The Softbank Group’s philosophy is to “contribute to people’s happiness” through the information revolution. With a tepid share price performance over the past year, shareholders are probably looking for some of that happiness themselves. Ghost Grad Kreeti Panday takes a closer look.

Japanese multinational conglomerate SoftBank Group, has released results for the three months ended June 2022, reporting a ¥3.16 trillion ($23 billion loss) for the quarter. That’s particularly horrible when compared to the ¥761.5 billion profit made in the comparable period.

Born in the 80s

SoftBank was founded in 1981 as a software distribution company. The next step was to launch monthly magazines in 1982, which shows how far this group (and the world) has come. It was only when the internet came around that SoftBank started to do landmark deals, like a joint venture to launch Yahoo! Japan in 1996 and an investment in Alibaba in 2000.

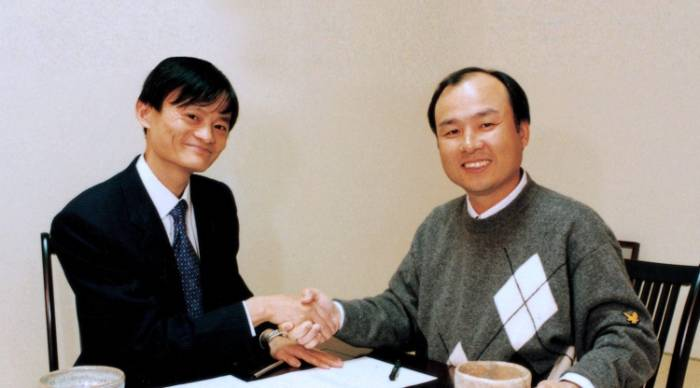

This picture from the SoftBank website of SoftBank founder Masayoshi Son and Alibaba founder Jack Ma is well worth replicating here:

In 2017, SoftBank launched its first Vision Fund, investing in the types of businesses that get Cathie Wood all hot under the collar. There are now two such technology-focused venture capital funds with investments in over 470 companies in aggregate, consisting of mainly AI-focused unicorns (privately-held companies that have reached a $1 billion valuation). In 2019, SoftBank created the $5 billion SoftBank Latin America fund to invest in similar companies in that region.

What goes up…often comes down

We all know that that 2020 – 2021 saw an incredible bubble in the valuations of futuristic companies that are big on promises and often rather low on cash flows.

It’s only when you see the numbers put forward by SoftBank that you realise the scale of it all. The Vision Funds posted an investment loss of ¥2,9 trillion (around $21.5 billion). Thankfully, the realised loss was across the two funds was just over ¥27 billion ($200 million), so the rest was based on mark-to-market movements and valuation declines in private investments.

Masayoshi Son, has largely blamed the loss on global stock market turmoil and the rapid fall of the yen. Many of the companies that the group is invested in are technology stocks, which have suffered due to Central Banks raising interest rates in response to rising inflation. He has emphasised the defensive and conservative approach that the group has now adopted in its investments following the losses, which is possibly too little too late.

One of the major issues is the drop in IPOs as the listing environment soured. When you’re planning to list a company at a gigantic (and ridiculous) valuation, you better get the timing right. Those days were left behind in 2021 and we won’t see them again unless we return to an environment of incredibly low interest rates and frequent use of the money printing machines.

This isn’t good news for SoftBank. It cannot easily force the founders of unicorns to list into an unsavoury valuation, though this problem fixes itself as these founders burn capital. SoftBank has historically done well from taking profits on IPO that are used to invest in other companies.

Troubles in China

With core investments in the likes of Alibaba, the recent geopolitical climate in China hasn’t done SoftBank any favours. Covid-19 lockdowns have been a problem, tensions between Taiwan and China have flared up and the Chinese Communist Party (CCP) has been taking aim squarely at tech companies. This led to incredible destruction of value at ride-hailing company Didi, in which SoftBank invested $12 billion through Vision Fund 1 in 2017. SoftBank has registered a $9.3 billion loss on that investment.

SoftBank now appears to be losing faith in the Chinese operating environment for tech companies, lowering its stake in Alibaba Group Holding by 38.4% to 14.7% for a gain of $34 billion. At least someone has made a profit on Alibaba shares.

This came after the US Securities and Exchange Commission (SEC) added Alibaba to its delisting watchlist based on the Holding Foreign Companies Accountable Act (HFCAA) – legislation that scrutinises China-based US-listed companies. The sale is seen as a significant move as SoftBank has been considered one of Alibaba’s biggest champions since its initial investment.

Other disposals

SoftBank also sold the remainder of its stake in ride-hailing company Uber between April and July at $41.47 per share. The group invested in Uber in 2018 and again in 2019, becoming its largest shareholder. In 2021, the group sold a third of its stake and has now disposed of the balance.

SoftBank also sold stakes in online residential real estate company Opendoor, US-based cancer care group Guardant Health and Chinese real estate platform Beike.

Getting serious on debt and costs

The loan-to value (LTV) ratio, which the company aims to keep at a maximum of 25%, has been lowered to 14.5% as a result of the group’s “defensive” strategy. SoftBank also intends to keep a cash position sufficient to cover the group’s bond redemptions for at least the next two years.

Earnings per share decreased from ¥437.45 to a loss of ¥1,949.55. Clearly, action is required. Masayoshi Son warned of group-wide cost reduction within the company, announcing that “headcount may need to be reduced dramatically.” The company did not, however, give any indication of the scale of this cost reduction.

There are also executive reshufflings underway. Rajiv Misra, CEO of SoftBank Investment Advisors (which manages Vision Fund 1) and of SoftBank Global Advisors (which manages Vision Fund 2), will be relinquishing the latter role and retaining the former, being described as a “key man” for Vision Fund 1.

Despite all these pressures, the company has authorised a share repurchase programme of ¥400 billion. If there’s one thing tech companies just love, it’s the use of share buybacks.