- The Gold Fields share price tanked over 11% in the morning and eventually closed over 20% lower once the US woke up. The market reacted to an announcement that the company is acquiring Yamana Gold. This is such a significant deal that I wrote a feature article on it that you can read here.

- Famous Brands has released results for the year ended February 2022. This result is against a base that is so soft that you would send it back if it was your pizza. Nevertheless, it’s a strong performance and there’s further room for recovery. I covered it in detail here.

- Reinet Investments has released results for the year ended March 2022. This is effectively Johann Rupert’s investment vehicle that was born out of a restructure of Richemont. Reinet holds investments in British American Tobacco and Pension Insurance Corporation Group, as well as several private equity and unlisted investments. The net asset value at 31 March 2022 is up 9.4% year-on-year, a similar growth rate to the average since 2009. The net asset value per share is EUR31.99 and Reinet has been using share buybacks to take advantage of the discount to net asset value. Converted at today’s exchange rate, the net asset value per share is around R535 and the share price is R320, so the discount is 40%. The proposed dividend per share of EUR0.28 per share is a 12% increase vs. the prior year.

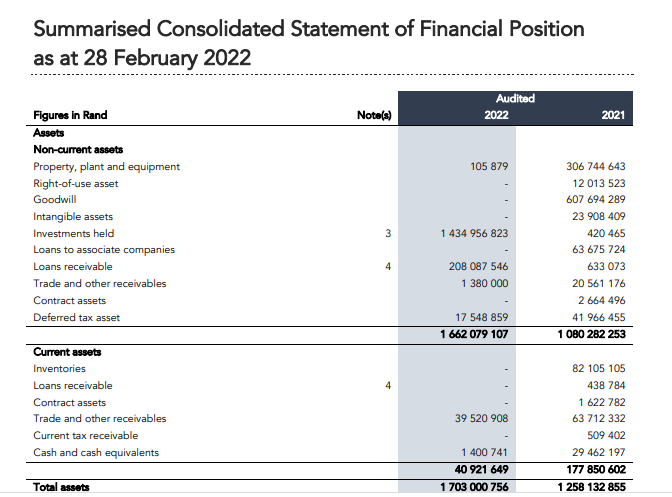

- Huge Group has released results for the year ended February 2022. The comparatives are useless, as Huge used to consolidate its underlying companies like an operating company usually does. Now, Huge has changed to an investment entity, so it recognises their fair values with the changes through profit or loss. I want to show you what this looks like in practice with a snippet of the balance sheet below. Personally, I think this accounting change is really weird and it puts me off ever buying the shares.

- South32 has completed the acquisition of an additional 16.6% shareholding in Mozal Aluminium. The final price is just over $2 billion and takes the shareholding to 63.7%. Aluminium is key to South32’s strategy around a low carbon future, as the lightweight metal has numerous applications in making things lighter and more efficient (like cars).

- Labat Africa has issued shares representing 5.2% of the company for cash. The prices range between 21.90 cents and 26.61 cents. The company has raised nearly R5 million based on the midpoint of this range. The funds will be used to expand the cannabis healthcare business and for working capital. The company also released interim results for the six months ended February 2022, in which revenue fell by 5.7% and the operating loss worsened by 37.4%. The headline loss per share was 4.3 cents.

- Tongaat Hulett is in a really tough spot and is busy negotiating with its lenders around the capital structure. The lenders have made the seasonal overdraft facility available at an earlier date than previously contemplated and have extended other debt reduction milestones to 30 June 2022. These milestones include the proposed rights offer.

- Renewable energy group Mahube Infrastructure announced results for the year ended February 2022. Revenue is up 76.6% and HEPS has increased to 118.9 cents. The tangible net asset value has increased from R10.63 to R11.21 and a final cash dividend of 32 cents per share has been declared. The share price closed around 12% higher at R5.99.

- If you are a MiX Telematics shareholder, be aware that the company is presenting at a conference and that the presentation should be available on the corporate website by Tuesday night (it was not available at time of writing this).

- Insimbi Industrial Holdings is a fascinating small cap. This group supplies ferrous and non-ferrous alloys, refractory materials and plastics. In the year ended February 2022, revenue increased by 23% to R6 billion and net profit jumped 138% to R104 million. The group generated cash from operations of R236 million and HEPS was 138% higher at 24.58 cents. Rising commodity prices have helped here. Still, no dividend has been declared in the interest of caution. The share price closed 1.8% higher at R1.14.

- Afine Investments owns a portfolio of fuel forecourts. The company is recently listed and the group was restructured for the listing, so there are no sensible comparable financials. In the year ended February 2022, HEPS was 46.23 cents and the dividend is 27.80 cents. The net asset value is R3.55 per share. The share price closed slightly higher at R6.95.

- DRA Global has appointed James Smith as interim CEO of the company. He is expected to resume his old role in the business when a new CEO is appointed. In the meantime, he will bank an annual package of R5.5 million plus bonuses.

- FirstRand has renewed the cautionary linked to the potential repurchase of its B preference shares. The bank is still investigating the optimal process for a repurchase and has not made a formal offer as of yet.

- If you are an Acsion Limited shareholder, you should pencil in 10th June for the release of full year results. I suggest a pencil, as there are “unforeseen circumstances” causing a delay.

- Just when it seemed things couldn’t get much worse for Pembury Lifestyle Group, the company announced that CEO Andrew Mclachlan suddenly passed away.

jy is te laat gebore,, kruger rande in 1995 was r1385.00