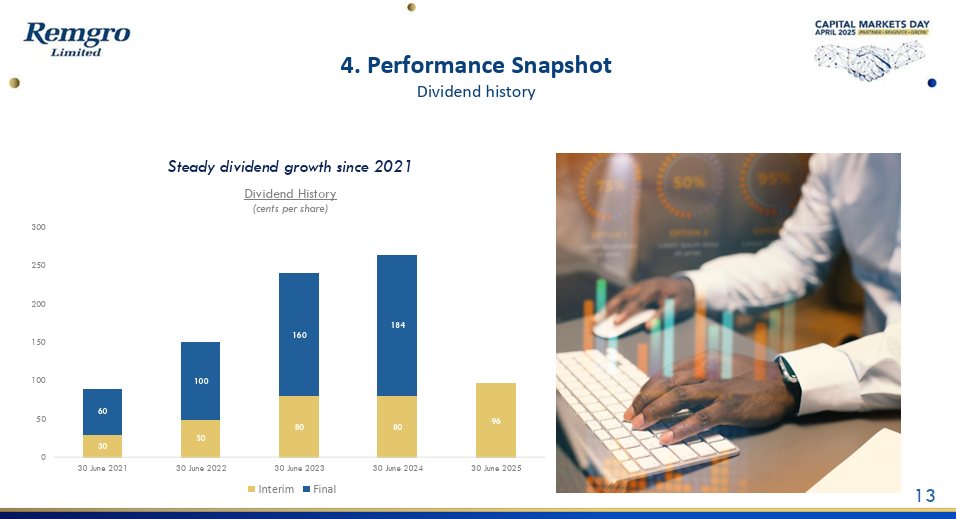

Instead, we have to suffer through one slide that proudly shows the dividend growth:

Followed immediately by this one that makes it sound like you need a world-famous detective to figure out what the discount to INAV refuses to close:

Two words: share buybacks. Do more share buybacks! Sigh.

Don’t hold your breath, as this slide (including my annotation of the key block) makes it very clear that not prioritising the cash dividend would be a “betrayal of the fundamental tenet” at Remgro. Why not just rename it to Remcash then, as clearly that’s the priority?

Moving on from my capital allocation frustrations, I must note that with 26% of the portfolio sitting in healthcare, it’s perhaps not surprising that this was a major focus area. The capital markets day presentation was accompanied by a financial update from Mediclinic, where USD-denominated revenue grew 5% and adjusted EBITDA margin expanded from 14.7% to 15.0%. Yay for that – finally some decent numbers coming from hospital groups!

The suite of presentations also includes one on Remgro Infrastructure – and specifically CIVH, the company with which Vodacom has been trying to do a fibre deal that the competition authorities don’t like. The hearing in the Competition Appeal Court has been set for 22 to 24 July, with an expected ruling by September 2025. Just in case the deal doesn’t go ahead, management outlined their strategy going forward and the potential for return on investment to move significantly higher as fibre penetration rates increase.

For me, until share buybacks become a larger priority than cash dividends, I have no interest in holding shares in Remgro.

Schroder’s portfolio valuations are still dropping (JSE: SCD)

Western Europe really isn’t offering much excitement at the moment

In the same way that people tend to lump Africa together as though all the countries are similar (clearly a huge mistake), many investors treat “Europe” as one place. This couldn’t be further from the truth. The growth prospects in Poland and Portugal definitely aren’t the same as in France or Germany for that matter.

Schroder European Real Estate Trust is a useful way to see that in practice. The fund releases quarterly valuation updates and the direction of travel usually seems to be down. Sure enough, the latest quarter reflects a like-for-like decrease of -0.3% over the quarter, with the industrial portfolio helping to mitigate much of the pain.

The segmental movements are important, with industrial up 1.8% (a combination of rental growth and more supportive valuation yields), while office fell by 0.9%. The silver lining for the offices is that at least they fell by much less than in the previous quarter, when they were down 2.4%.

There’s only one retail asset left in the fund, so looking at the 2% decrease in value in that asset and drawing any broader conclusions about the asset class would be foolish, particularly as the decrease is mainly due to the shorter remaining lease term.

Given the automotive sector troubles, I was pretty surprised to see that the valuation of the Cannes car showroom was unchanged. These are specialist properties and I don’t think many people have positive sentiment towards this sector at the moment.

The fund will be changing valuers from Knight Frank to Savills with effect from the end of June. Before you get suspicious, a “shadow valuation” by Savills has shown a consistent valuation with the numbers that Knight Frank has been achieving. They attribute the change in service provider to best practice and governance, in the same way that you would want to see an auditor rotation.

Nibbles:

- Director dealings:

- Des de Beer bought another R7.5 million worth of shares in Lighthouse Properties (JSE: LTE). I’m quite sure he was a major participant in the scrip distribution, although we have to wait for confirmation of that. Separately, Lighthouse confirmed that holders of roughly 47% of eligible shares chose the scrip dividend alternative, so more than half of shareholders preferred the cash.

- The CEO bought R510k worth of shares in Ascendis Health (JSE: ASC). This purchase was matched by Calibre Investment Holdings, an associate of a non-executive director, so that means insider buying of over R1 million in total. This is an interesting follow-on to the recent failed take-private.

- An associate of a non-executive director of Sun International (JSE: SUI) bought shares worth R874k.

- An associate of a non-executive director of BHP (JSE: BHG) bought shares worth just over R600k.

- An associate of a director of iOCO (JSE: IOC) bought shares worth R20.7k.

- Gold Fields (JSE: GFI) has a headache in Ghana, where the Minerals Commission has rejected the company’s application for a lease extension at Damang Mining. This is despite Gold Fields protesting on the basis that the application has fulfilled all statutory requirements. The government has now served an eviction notice to Gold Fields, with the company having to be off the site by 18th April – yes, in just a few days from now! Nothing is ever easy or predictable in Africa.

- Something may finally be happening at Kibo Energy (JSE: KBO), with the company confirming that it is at an advanced stage in its assessment of potential projects for acquisition as part of a reverse takeover transaction. For this reason, trading in the shares listed on the AIM in London will be suspended as a precautionary measure. The JSE rules are different to those in London and trading won’t be suspended here. I’ve always found it odd that trading can be suspended on one exchange but not the other, as it really seems to defeat the purpose of the precaution.

- The chairperson of Jubilee Metals (JSE: JBL), Ollie Oliveira, is retiring from his position with effect from 30 April 2025. He will be succeeded by Dr Mathews Phosa, currently the vice-chairperson. Also, interim finance director Jonathan Morley-Kirk has been appointed to that role on a permanent basis.

- As part of the broader investment by Kinetic Development Group in MC Mining (JSE: MCZ), there are two new director appointments to the board at MC Mining. One is the CFO of Kinetic Asia, while the other is a highly experienced executive with tons of experience in Asia.

- Hedge fund manager All Weather Capital has increased its stake in Trencor (JSE: TRE) from 4.56% to 7.48% ahead of the intended winding up of that company.