There’s been some buzz around MultiChoice recently, as French investor Groupe Canal+ has built its stake up to over 20%. Ghost Grad Sinawo Bikitsha wonders whether there’s something bigger on the horizon.

There is no word on this planet that irritates South Africans like the word “MultiChoice” (Ghostly editor’s note: I would wager that Eskom takes first place). With the company facing a tough consumer climate and plenty of new competition from streaming players, why is a massive French broadcasting empire so interested in cute and vulnerable MultiChoice? Hmm.

Slow and steady

Last week, MultiChoice Group announced that a French broadcaster named Groupe Canal+ increased its shareholding in the JSE-listed South African broadcaster to 20.1%. Canal+ has been building up the stake since 2020, when it moved through the 5% threshold to hold 6.5% in MultiChoice.

Local regulations require an announcement to be made whenever a shareholder moves through a 5% shareholding level. This helps us keep track of potential corporate actions.

It’s usually cheaper for a company to build up a stake slowly, as the price paid for the initial shares is the market price. When a buyout offer is made, a control premium needs to be offered to entice shareholders to accept the offer. This premium is usually between 20% and 40% over the traded share price. If you can be patient, it’s better to go slowly in the beginning and mop up a decent stake before potentially making the big offer.

Who is Canal+?

Canal+ is a French broadcasting and streaming company that operates in Europe, Asia and Africa. The French broadcaster has around 24 million subscribers worldwide.

Canal+ is owned by Vivendi, a French company with artistic diversity in television and cinema, publishing, videogaming and live entertainment, just to name a few. Vivendi is listed on Euronext Paris. In addition to Canal+, the parent company owns stakes in publishing company Editis, French multinational advertising company Havas, media press Prisma Media, distribution platform Dailymotion and video gaming company Gameloft.

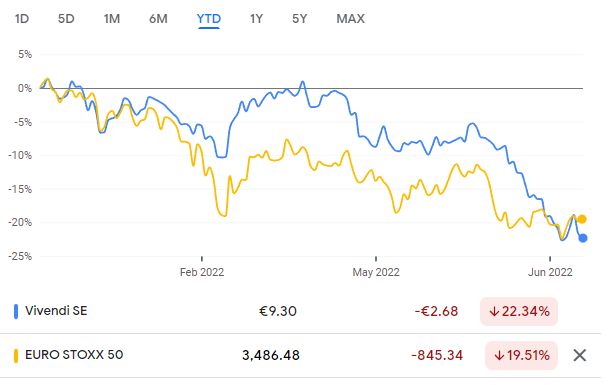

In 2022, Vivendi has underperformed the EURO STOXX 50 index (though both have taken plenty of pain):

French kiss number 1: an offer in 2018

There was a rumoured deal in 2018 that most people aren’t aware of.

Before Canal+ bought MultiChoice’s shares, various news sources suggest that Vivendi tried to acquire MultiChoice Group in 2018. At that stage, MultiChoice was still part of Naspers and the deal was rejected. In 2019, MultiChoice was unbundled by Naspers and separately listed.

The French lover clearly didn’t handle the rejection well. With MultiChoice now separately listed and the shares trading on the open market, Canal+ put plan B into action and began building its stake in 2020, having doubled its shareholding in the MultiChoice Group by November 2021.

MultiChoice stated that the Group would keep an “open mind” in the relationship with Canal+. The commentary coming from Canal+ painted a story that it viewed the MultiChoice stake as a financial investment. It’s unusual (though certainly not unheard of) to see a company holding a financial investment in another company in the same industry. This would typically be a strategic investment, opening the door to something bigger.

Interestingly, Groupe Canal+ has been acquiring other rising African media houses. The parent company Vivendi is vigorously searching for new pay-television and magazine acquisitions. In fact, Vivendi has quite the reputation for taking part in aggressive takeovers.

In 2019, Groupe Canal+ acquired ROK studios, a Nigerian TV and film production house. This year, the French media house acquired Rwandan streaming service ZACU TV, enhancing the group’s position in East Africa. Canal+ maintains that the Group’s main target is to produce pleasing content for African subscribers. Evidently, Vivendi is steadfast in growing its presence in Africa’s TV and film industry, with the French empire criticised at times for being a bit bullish.

French kiss number 2?

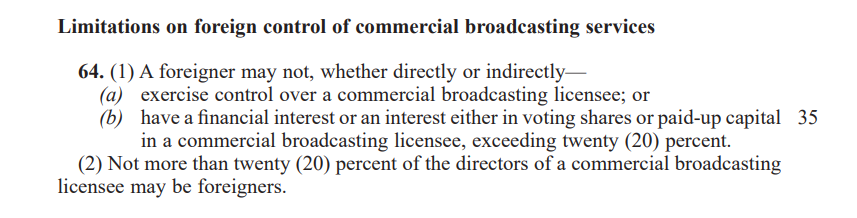

Here’s the problem: section 64 of the Electronic Communications Act, 2005 says that foreigners cannot have an interest in a commercial broadcasting licensee of more than 20%. There’s clearly already a problem, though the word in the market is that MultiChoice’s MOI limits voting rights to 20% for foreigners regardless of how much they hold. This doesn’t deal with the “financial interest” point though, which is in black and white in the Government Gazette:

It’s not obvious how Groupe Canal+ could increase its stake from here. This means that either (1) it really is a financial investment, (2) Groupe Canal+ is looking to do a content deal with MultiChoice or (3) there’s a chance that the rest of Africa business gets carved out and sold to the French, which would make some sense from a language perspective. These options aren’t mutually exclusive.

For now, I’m an unhappy consumer. MultiChoice has increased DSTV subscription prices and reduced channels. Whilst I must commend MultiChoice for being able to secure Disney+ for DSTV Explora Ultra subscribers, I just don’t find the story very appetising. If this was breakfast in Paris, MultiChoice would be the overbeaten egg whites with an irreversible curdled texture rather than foamy soft deliciousness .

Great insight into Canal’s dealings!