Ghost Grad Karel Zowitsky brings us Ghost Global this week, featuring updates on Disney, Rivian, Unity and Coinbase.

Disney magic

Disney seems to be back in full swing, with an increase in revenue across the board. Much of this is attributable to the reopening of Disney parks, with revenue from the Disney Parks, Experiences and Products segment increasing by 70% to $7.4 billion in Q3. Over the nine month period, revenue is up 92% to $21.3 billion. Naturally, Covid disruptions are in the base period and so these numbers reflect a strong recovery.

Although revenue in the Disney Media and Entertainment Distribution segment increased by 11% to $14.1 billion, the real story is in the operating profit line. Despite an increase in revenue and paid subscribers for Disney+, ESPN + and Hulu, this segment’s operating income fell by 32% to $1.4 billion. The problem is that the streaming businesses lost more than $1 billion this quarter!

Disney attributes this pressure on profits to higher programming and production, technology, and marketing costs. If you are a subscriber of Disney+ you would be well aware of the volume of content that Disney produces – to the extent that it feels overwhelming. Who has the time to watch so much TV? As great as this sounds for a consumer, a shareholder might feel less excited about the new Star Wars series Andor.

Going back to the Disney Parks, Experiences and Products segment, operating income increased $1.8 billion to $2.2 billion in Q3. It’s easy to understand that this increase is due to the strong recovery we are seeing in the global tourism sector. Higher volumes of attendance, occupied room nights, and cruise ship sailings drove this increase.

Troubles at Rivian

With the world attempting to move to a net-zero future, many mainstream car manufacturers have been creating and bringing electric vehicles to the market. Rivian is one such company, but is relatively new to the scene and is struggling to compete and attain market share in a very competitive industry. Rivian was incorporated in March 2015 and went public on the NASDAQ in November 2021.

Turning to the results, we see that Rivian is currently unable to generate a profit from sales as gross profit came in at a $1.2 billion loss for the 6 months ended 30 June 2022. It’s hard to compare this to the prior period, as there were no sales in the 6 months ended 30 June 2021! Needless to say, when you can’t even make a gross profit, the income statement doesn’t get any prettier as you move further down. Over the six months, the loss deteriorated by $1.6 billion to $3.3 billion.

Ford and Amazon both hold significant stakes in Rivian. This hasn’t helped them this year, with the share price down 70% since the IPO. Investing in an IPO is risky, especially when a company comes to market without any kind of sales track record.

Unity – a mixed bag

Unity is a software company that provides a platform for creating 2D and 3D content. This platform is currently used by game developers, automotive designers, architects, and filmmakers. It’s an interesting industry to be in as the world becomes ever more integrated with technology. This is evidenced by the amount of content that creators are pushing out on platforms such as YouTube, Instagram, and TikTok.

Technology integration has also become an exciting way for companies to diversify their revenue streams or upgrade their product offerings. Netflix is one such example that comes to mind, with a strategy to offer in-app mini-games along with their video streaming service.

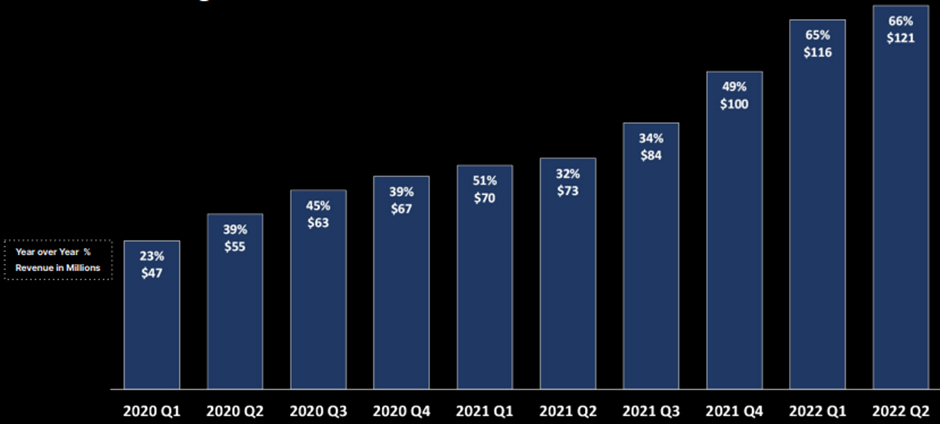

The Create Solutions segment has seen an increase of 66% year-on-year in revenue for Q2, assisted greatly by clients outside of the gaming industry that contribute 40% of revenue in aggregate. The likes of Mercedes-Benz is included in the client base. Unity’s most recent earnings presentation contained an interesting graph that demonstrates the consistency of revenue growth as well as a recent acceleration:

The Operate Solutions segment suffered a 13% year-on-year decline in revenue in Q2, coming in at $158.5 million vs. a strong performance last year of $183 million.

The group remains heavily loss-making, with an adjusted loss of $44 million this quarter.

Coinbase was correlated with bitcoin after all

Coinbase is a technology company that offers a platform for users to buy, sell, and invest in cryptocurrencies. Regardless of what you think about crypto, this is a company that saw a gap in the market and created a business that facilitates crypto transactions. The company currently has over 103 million verified users and 4,900 employees, with operations in over 100 countries.

Despite a long tail of coins out there, the passage of time has proven that Coinbase is highly correlated with the bitcoin price. Even without running the numbers properly to work out an r-squared (remember that from stats?), you can see the correlation in these charts:

If you ever thought that investing in Coinbase would diversify your bitcoin holdings, you were sadly mistaken.

In the first half of the year, revenue at Coinbase halved to $1.97 billion and expenses increased by just over $1.4 billion, leaving the company with a net loss of $1.5 billion vs. a profit of $2.3 billion in the comparable period.

Ghostly editor’s note: many attacked me when I said that buying the Coinbase IPO was a terrible idea. Well, here we are.

Interested in global stocks? For just R99/month or R990/year, you can have access to institutional-quality research that is guaranteed to expand your investment knowledge. Visit the Magic Markets website to subscribe.