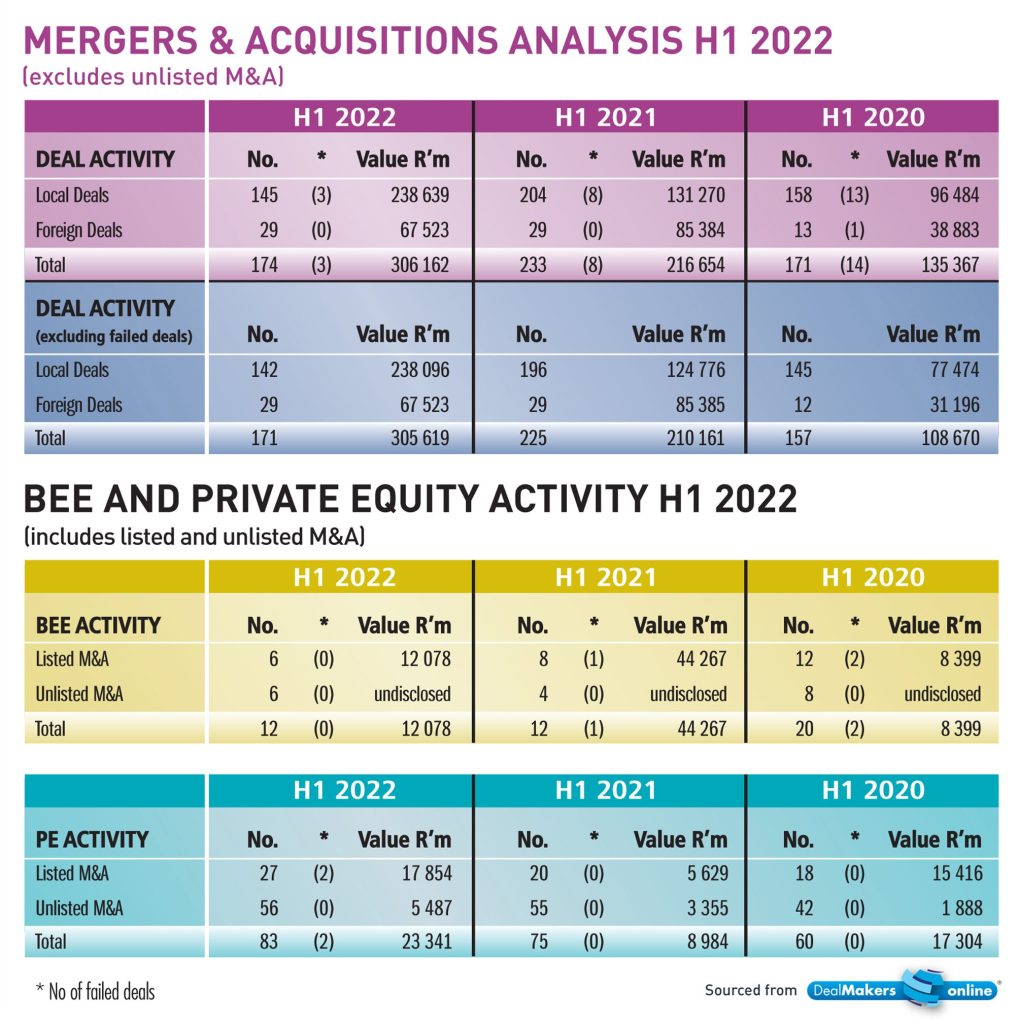

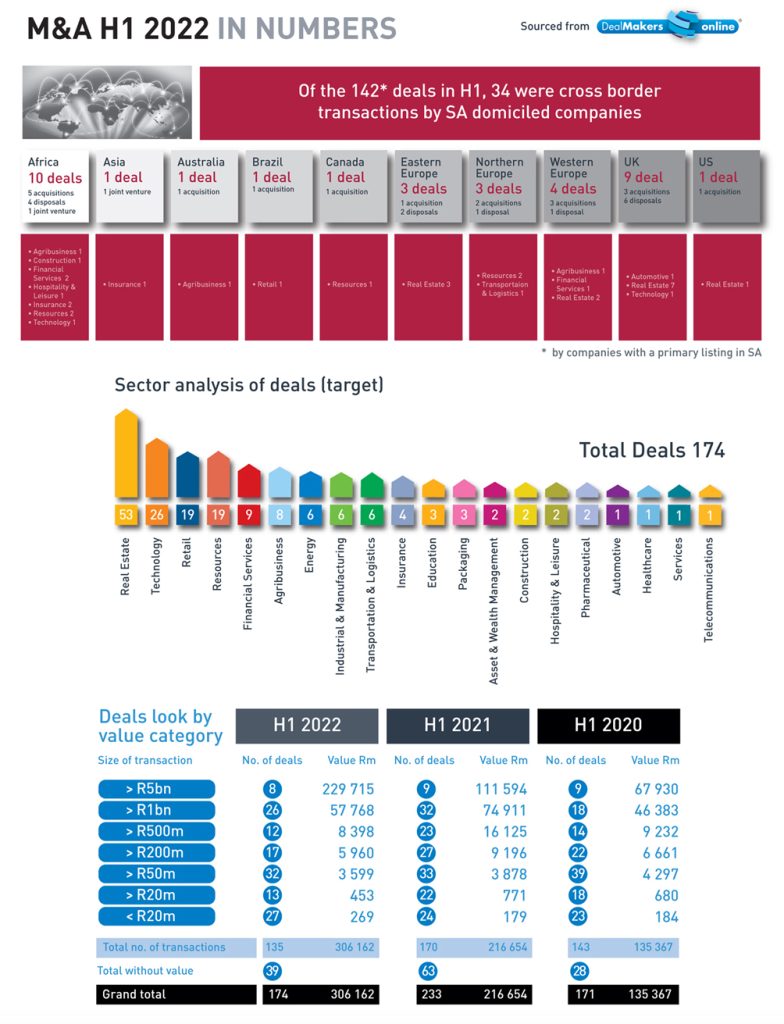

The total value of M&A activity for the period H1 2022 (including failed deals, of which there were three) was R306,2bn from 174 deals. While the deal value was up significantly on H1 2021’s R216,7bn, the number of deals was down 25% on those recorded in H1 2021. To a degree, the increase in the aggregate value of M&A transactions can be attributed to the two largest deals by value for this period – Gold Fields’ acquisition of Yamana Gold, valued at R103,85bn (US$6,7bn) and Sanlam’s African joint venture with Allianz SE, valued at R33bn (€2bn). Two significant BEE deals were reported in the period – by Shoprite, valued at R8,89bn, and by Old Mutual, valued at R2,8bn.

Of the 174 deals executed in H1 by companies listed on one of the local exchanges, 142 of these involved companies with primary listings. Of these, 34 were cross border transactions by SA domiciled companies, with Africa and the UK being the top two destinations. Drilling down further, the targets across Africa were, in the main, insurance, resources and financial services; while in the UK, real estate dominated the deals.

While capital markets remain volatile and unattractive for new listings, more and more corporates with primary listing on the JSE are taking secondary listings on A2X. Share buy-backs by corporates continued and, during the period, a total of R71,64bn was returned to shareholders – up significantly from the R24,13bn returned in H1 2021. Shareholders also received R28,1bn in the form of special dividends, up significantly from R5,2bn in the comparable period in 2021.

Download this latest issue of DealMakers here

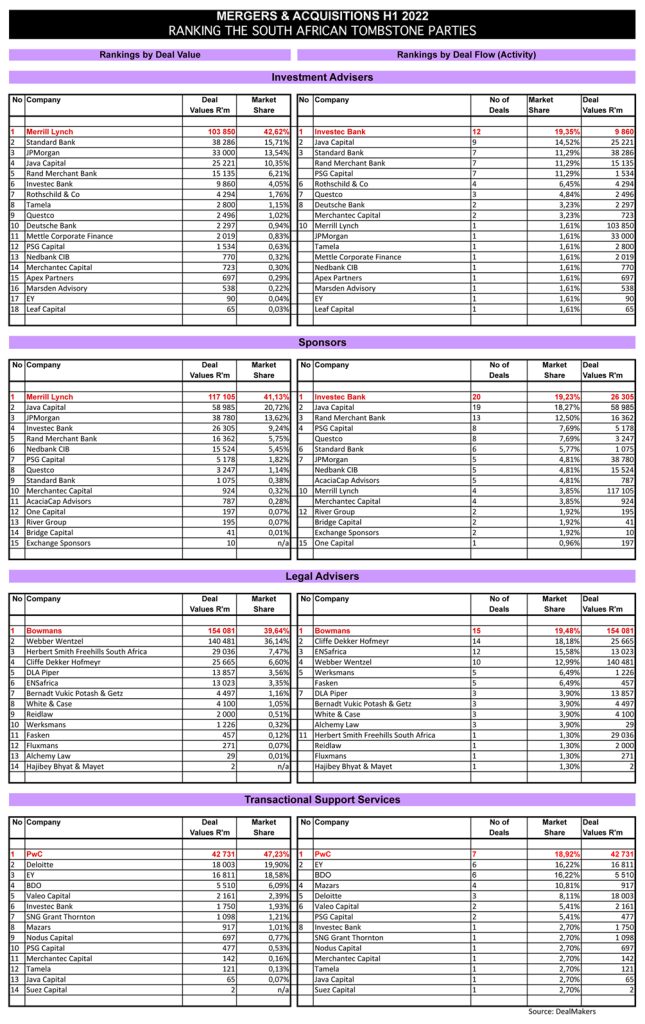

DealMakers H1 League Table – M&A activity by the top South African advisory firms (in relation to exchange-listed companies).

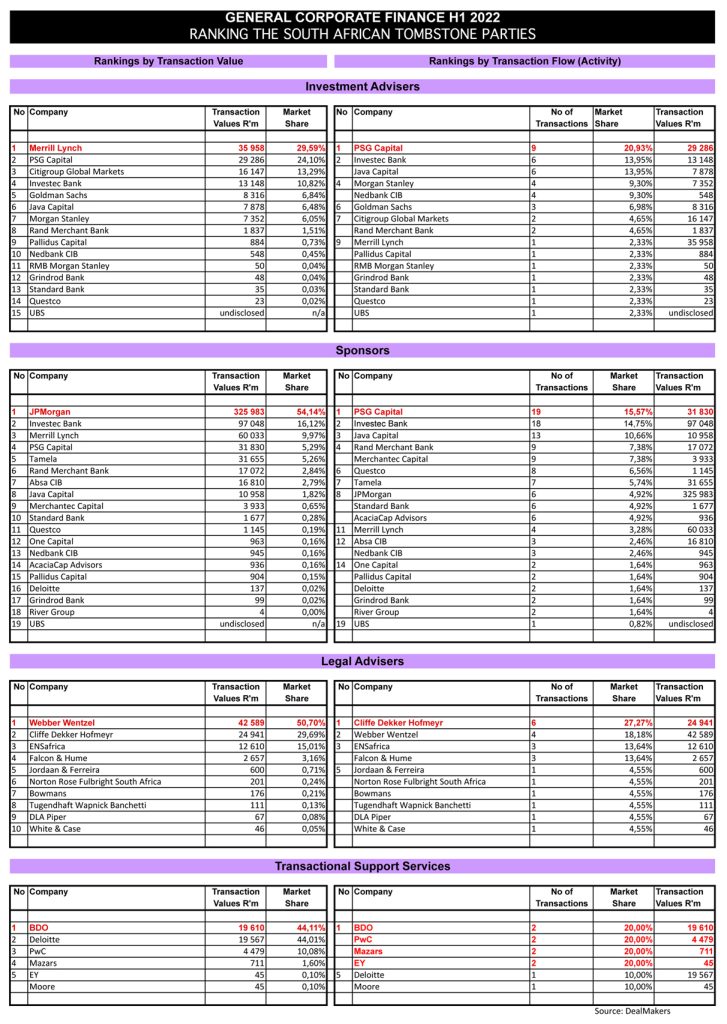

DealMakers H1 League Table – General Corporate Finance activity by the top South African advisory firms (in relation to exchange-listed companies).

Included in this issue is the second edition of Women of SA’s M&A and Financial Markets Industry and, for the first time, Women of SA’s Private Equity and Venture Capital Markets, which forms part of this issue of Catalyst. The stories of the women who grace these pages offer inspiration and words of courage, and are examples of how hard work, resolve and sheer determination have seen their aspirations become reality.

The latest magazine can be accessed as a free-to-read publication at www.dealmakersdigital.co.za

DealMakers is SA’s M&A publication

www.dealmakerssouthafrica.com