The team from TreasuryONE takes a look at the market environment ahead of the release of non-farm payrolls on Friday.

In the last couple of days, we have seen a flight to safety again as the US dollar came charging out the blocks after the hawkish statement from Fed Chair Jerome Powell at Jackson Hole on Friday. Although the speech was only a matter of minutes, some of the key takeaways from the speech were that the Fed will focus on data but that there is no pivot in sight.

The market took this as a very hawkish signal, and we have seen the US dollar trading below parity against the Euro with only brief moments of the dollar trading above parity. This is in stark contrast to the previous time that the US dollar broke below parity, where the snapback was swift and sudden.

Refer to the below EUR/USD graph, with the momentum well against euro strength currently:

The flight to the US dollar was evident as commodities like gold, normally associated with a safe haven play, were also sold off in the wake of Fed Chair Powell’s speech. It seems that the old adage: “buy dollars, wear diamonds” is certainly true for now.

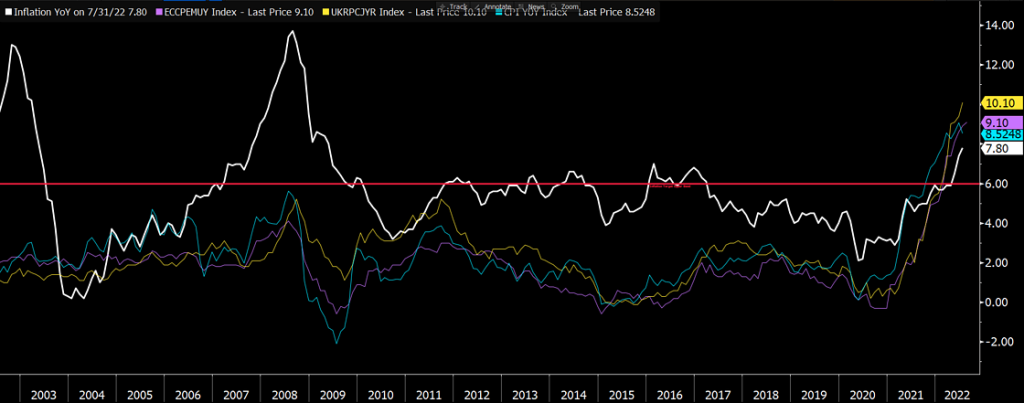

The Eurozone will come under renewed pressure in the short term, especially in relation to the energy crisis that is gaining speed as winter approaches. With energy consumption costs soaring, and with inflation printing higher at 9.1% vs 9.0% expected, we could see the euro under pressure.

The below graph shows the Eurozone inflation (in purple) versus some peer countries. We can also see South Africa’s inflation (in white) still below the US, Eurozone and the UK.

With the Fed still taking centre stage, we expect a lot of volatility around the non-farm payroll number out on Friday, with markets waiting anxiously for the number. We expect the US dollar to remain on its firming path should the number exceed expectations. Should the number miss expectations, we could see a bit of a relief rally in EM currencies in the short term.

Speaking of EM currencies, the rand has broken above R 17.00 in the wake of the flight to the US dollar and could be under more pressure should we have a positive US non-farm number. In the past few trading sessions, the rand has followed the US dollar, which will influence any rand moves in the short term.

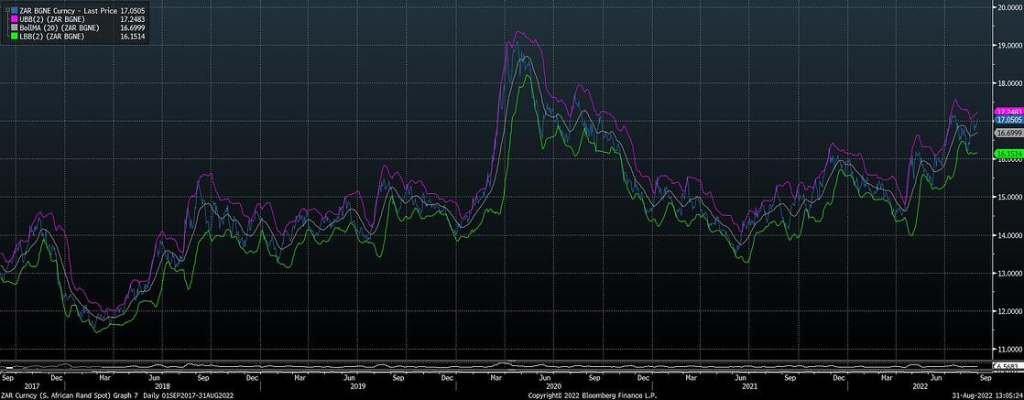

See below the current USDZAR chart, the rand still comfortably within the R17.30 to R16.50 range.