Naspers and Prosus dominated SENS and the market on Monday, rocketing either 20% or 25%, depending on which member of the dynamic duo you looked at. That’s a gigantic move for a group this size. After an extended period of negative sentiment towards Chinese and growth assets, what changed?

There was plenty of news around Prosus and Naspers on Monday. Let’s kick off with the easy part: the sale of the shares in JD.com. It gets complicated from there, so enjoy the easy start.

Turning JD.com into cash

In December 2021, Tencent distributed most of the shares that it held in JD.com – a Chinese eCommerce giant. Prosus received a 4% effective interest in JD.com as part of the unbundling.

Prosus decided to sell this stake and took a while to do so, raising $3.67 billion in the process. The carrying value at 31 March 2022 in the Prosus financials was $3.94 billion, so the sales were concluded at a loss vs. that value.

Before you get excited about a special dividend to help close the discount to net asset value (NAV) that Naspers / Prosus is famous for, I must point out that Prosus will retain the cash for “general corporate and liquidity purposes” – in this environment, Prosus isn’t letting go of any excess cash.

Considering the approach being taken with the JD.com cash, the rest of this update and the market reaction is even more surprising.

Prosus results: not pretty

I don’t usually quote directly from corporate results announcements. In this case, there are some gems that are worth repeating.

Here’s the first one:

“Core headline earnings were US$3.7bn, a reduction of 23% which reflects ongoing investment in the eCommerce portfolio and a period of slower growth at Tencent as it adapted to regulatory changes in China.”

In summary: Prosus has been built by taking cash from Tencent and deploying it into all kinds of growth verticals in regions around the world. The share price was hammered in the past year by a souring of sentiment towards China, as this is the source of Prosus’ cash.

The rest of the group is a furnace that Prosus must keep pouring cash into.

Here’s another quote that I think is worthwhile:

“The discount to the group’s sum of the parts increased to an unacceptable level.”

Well now, you don’t say?

The discount to what Prosus believes the group is worth is always a hot topic for debate on the JSE. Nobody disputes that a contributor to the discount is the spectacular remuneration enjoyed by the top executives at Prosus. Another major contributor is the exceptionally complicated holding structure that was made even worse by recent corporate action to create a “cross-holding” of Naspers holding into Prosus and Prosus holding into Naspers: a web that any spider or Financial Accounting IV examiner at Wits would be extremely proud of.

Prosus talks about moving into a period of prudent balance sheet management. This isn’t a bad idea, after the company invested $6.2 billion during the latest financial year in its numerous assets. Prosus also talks about prioritising existing assets, which suggests that bold new acquisitions may not be on the menu.

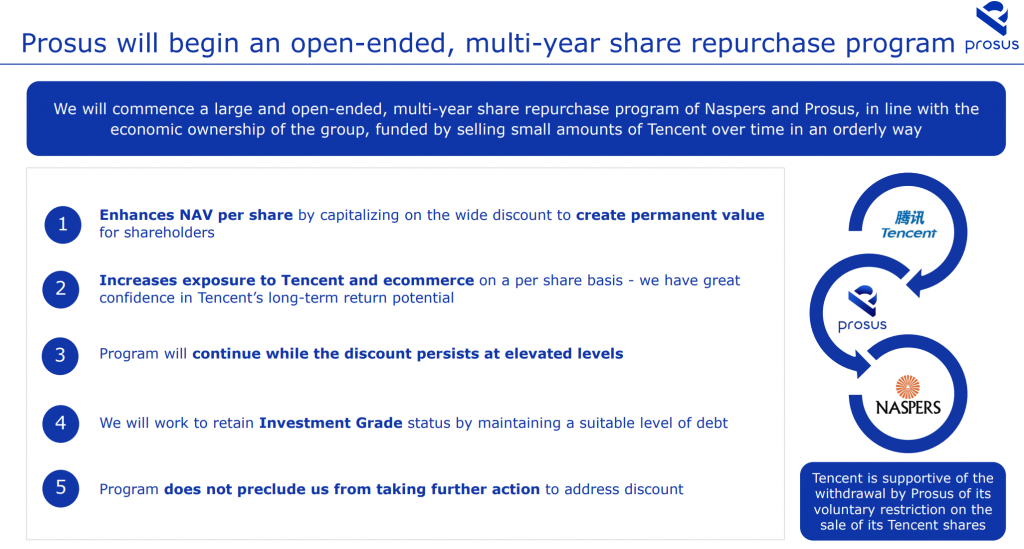

The news that really drove the share price jump was found in the analyst presentation rather than the results announcement on SENS. If you’ve ever wondered what a gazillion-dollar slide looks like, here it is:

Simply, Prosus is going to gently sell down its stake over Tencent and drip the proceeds back to shareholders in the form of share buybacks. The market sentiment towards this management team’s ability to allocate capital is so negative that this seemingly innocuous update caused a celebration in the share price that would put the Stormers to shame.

I’m just not sure why Prosus can’t start with the JD.com cash, since returning cash to shareholders is now supposedly a priority?

“Investing through the income statement”

In case you’ve ever wanted an innovative way to say “we made losses,” Prosus is here to help you out:

“In the second half of the year, we invested heavily through our income statement.”

Investing “through your balance sheet” means deploying cash into assets. Investing “through your income statement” is a fancy way to say that you incurred a lot of expenses.

I’m going to summarise what this looks like in practice. Get ready.

The Prosus eCommerce businesses grew revenue from $6.2 billion to $9.8 billion in the past year, which sounds wonderful. The trading loss in that segment worsened spectacularly from -$429 million to -$1.1 billion.

Investing through the income statement indeed. I do that a lot when I fill my car up at the petrol station, for example.

I’m not shocked at all that Food Delivery was the major offender. It’s beyond me how that model will ever make money. I love it far too much as a consumer for the economics to make sense. If it always feels like a bargain to me to get someone else to bring my food, it means that it is a bargain and thus the service provider is making a loss.

The Prosus result gives a useful summary of capital allocation over the past six years. Of the approximately $50 billion that the group had at its disposal, 57% has gone into the business and new growth opportunities, 25% has been returned to shareholders through buybacks and dividends and 18% has been retained in cash.

Speaking of cash, there is less of it on the balance sheet than the amount of debt. This puts Prosus in a net debt position. The group has $13.6 billion in cash and $15.7 billion in interest-bearing debt.

The consolidated free cash outflow for the year was $562 million. After year-end, Prosus received a $565 million dividend from Tencent. You can be sure that much of that dividend will be invested through the income statement as well.

A quick note on Naspers

Naspers is basically Prosus plus some other local assets like Takealot and Media24. We’ve all shopped on Takealot before, so I’ll focus there. An honourable mention must go to Media24 for being strongly profitable again!

The economics here are just incredible. Takealot’s revenue in FY21 was $606 million and the trading loss was $7 million. In FY22, revenue was $827 million and the trading loss was still $7 million. In case you are wondering where Massmart’s economic profit pool was destroyed, now you know. Takealot has grown revenue and gone absolutely nowhere on profitability, funded by the endless cash machine known as Tencent.

Amazon is said to be coming to South Africa in 2023. If Takealot couldn’t make a profit during the pandemic and without Amazon operating in South Africa, what do you think its chances are in a post-pandemic, recessionary environment with Amazon as competition?

Perhaps I’m terribly wrong here, but I want to see Prosus and Naspers maintain these share price gains after the end of the quarter, when big institutional funds are finished with their window-dressing activities to help report better investment performance. The incentive at the end of a quarter is to buy and push prices up, resulting in a better-looking portfolio.

Thank you Ghost for an honest, straightforward article and your remarks on gems like “we invested heavily through our income statement.” This is how I learn from you!

Thank you – it’s a pleasure! I think it’s always important to consider bull and bear cases on all news stories in the market.

As a young finance student I had a little bit of difficulty understanding the sens report and the decisions that were being made by Prosus. This breakdown did wonders. Thank you

That’s great to hear – good luck with your studies! I was there too, many years ago…

Very smartly put…why the fixation with this Npn / Prx pair ? I wonder? Fact is the growth engine that gave us NPN is going or gone now. The future engine is somewhat of an enigma!

An enigma that is HUNGRY for cash.

I agree with your comments 100%.

Shades of Steinhoff – build the share price higher with no dividend payback to investors, , invest in unprofitable bits and bobs to enhance turnover, huge payouts to directors and connections, dodgy shareholding sleight of hand and a believing public looking to be proud in something on the JSE after SAB and other SA jewels have sold out! Recipe for short term success but long term disaster!

The big institutions should be ashamed at their complicit behaviour…the only one who will lose is the poor investors who trust their wealth managers to act in their best interest but who in fact work to enrich themselves and their bosses. I predict many tears to follow…but hope I’m wrong!

Great article as always, love your daily updates!

Thanks very much!

This is particularly sobering

Yup – sadly the real story often is!

What an excellent article.

Thank you!

Prosus/Naspers classifies food delivery as a technology business. I’m not sure why. When I was a child in the 1950’s my mother used to phone the grocer and her order would be delivered. What is the difference?.

I will also quote from the results announcement “The online food and convenience industry is still in its early stages of development, and we are excited by its long-term prospects, and we believe it will ultimately yield a good return on investment.”

Anybody like to hazard a guess as to how long ultimately is?

I personally think the economics will never become appealing, like streaming. As soon as they start to look good, new competitors will enter.

The weird dynamic that has also been missed here is that investors are paying up for management’s “capital allocation” abilities, which capital allocation is actually value destructive on the whole…the share price gains aside. The nature of the corporate structure almost certainly ensures that the discount to NAV never closes

They are actually being applauded by the market now for FINALLY doing something positive after years of destroying value, as you say. It’s the most extraordinary thing for me.