If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

EO-eish: don’t say I didn’t warn you

For many months, I’ve been writing about an inevitable capital raise at EOH

So here we are: EOH is trading at R3.80 per share. I got out at breakeven (above R7 per share) some time ago. Just three months ago, there was still the chance to get out at over R5 per share when it was extremely obvious that an equity capital raise would be unavoidable.

All I can hope is that a few lessons have been learnt here by investors.

EOH tried its very best to deal with the enormous amount of debt on the balance sheet. Disposals of assets were achieved at modest multiples, so that didn’t do any favours for the investment story. There were also delays in closing certain disposals, which is a disaster when the balance sheet is a ticking timebomb.

We’ve now reached a point where the company needs a rights offer of R500 million in addition to a R100 million issue of shares to Lebashe Investment Group, EOH’s empowerment shareholder. With a market cap of just R680 million, the capital raise is almost equal to the current market cap.

Lebashe has saved the company before, putting in R750 million in 2018 in a “necessary capital injection for an unsettled EOH” – an interesting choice of words. The original deal allowed for a further issuance of shares to Lebashe provided the EOH share price reached R90. Needless to say, that share price is now an utter joke vs. current levels. The proposed new deal resets that strike price to approximately the current share price plus a 25% compound annual growth rate (CAGR). The maturity has also been extended by a further 5 years.

Nodus was appointed as independent expert in relation to the Lebashe deals (the specific issue and share amendment) and has opined that the transactions are fair.

Underneath all of this, there is a sustainable business that generated R282 million in operating profit for the year ended July. This is before interest costs, of course. If all goes well with the rights issue, those who follow their rights will have exposure to a much healthier balance sheet and a company that generates cash. Losses incurred up until now may never be recovered, sadly.

The proceeds from the capital raise will be used to repay R563 million of its bridge facility (of which R728 million is outstanding), with the remaining cash used to improve other elements of the balance sheet.

Although pricing for the rights issue hasn’t been finalised yet, the scenarios in the announcement assume a range of discounts from 20% to 40%.

Most importantly, there is no mention at this stage of an underwriter. There’s no guarantee here of the full R500 million being raised. Lebashe has agreed to follow its rights, so that’s something at least.

Murray & Roberts gets some momentum in renewables

The Power, Industrial and Water platform is making some progress

OptiPower (a division of Murray & Roberts), in consortium with Concor Construction, has been awarded contracts by EDF renewables with a combined value of R1.2 billion. This is a result of ongoing engagement by the Power, Industrial and Water platform with Independent Power Producers who were shortlisted for renewable energy projects in South Africa.

The engineering, procurement and construction contracts relate to the Koruson Main Transmission Substation and the San Kraal and Phezukomoya Wind Energy Facilities.

EDF Renewables currently operates four wind farms in South Africa.

This is useful momentum in a platform of Murray & Roberts that has been struggling to get traction thanks to ongoing delays in project approvals and a generally low level of investment in South African infrastructure.

Richemont makes investors richer

Performance for the six months to September looks excellent

Luxury goods are known for being almost immune to economic downturns. If you’ve got literally millions for jewellery, then chances are good that interest rates don’t bother you too much.

Sales in this period were up by 24% at actual exchange rates and 16% at constant rates. There were double-digit increases in all regions except Asia, which only grew by 3%. Retail sales are 67% of group sales and grew by 30% at actual rates and 21% at constant rates.

Operating profit from continuing operations was up 26%, with operating margin of 28.1%. It’s as though Richemont operates in a different world to everyone else. This is the joy of luxury goods.

If we look at operating segments, Jewellery Maisons grew sales by 24% at actual exchange rates and delivered a 37.1% operating margin. Specialist Watchmakers grew sales by 22% at actual exchange rates and achieved a 24.8% operating margin.

The focus on continuing operations is key here, with a 40% jump in profit to €2.1 billion. With discontinued operations included, the group result looks very different. The loss from discontinued operations is €2.9 billion, primarily due to a €2.7 billion write-down of YNAP net assets as part of the deal with FARFETCH to sell a controlling interest in YNAP to that company.

If you’re interested in learning more about that deal, we covered FARFETCH in Magic Markets Premium when news of the deal broke in September 2022.

The Foschini Group falls 7% despite solid results

The market saw something that it didn’t like – perhaps the inventory levels?

In the six months to September, The Foschini Group (TFG) reported revenue growth of 23% and headline earnings per share (HEPS) growth of 18.1%. Despite the jump in profits, the interim dividend of 170 cents per share is identical to last year.

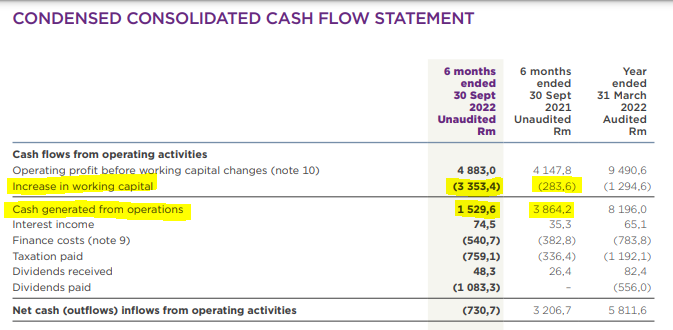

A lower payout ratio tells you that the balance sheet has come under some pressure. You have to go digging in the cash flow statement to find the problem and in doing so, you’ll also see why the share price dropped.

To help you learn where to find this stuff, I’ve highlighted it below:

When you see a swing like this, there are only three possible explanations: higher debtors, higher inventory or lower payables. In a retail business, it’s almost always inventory.

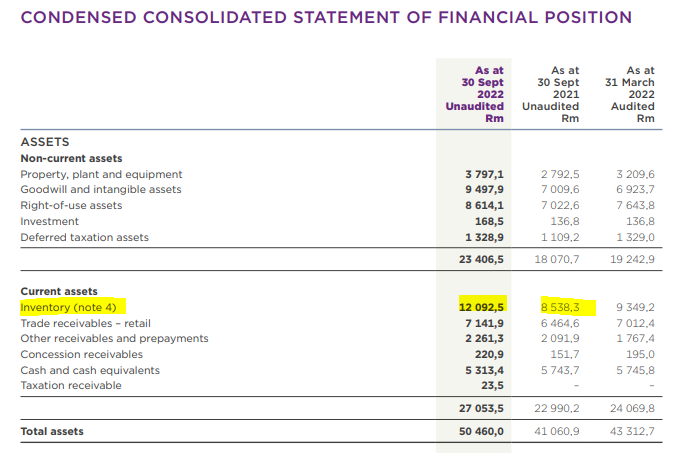

Aaaaaand…bingo:

The announcement doesn’t give many details on the inventory balance. Again, you need to get your inner sniffer dog out to find the details.

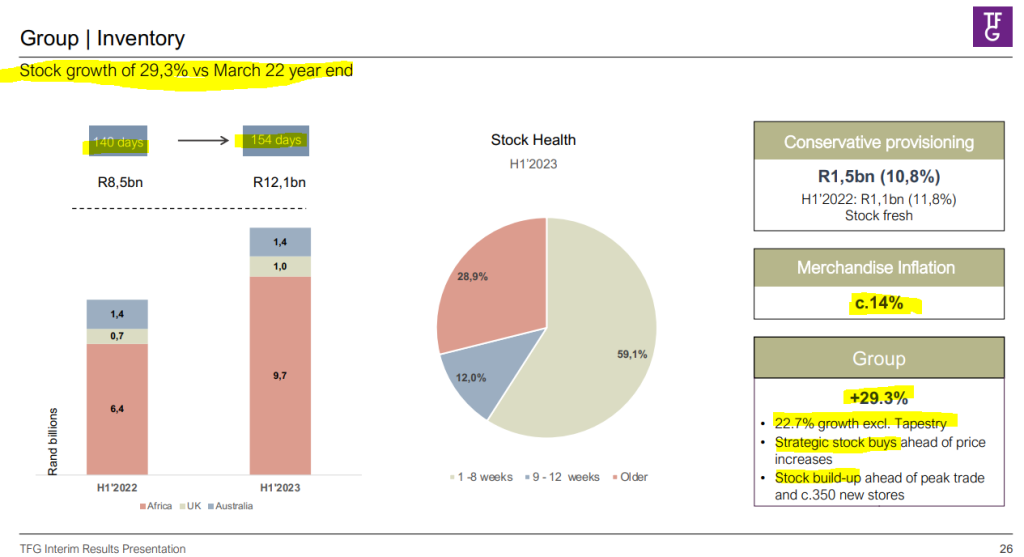

If you dig through the results presentation, you’ll find a slide that discloses 29.3% growth in inventory and 22.7% if you exclude the acquisition of Tapestry Brands. When you see huge balance sheet movements like this, always keep in mind whether there are acquisitions, as that can explain a large jump. In this case, the acquisition is only part of the reason.

Inventory days increased from 140 days to 154 days, as the group bought in inventory ahead of price increases and peak trading period. It’s also worth noting that merchandise inflation is 14%, so that sucks a lot of cash to keep the stores well stocked.

Here’s where I got these stats:

Did the market overreact? TFG has been priced for perfection for a long time now, so the smallest blemish in the results gets punished. Provided sales go as planned over the festive season, I suspect that the company will be ok.

For those who are feeling bullish on consumers in this environment, or those who enjoy trading ranges, the share price is at an interesting level:

Little Bites:

- Director dealings:

- A director of Gold Fields joined me in selling shares after the juicy jump in the past week. Unlike me, the director sold shares worth a whopping R3.9 million.

- A director of Sappi has sold shares worth R962k – I would take careful note of this when read in the context of the company outlook that was covered in Ghost Bites earlier in the week.

- A director of a subsidiary of Santova has sold shares in the company worth R923k.

- The CEO of Altron has purchased shares worth nearly R46k.

- As I expected to see as a Hyprop shareholder, many of the directors elected the dividend reinvestment alternative (just like I did).

- A director of a subsidiary of African Rainbow Minerals has sold shares worth R2.75 million

- There seems to be action brewing in the Grand Parade Investments shareholder register. Sun International now holds 10.56% in the company. Is this the start of a play by Sun International for Grand Parade? The assets certainly make a lot of sense together. In the meantime, GMB Liquidity (which has made a mandatory offer to shareholders) now holds 35.1404%.

- The board of Kore Potash must be holding its breath to see what happens next with the Minister of Mines in the Republic of Congo. In early October, the company received a letter from the Minister “expressing his discontent” with the administration of the companies in the country and the lack of progress being made towards the financing of the Kola Project. The company has formally responded to the Minister with a view to continuing the historically “strong and constructive” relationship with Kore Potash. In Africa, being on the wrong side of the government is never a good thing. Sadly, it’s often not the fault of the company, with many African governments well known for shaking the tree to see how much money falls out in the right places.

- Eastern Platinum has reported results for the third quarter of 2022. Revenue increased by 8.1% year-on-year in this quarter and from a year-to-date perspective, revenue is up 4.8%. Gross margins are higher and the group is making operating profits this year vs. operating losses in the comparable period. Due to a large foreign exchange loss, the group reported a net loss as it reports in dollars. The working capital picture isn’t great at all, with the company owed $16.4 million from a key customer. The group is busy raising capital to accelerate the restart of the Zandfontein underground operation.

- ISA Holdings released results for the six months ended August. Turnover increased by 9% and HEPS was 40% higher at 6 cents, with a particularly strong contribution from the investment in cybersecurity and records management business DataProof. In something you really won’t see every day, the payout ratio is 100%. Yes, the interim dividend is equal to HEPS at 6 cents per share!

- Unsurprisingly, the shareholders of Cognition Holdings voted almost unanimously in favour of the disposal of Private Property. I think that the company achieved a great price for this asset.

Well a fantastic read on TFG’s analysis. Big up

I learnt a bit today 🙋🏼♂️

completely absorbed by analysis on TFG