Until the Covid-19 pandemic, most experts were of the opinion that tourism was the world’s largest industry (based on percentage of global GDP) – bigger than oil and agriculture! Chris Gilmour unpacks the industry and takes a deeper look at City Lodge.

Tourism was a growing industry until the pandemic. It had special relevance to less developed countries, where it made a disproportionately large contribution to GDP. Sadly, the pandemic (with enforced lockdowns) changed everything. Travel and tourism as a sector was hit harder than most and has taken longer to recover.

Only now is the aviation industry at last managing to see the light at the end of the tunnel as more and more tourists make up for lost time during the pandemic. And hotel chains, too, are starting to get back to pre-pandemic occupancies and room rates.

Can a recession derail this story?

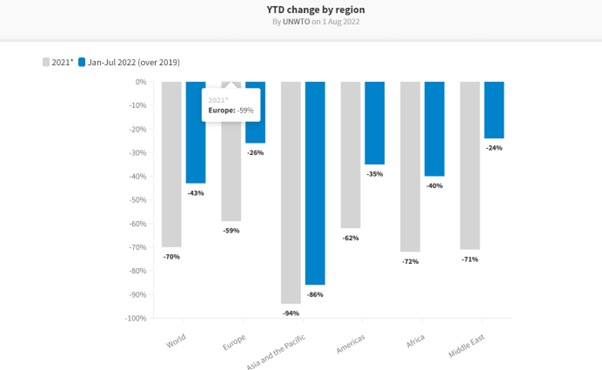

But times remain tough. A global recession is looming on the not too far horizon and that must surely put a dampener on travel and tourism. But having said that, the latest surveys from the UN World Tourism Organisation (UNWTO) suggest that the improvements seen in in 2022 will carry through to 2023 and beyond.

They (almost) all survived

Locally, the hospitality (accommodation and restaurant) groups in South Africa, such as City Lodge, Famous Brands, Spur, Southern Sun and Sun International all suffered especially badly during lockdown and it is frankly miraculous that they have all survived.

Of course, the big listed casualty was Comair, which went into business rescue almost immediately when the pandemic struck and which looked like it might survive in unlisted form as lockdown restrictions eased. But it wasn’t to be and it eventually it went bust in June this year.

Checking in at City Lodge

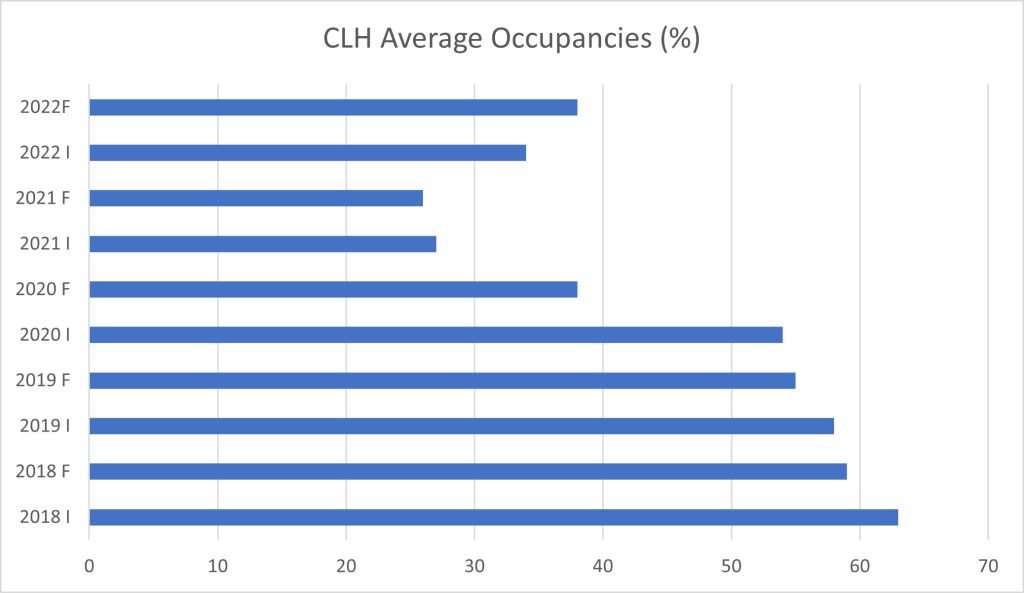

City Lodge released its full year results to end June on 23 September. They were slightly better than expected, with full-year EPS being slightly positive at 14c but HEPS still slightly negative at -8.6c. But average occupancies were above breakeven for the first time in two years and all the hotels were open from about March this year.

The east African hotels were sold off and the proceeds received in July. The funds were used to pay down debt, which now stands at around R250 million.

The graph of average occupancies masks the harsh reality of what occurred at the deepest part of lockdown restrictions in 2020. In those days, the only City Lodge hotels permitted to remain open were so-called “quarantine hotels” that housed repatriated South Africans. Average occupancies plummeted to around 4% at one point during the darkest days of lockdown.

City Lodge also had to contend with a massive rights issue to fund its BBBEE programme. This was highly dilutive.

A shift in the model

The basic philosophy of City Lodge has always been to offer a quality room at a relatively low price without much in the way of food and beverage choice. Basically, that meant bed and breakfast. Discounting of room rates was never a big deal apart from promotions such as “Spouse on the House” and “Bid2Stay” for example. The target market was predominantly the corporate sector.

With the onset of the pandemic, that has all changed. A full repertoire of food is now offered at most hotels now, though without going totally overboard in terms of choice. So for example, tasty items such as pizza, burgers and shisa nyama are offered. This type of food undoubtedly appeals to both corporate and leisure travellers who often don’t want to venture out at night due to drinking and driving considerations or general safety concerns.

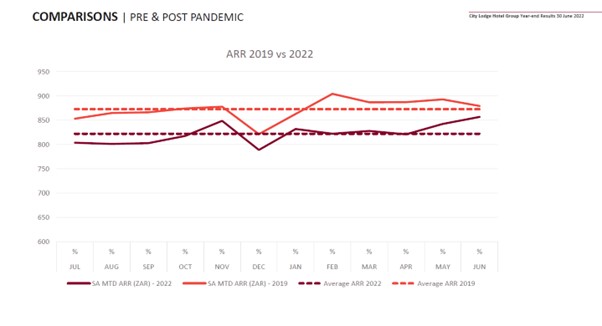

Discounting takes place on weekends, with weekend special rates as well as a discounted Friday rate once a month at month-end called Woza Friday. Average room rates are moving up nicely and are not far off where they were pre-pandemic. Before getting excited, it’s worth remembering that City Lodge has effectively endured four years of inflationary cost growth and will only now be recouping a full room rate.

As with most global hotel chains, City Lodge makes extensive use of artificial intelligence when calculating room rates and this has helped to recoup better room rates in recent times.

A lower breakeven

Unlike most hotel chains, City Lodge doesn’t employ the services of a hotel management company, so there is a huge cost saving involved here. This is reflected in the much lower than average breakeven occupancy rate. Breakeven occupancy level for a chain such as City Lodge, with its predominantly three and four-star properties, would typically be in the high 50%’s / low 60%’s. However, thanks to its very low-cost structure, absence of a management company and the fact that it owns most of its properties, City Lodge’s breakeven occupancy level is nearer 38%.

Analysis of hotels primarily revolves around occupancy levels and is a classic case of marginal cost analysis. In other words, beyond breakeven occupancy level, operating profit falls almost unhindered (apart from tax) to the bottom line. This is due to the heavy capital nature of hotel construction and is especially relevant in City Lodge’s example, where most of its properties are owned.

The new financial year has started off well for City Lodge, with occupancies in September hitting a high of 58% after achieving 52% in July and 56% in August. The inbound foreign tourist season begins this month and runs all the way through to at least March next year and indications are that it is going to be substantially better than last year’s very low base of comparison. A number of new airline routes have either opened up already or will be opening up by year end, including Air Belgium from Brussels, United from Washington and Delta to Cape Town from Atlanta. Additionally, BA and Virgin Atlantic will be adding an extra 25 fights per week at the height of the holiday season.

And all the while, corporate travel is slowly but measurably improving as office workers return to their desks.

There are some options for investors, but not many

There aren’t too many options available on the JSE for investing in the hotel business: City Lodge, Southern Sun Hotels and Sun International.

Sun International is predominantly a gaming operation and the hotel side is mainly an interesting add-on in my opinion.

Southern Sun is by far the largest hotel chain in the country and the one with the longest pedigree. It is a quality operation but it lacks the elegant simplicity of City Lodge, with its 15 different brands, its multitude of hotel management agreements and its higher breakeven occupancy level.

So, the bottom line is that the worst now appears to be over for City Lodge and investors can reasonably look forward to a gradual improvement in earnings. Having said that, dividends may still be a while away.

A very fair appraisal