If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Balwin benefits from semigration

Demand has been boosted for apartments in the Western Cape and KZN regions

I’ll be honest, I’m surprised that people have been semigrating to KZN. Perhaps the warm sea more than offsets the numerous problems that the battered province has experienced.

In the six months to August, Balwin recognised 8% more units in revenue and managed to achieve an uptick in gross margin as well. Although there is a healthy book of pre-sold apartments, Balwin does note that rising interest rates are likely to cause a slowdown in sales growth.

HEPS is expected to be 45% to 50% higher in this period, implying a range of between 36.18 cents and 37.43 cents. The share price closed 8% higher at R2.70. For reference, that’s where it was trading in April 2020 when government was still trying to restrict chicken sales at Woolies.

Growthpoint: there’s a problem in Sandton

With Office vacancies even worse in FY22 than FY21, some creative ideas are needed for the space

Whenever I see an update from Growthpoint, I always make sure that I read about the V&A Waterfront. This is South Africa’s premier tourist destination, so it’s a great barometer for the post-Covid recovery. Distributable income from this magnificent property was just R364.9 million in FY21 and has come in at R566.7 million for FY22. The vacancy rate has dropped from 3% to 1.6%.

At the other end of the spectrum, the Office portfolio has seen vacancies increase from 19.9% to 20.7%. Retail improved from 6.2% to 5.5% and Industrial came in at 5.7%, a solid improvement from 9.4% last year.

Growthpoint’s biggest headache is clearly the office buildings, with the company noting that this sector remains oversupplied. I genuinely believe that hybrid working is here to stay, so there has been a structural decrease in demand. They would be better off converting half those offices to padel courts.

Looking at other key indicators:

- SA REIT Funds From Operations (FFO) increased by 13.7%

- The loan-to-value (LTV) ratio decreased to 37.9% vs. 40% in the prior year

- Net asset value per share increased by 6.7% to R21.58 (vs. the current share price of R13.00)

- The dividend per share is 8.4% higher at 128.4 cents

Motus operandi

Motus is acquiring an aftermarket parts business on an EBITDA multiple of 6.5x – 6.9x

Motus has been trading under cautionary since June. Unlike some companies in the market (Zeder / Onelogix come to mind), the company actually gets on with things after releasing a cautionary.

Although we still don’t know who Motus wants to acquire, we do have a few more details now:

- The target is an aftermarket parts business

- Motus will be acquiring 100% in the business

- Due diligence is underway (as are negotiations) and should be concluded by 3 October

- The company is in a faraway land (a “foreign jurisdiction in which Motus operates”)

- The purchase price is between R3.7 billion and R3.9 billion, representing an EBITDA multiple of 6.5x to 6.9x

The business is apparently “asset light” which I find interesting – this means that it generates a return off a relatively modest balance sheet. I guess that when compared to the core Motus business of car dealerships, that is possible.

What I don’t understand is that the cautionary announcement has been lifted, even though we don’t have detailed terms yet. I wouldn’t have done that, personally. There’s no guarantee of a deal at this stage and we don’t know who the counterparty is.

Motus’ market cap is R23 billion, so this isn’t such a small deal that it can be ignored as irrelevant.

Bonjour, DSTV

Groupe Canal+ seems to be far more interested in economic rights than voting rights

French media company Groupe Canal+ SA clearly sees value in the MultiChoice business, despite the challenges it faces in retaining premium subscribers. Canal+ has acquired even more shares, taking the stake to 26.26%.

This has become a serious investment now.

My understanding is that South African regulation limits foreign shareholders from holding more than 20% of the voting rights in an entity holding a commercial broadcasting licence. This means that Canal+ holds a 26.26% economic interest and a much lower voting interest, as the calculation has proportional elements to it.

It’s not clear what is going on here and the market doesn’t seem to be pricing in a buyout offer (probably because of the cap on voting rights), with the share price down by around 6% this year.

Perhaps all the programmes will soon have French names? At least Carte Blanche will avoid any rebranding fees.

Cement volumes drop in South Africa

In the five months to August, PPC’s group revenues increased by 9%.

This wasn’t thanks to South Africa, where cement sales volumes fell by 1%. An increase in average selling price by 5% saved the local result, with net debt decreasing from R1.2 billion in March to R1 billion at the end of August.

No, the real winner was Rwanda, with the East African country achieving 16% growth in volumes. It also helps that 70% of cement sales in Zimbabwe were in foreign currency, as this enabled a $4.4 million dividend to be upstreamed in June. Another dividend is expected at the end of the year.

As a reminder of what hyperinflation looks like, PPC Zimbabwe increased US$ prices by 5% in March, then another 2% in April and finally by a further 5% in August!

Little Bites

- Des de Beer is still buying shares in Lighthouse Properties, this time worth nearly R1.7 million.

- After being part of the campaign to save Ascendis, Carl Neethling has been appointed as acting CEO and Chief Transition Officer of the group, with this appointment expected to last for around 9 months, much like a pregnancy. He will earn R1 per month, so it’s about as financially beneficial as a pregnancy as well.

- Keen to learn more about the battery metals strategy at Sibanye? The company released a presentation that you’ll find here.

- Stefanutti Stocks is selling its businesses in Mozambique and Mauritius to a privately owned group for a total of $13.5 million (subject to adjustments). The proceeds will be used to reduce debt as part of the restructuring plan.

- Pan African Resources is a rock solid miner. For the year ended June 2022, record gold production was achieved (up 1.9%) and profit after tax was slightly higher for the year, which is a lot more than its competitors can say. Net debt reduced by a whopping 66.7%, which is why the company can pay a dividend and execute a share buyback programme. For some variety in the story, the first commercial harvest at the Barberton Blueberry project was achieved!

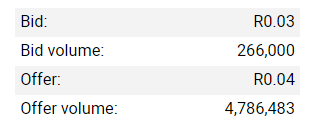

- The High Court has granted the provisional liquidation order against Constantia Insurance Company Limited, which contributes almost all of Conduit Capital’s revenue. This is what desperation from investors looks like:

Howzit Ghost.

New version of Ghost Bites was great. Given you experience in Westworld aka corporate finance, I personally would love to have your perspective on some of the bites. Meaning not just information reporting but also some opinion on how a seasoned banker/trader would interpret a specific SENS announcement. Love your content and keep hustling. Routing for you all the way from Munich.

This would be great

Morning! Loved the format this morning! Keep going, this is excellent content! Thank you for your insights.

Nice one, Ghost. I like the addition of the ‘Little Bites’.

Love the Little Bites!

I love this new version of Ghost Bites easy flow and I can quickly go through it. Please keep including your own mix and honest comments & humour.