Absa has released a trading update for the five months to May 2022 as well as a trading statement dealing with the six months ending June 2022. The banks have been stellar performers this year in a market that has inflicted pain on most people.

Regular readers of Ghost Mail will know that I’ve been talking about the banks quite a bit this year. With rising rates and demand for credit from both consumers and businesses, it’s an environment in which the banks tend to shine.

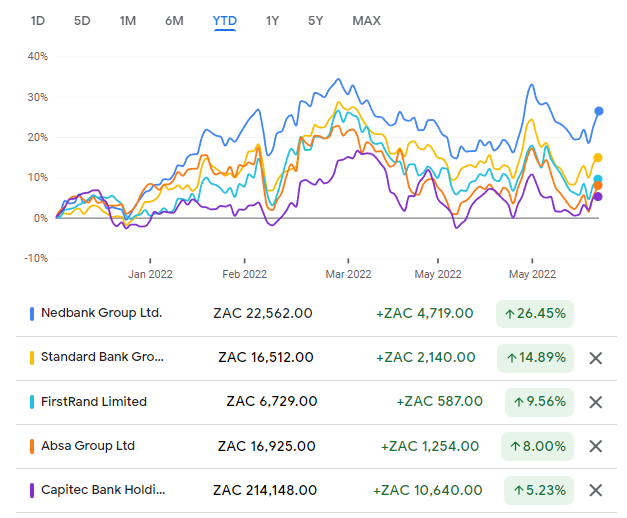

The bank share prices tend to be highly correlated when it comes to short-term moves, as they are impacted by similar macroeconomic realities. They may move together, but that doesn’t mean they have moved to the same extent this year.

Here’s a chart explaining what that looks like (note the gap between Nedbank and Capitec, despite the waves typically rising and falling together):

I must say, when I wrote on the banks just a few weeks ago, the share price gains looked a lot better in a similar chart.

In the Absa update, the bank notes that demand for customer loans was high single digits, with improved growth in the Corporate and Investment Banking (CIB) division. There was similar growth in Retail and Business Banking (RBB), which is driven by demand for home loans and vehicle and asset finance.

Customer deposit growth slowed to mid-single digits, with Absa noting that this was driven by a reduction in low-margin national government deposits. Deposit growth in the RBB division has been described as “solid” which is too vague to really give us insights.

Keep an eye on RBB customer deposit growth this year. People are saving less and spending more in my view, no doubt a function of the cost-push inflationary environment we find ourselves in. It’s good for banks when consumers are buying assets and bad for banks when they are buying petrol and food instead, as this lowers the credit quality of the average borrower. Absa hasn’t included any specific commentary on this – it is just common sense.

Revenue growth for the five months looks good, up by low double digits. This was driven by net interest income (which benefits from higher rates and loan growth) and non-interest income (assisted by a rebound in life insurance revenue and decent growth in fee and commission income as well as trading revenues).

This strong revenue growth resulted in improved margins. The bank talks about positive JAWS, which means income growth exceeded growth in operating expenses. The cost-to-income ratio improved to the low 50s.

Pre-provision profit over the five months grew by mid-teens. Below that, the bad news is that “credit impairments grew materially” though this was off a relatively low base. The credit loss ratio is above the through-the-cycle target range of 75 to 100 basis points.

Inflation is starting to bite I think, visible in higher vehicle and asset finance credit impairments. Be careful here – when the banks tighten up on lending for vehicle finance, the incredible numbers we’ve seen from car dealership businesses will falter.

On the plus side, the impairments in CIB decreased materially. Absa’s models are suggesting that companies are a lot better off than consumers at the moment.

Return on equity for the period has improved to almost 17% which is really good. To sweeten this deal even further for investors, the dividend payout ratio will increase from 30% to 50% as the core equity tier 1 ratio is very strong at 12.5%. Simply, this means that the bank’s balance sheet can easily support a higher dividend.

Normalised headline earnings per share (HEPS) for the six-month period will be at least 20% higher than the 1,019.7 cents in the first half of 2021.

The net asset value per share at the end of 2021 was R149. The share price is trading around R169, which is a 13.4% premium to a number that is nearly six months out of date and would’ve grown accordingly, as this has been a strong period for the business.

We will only know once June results are released, but I would guess that the current price is probably at or slightly above the 1H22 NAV per share.