The mergers and acquisitions (M&A) environment has shown signs of recovery, particularly in the past three months of this year, but deal flow remains below the level seen in 2023. This is attributed largely to global economic pressures; particularly rising interest rates, which have stymied leveraged buyouts and reduced the availability of debt financing.

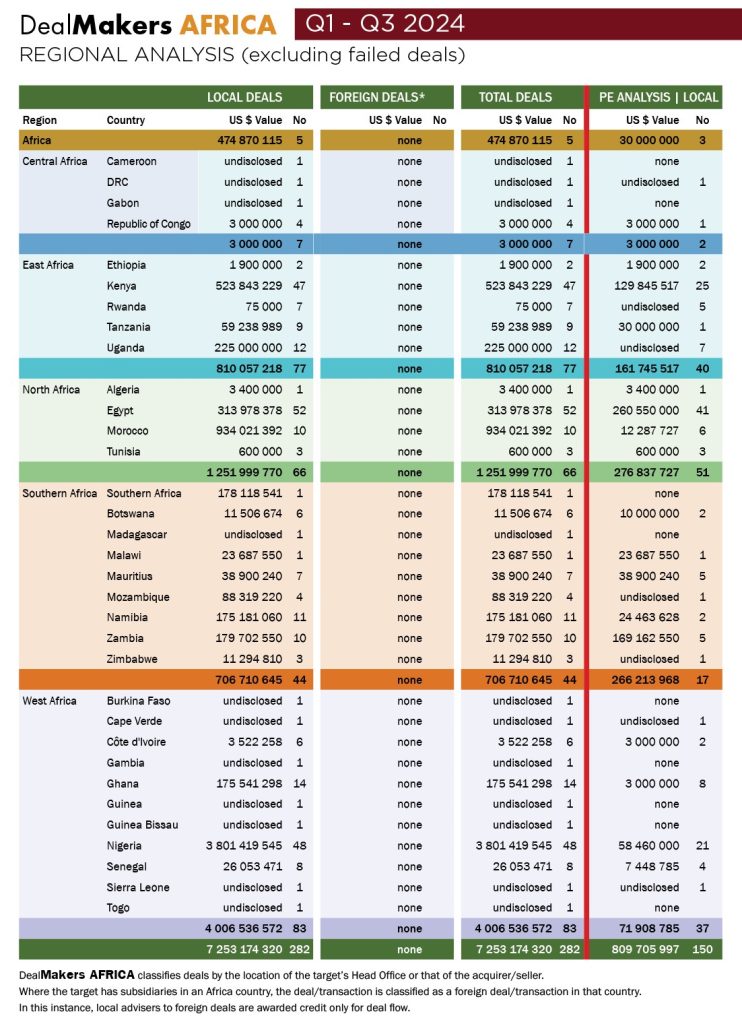

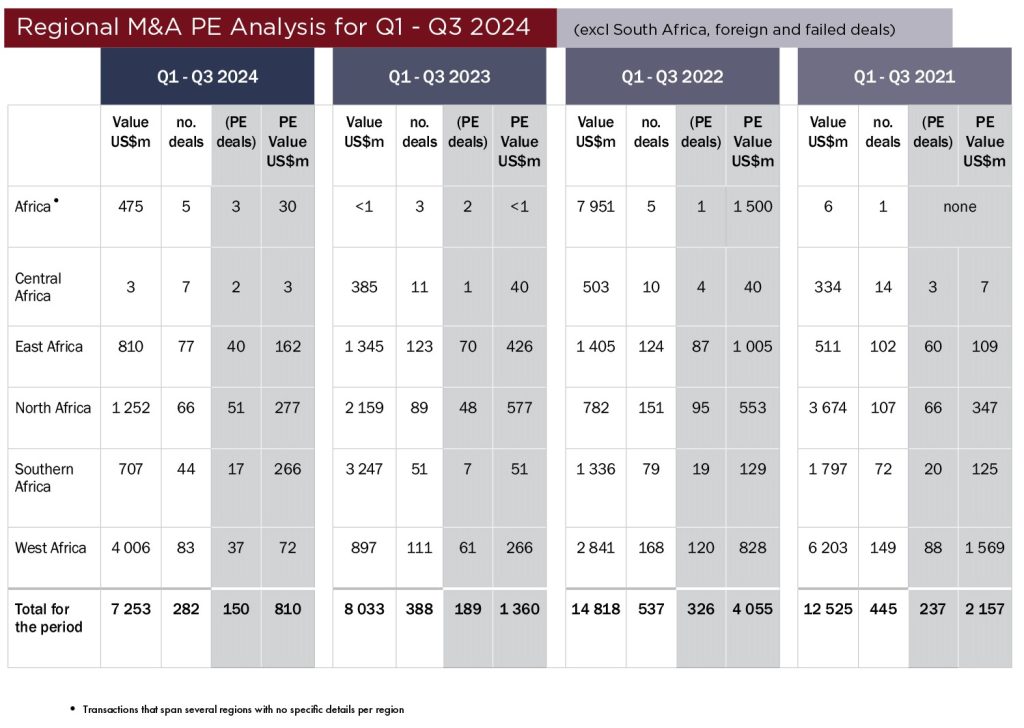

The value of deal activity for the 2024 year to end-September, as captured by DealMakers AFRICA, was down 10% year-on-year at US$7,25 billion off 282 deals, compared with 2023’s figure of $8 billion (388 deals). Deal activity was highest in West Africa (83 deals) and, more specifically, in Nigeria (48 deals). However, it is Egypt that leads the tables with a total of 52 deals recorded for the period, of which 41 are private equity (PE) transactions.

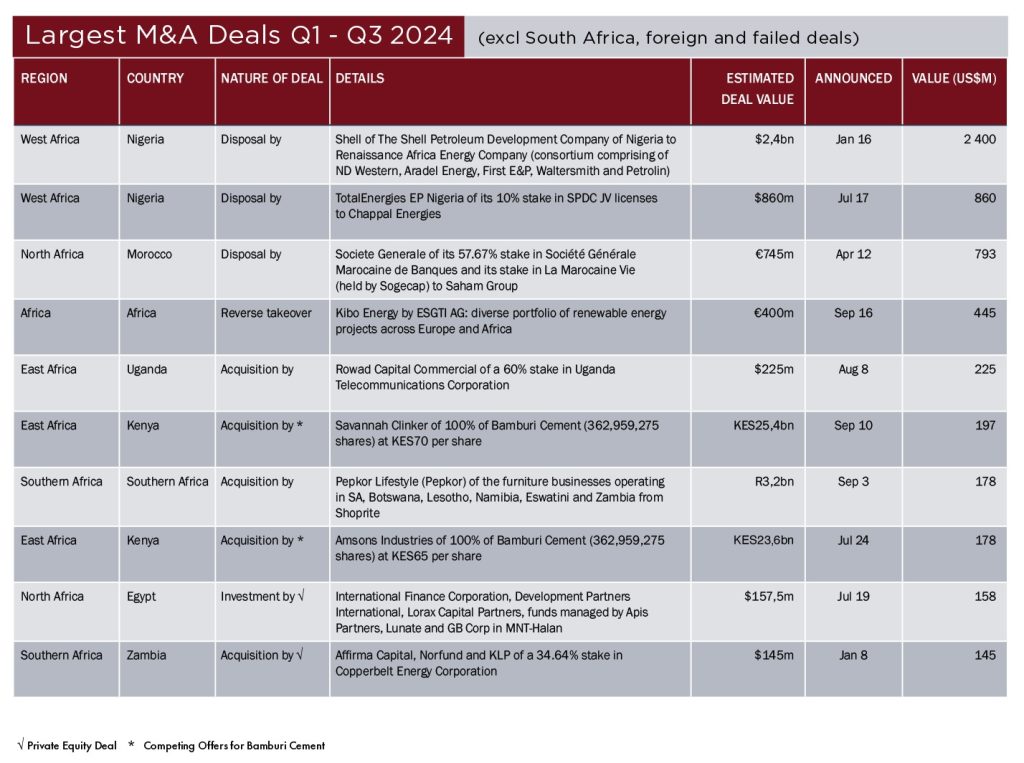

Oil and gas continue to be pillars for M&A, especially given the strategic importance of natural resources to African economies. However, renewable energy projects are gaining momentum as sustainability becomes a more pressing concern for both local governments and international investors. Of the top 10 deals by value recorded by DealMakers AFRICA so far this year, the disposal by Shell of its assets in Nigeria to a consortium tops the table at US$2,4 billion.

PE has, in the past, been an influential though not dominant force driving M&A activity. In 2022, PE accounted for 57% of deal flow across the continent, though this has fallen due to the economic environment. But as the high interest rates that initially deterred private equity are expected to gradually ease, increased activity is expected on this front, with the focus on sectors where PE typically plays a strong role, such as consumer goods, healthcare, education and logistics.

According to the latest World Bank forecasts, sub-Saharan GDP is expected to expand by 3.9% next year, though serious risks from armed conflict and climate events like droughts and floods could impact this figure.

M&A activity in Africa in 2025 is expected to be shaped by both recovery and strategic positioning. Global trends reflect a more nuanced and strategic approach to M&A, focusing on long-term resilience and alignment with technological and environmental imperatives. As economic and financial conditions evolve, PE’s contribution to M&A could transform, leading to greater deal-making in sectors that capitalise on Africa’s unique growth opportunities.

The latest magazine can be accessed as a free-to-read publication on the DealMakers AFRICA website

DealMakers AFRICA is the Continent’s M&A publication

www.dealmakersafrica.com