With the benefit of Stats SA retail sales growth data, Chris Gilmour digs into the South African retail sector.

I always greet the monthly release of retail sales growth data by Statistics South Africa (StatsSA) with a certain degree of trepidation these days, for a variety of reasons. First and foremost is the gut feel that retail sales growth really should be on a noticeable downwards trajectory, considering the poor state of the ambient economy coupled with the increasing interest rate environment.

But it’s not.

Admittedly, much of the rationale for this lies in favourable base effects from the previous year. Whether these relate to coronavirus restrictions or riots doesn’t make much difference. The second reason is the extent of revisions of data by StatsSA.

I can understand why a so-called “flash” estimate of retail sales might be reviewed and subsequently revised a month later. But I am discovering significant revisions taking place going back 3, 6, 9 and more months prior. This doesn’t instill confidence in the integrity of the data.

And then lastly, most JSE-listed retailers are now exhibiting good growth in sales and HEPS, virtually regardless of sector. Even companies such as Truworths which had been languishing for many years has, all of a sudden, produced record earnings. Having said that, most JSE-listed retailers’ share prices are still languishing well below the levels they were trading at five years ago, with the notable exceptions of Clicks and Lewis.

This used to be a glamour sector on the JSE, but not anymore. The companies are still very high profile and it is superficially easy to draw conclusions about their readiness to compete, based on subjective engagements on a personal level.

The big question now is for how long JSE-listed retailers remain on fairly elevated ratings, given the poor outlook for the consumer economy? The answer to this question is that only the strong and the adaptable will survive and flourish in the difficult years that lie ahead for consumer stocks.

Defensive choices

Let’s start with the defensive retailers: the food and drug retailers.

As previously mentioned, Clicks has been an outstanding performer in the market, even though its actual earnings performance has hardly ever shot the lights out. But it is in the right sector (pharmaceutical retailing and wholesaling) and that is highly resilient to the economic cycle. It’s perhaps not surprising that it remains the most highly rated retail stock on the JSE.

The second most highly rated stock is Dischem, not far behind Clicks. Although as a consumer I find it infinitely more interesting and varied than Clicks as a shopping experience, its fundamental earnings performance has been erratic and its share price isn’t vastly different to where it was five years ago following a clumsy, ham-fisted private placement instead of an IPO.

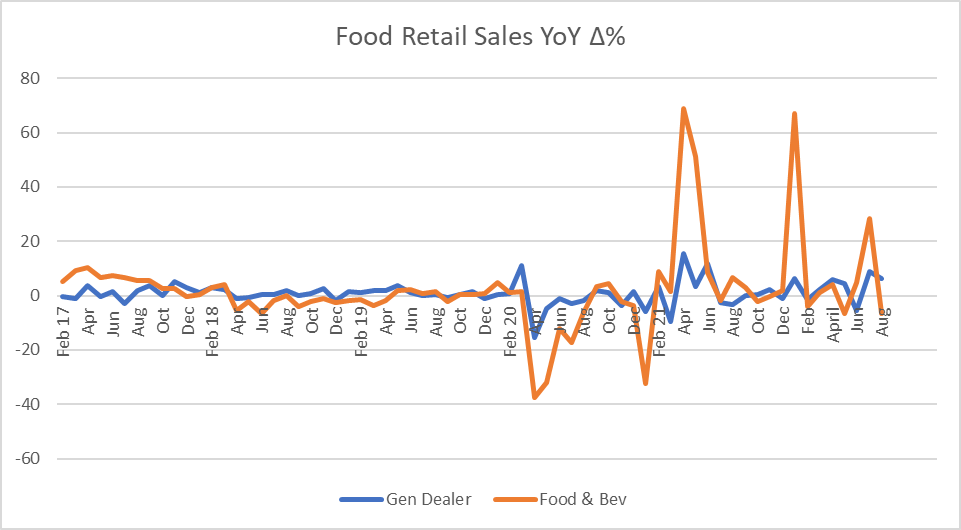

Food retailers in SA should, in the normal course of events, exhibit relatively low and predictable sales growth. That pattern has been thrown into confusion in recent times by the impact of lockdowns and liquor restrictions, as well as the impact of riots in KZN and parts of Gauteng.

The most recent example is the spike in sales in July, followed by a big reversal in August, as shown in the graph below:

Pick n Pay appears to have found a new lease of life under new CEO Pieter Boone. Its interim results two weeks ago were undoubtedly aided by comparison from a soft base in 2021 but nevertheless the group managed to squeeze out some decent sales growth for the first time in years. Their clothing division is really pumping, as is their discounter chain, Boxer.

But can Boone work his magic on the two other elements of the business – QualiSave and the traditional Pick n Pay chain? Only time will tell. The plan is to pit the traditional Pick n Pay chain up against Woolworths Foods at the top end, whereas QualiSave is aimed at the middle market.

Woolworths Foods has definitely lost market share to Checkers in the past year or so and now it’s going to be up against a re-energised Pick n Pay. Provided Pick n Pay can maintain even a slightly favourable price differential between itself and Woolies Foods, chances are it can take market share away.

This just leaves QualiSave. These are smaller Pick n Pay stores where the average number of products on the shelves (stock-keeping units or SKUs) is 8,000. This compares with 3,000 SKUs at a Boxer and 18,000 at a typical Pick n Pay. Just for the sake of completeness, a typical large Tesco in the UK would stock around 45,000 SKUs. QualiSaves should operate on a lower cost model than a traditional Pick n Pay and if that lower cost can be passed onto consumers via lower prices, the re-branding will work. But it will take time for consumer awareness in this regard to catch on.

Spar had its “day in the sun” a few years ago when it bought its Irish, south of England, Swiss and Polish operations. But Spar pricing is perceived to be somewhat more expensive than the average in SA and that could result in a loss in market share over time. Unlike Pick n Pay and Shoprite, Spar doesn’t really have a dedicated discounter brand in SA.

Meanwhile, Shoprite just keeps on pumping out the sales and earnings growth regardless. This is the benchmark by which all food retailers in SA are measured and that situation is unlikely to change anytime soon.

Five years ago I joked with SABC TV interviewer Arabile Gumede that I would rather buy Woolies 250g Chuckles Malted Puffs than Woolies shares. They were both trading at around R60 at the time. Today, the Woolies share price is still pretty much where it was then, perhaps a little higher, but Chuckles are now trading at R75. Go figure.

Clothing retailers

On the clothing front, The Foschini Group (TFG) and Mr Price remain the front-runners in the race to remain relevant in the languishing SA economy. TFG has particular relevance as it has differentiated itself with its quick manufacturing capability that is gradually onshoring an ever-greater proportion of its clothing requirements.

And Woolies? Well, if and when it can do something about disposing of the Australian millstone around its neck, it will have to take a long, careful look at its clothing offering. Still in many ways a glorified department store configuration, is it really best suited to the changing SA consumer economy?

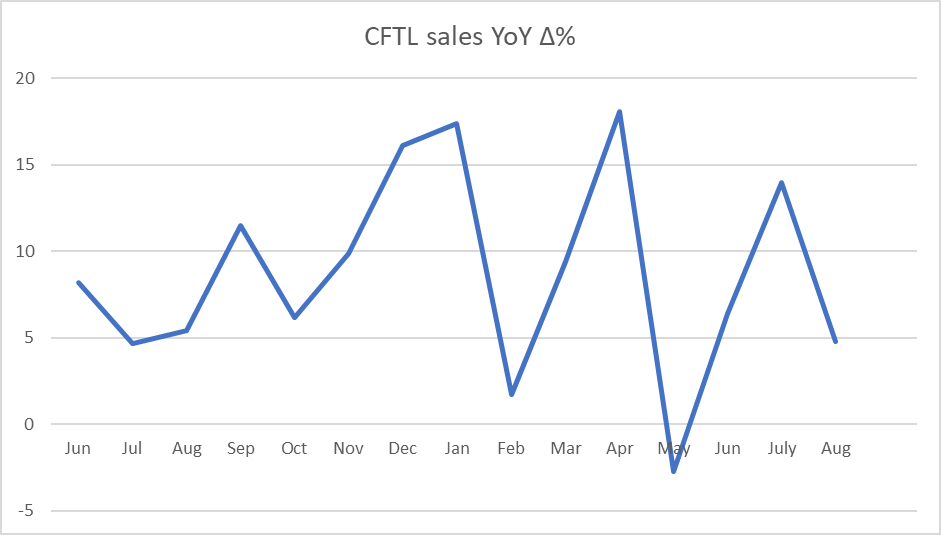

According to StatsSA, the clothing, footwear, textiles and leisure (CTFL) category has been fairly strong for some time now, albeit erratic in nature, as show in the graph:

As is the case with food retailers, where the real battle is at the low end of the social spectrum between the discounters such as Boxer and Usave, so in CFTL the battle is on for the hearts and minds of the low-end consumer in South Africa.

Pick n Pay appears to have found a real niche in its clothing offering and it seems to be taking considerable market share. Mr Price is the acknowledged leader in this area with its fashion at a low price but TFG, as mentioned earlier, is attacking the situation from a different perspective, namely local manufacturing. All three should continue to do well in the SA environment.

It will be instructive to see what kind of sales and earnings growth Truworths manages to squeeze out of its local and UK operations this financial year. Most of its products are in entirely the wrong price points for a languishing economy and as yet it doesn’t have sufficient traction in the low-end segment of the market. Its credit-granting is arguably the best in the business but that is of cold comfort in a market that is increasingly credit-averse.

Is the entire sector too expensive?

So we’re left with a sector that was formerly glamorous in the sense that it contained companies with high sales and earnings growth and high ratings, but which are now just relatively highly rated without necessarily being high growth any more. The foreign fund managers loved the listed JSE retailers because they offered first-world retail management in an environment that looked like an emerging market. And they were primarily responsible for pushing the shares to the dizzy heights that they achieved some years ago. But the local institutions are far closer to the action and are not as easily impressed as their foreign counterparts. The reality is that SA’s GDP growth rate is unlikely to exceed 2% for the foreseeable future, which is a damning indictment on a country with the highest persistent rate of unemployment of any country in the world.

I have always taken the simple view that if a share is rated on a PE of 20x, it should offer HEPS growth of at least 20% per year for the foreseeable future. And yet we have numerous examples on the JSE of shares sitting on PE ratios of 20%+ but where HEPS growth is nowhere near 20% per year.

And while investors love Clicks because of the predictable nature of its business, does it really deserve to be rated on a PE of over 30 times?

So this is the time for highly focused stock-picking to come to the fore. Only highly innovative, nimble retail companies with strong balance sheets will survive intact over the next few years. Already, Edcon and Stuttafords – both unlisted – have hit the buffers and Massmart looks like it’s going the same way.

Shoprite, Mr Price and TFG have been investing heavily through the cycle and will emerge in good shape in my opinion. It looks like Pick n Pay is at long last following suit and also investing heavily.

Clicks will be around forever, though perhaps not on quite such a rarefied PE and the same goes for DisChem.

But beyond this list of six retailers, I can’t say with any certainty that they’ll all be around in ten years’ time.