As we head into the back part of the year, we are seeing that data is getting more scrambled across the globe, which could only mean that volatility is going to be the rule rather than the exception. The team from TreasuryONE explains.

Last week, we saw US CPI coming in better than expected, with the number printing at 8.5%. Other data out of the US in the last couple of weeks also tended to beat expectations to the positive side.

While the number is still high, many analysts believe that the US has reached peak inflation and that the hawkish narrative by the Fed could be slowed down and that we are in line for a 50 basis point hike rather than the 75 basis point hikes that analysts in the market have punted. The immediate reaction to the number was for the US dollar to weaken, which was good news for EM currencies like the rand.

This all points to the narrative that there could be a soft landing in the US economy.

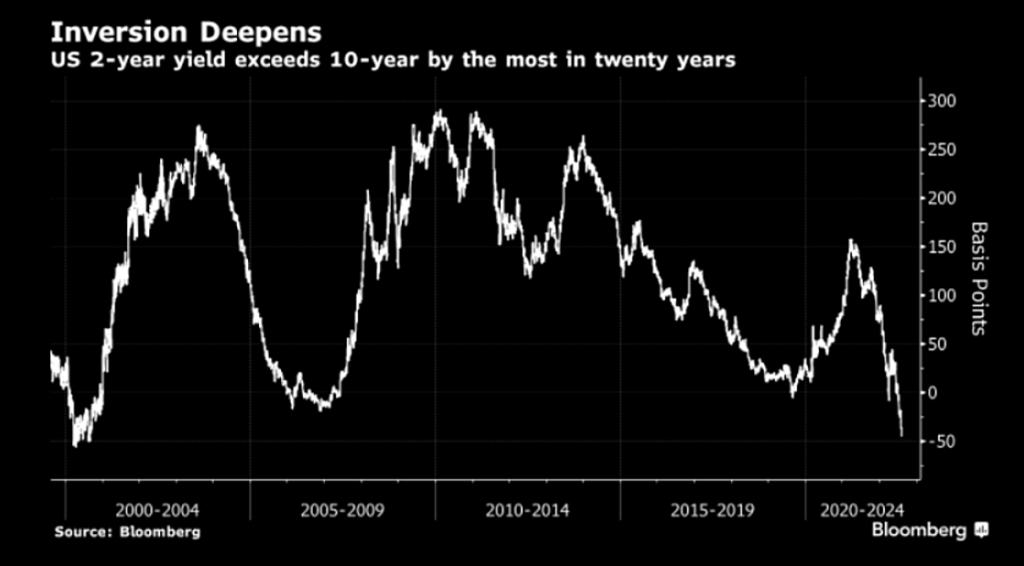

However, the story in the bond market is a little bit different. For a six-week period now, yield curves are inverted. Yield curve inversions, which are rare, are viewed as a good recession predictor because they suggest that investors believe – with the interest rate on long-term bonds being lower than the rate on short-term bonds – that economic growth is slowing.

With bonds seeing troubled times ahead, it only adds to the volatility pot and data being scrambled.

The rand, which touched the R17.00 level not too long ago, traded all the way down to R16.14 in the wake of the data release. Still, the rand, for one, ran too far too quickly, and the second part of the rand bounce back has been weak data out of China, with Chinese data disappointing the market and the Chinese Central Bank cutting interest rates unexpectedly. The Chinese economy is still battling a real estate slump and strong COVID controls which will weigh down any significant growth.

This brought about the market running back to the US dollar, with the US dollar trading below the 1.02 level against the euro, after comfortably trading above that mark after the CPI number. There seems to be a definite divergence between the US and Chinese economies, and that data divergence could set the tone for volatility going forward.

The rand enjoyed the “good” CPI data out of the US but sank back to the R16.40 level after the Chinese data misses. We expected the rand to trade around that level until the release of the FOMC minutes on Wednesday.

The key message from those minutes was that the Fed will continue to hike rates for as long as inflation remains above the 2% target. The pace and size of the hike could slow depending on fresh data in the coming months.

The rand lost ground and remained weak on Thursday, trading around the R16.80 mark. We saw a full reversal since the US CPI numbers, when the rand enjoyed a sell-off in the dollar.