Andre Botha (Senior Dealer at TreasuryONE) and George Glynos (Head of Research at ETM Analytics) discuss the probability of a recession in 2023.

Inflation has become a global problem, and in an effort to combat it, we have seen Central Banks hiking interest rates. The question becomes, what is the cost of the hiking cycle? From what we can establish, the Central Banks are hiking into a low-growth scenario which has greatly increased the chances of a recession.

Below are some prominent charts that emphasise the point.

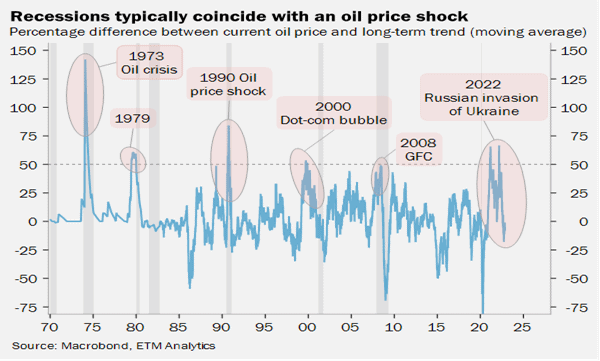

To start with, over the past 50 years, no oil price shock has occurred without a recession in oil-exposed developed economies.

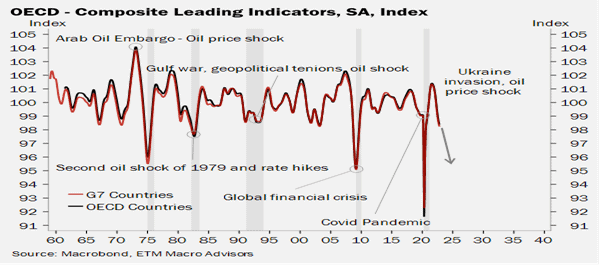

Global leading indicators are turning lower, raising the recession flag. Five times out of eight that the leading indicator has fallen to this levels, worldwide recessions have followed. As central banks continue to raise rates, quantitative tightening has only begun, the full consequences of monetary tightening have not yet materialized, and inflation remains high and detracts from disposable incomes, we anticipate a further decline in the leading indicator.

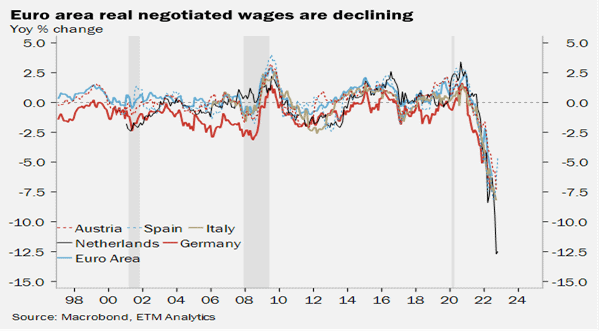

The cost-of-living crisis, especially in the Eurozone, has become extreme. There is no escaping the slowdown that is coming. You can either hike rates to curtail inflation – which will slow growth – or inflation will do it for you. As a result of Europe’s reluctance to raise rates, inflation has become a greater concern. As a result, household disposable income is plummeting, which will have a significant negative impact on consumer spending.

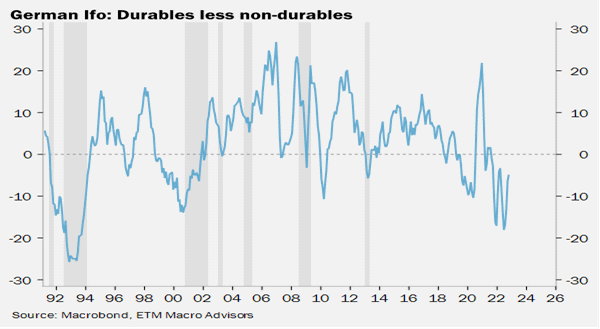

Europe’s biggest economy is under considerable pressure and the demand for durable goods relative to non-durables is well below zero, signaling a constraint on expenditure and consumption on bigger ticket items. Historically, such levels have indicated a recession.

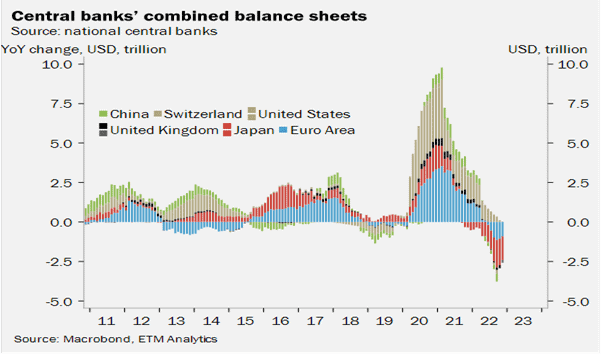

Liquidity is actively being drained from the global economy at a rate not seen since the data started getting captured in 2007. This will have a huge impact on consumption, bank lending, economic growth, and the financial markets.

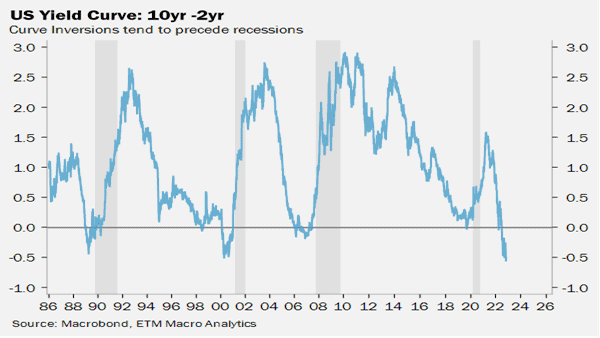

The US yield curve is the most inverted it has been since the 1980s, making it one of the greatest historical indicators of a recession. The Fed believes it can engineer a soft landing. The question to ask is whether the Fed will get it right. The smart money is that they won’t because the global coordination of hikes and inflation makes this time different.

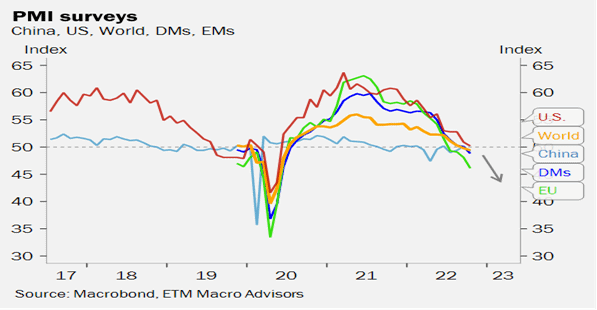

Global PMI readings have all fallen and are looking to dip into contraction territory. Over the weekend, the IMF warned that this would further detract from global GDP growth and that their expectation for global growth in 2023 could be revised down from the 2.7% they had predicted in their previous forecast.

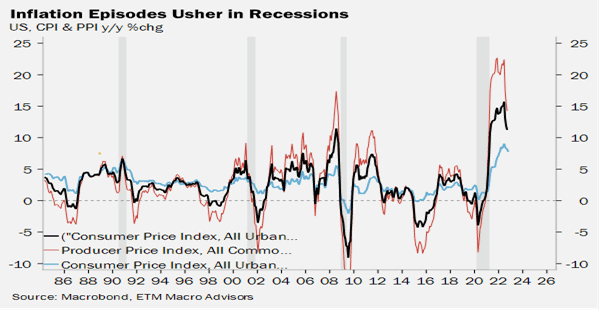

Inflation episodes tend to usher in recessions and this has been the most extreme bout of inflation in many decades.

From the above, we believe that there is a very strong case to be made that a recession is in most likelihood on our doorstep and could be the story of 2023. The warning signs are flickering and there is enough evidence there that a significant slowdown is approaching.