Sun International hosted a capital markets day on Tuesday and made the presentation available online, which is always a great opportunity to learn more about a listed company. In this case, it’s all about the glamorous world of casinos and hotels, which weren’t so glamorous in 2021 and 2021.

Since the start of 2020, Sun International has lost nearly 30% of its value. Needless to say, there were times when things looked a lot worse than they do now. Over the past year, the share price has put in a strong recovery of over 55%!

The group owns 11 urban casinos, including the iconic Sun City Resort as its most famous venue for bad decision-making and good memories. Carnival City, GrandWest and Sibaya are also in the portfolio, along with Golden Valley which entertains the people On The Other Side Of The Tunnel in Worcester.

In the five months to May 2022, revenue was up 34% and adjusted EBITDA jumped by over 80%. One thing you need to understand about the hospitality industry is that operating leverage is substantial. This means that any percentage impact in revenue is amplified at operating profit level. This applies on the way up and the way down.

The operations have bounced back considerably, with income over the five months running at approximately 92% of the comparable period in 2019. Adjusted EBITDA margins have improved thanks to major cost cutting and efficiency projects during the pandemic, so adjusted EBITDA is higher now than in 2019. The group is aiming for further improvement, including between 200bps and 400bps in the Casino segment by FY26.

Of R4.29 billion in income over this five-month period, just over 60% is from the Casino segment. If gambling bothers you, then Sun International isn’t for you. There’s nearly a 23% contribution from Resorts and Hotels and 14% from Sun Slots, with the rest from Sun Bet (a sports betting business).

The Resorts and Hotels segment posted the highest year-on-year growth (62.3%) with Sun Slots the slowest at 15.9%. This is hugely skewed by the relative impact of the pandemic on the different segments, so I wouldn’t read too much into this.

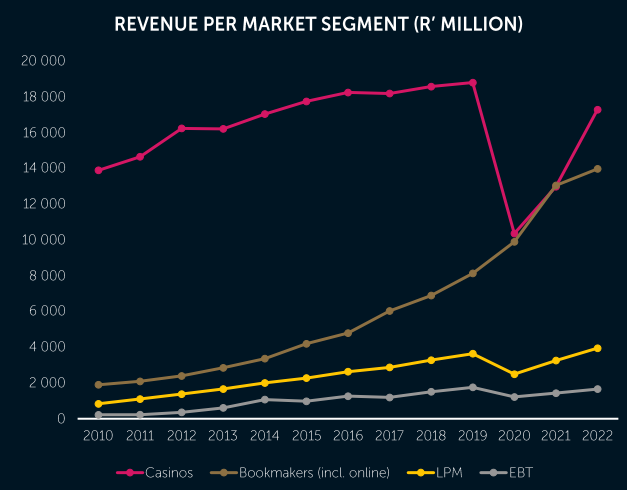

There was a great chart in the presentation that I’ve included below to demonstrate how the pandemic hammered the Casino segment in particular:

Importantly, the group managed to reduce debt from R6.4 billion at the end of December 2021 to R5.8 billion by the end of May. With interest rates clearly on the up, Sun International needs to keep chipping away at the debt.

Luckily, these businesses practically print cash once the initial build cost is out of the way. Annual capital expenditure is only around 5% to 7% of revenue, with Resorts and Hotels being the most cash hungry with 10.3% of revenue expected to be invested in capital expenditure in FY22.

I also found it interesting to see how EBITDA margins can vary in the different Resorts and Hotels. For example, the ambition at Sun City is to grow EBITDA margin to over 20% by FY24, yet the Table Bay Hotel is only aiming for over 15%. These are totally different business models of course, so I’m just including these as interesting nuggets to help you learn about the industry.

If you would like to flick through the entire presentation, you’ll find it at this link.

The problem I have with these significant Businesses like SUI is the lack of introspection and indeed, circumspection when confronted with a challenge that could derail the business and the industry. What steps did the Company take to validate that the alleged pandemic was a fact?! What measures did they take to assess the potential harm caused to health by certain mandates like wearing a mask (face covering)? Will a business like SUI simply follow the mandates once again simply because some bureaucrats in politics or in the UN sound an alarm with little tangible evidence to substantiate their claims?

Where are the South African brass balls, a pair to simply hold the legislators accountable.