The team at TreasuryONE notes that despite all the happenings currently in the market, the same recurring themes with inflation and interest rates are still red-hot topics. The currency market is still affected mostly by what the US dollar does. We have seen some of the risky assets that were on the back foot in the last couple of weeks, rally against the US dollar as the euro showed some grit last week.

The chief reason for euro strength has been the fact that the ECB hiked interest rates by 50 basis points at their meeting last week. This surprised the market a little as it was pricing in a 25-basis point hike. The guidance from the ECB is that they will look at the data with further rate changes and this was enough for the market to halt the rampant dollar a little. The market is pricing more rate hikes in 2022 for the ECB and is even expecting another 50-basis point hike come September.

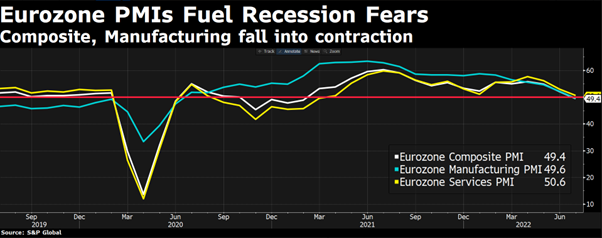

However, PMI data out of Germany showed that the expectation is that the Eurozone economy (see below graph) will slow down due to soaring inflation, so expectations of further rate hikes could be difficult. With the Eurozone behind the curve, it could be a volatile space to trade in as Central Bank policy could shift quickly as economic impacts become clearer.

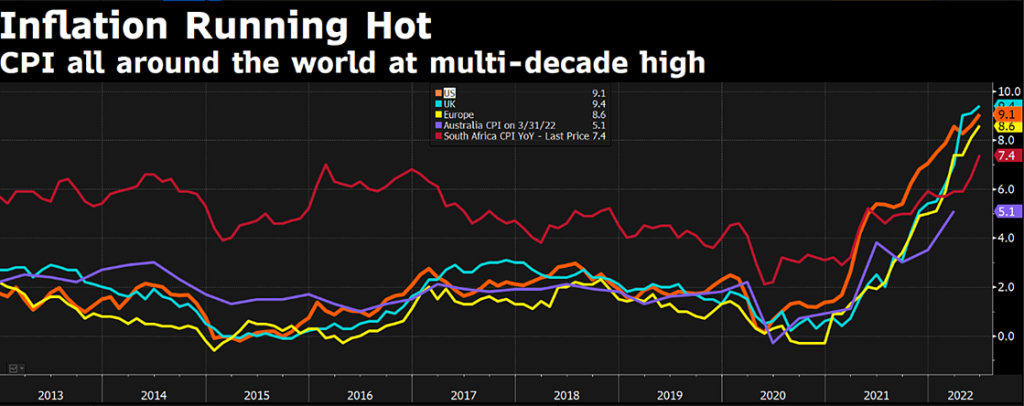

The ECB was not the only Central Bank to lift rates last week. The Monetary Policy Committee of the SARB hiked rates by 75-basis points in lieu of the higher-than-expected inflation out of South Africa. Looking at the graph below, inflation in South Africa came out at 7.4% for June, which is still below the US, UK and Eurozone. Food and energy inflation is the main contributors to the current higher inflation. Some relief might be on the cards with a fuel decrease coming in August.

The rand liked the higher-than-expected rise in interest rates but the outlook for the economy is not looking that great with growth continuing to lag, even if the SARB did revise growth upwards for 2022 to 2.0% from 1.7%. The rand also benefitted from one of the other emerging markets, Turkey, cutting interest rates by 100 basis points.

The rand moved from the R17.20 level and closed the week around the R16.80 level and looked to trade in those ranges for the early part of the week before the FOMC meeting on Wednesday. The main event of the week is this decision and the market is fairly comfortable that the Fed will hike by 75 basis points. The market will look to the press conference after the announcement as to what momentum the market will have.