After things cooled down in the DIY retail industry, are there some opportunities to be found locally and abroad? Chris Gilmour gets out his hammer and nails.

The home improvement industry is a large element of discretionary retailing globally and has, generally speaking, been in an uptrend for many years. However, in recent times, this sector has been perceived by investors to be vulnerable to a downturn in consumer spending and share prices have come off accordingly.

But some of them may now be looking good for the longer term.

Home Depot

Back in the late 1990s when I was a retail analyst with the great Merrill Lynch (now part of Bank of America), I regularly attended retail field trips in the US with institutional fund managers and my fellow sell-side analysts at Merrills from many different parts of the world. One of the highlights of those trips was always the visits to Home Depot locations in America. These were vast stores; so vast in fact that electric golf buggies were provided inside in order to get around. There was nothing like Home Depot in South Africa in those days and there still isn’t.

Today, Home Depot is the world’s largest home improvement company. The group employs around half a million peoples and operates out of more than 2000 stores in north America and China.

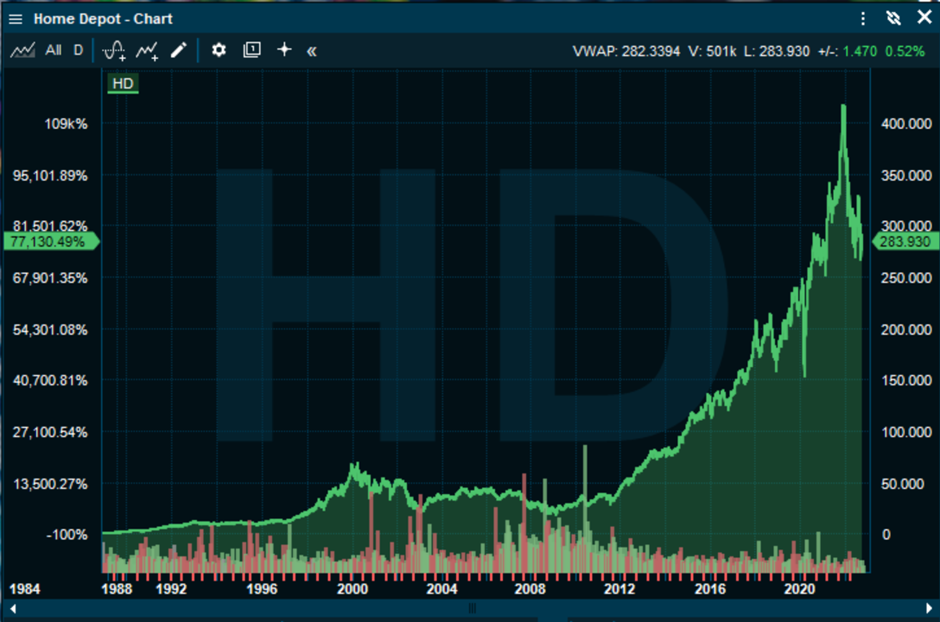

As can be seen in the price chart, Home Depot’s price has taken a beating in the past year. But earnings have been growing steadily for many years and last year was no exception. The share is trading on an historic P/E of 17x, which is not expensive for a company of this quality.

UK alternatives

The UK also has a large home improvement/DIY market but only very few of the companies are listed. The biggest is Screwfix, which caters predominantly to “the trade”, with its counter-only service that doesn’t permit the buyer to browse for products. It’s an unpleasant experience for the amateur DIY-er and if you’re not lucky enough to be served by a switched-on person behind the counter, the experience can be agonising. Professional tradespeople seem to enjoy this approach, however. Screwfix is owned by Kingfisher plc, which is listed on the London Stock Exchange.

Then there’s B&Q, which is also owned by Kingfisher. This closely resembles Builders Warehouse in South Africa, which is not surprising, as an ex-director of B&Q was consulted by Massmart to design Builders Warehouse. Kingfisher also owns the European brands Castorama in France & Poland and Brico Depot in France, Spain, Portugal and Romania.

Kingfisher has been a lousy performer over many years. Although it participated in the recent “homebody bounce”, it is pretty much where it was thirty years ago.

Another big home improvement company in Britain is Travis Perkins. This company refers to itself as the largest builders merchant in the UK and has a slightly attenuated range of products in comparison with B&Q for example, though its still includes general building materials, timber, plumbing & heating, kitchens, bathrooms, landscaping materials and tool hire. Until last year, it owned the Wickes DIY chain but unbundled that and listed its separately on the LSE.

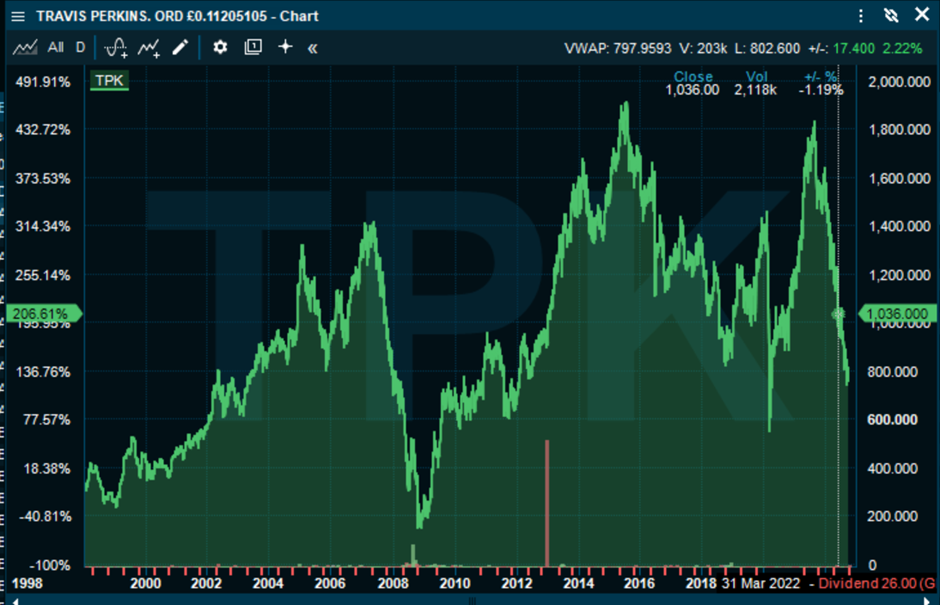

Again, a fairly erratic performer, even over the longer term.

Wickes has a chequered history, being founded originally in the US in the 19th century, though it is more commonly associated with a UK domicile. Superficially at least, it looks very similar to B&Q and there are over 200 Wickes store in the UK.

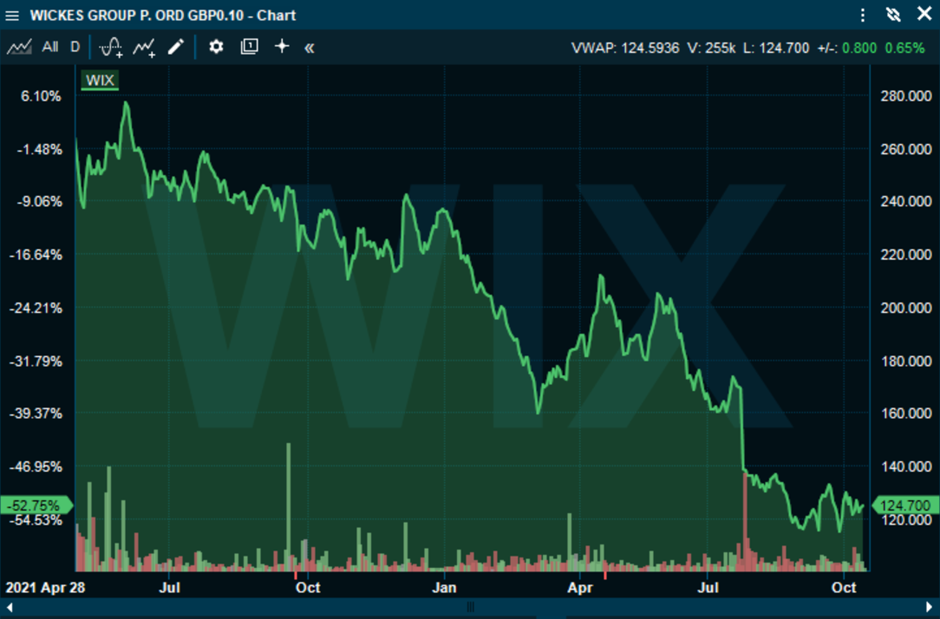

It was previously listed on the London Stock Exchange but delisted amid scandals in the 1990s and was eventually bought out by Travis Perkins. It was demerged and re-listed on the LSE in April last year and the share price has been on a downwards trajectory every since.

Other non-listed home improvement retailers in the UK include The Range and Homebase, the latter being founded by Sainsbury’s in the late 1970s. These are fundamentally different in scope to the likes of B&Q / Screwfix / Travis Perkins and Wickes insofar as they more closely resemble home furnishing retailers with the addition of garden centres. These are not necessarily the type of places that handymen would go to for supplies.

Local hasn’t been lekker this year

This brings us to South Africa. Although there are a great many outlets around the country where the dedicated DIY-er can find satisfaction, only a couple are listed, those being Cashbuild and Italtile. Italtile is a highly specialised home improvement retailer, focusing on tiles and sanitaryware and doesn’t quite compete in the same space as the others.

Builders is part of the struggling Massmart operation and the Build it franchise is part of Spar. There are plenty of other independent hardware retailers all over South Africa, including the Mica and Jack’s Hardware buying groups as well as EST Africa. Collectively, this industry is estimated to be worth around R80 billion a year.

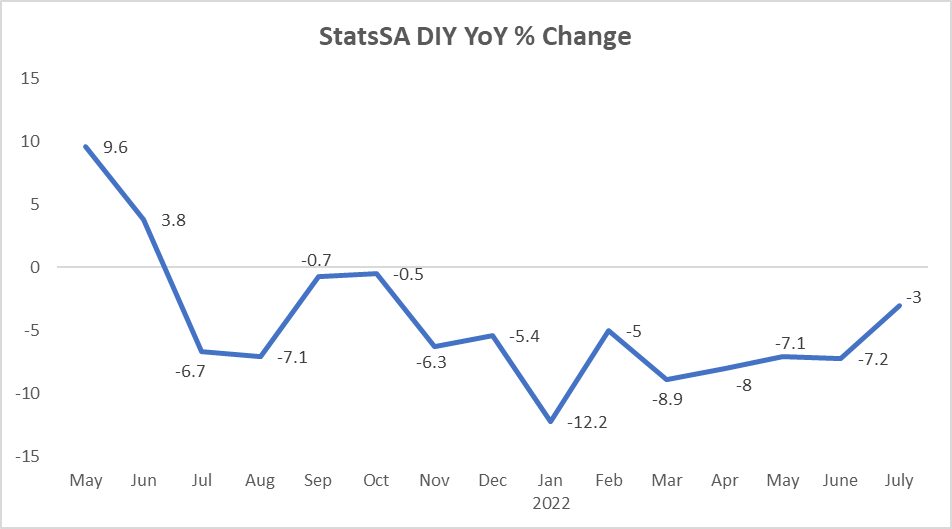

To put this in context, Pick n Pay estimates that the total food & grocery market in SA is worth around a trillion rand. This would mean that the home improvement market is estimated to be worth about 8% of the food and grocery market. The DIY category, as proxied by StatsSA’s “Hardware, Paint & Glass”, has been a dismal performer since a degree of normality returned to these retailers in April and May 2021, following a series of lockdowns in 2020. The accompanying chart demonstrates that this category has experienced negative growth for most of that time. Having said that, the trend may have troughed earlier this year with a very gradual uptrend now apparent.

Of the 318 stores Cashbuild operated at end June 2022, only 9% were located in metropolitan areas, with a relatively even split for the rest between townships, towns and rural areas. The biggest sales declines last year were in Gauteng (-21.2%) and KZN (-22.2%) reflecting the impact of the riots in those two provinces in July 2021. Overall group revenue was down by 12% to R11.1 billion, operating profit fell by 16% to R876 million, headline earnings collapsed by 33% to R436 million and the dividend was slashed by 57% to 1 264c/share. Admittedly, the dividend cover changed from 100% payout to 67%, which also impacted the severity of the fall in the dividend.

EBIT margin was 7.9% last year but management reckons this is not sustainable. The new year started off relatively weak and conditions in this highly competitive industry are forecast to remain very tough.

This is a great company with an outstanding pedigree and is exceptionally well-managed. But it is going to struggle this year and next. On a PE ratio of 10.6x, it’s not especially cheap either.