The concept of a “defensive stock” comes up often, doesn’t it? What does it actually mean? Most importantly, can companies really be considered defensive when faced with such uncertain macroeconomic times?

Let’s go straight to the heart of the matter – defensive stocks tend to trade at high valuation multiples based on an assumption that the operations are bulletproof. This is dangerous for two reasons. Firstly, high valuation multiples create the risk of a nasty multiple unwind. Secondly, operations are never bulletproof.

“Consumers will always need xyz” is the frequent argument and there’s a great deal of truth in it when “xyz” means pharmaceuticals or basic groceries. This argument unfortunately misses some critical elements of the business models of these companies, leading to hard lessons for investors.

Defensive, in parts

It is absolutely correct that some products are defensive. It is absolutely false that an entire business model is defensive.

Let’s use a typical pharmacy business as an example. Behind the counter, the pharmacists are ready to sell you medicine that you probably can’t go without. Clearly, that’s a defensive product category. Inevitably, products that are “needs” rather than “wants” tend to achieve a much lower gross margin. A retailer makes far less by selling you bread or pills than by selling you an exciting pink kettle (a Mrs Ghost favourite).

If we move on to a supermarket example, then we see margin mix really come into play. Fresh foods and staple groceries achieve low margins and supermarkets compete viciously on price to attract customers to the store. The higher margins are achieved by seducing consumers with unusual or interesting products, or luxuries in the checkout aisle that tempt you into adding something to your basket.

Ever wondered why supermarkets sell things like toiletries, garden and pool products and even clothes? It all comes down to margin mix.

Margin isn’t defensive

We now arrive at the inconvenient truth in this honeymoon story about defensive stocks that somehow withstand any economic pain: margin mix.

The high valuation multiple is based on all the earnings, not just the earnings from defensive categories. If you’re paying a Price/Earnings multiple of 30x for a retailer, you’re also paying 30x for the net profit earned by selling organic yoghurt, not just bread and milk.

What happens when the organic yoghurt is no longer in the trolley? Even worse, how do you feel about paying 30x when the gross margin is a sitting duck in an economic downturn as consumers change their habits and stick to just the basics?

Walmart is down 14.6% this year. The share price was smashed in May after releasing results for the fourth quarter of the 2022 financial year. People bought the dip and those who sold soon thereafter made good money. Those who bought and held in the hopes of a steady recovery are back where they were in May.

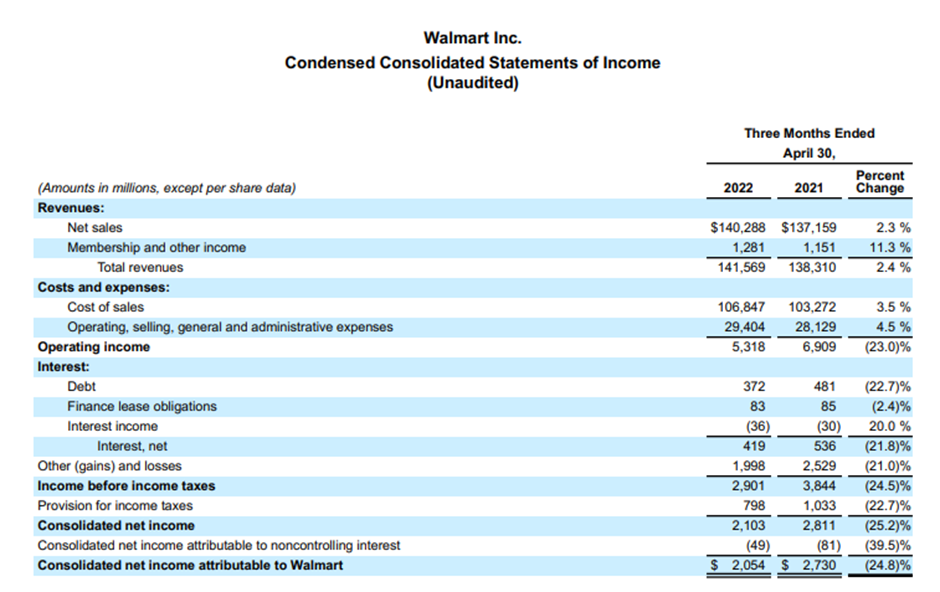

Why is Walmart hurting investors? Because the mix isn’t defensive. Simple as that. In the latest quarter, sales grew by 2.4% and operating income fell by 23%. Walmart irritatingly doesn’t disclose gross profit as a separate line on the income statement, so we have to calculate it from this section of the financials:

Gross profit in the latest quarter is $33,441 (in millions, as per the excerpt above), a margin of 23.84% if we ignore membership and other income which doesn’t carry a “cost of sales” when being earned. In the comparable quarter, gross profit was $33,887 and gross margin was 24.7%.

A deterioration of 86 basis points at gross margin level is a disaster for a retailer. Remember, the margins are really thin by the time we reach net income. In the latest quarter, consolidated net income of $2,103 is a net margin of just 1.49%. Now you can see why a seemingly small change in gross margin has such a significant impact on net income.

This is what we do in Magic Markets Premium

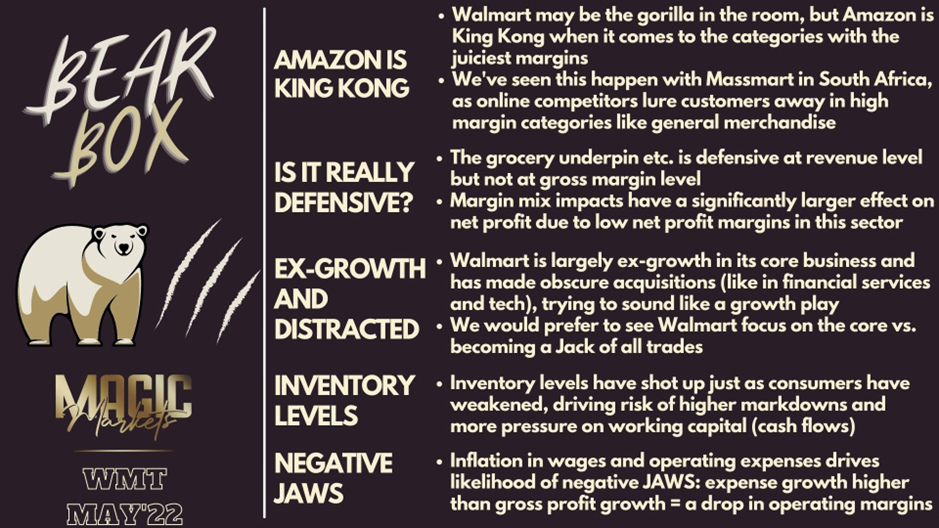

In every report and podcast that we produce on a global listed company, Mohammed Nalla and I focus on the major drivers of value and the key issues facing each company. We always prepare a Bull Box and a Bear Box, so we give a balanced view that deals with the pros and cons of each company. For example, here’s the Bear Box from Walmart back in May (take special note of the second bullet point):

These insights are available to you for R99/month or R990/year, so you pay for 10 months and get 12. I am beyond proud of what we do in Magic Markets Premium, as I firmly believe that we are bringing institutional-quality insights to retail investors at a price that they can afford.

If you are ready to accelerate your investment knowledge and your ability to unpack a business model and value a company, then subscribe and get stuck in on the library of over 35 reports – plus a new one every week!

Ready? Subscribe at this link and make the best investment of all: an investment in yourself!