Andre Botha, Senior Dealer at TreasuryONE

In a market that has been very uncertain at the best of times in the recent past, where we have seen emerging markets running stronger with the US dollar and then a subsequent mini-emerging markets meltdown, one thing has remained relatively stable: given time, the US dollar is the ultimate market mover and holds the key to the movement of other currencies.

As can be seen below, the rand has followed the dollar index closely:

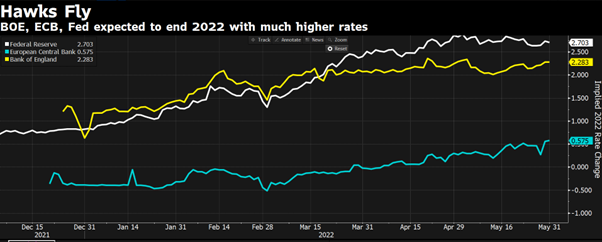

Let’s look at last week as an example. In the recent past, we have seen the ECB speculating that they might start hiking rates to curb inflation in the Eurozone. Granted, this was euro positive, but the real move in the US dollar came as the expectations of significant hikes in the back end of 2022 from the US have started to dwindle.

Coupled with chatter from other reserve banks across the world about faster rate hikes as can be seen from the chart above, the possibility that the US might not hike as aggressively later in the year has caused the market to believe that the interest rate differential between the US and the rest of the world will be less at the end of the year. This has undercut some of the US dollar strength and has seen the US dollar move to 1.07 against the euro after trading at 1.04 not so long ago.

What does this mean for emerging markets, but in particular for the rand?

In the short term, we have seen that the rand has picked up the tailwinds after the MPC announcement and the US dollar weakness, and the rand has made a run at the R15.50 level. Whether there is enough momentum to continue down to the R15.20 level remains to be seen, but we expect that gains could be hard to come as the market needs a sustained signal that risky assets are the month’s flavour for the rand continues on its merry way.

One only has to look at the performance of the stock indices over the past couple of weeks to see that everything is a little topsy-turvy at the moment. From the graph below, one can see that the US equity markets ended its longest losing streak since 2001:

US non-farm payroll number on Friday

As is usual with the first week of the month, the US non-farm payroll number is released on Friday, and while it is early days in the interest rate hiking cycle in the US, it will be interesting to note if/whether the recent rate hikes have caused a halt in hiring in the US. It will be interesting to see how the US dollar will react in an event like that.

On the local front, we believe the rand will trade in a range of R15.40-R15.70 for most of the week, with the real issue being the US non-farm payroll number on Friday.

New fuel price hikes are coming into effect this week. As parliament weighs up how to protect the consumer from the price hike, we can expect inflation to jump on the back of this and force the hand of the MPC down the line to hike interest rates again.