BHP gets the OZ Minerals board across the line

The revised proposal has done the trick

OZ Minerals is an Australian mining and exploration company with copper-gold and copper-nickel mines and projects. It also operates a copper-gold hub in Brazil. BHP has its eye on the copper and nickel as commodities that are important in the global megatrends of decarbonisation and electrification. It also helps that OZ’s operations in South Australia are fairly close to existing operations of BHP.

BHP’s original offer for 100% of the company was A$25 per share and the board of OZ said thank you, but no thank you. With a revised offer of $28.25 per share (13% higher), the board has agreed to unanimously recommend the proposal to shareholders. This is a 59.8% premium to the 30-day VWAP before the original deal price was announced to the market.

The next step is for BHP to perform a confirmatory due diligence, a process that is expected to take four weeks. If that goes to plan, the parties will then conclude a binding scheme implementation agreement.

Gemfields may make you green with envy

The latest emerald auction included a 37kg showstopper called the Kafubu Cluster

Recent updates on Gemfields have been focusing on the terrorist activity in Mozambique and the risks for the ruby mine in that region. Thankfully, Gemfields also owns a very successful emerald mine in Zambia called Kagem (75% owned by Gemfields and 25% by the Zambian government).

In the latest emerald auction, 34 of the 37 lots were sold and auction revenues were $30.8 million. The Kafubu Cluster was 44% of the total weight at this auction.

This auction caps off a record year of revenue for Kagem, coming in at $149.4 million and way ahead of the previous record of $92.3 million set in 2021.

With relatively low liquidity in the stock and all the volatility around Mozambique, it’s been a fairly chaotic year for the share price:

Murray & Roberts gives full details of the Clough deal

It’s time to close this chapter and refocus the group

After releasing a cautionary announcement earlier this month, Murray & Roberts has released a Category 1 announcement for the disposal. This is the largest type of deal under JSE rules – one that requires shareholder approval before it can be implemented.

The asset on the chopping block is Australian engineering and construction company Clough. The buyer is Webuild, an Italian construction firm with a global footprint. Webuild has worked with Clough before on various projects.

Although the deal value is AUD350 million (around R4 billion), most of that value will be discharged through writing off an intercompany loan. Murray & Roberts will only receive a cash payment of A$500,000 (around R5.75 million).

To keep the lights on at Clough until the deal closes, Webuild has committed to put in an interim loan facility of A$30 million. Before Clough can access this loan, the Italians want more certainty that the deal is going to happen. For this reason, Murray & Roberts wants to obtain shareholder undertakings by holders of more than 50% in the company by the end of November. This is different to the formal shareholder vote which needs to follow the standard JSE timeline. The undertakings are purely to give comfort to Webuild.

All the trouble at Clough comes from fixed-price contracts that were hit by Covid, giving rise to claims on projects and delays in receipt of milestone payments. When construction goes wrong, it goes badly wrong. Clough’s profit for the year ended June of R307 million has swung to a huge loss of R1.18 billion because of the contractual issues. The net asset value of Clough is R4.2 billion, of which R3.9 billion relates to the intercompany loan. This means that the purchase price is still below the net asset value by a few hundred million rand.

Assuming this deal goes ahead, Murray & Roberts will have residual exposure in Australia through RUC Cementation, part of the company’s Mining platform and unrelated to Clough.

A circular will be distributed to shareholders in due course.

Novus looks ahead to a future in education

The Pearson acquisition will give Novus a new platform for further investment

Currently, Novus is a printing and packaging business. In the six months ended September, the Print segment was hit by very high input costs (pulp and paper) and supply chain challenges. The Packaging segment had a much happier time with ITB Flexible Packaging Solutions showing revenue growth and Novus Labels returning to profitability.

At group level, revenue fell by 3%, the gross profit margin deteriorated from 24% to 16.9% and operating profit fell by a particularly nasty 74% to R23.3 million. It really was a tough period for the business with many external factors that hurt the numbers.

In Print, revenue fell by 5.5% and the business slipped into the red, with an operating loss of R7.8 million vs. operating profit of R76 million in the prior period. Gross margin collapsed from 26.8% to 16.9%. Although global pressures like pulp prices tend to normalise, the bigger issue is that this is a sunset industry. Print volumes were down 14.5%, driven by significant declines in demand by magazines and newspapers. Some of that demand has been lost to competitors who were willing to price more aggressively.

In Packaging, revenue increased by 7% and gross margin improved from 12.7% to 16.3%. Operating profit of R29.1 million is nearly double the R15 million achieved in the prior period.

The group is trying to improve its profitability through various cost-saving measures. General overheads decreased by 17.8% in this period. There are also various once-off costs in this period related to retrenchments and the Pearson acquisition.

Working capital has come under significant pressure from the supply chain issues and this issue isn’t going away, with Novus deciding to increase its paper stock volumes above historical seasonal levels.

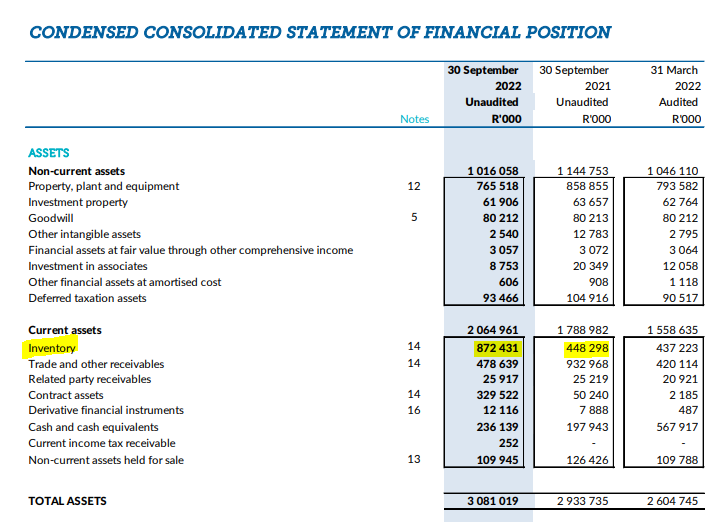

When the SENS announcement gives lots of fluffy wording in the working capital section and not enough numbers, you know you need to go digging. Take a look at the stark difference in inventory balances:

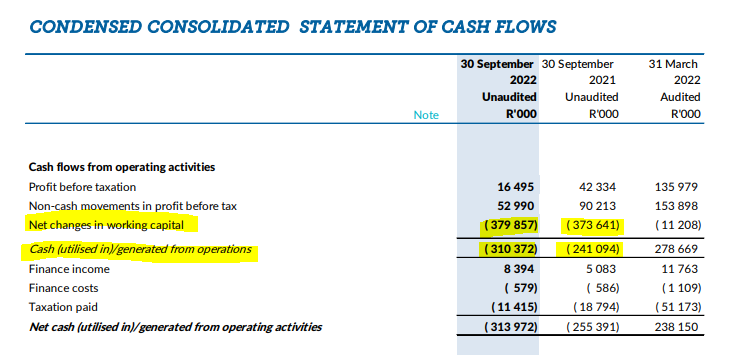

The first half of the year generally isn’t great for cash generation at Novus, as demonstrated by the Statement of Cash Flows which shows the cash flow pressure in the interim period that usually reverses in the full year numbers:

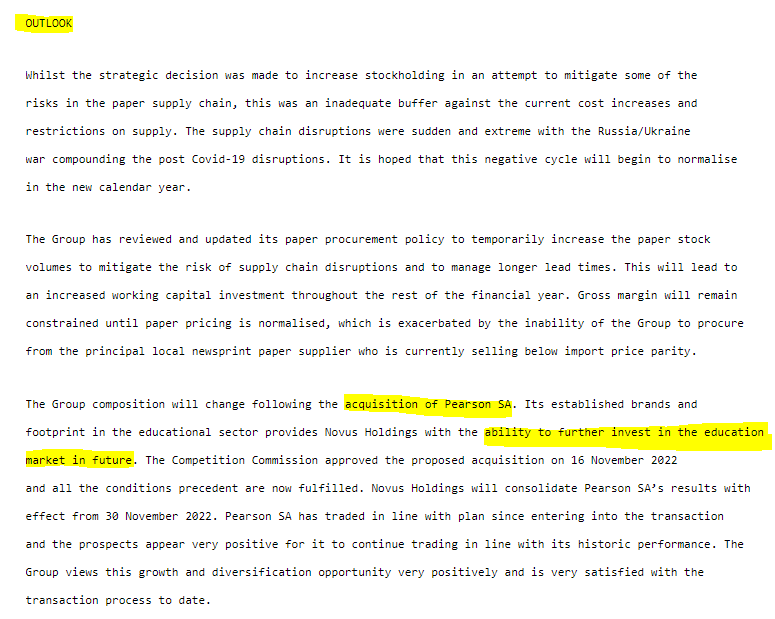

Looking ahead, the Pearson acquisition is going to be transformative for the group. With an effective date of 30 November, the Pearson numbers will be in the full year result. The outlook section of the announcement makes the intentions clear:

Southern Sun bounces back after the pandemic

With detailed results due soon, a trading update gives us a peek at the performance

For the six months ended September, Southern Sun’s revenue has considerably more than doubled vs. the comparable period. This is the case even if you exclude the once-off payment of R399 million received from Tsogo Sun Gaming.

EBITDAR (an important operating profit metric for hotel groups) increased from R145 million to between R454 million and R482 million.

By the time we reach adjusted headline earnings per share (HEPS) level (excluding the payment from Tsogo), we see a swing from a loss per share of 11 cents to a profit per share of between 0.9 cents and 2.7 cents. Although the group is profitable, the damage caused by the pandemic is still visible.

For reference, adjusted HEPS for the six months ended September 2019 was 6.9 cents.

Little Bites:

- Director dealings:

- A director of Transaction Capital has acquired shares worth R4.7 million.

- Des de Beer has acquired more shares in Lighthouse Properties worth R1.9 million.

- I’m no expert on matters of law, but it appears as though Trustco has run out of ways to fight its listing suspension. The Financial Services Tribunal has delivered its ruling in the Suspension Reconsideration Application, in which it dismissed Trustco’s application and ordered the company to pay half of the JSE’s costs. Trustco needs to get its accounting in line with the JSE’s requirements.

- Afine Investments released results for the six months ended August. This is a specialised REIT that has a portfolio of fuel forecourts. Revenue is only 0.25% higher and HEPS has dropped by over 19%. The net asset value per share increased by 46% to R3.62. A dividend per share of 19.3 cents has been declared and the share price is R4.35.

Thanks. Doing the Lord’s work as always. 😉