4Sight has announced an interesting acquisition (JSE: 4SI)

And perhaps most importantly, they are paying for part of it with shares

4Sight Holdings is a rather interesting small cap on the local market. For starters, check out the jump in the share price since mid-2023:

Clearly, the market is showing some interest here. With the news of an acquisition of X4, a group that focuses on payroll solutions to customers across more than 20 African countries, there’s even more to sink your teeth into. This is a solid business with recurring income, offering a number of payroll-related services like employee self-service platforms that integrate with WhatsApp. You can immediately see how a solution like that can be useful in Africa.

The total deal value is R42.4 million if the profit target is achieved. The structuring here is clever, with the amount split into two equal tranches. The first tranche of R21.2 million is 50% cash, 50% shares. The share component is calculated based on the 30-day volume weighted average price (VWAP). The second tranche (the earn-out tranche) is also on a 50-50 basis of cash and shares, calculated at the time based on the 30 day VWAP.

I certainly can’t fault that. There’s a solid mix of upfront and deferred payments, as well as that rarest of things on the JSE: a small cap actually using its shares as acquisition currency!

As for the valuation, if the net profit after tax for the year ended February 2026 is R6.06 million, then the full additional tranche of R21.2 million is payable. If that happens, the earnings multiple would’ve been 7x.

If the company achieves less than R3.03 million in net profit after tax for that year, then no amount is payable on the second tranche. For amounts between R3.03 million and R6.06 million, there’s a pro-rata payment. You can see that the multiple of 7x is relevant here once more.

Interestingly, the multiple isn’t consistent if they achieve over 110% of the target net profit after tax i.e. for any amount in excess of R6.66 million, in which case there’s a ratchet on the multiple that leads to the second tranche being 120% of the base expected payment.

And in case you’re wondering, net profit after tax was just under R5 million for the year ended February 2025. The base target for the earn-out therefore reflects growth of 21.5%, which gives you a sense of what might be possible here.

The key personnel of the seller will pledge all 4Sight shares received as purchase consideration, with the pledge lasting until 28 February 2028. This locks them in for a few years, with 4Sight having the option to repurchase shares from any key personnel leaving the group during that period.

Overall, this looks like a professionally structured deal that shows a lot of promise. It’s a Category 2 transaction, so there is no shareholder vote on the transaction. The implementation date for the deal is 30 April 2025.

I wish we saw a lot more of this type of dealmaking among small caps!

Even Afrimat’s diversification wasn’t enough for the cycle this year (JSE: AFT)

The drop in HEPS was even higher than in the interim period

The year ended February 2026 is one that Afrimat will want to forget as quickly as possible. Operating in the commodities sector means that you need to have a strong stomach for the bad years, when the cycle dishes out a gut punch despite the best efforts of management.

It was clear that this was going to be an ugly year, as interim HEPS was down by 79.9%. Things got worse rather than better, with HEPS for the full year expected to be between 85% and 90% lower.

The iron ore market did the damage, with a combination of lower prices and a reduction in volumes by ArcelorMittal South Africa in the first half of the financial year. Although volumes have recovered over the rest of the year, this doesn’t solve the iron ore pricing pressure or the ongoing frustration of Transnet running well below the allocated rail capacity.

Afrimat is also still incurring losses in cement, as it will take time for the Lafarge acquisition to reach its full potential. A further issue was found in the anthracite business, where exports were impacted by the closure of the border with Maputo.

There were some positives, like the Construction Materials segment that enjoyed a strong performance in aggregates and a better story in margins. Sadly, this was nowhere near enough to offset the iron ore pressures, hence it was a poor outcome for investors over the past 12 months.

Although it’s very difficult to predict where the cycle could go, Afrimat does sound confident that the year ahead will at least see a partial recovery.

The PIC is accepting the offer made to Barloworld shareholders (JSE: BAW)

And honestly, I’m not surprised

In my recent writing on Barloworld, I’ve pointed out that I think shareholders are being too greedy on this one. Much as we saw in the Bell Equipment offer, activist minority shareholders dug their heels in and refuse an offer that looks pretty reasonable to me on paper. At this point in the cycle, if someone offered me a reasonable price for businesses exposed to broader commodities, I would take it and run.

The PIC clearly shares that sentiment, with the decision having been made to accept the offer from the consortium. The PIC holds 21.93% of the shares in Barloworld, so this takes total acceptances to 46.93% of Barloworld’s shares.

Interestingly, if they reach the 90% acceptance threshold that would be required for a squeeze-out transaction (a mechanism to force the remaining shareholders to accept the offer), then Barloworld would be delisted and the consortium would need to implement a B-BBEE transaction. This is one of the conditions of the PIC’s acceptance of the offer. It’s highly likely that this would in any event be a condition of the Competition Commission approved the deal.

If such a transaction is needed, it will be for 13.5% of the shares in Barloworld. As part of the broader Black Ownership calculation, this would presumably be sufficient for Barloworld’s needs. If Barloworld stays listed, then no such deal will be done.

As a further nuance in this deal, the consortium has the right to walk away from the entire thing if they don’t achieve a 90% acceptance rate. Although I doubt strongly that they would walk away after all this effort, I also wouldn’t be surprised if they are looking to get an outright controlling position. At the current acceptance level of 46.93%, they aren’t far off.

Capitec just keeps winning (JSE: CPI)

Investors can’t get enough of this story

Capitec closed 7% higher after releasing results. This takes the 12-month performance to 54%. That sounds wild when you consider the global backdrop to this performance, but headline earnings increased by 30% in the year ended February 2025 and so there’s no shortage of growth to back this up.

Cash isn’t a problem either, with the dividend up by 34%. Juicy.

There are still those who believe that Capitec is focused on only the lower income segments and that they will run out of growth. If you’ve been paying attention, you’ll know that there is far more to Capitec than just its original client base. For example, they’ve achieved growth of 26.5% among high earners (over R50,000 per month) and they have a rather ridiculous 51% market share of the South African youth population (ages 16 – 35).

Bank accounts are sticky. Switching banks is a pain. To have that kind of market share among younger clients is an absolute triumph. These are the reasons why the market is happy to pay a large multiple for the Capitec growth story, as the drivers of growth are clearly visible.

There are other important drivers of growth, like value-added services and Capitec Connect, which saw a 61% jump in income. Once you’ve built a big platform, it’s possible to generate tons of additional income by winning a greater share of wallet. The scary thing is that there are no heroics here – they are simply taking sensible services to the client base.

Earnings in this period were further boosted by a significant drop in credit impairments of 15%, which took a 10% increase in net interest income and leveraged it up to a 39% jump in net interest income after impairments. Combined with 22% growth in non-interest income (which is a key driver of Return on Equity), they managed a 28% increase in headline earnings excluding AvaFin, or 30% including it.

Speaking of Return on Equity (ROE), this all-important metric increased from 26% to 29%. Most South African banks are running at around half of that level.

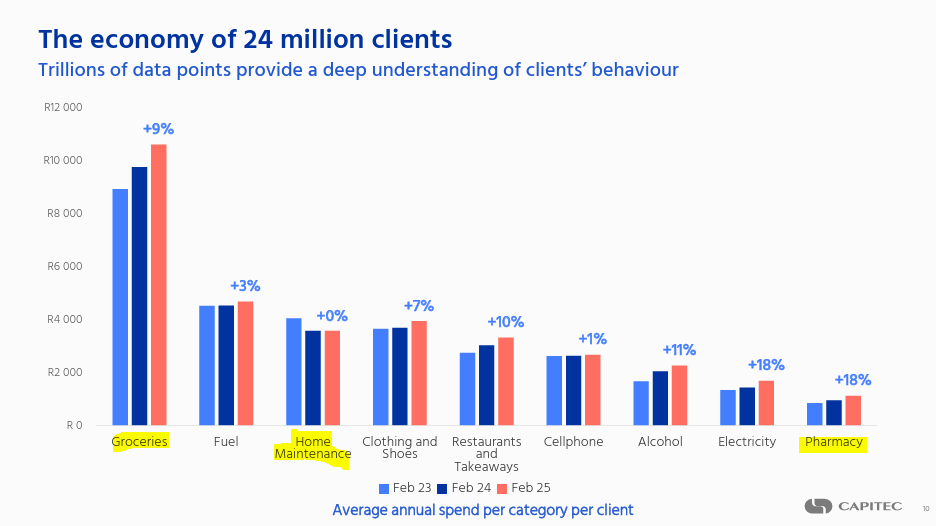

The results presentation includes tons of fantastic data, like this slide:

This is the benefit of reading widely in the market. Note the spend in Groceries on the far left and then consider how well Shoprite has been doing in the past few years. Also, look at Pharmacy on the far right and think about the growth drivers for Clicks and Dis-Chem. Finally, look at Home Maintenance and the absolute lack of growth over the past couple of years. DIY businesses have been struggling and this slide shows you why.

Secured home loan products are due to launch mid-2025. Additional loan products are also coming this year, across credit card and earnings-linked debt. This is by a country mile the best post-democracy business story in South Africa and there’s little sign of it slowing down.

Emira Property Fund’s CEO is leaving (JSE: EMI)

The market tends to get nervous of stuff like this

It’s pretty unusual to see a listed company and its CEO part ways suddenly. It sends a message to the market of tough conversations behind boardroom doors, which naturally creates jitters among investors.

What makes this particularly unusual is that Geoff Jennett has been the CEO of Emira since August 2015, so one has to wonder what suddenly changed after nearly 10 years in that position. The only information given in the announcement is that there were “strategic differences” that led to this decision.

Hopefully, more information will come to light when the next CEO is announced.

Even Quilter struggled to grow its assets this quarter (JSE: QLT)

But the key is that net inflows were strong

Whenever I write about businesses in the financial services space that make money from assets under management, like Quilter, I talk about how important it is to look at net flows. Total assets under management will jump around based on market movements that are outside of the control of the company in question. Net flows, on the other hand, are a direct result of the distribution strategy and how well assets are being attracted to the group.

Quilter actually reports assets under management and administration (AuMA), rather than just AUM, with that number practically flat for the three months to March 2025. The net inflows as a percentage of opening AuMA were 7% on an annualised basis, which is strong. This was unfortunately offset by market and currency movements. Still, it shows that they attracted net inflows during a difficult time.

It gets even better when you look at what Quilter describes as core net inflows, which were 16% higher than the previous record quarter. The High Net Worth segment was a strong performer and the Affluent segment did especially well, particularly driven by lower outflows.

Thanks to all the economic uncertainty around tariffs and the impact that this is having on global asset prices, 2025 could be a less lucrative year than expected at Quilter. Still, with such strong metrics in inflows, they are positioning the business for growth in years to come.

Nibbles:

- Director dealings:

- Oddly, the CEO of Sun International (JSE: SUI) seems to have disposed of R45k worth of shares that are linked to a share award but aren’t part of the taxable portion. It’s just strange to see such a small disposal by a CEO. Another odd part of this announcement is that the CFO sold R2.08 million worth of shares that are supposedly the taxable portion of an award, except the full award was worth R2.45 million. I know that taxes are rough in South Africa, but nobody’s tax rate is that high.

- Europa Metals (JSE: EUZ) is still figuring out what its future holds. They either need to wind the thing up, or find a suitable acquisition. In the meantime, they’ve sold 1.5 million shares that they hold in Denarius Metals Corp, generating around £450k in the process. They will use this for various payments and for “assessing opportunities” – in other words, for professional fees. For context, Europa still holds 5.5 million shares in Denarius.

- Wesizwe Platinum (JSE: WEZ) is still struggling to get its financials for the year ended December 2024 done. They are hoping to get the annual financial statements out by 31 July 2025, as well as the integrated annual report and notice of AGM by 31 August 2025.