Telkom has had the difficult task of evolving from a technological dinosaur into a data-focused telecoms business. It hasn’t been easy, with the group on a treadmill of declining legacy revenue and pressure on cash flows.

Telkom has released a trading update for the quarter ended June 2022. The numbers aren’t pretty I’m afraid, with a drop in revenue of 3.2% and a nasty knock to group EBITDA of 15.2%. There is a 320 basis points contraction in EBITDA margin to 22.7%, which is what happens when your staff get an increase of 6% and your revenue shrinks.

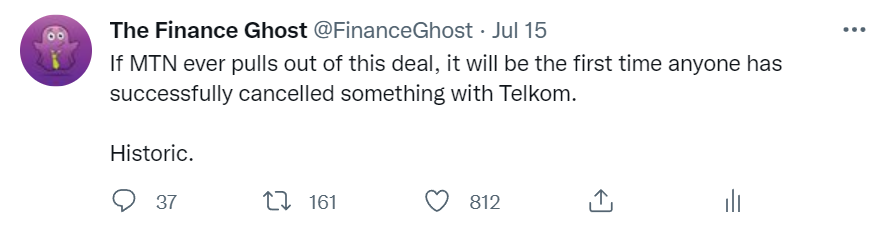

Spectrum and fibre. There are the juicy bits that I think MTN is after at Telkom, with the yellow giant recently announcing that it is contemplating a buyout offer for Telkom. If nothing else, it inspired my most popular tweet since I became a ghost:

The core product offering of a telecoms business is incredibly boring. Phone calls and mobile data usage are so 2010. Don’t even get me started on SMS, which was last relevant when people listened to Backstreet Boys. The acronym should now be Spam Messaging Service instead.

Speaking of has-beens, fixed legacy voice revenue fell by 19.9%, mainly in the Enterprise and Small to Medium Business segments. There are still grannies out there with home phones but almost everyone else has given up.

Keen to move into new growth areas that preferably offer better margins, telecoms companies have pushed into fibre packages and even financial services. In emerging markets in Africa, using smartphones to distribute products makes a world of sense.

In the US, telecoms companies have chosen to push the streaming angle instead, partnering with content providers in an attempt to push data products. We explored this interesting point when we covered AT&T in Magic Markets Premium.

Telkom’s mobile business is also picking up, though I’m not convinced that the Competition Commission will be thrilled about this potentially rolling into MTN. Active mobile subscribers increased 7.8% year-on-year to 17.3 million, with an ARPU (average revenue per user) of R88.53. The vast majority (14.5 million) are prepaid subscribers, which is why the ARPU is much lower. A contract subscriber has an ARPU of R208.50 and a prepaid subscriber has an ARPU of R64.77.

Mobile data traffic increased by 12.4%, which means that (unsurprisingly) each subscriber is using more data than before. There has been a 2% increase in broadband subscribers to 10.7 million. The problem is that pricing decreased by 14.8% as data becomes cheaper every year, so overall mobile data revenue actually fell year-on-year.

In the fibre business (Openserve), which is what I think MTN wants above all else, fixed traffic increased by 18.9% and the number of homes passed with fibre grew by 45.3% to over 890,000. The connectivity rate is 46.6%, which is the number of homes actually connected (414,847) vs. the number of homes who had their pavements destroyed to lay fibre. The number of connected homes grew by 35.2% which is lower than the growth rate in homes passed by fibre, so the connectivity rate has dropped. Still, Telkom says this is the highest rate in the market.

Openserve’s fibre revenue increased by 6.5%, with broadband services growing to over 612,000 and offsetting the copper access decline. Fixed voice revenue fell by 24%, so the net impact for the business is a revenue decline of 3.9%. EBITDA margin was also hit by increased costs, coming in at 29.9% for the quarter.

Notably, Openserve has been split into a separate legal entity. This is usually a precursor to a transaction for that part of the business. I suspect that MTN is ready to negotiate with the Competition Commission on the basis of getting Openserve and leaving behind the mobile business if needed.

Moving on to the masts and towers, Swiftnet now has 3,935 towers and achieved revenue this quarter of R322 million, ever so slightly lower than R325 million in the comparable period. The pipeline is over 2,000 sites and 393 already have approved building plans. The EBITDA margin is 71.4%, up from 67.2% in the prior period on a normalised basis. This business was earmarked for a separate listing but market conditions aren’t favourable.

The BCX IT business had a mixed performance across its business units, with an overall decline in revenue of 3.7%. An improved supply chain outlook for the remainder of this year is a positive sign. The really good news is that EBITDA has improved by 15.6% because of a focus on efficiencies. This is impressive vs. the revenue result.

One of the other good news stories is a reduction in capital expenditure by 35.2% because of front-loaded expenditure in the past two years.

To end off, here’s a chart showing the share prices of the three telecoms players over the past year. Even after the recent decline, MTN has been the star of the show, with the Vodacom share price even more boring than fixed line voice calls:

Yellow Giant needs a fiber network, I think they will pull in open serve definitely . Its a gamble but we will wait and see