If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Caxton vs. Mpact: the latest

Spoiler alert: they still hate each other

Well, here we go again.

Caxton kicked off this announcement by pointing out that Mpact promised a detailed response to Caxton’s announcement “in the near future” and that nothing further has been released for a full week. I can’t fault that view. Mpact did leave things hanging with the last announcement. Never one to miss an opportunity, Caxton has complained to the JSE that Mpact’s announcement is an abuse of the listings requirements.

Mpact has now withdrawn the enforcement proceedings against Caxton and its Chairman. In the related non-confidential affidavit, Caxton claims that Mpact is admitting to the issue of customer flight by Golden Era, a large customer and material shareholder in Mpact. Caxton also reminds us that the Tribunal has confirmed that customer flight is an irrelevant consideration for whether Caxton is allowed to file a Rule 28 merger filing application.

This alleged customer flight is the crux of the entire issue. Caxton notes different statements made by Mpact in this regard, which can be interpreted on a spectrum ranging from Golden Era immediately moving its business away from Mpact through to the commencement of a process to move away over time. According to Caxton (and I must agree with this particular view), such a loss of a key customer would be considered a “poison pill” for a potential takeover by Caxton. The reason for this situation is that Golden Era and Caxton are strong rivals in the market, so Golden Era wouldn’t want to do business with a Caxton-controlled entity.

Separately, Mpact believes that Caxton and its chairman have committed criminal offences under the Competition Act, which can lead to a penalty of 10% of turnover and/or a R10,000 fine and/or imprisonment up to six months. We can all agree that those are very different punishments. Caxton and its chairman deny any such breach of the law.

The saga continues as we await Mpact’s promised announcement…

Mondi announces a strong quarter

With a share price down 27% this year, Mondi is still trying to recover from the Russian exposure

If we exclude the Russian operations, Mondi’s underlying EBITDA for the third quarter was €450 million, up 55% vs. the same quarter last year. The result was driven by higher selling prices and volume growth across most of the underlying businesses.

There’s a remarkable insight in the announcement related to Mondi’s energy needs. Although European gas prices have been a feature of the markets this year, Mondi generates most of its energy internally. Of the internal energy production, 80% is from biomass sources! Overall, only 10% of the fuel is sourced from natural gas. This is an incredible example of sustainability and good business sense in action.

The group is busy with a €1 billion expansionary capital investment programme and the projects are expected to deliver mid-teen returns. This includes a €400 million kraft paper machine in the Czech Republic facility and the acquisition and upgrade of the Duino mill in Italy for €240 million.

All eyes are on the disposal of the Russian business, with an agreement already in place to dispose of the operations for €1.5 billion. There are huge outstanding regulatory approvals for this deal, so investors are collectively holding their breath in the hope that it goes through.

Aside from Russia, investors can take a lot of heart from Mondi’s ability to grow volumes and push through pricing increases in difficult times.

Oligarch Ivan Tavrin acquires Avito from Prosus

Prosus will be paid around R44 billion with an expected close this month

For those who thought that Avito is a “donut” (i.e. a worthless, big fat zero in value), there’s a surprise on SENS. In March, Prosus announced a separation of the Russian classifieds business (Avito Group) from the rest of the business. This was obviously a move towards leaving the country in the wake of the invasion of Ukraine.

As Mondi and now Prosus have demonstrated, there are Russians waiting to acquire businesses from multinational organisations who are leaving the country. The news of a RUB151 billion (R44 billion) offer for Avito from Kismet Capital Group (controlled by oligarch Ivan Tavrin) will be welcomed by Prosus shareholders, as Prosus owns 99% of Avito.

These are extreme circumstances, so it becomes difficult to debate what the “fair value” really is. Avito made a profit of $160.3 million in the year ended March 2022. The purchase price works out to around $2.4 billion, so that’s a Price/Earnings multiple of 15x. That’s not the “desperate” price many would’ve feared!

Quantum’s financial performance is no yolk

Shareholders won’t be laughing when they see these numbers

If you love high margin businesses with low risks, the only involvement you should have with eggs and poultry is buying the products at your local grocery store. Poultry producers need to deal with everything from volatile raw material input costs through to the risk of avian influenza.

For the year ended September, Quantum’s headline earnings per share (HEPS) will be at least 63% lower than the comparable period. This implies a maximum HEPS number of 19.3 cents vs. 52.2 cents last year.

It’s been a perfect storm for the company. The margins in poultry are thin on a good day, so a substantial increase in raw material costs quickly eats into the profitability. With other issues like fuel and electricity costs along with loadshedding, there’s really not much margin left. To make it worse, a weak consumer environment put pressure on egg selling prices and reduced demand for layer livestock. The final nails in the coffin were outbreaks of avian influenza and weather conditions in the Western Cape, along with labour unrest at the Kaalfontein layer farm in Gauteng.

When demand for point-of-lay hens drops, the company needs to hold them for longer than planned and this drives a higher cost of production and reduced margins. The poultry industry is one of the strongest examples of operating leverage in action, as very high fixed costs and low contribution margin (profit per hen, per egg etc.) mean that profitability is hugely impacted by changes in volumes.

Of course, this means that when things are going well, they go very well.

In response to the pressure on profitability, Quantum is closing businesses that just aren’t attractive. The decision has been taken to close the Tongaat layer rearing farm and the East London packing station.

There is minimal liquidity in this stock, which is the only explanation for why the share price didn’t move on Friday despite this announcement.

Tongaat needs R1.5 billion for milling

Stakeholders will shortly receive a restructuring plan from the board

Tongaat Hulett is currently suspended from trading on the JSE. Despite reducing its debt from R11.7 billion to R6.3 billion through various asset sales and other management actions, the company’s balance sheet remains unsustainable.

The wheels really fell off when the planned equity capital raise from Magister Investments failed.

The sugar milling operations are performing better than the previous season but the company needs R1.5 billion to cover the peak working capital requirement. In July, South African lenders put forward a R600 million base facility. It has a scheduled repayment date of 25 October, which is less than two weeks away.

In an attempt to keep the company alive, the board has developed and approved a restructuring plan. “Various stakeholders” need to accept the proposal, with the announcement not giving further details on who the stakeholders are or what the proposal is. All we know is that the plan seeks to address both the debt and liquidity constraints.

This is perhaps a perfect example of the old joke: when you owe the bank R6 million, it’s your problem. When you owe the banks R6.3 billion, it’s their problem.

Anything could happen here!

Little Bites

- Director dealings:

- A director of Bidvest sold R10 million worth of shares on the open market.

- A director of NEPI Rockcastle acquired shares in the company worth nearly R2.3 million.

- Des de Beer has acquired another R5.5 million worth of shares in Lighthouse Properties (and I still can’t find a working website for the company).

- In a production report for the nine months to September 2022, Merafe confirmed that attributable production from the Glencore Merafe Chrome Venture in the third quarter was 84kt, resulting in a 3.7% increase in production year-to-date vs. the prior period.

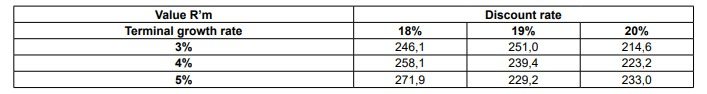

- Cognition Holdings is in the process of disposing of 50.01% of Private Property for R150 million. In the circular released to shareholders on Friday, the independent expert concluded that the price is fair as it is higher than the suggested fair value range of R107.5 million to R136.3 million for 50.01% of the group. To help you understand how sensitive a valuation is to discount rates and terminal growth rates (the assumed growth into perpetuity), here’s the sensitivity table from the circular:

Would this be the Lighthouse properties website?

https://www.lighthouse.mt/

Thank you so much for the great content!

Hi just confirming I’ve been loaded for your R99 per month premium subscription. I receive ghost mail which I think is the free subscription.

Is this table of values for Cognition correct.

Surely the higher the discount rate the lower the value.