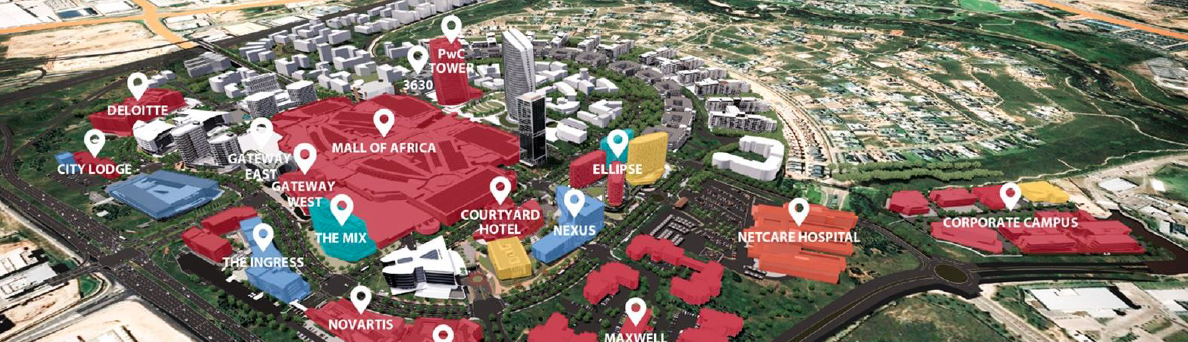

Attacq is best known for its strategy in the Waterfall precinct between Johannesburg and Pretoria. I think the node makes sense in terms of its location, so I bought shares in Attacq towards the end of last year based on that view and the substantial discount to net asset value per share. So far, so good for my return.

The fund has now released results for the six months ended December 2021. After distributable income per share fell by 57.5% in the same period in 2020, it increased by 33.6% in this period. You don’t need to get the calculator out to figure out that it hasn’t returned to pre-pandemic levels.

Of concern is that the distributable income growth came from the “Other Investments” segment and reflects a dividend received from MAS Real Estate. The Waterfall City distributable income fell by 6% and rest of South Africa fell by 13.5%. The core business is still struggling.

It’s a similar story for the net asset value (NAV) per share, down 26.6% in the prior period and up 7.1% in this period, so it is well below pre-Covid levels. The NAV per share is R16.83, so yesterday’s closing price of R7.37 is a 56% discount to the NAV. One should always treat that NAV with scepticism and assess the underlying assumptions for reasonability, but a large margin for error (i.e. discount) certainly helps and that’s part of why I bought shares in Attacq last year.

Vacancies are important here and Waterfall City has headed firmly in the wrong direction in the past six months. Occupancy in the Collaboration hubs (office properties) was 93.8% at the end of June 2021 and this dropped sharply to 81.6% by the end of the year. The Retail-experience hubs improved slightly, the Logistics hubs remained fully-let and the same is true for the Hotel segment.

Just 9.9% of clients with expired leases were retained in the Collaboration hubs with a rental reversion of -10.1%, which means that the clients who stuck around scored cheaper leases. On the retail side, the retention rate was 79.8% but the rental reversion was -8.1%.

The problem child is clearly the office portfolio, which represents 36.7% of the total portfolio. There’s more space under construction, which isn’t ideal. The longer-term pipeline focuses on residential and logistics properties and is clearly more in line with what the market wants.

Having said that, companies are pushing staff to return to the office and a well-located, mixed-use precinct like Waterfall offers an attractive environment for staff – in my opinion at least!

The gearing has improved considerably, down from 46.3% to 38.0%. A reduction in debt is a good thing in this environment. This was made possible by the sale of the Deloitte head office (R850 million) and the and sale of 50% in various distribution centres to Equites for R444.5 million.

As the property market recovers from Covid, it is encouraging to note a decrease in Covid-related rental discounts of 84.3%. Weighted average trading density has increased by 8.7% after dropping 6.5% in the comparable period, so it has increased to slightly above pre-Covid levels.

The portfolio in Rest of Africa is held with co-shareholder Hyprop Investments and both funds want to sell the portfolio and get the cash back to South Africa.

Despite the substantial increase in distributable income per share, there’s still no interim dividend. Attacq continues to take a conservative approach to its balance sheet. This remains a rather speculative play and I’m holding on.

Disclaimer: the author holds shares in Attacq.