If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Altron reports a big jump in HEPS

The operations seem to be performing well

For the six months to August, headline earnings per share (HEPS) for the continuing operations will be between 40 and 42 cents. In the prior comparative year, HEPS was just 11 cents.

Altron’s operations have performed well, with Altron noting solid performances from Altron Managed Solutions, Altron Karabina, Altron FinTech and Altron Arrow. It’s also important to note that Lawtrust was acquired in October 2021 and so the full impact of that acquisition is sitting in these numbers and not in the comparable period. Another critical point to note that Altron Arrow was reclassified as a continuing operation, so it is not in the base period either.

This means that the year-on-year growth rate of HEPS isn’t particularly helpful. It’s more useful to focus on the earnings range.

Altron is trading at R8.60 and the market didn’t have time to react to this announcement, as it came out just before the close. Let’s see how the market reacts once the numbers have been digested.

A famous recovery

King Steer burgers and Debonairs pizzas are flying out the door again

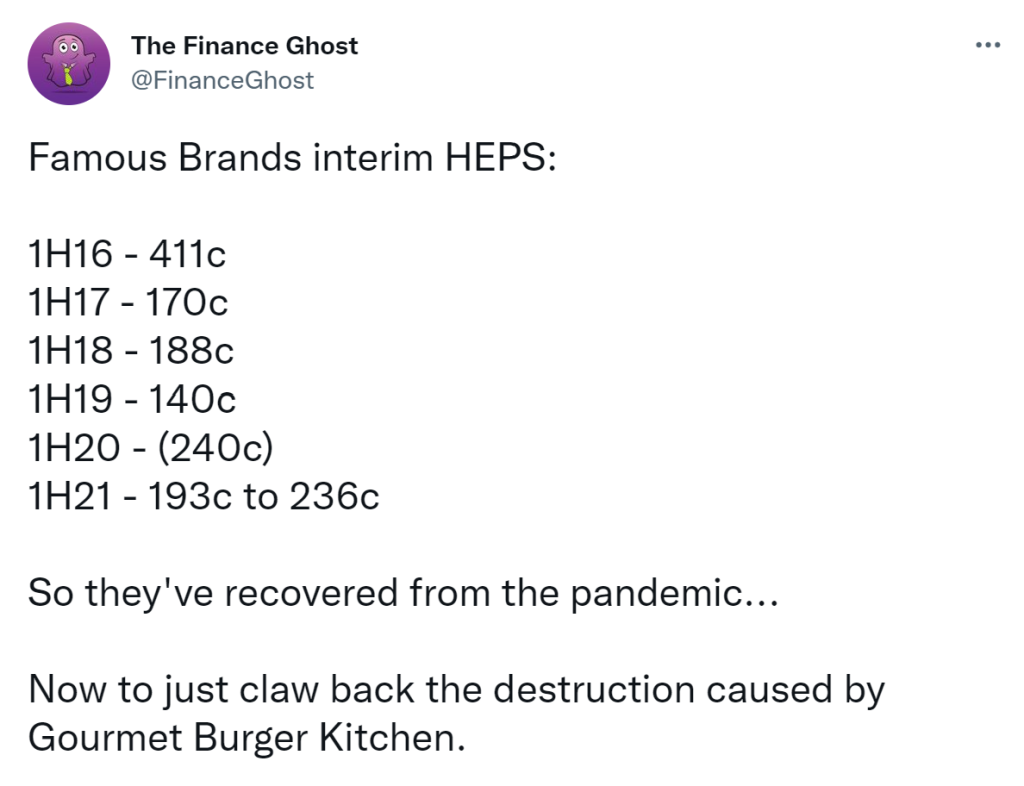

In a trading statement for the six months ended August, Famous Brands confirmed that headline earnings per share (HEPS) will be up by between 99% and 143%.

Of course, there is a huge base effect here from the pandemic. To really understand this situation, we need to look further back.

I’m too lazy to type it all out again, so I’ll just refer to my tweet on the matter (and invite you to follow me on Twitter if you don’t do so already):

Famous Brands has lost two thirds of its value since the peaks of 2016 and is down 30% this year.

Force manure

The Transnet strike is negatively impacting Kumba Iron Ore (and the whole country)

Force majeure is a legal construct in which a party claims that a contract cannot be fulfilled due to unforeseeable circumstances. Whether or not strike action in South Africa is “unforeseeable” is a debate for another day.

The brilliance of “force manure” is attributed to Capital Sigma on Twitter. I just loved that clever twist the moment I saw it.

The economy will shortly be in the manure if this strike doesn’t get resolved. Mineral exports saved us during the pandemic and we really can’t afford to lose out on this critical source of revenue as a country.

After Thungela downplayed the impact of the strike by noting the extent of its stockpiles in Richards Bay, Kumba Iron Ore has come out with a less favourable story.

Kumba owns just over 76% in Sishen Iron Ore and the updates refer to Sishen’s production and export numbers, so one can argue that only three quarters of the impact is attributed to Kumba. Still, a production impact of 50,000 tonnes per day for the first seven days and 90,000 tonnes per day thereafter is serious. Of greater concern is that export sales will be impacted by 120,000 tonnes per day.

The share price fell nearly 4% in morning trade and partially recovered to close 3.5% down. If this strike continues, a lot more manure will stick to the share price.

Sappi keeps it short and sweet

It took just one paragraph to drive the share price nearly 8% higher at the close

When it comes to SENS announcements, there’s often a lot of fluff on the JSE that needs to be worked through to find the key messages. Sappi certainly wasn’t guilty of that as it provided the outlook for the fourth quarter.

Back in August, management guided a strong fourth quarter notwithstanding inflationary pressures. At the time, the expectation was for EBITDA to be below the record levels in the third quarter. The excitement in the market is because management now expects fourth quarter EBITDA to beat the third quarter i.e. to be a new record.

The company notes that market conditions were stronger than expected and European energy prices (especially gas) were lower than expected.

The share price has been on a bumpy ride, with this rally only taking it back to levels seen in early August. For the year, the share price is up less than 5%.

Sirius puts out a positive message

With a share price down more than 50% this year, shareholders need good news

The Sirius Real Estate share price is a victim of a crazy valuation coming into this year. As I always say, you need to be extremely careful of property funds trading at a premium to book. There’s no better example of that risk than Sirius.

Sirius is trying hard to own the narrative here, with a SENS headline that screams “Trading update: in line with expectations, with continued rental growth and a strong balance sheet” – that’s when you know that the company is sensitive to what has happened to the share price.

Let’s take a closer look.

In Germany, the like-for-like annualised rent roll is up 2.4% and the rate per square metre is up 3.3%. In the UK, the annualised rent roll is 4.1% higher and the rate per square foot has increased by 8.4%. Although disposals and acquisitions would skew the relationship between total rent and the rate per metre or foot, my immediate reaction was to think that occupancies must be lower if the pricing has increased more than total rent.

Sure enough, group occupancy is down from 85.3% to 84.4%. That’s not exactly the story that shareholders want to hear from an industrials-focused group that is supposed to be experiencing high demand for properties. The group plays this down by noting that the historical trend has been for tenants to vacate properties in the first half of the financial year. Over the next six months, we will get more clarity on the demand dynamics for these properties.

It’s fascinating to note that German converted 78.1% of enquiries into viewings and 11.5% into sales. In the UK, just 17.3% were converted into viewings and 4.7% into sales. Perhaps the Germans really are more precise with what they want?

Keep a close eye on the balance sheet. A facility of €170 million was refinanced with a fixed rate of 4.26%, taking the group’s weighted average cost of debt from 1.4% to 1.9%. The weighted average debt expiry has increased to 5 years from 3.8 years. If you are investing in this sector, you need to do proper analysis of the balance sheet and assume that any expiring debt will be replaced at a cost in line with current market rates.

Sirius believes that the portfolio valuation will increase at the end of September, as values in March were at “relatively high gross yields” according to the company: 7% in Germany and nearly 12% in the UK. Remember, a higher yield means a lower value. Shareholders want to see these yields come down so that property values go up.

Finally, Sirius used the announcement to reassure investors about the gas situation in Germany, where gas reserves are more than 90% of capacity. Sirius doesn’t believe that there will be any material changes to its fixed rate agreements for gas supply.

Little Bites

- Des de Beer is still buying shares in Lighthouse Properties, this time to the value of R4.7 million.

- In an interesting board appointment, James Formby (the ex-CEO of Rand Merchant Bank) has agreed to join the Pick n Pay board. It’s unusual to see an investment banker go to a group that isn’t exactly known for its dealmaking habits. Is this a sign of future potential activity?

- Bruce Cleaver is stepping back from his role as the CEO of De Beers to become the diamond miner’s Co-Chairman (an unusual role). Al Cook has been appointed as the new CEO of De Beers, bringing with him 25 years of experience mainly at BP and Equinor. Petrol is now so expensive that oil & gas executives are being promoted to run diamond mines!

- There’s also a change in top leadership at Quilter plc, where CEO Paul Feeney will step down from his role as CEO at the end of October. Steven Levin will take over as CEO. He currently runs the Affluent division at Quilter, having been with the group since 1998. Feeney served in the role for 10 years and the long innings of Levin at the group is a tick in the box for succession planning. Perhaps Truworths should take some notes here.

- Grindrod’s disposal of Grindrod Bank has become unconditional. This means that the effective date of the disposal is 1 November. David Polkinghorne has resigned from the Grindrod board and will continue to serve on the board of Grindrod Bank.

- Salungano Group has announced that Arnot OpCo has been placed under business rescue proceedings. The parties who opposed the business rescue application were ordered to pay costs. Salungano’s investment in this entity was already fully impaired. The supply of coal to the Arnot power station will continue for now.

- After a delay attributed to Covid lockdowns in China, SEPCO Electric Power Construction Corporation has presented an Engineering, Procurement and Construction (EPC) contract proposal to Kore Potash for the Kola project in the Republic of Congo. Kore Potash is now finalising terms with SEPCO, as there is obviously a negotiation process underway (nobody ever accepts the first draft of a contract). The Summit Consortium is waiting for the outcome of this contract negotiation before presenting its royalty and debt financing proposal for the construction cost.