Ghost Grads Karel Zowitsky and Sinawo Bikitsha joined forces during a busy week of varsity exams to pull off an excellent edition of Ghost Global.

Lululemon: manifesting returns

Yoga moms, rejoice! Lululemon recently released results for the second quarter of the financial year, proving once again that despite roaring inflation affecting consumers, not all consumers are affected equally. With the right products targeting a high-end niche, inflation is but a small bump in the road.

Lululemon essentially developed the athleisure clothing industry. This has been a hugely popular category in the new reality of working from home and dressing down. The products aren’t Louis Vuitton but aren’t at Nike levels either, creating an interesting price point that is premium enough to be resilient but also not out of reach for many consumers.

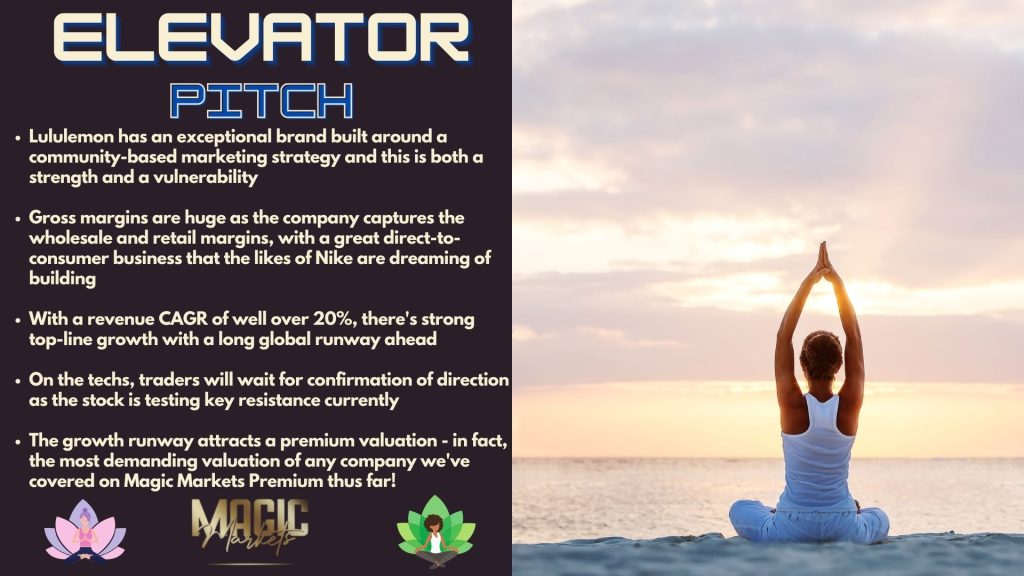

The other key element of the model is the direct-to-consumer strategy. Lululemon got this right before people realized how powerful it was, with the likes of Nike now playing catch up. The Finance Ghost and Mohammed Nalla explored this extensively in their report and podcast on Lululemon in Magic Markets Premium:

The results for Q2’22 revealed a 29% increase in revenue to $1.9 billion, up 28% in North America and 35% internationally. Online sales contributed nearly 42% of net revenue. Although gross margin decreased by 160 basis points to 56.5%, that’s still a very healthy margin.

One of the most important things about this business is that it’s not just the yoga moms who should be rejoicing. The company’s growth strategy is to double revenue from 2021 to 2026, which requires significant growth in men’s clothing as well. The group plans to quadruple its international revenue, so opening new stores in Spain and regional eCommerce platforms is in line with that.

Lululemon’s share price is down nearly 19% this year, a reminder that even the best businesses at the wrong valuation multiple are still bad investments.

Best Buy. Or not.

In stark contrast to its name, Best Buy’s share price is down nearly 30% this year. Ouch.

With a focus on the sale of consumer electronics, this is a classic case of a general merchandise dealer feeling the pinch of consumer demand. As demand for digital goods normalized after the pandemic and stimulus cheques became a distant memory, US revenue fell by 13.1%. International revenue didn’t do much better, down 9.3%.

The impact on non-GAAP diluted earnings per share was particularly severe, dropping by nearly 50% to $1.54 per share for the quarter.

Although a share buyback programme was underway to take advantage of the decline, this was halted in Q2. The cash dividend stuck around though, with $0.88 per share for the quarter. For context, year-to-date dividends are $397 million vs. $465 million in share buybacks.

Weirdly, the CFO sold a tiny portion of his shareholding just a few days before the release of earnings. This wouldn’t be allowed in the South African market, as this would be considered a closed period. With only 890 shares sold and a shareholding of 59,513 shares remaining, perhaps he was just trying to afford lunch in an inflationary economy.

The biggest shock of all at Bed Bath & Beyond

This is sad news: the CFO of Bed Bath & Beyond (Gustavo Arnal, 52 years of age) passed away on Thursday after jumping from the 18th floor of an iconic building in Manhattan. The Jenga Building is perhaps a cruel example of dramatic irony in the context of the company’s operations, which are close to collapse.

Prior to the event, Arnal and activist investor Ryan Cohen were sued under a class action lawsuit for allegedly taking part in a “pump and dump” scheme that would falsely inflate the company’s value. Refer to the previous edition of Ghost Global to learn about Ryan Cohen’s relationship with the company. It’s worth noting that JPMorgan is also on the wrong end of this lawsuit.

This is a scheme that involves fraudsters and market manipulators spreading misleading and false information in an effort to send the share price into a frenzy, profiting along the way by selling the stock at an inflated price. This is not what you want to be accused of in life.

The lawsuit alleges that Cohen initially approached Arnal about a plan to profit from the stock. Over a couple of days in August, Arnal sold shares worth $1.4 million. That’s nothing compared to Cohen, who is believed to have made a profit of around $68 million on his trades after buying nearly 12% of the company in the first quarter of 2022.

The pain just keeps on coming at Bed Bath & Beyond, with the stock down 52% this year and more than 15% after the news of the CFO’s death hit the market. This comes off the back of strategic moves to strengthen the financial position, closing down around 150 stores (out of a footprint of 700+) and laying off 20% of its 32,000 employees. On the plus side, the company announced financial commitments of more than $500 million of new funding.

The company is preparing for a potential offering of up to twelve million shares of common stock, with the proceeds used to reduce debt.

Dial 911: Porsche is coming to the market

In lighter and certainly faster news, Volkswagen AG (VW) announced that the initial public offering (IPO) of Porsche is underway. This is a bold move against a bearish backdrop in global markets, particularly in Europe where the energy crisis is escalating.

To be fair, VW started preparing for this IPO back in February, before all hell literally broke loose in Europe.

Group CFO Arno Antlitz noted that the proceeds from listing Porsche will give the company more financial flexibility. With Porsche valued at $85 million or more, VW only intends to list 12.5% of the stock in the company.

This is an exceptionally complicated shareholding structure, with the Porsche family expected to acquire more than 25% of the carmaker closer to the IPO. Figuring out the VW group’s corporate structure is arguably trickier than designing the next generation 911!

Although car sales are under pressure, the VW group is making good progress in its electric vehicle strategy. There are other very exciting brands in the portfolio as well, including Lamborghini, Bentley and Audi. If you aren’t at the point yet of ordering your new GT3RS, you can at least add some Porsche shares to your portfolio.