The words “crypto” and “volatility” are synonymous. As these assets aren’t supported by underlying cash flows or a widely accepted valuation methodology, they tend to trade based on sentiment. Sentiment is just a function of human emotions, perhaps the most volatile natural phenomenon of all!

Note from The Finance Ghost:

Regular listeners to the Magic Markets podcast will recognise the Future Forex name. We’ve welcomed them to the show on a few occasions to explain the arbitrage process and how it works. You must always do your own research and always make your own decision. If it helps though, I know a number of people who have signed up with Future Forex and have smiles on their faces, particularly regarding the level of service.

Here’s the latest podcast with great information in addition to this sponsored article:

Future Forex’s crypto arbitrage offering typically delivers a net profit of 1% to 1.5% per trade regardless of whether crypto is in a bull market or a bear market, or even in a “crypto winter” as some have referred to the recent market troubles.

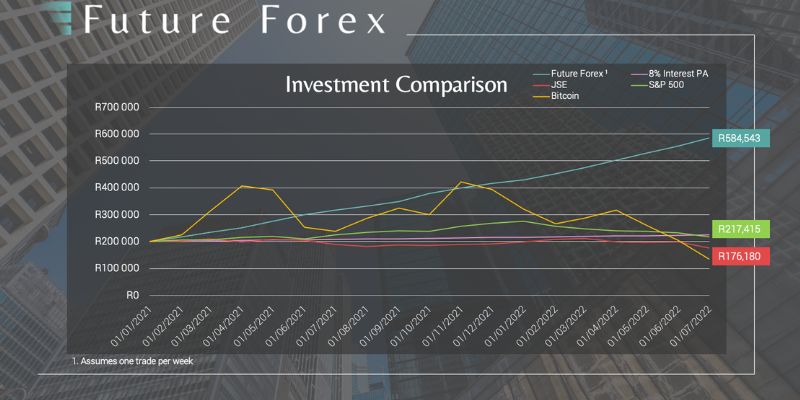

Earning 1% to 1.5% per trade isn’t exciting until you realise that due to the cyclical nature of the process allowing for multiple trades, you can earn between R100,000 and R150,000 per year with a starting capital of only R200,000. Using a realistic mid-point and based on many client examples, Future Forex clients are achieving annualised returns of 70% to 80% on initial capital.

Importantly, these indicative returns are net of all costs.

So how is it possible that such a volatile asset can be used to generate smooth, dependable returns that carry low risk?

The arbitrage advantage

An arbitrage is a strategy that takes advantage of pricing differences across markets. The idea is to simultaneously buy an asset where it is cheaper and sell it where it is more expensive. Such opportunities exist because of market inefficiencies that are often structural in nature.

In South Africa, these inefficiencies are caused by capital controls which result in a demand/supply imbalance in the local crypto market. These capital controls take the form of an R11 million Foreign Exchange Allowance which limits the amount of crypto you can purchase abroad and sell in South Africa each year. In an efficient market, higher returns come with higher risk. In this case, high returns are achieved with low risk. This is because returns are limited by your R11 million Foreign Exchange Allowance.

Don’t let your option expire worthless

Each year, you can take R11 million offshore. The first R1 million is a single discretionary allowance and the remaining R10 million is a foreign investment allowance. The R10 million can be unlocked through an application process that Future Forex’s in-house tax team and partner tax practitioner assist their clients with as a complimentary service.

You don’t need R11 million to take advantage of the full allowance. Future Forex recommend at least R200,000 starting capital to achieve the profit target. By performing the arbitrage 55 times, they achieve the return based on the full allowance rather than the starting capital.

If you don’t use this allowance, it expires at the end of the year and resets for the following year. This is effectively an annual option to earn a return on your allowance, one which expires worthless if you don’t take advantage of it.

The implicit usage of this asset which otherwise expires worthless, in combination with the inefficiencies of the local crypto market, is why the returns through arbitrage can be so lucrative despite the investment being exceptionally low risk.

There’s no such thing as “zero risk”

Future Forex are risk management experts. CEO Harry Scherzer’s background as a qualified actuary has allowed the team to hedge out the market risks and actively manage other risks through processes like detailed due diligence on counterparties. It’s also worth highlighting that Future Forex Arbitrage Services (Pty) Ltd is an authorised Financial Services Provider (FSP 51884) for currency remittance services.

The core market risks are crypto price fluctuation risk and forex risk, both of which are automatically hedged out by proprietary systems and use of floats. This locks in the arbitrage profit at the initiation of the trade, so they simply don’t trade on behalf of clients if the profit isn’t there. As a result, they never lose money on a trade.

The other critical risk is counterparty risk, as the very nature of a trade is that somebody needs to be on the other side of each step in the arbitrage process. It is impossible to hedge out this risk, as this is a business risk rather than a financial risk. Instead, Future Forex mitigate this risk to the greatest extent possible by only working with trusted partners that they have performed extensive due diligence on. In literally tens of thousands of trades, they have never suffered a default event on any obligation in the process.

Taking the pain out of the process

To take full advantage of the annual allowances, Future Forex has built systems that make the process as painless as possible, while hedging all of the market risks. Their relationship managers are highly trained and always contactable for clients to have peace of mind and a high-quality experience. To start your journey, complete a registration form at this link.

Alternatively, get in touch with Future Forex so that they can give you a call to answer any further questions you may have.